- Because QuickBooks file is clean, the Tax Accountant will have fewer questions of the busy contractor.

- Because QuickBooks file is clean, the Tax Accountant can easily find the reports needed to file the tax return

- Because QuickBooks file is clean, the Tax Accountant can focus on saving you money

You are the Happiest because taking a trip to the Dentist for many contractors is less painful than going to the Tax Accountant. Once a Tax Accountant is “Broke In” you hate to change them.

It shouldn’t have to be that way. Like a new pair of shoes – All is well and a Happier Experience, once the Tax Accountant and The Contractor understand the needs and expectations of the other.

Bad Experiences Just Spiral Down

Tax Accountant does not want to see a Box of Receipts, Twelve Bank Statements and a see you later; call me when it’s done. You reply "I wanted my refund yesterday."

It Is Tax Time, And The Tax Accountant Gets To Choose What Client To Work On Next

The condition of your Financial Statements (or lack of Financial Statements) may put you at the bottom of the pile. From time to time Tax Accountants will find paperwork or a QuickBooks file in such awful condition that they Refuse To Do The Taxes until changes have been made.

Contractors who are serious about their business need to be actively involved. A little bit of effort goes long ways to document that their company “Is A Business” and not “A Hobby.”

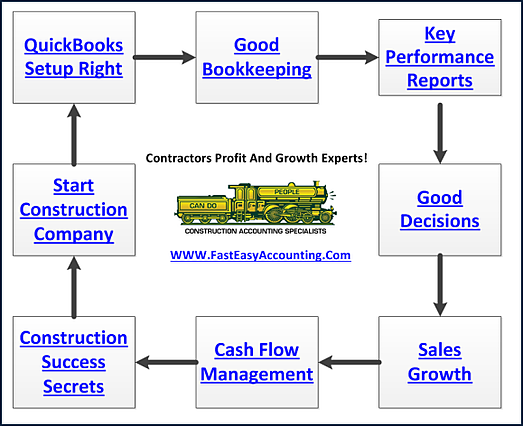

A Good Start Is An Accounting System Based On Construction Accounting

- Next, is keeping all the receipts.

- Pay all expenses by check, debit card or credit card.

- Creating Customer Invoices.

- Putting all the Income into the Bank.

- Hire a Construction Bookkeeper!

- Outsource to someone who understands your needs and Construction Accounting

The Thought That “Anybody Can Do It” Is Not Quite Right. Contractors Need People Who Specialize And Understand Construction Accounting. With all of the taxes and reports, due bookkeeping should be someone who knows what they are doing.

Most Bookkeepers specialize in an area. Restaurants, Medical and Construction all need bookkeepers. Just not the same Bookkeeper. Several General Bookkeepers have recently called saying they are the “New Bookkeeper” and are asking for help because they know the QuickBooks file is messy.

The Question is: Can We help? Short Answer – Yes, We Can Help!

- Bookkeepers want Help in setting up a New QuickBooks file

- Bookkeepers want Help cleaning up the mess of the previous Bookkeeper.

- Bookkeepers want Training on What To Do after the QuickBooks file is cleanup

- Provide a One Hour Consultation and Free Review of Your Existing QuickBooks File.

We recommend you have someone review your financial statements before going to the Tax Accountant. Remember this is the busiest time for Tax Accountants. They do not have The TIME or The ENERGY to look over all your transactions.

Tax Accountants look for high-level numbers and what can they easily move to fill out the tax return. Good Idea to clean up the QuickBooks file before visiting Tax Accountant or Your Banker. Know the difference between what a good Tax Accountant does, and a good Construction Accountant does.

Tax Accountants Are Paid To Fill Out Tax Returns Not Save You Money Or Be Your Mentor

We Are Paid To Do Your Contractor Bookkeeping And Be Your Profit And Growth Mentor

- What about this?

- What about that?

- Who owes me money?

- Who do I owe money to?

- Do you know your Customers?

- Do you know your Net Income?

- Do you know your Gross Income?

- Are you vehicle loans in QuickBooks?

- Has all of your bank accounts been reconciled?

- Has all of your credit card accounts been reconciled?

Construction Bookkeeping Is Answering The “What About” Questions Sooner Rather Than Later Or Not At All

- Without the Details entered into QuickBooks, it is IMPOSSIBLE to Create Useful Reports.

- Without Customer Invoices, there are no Accounts Receivable Reports

- Without Accounts Receivable Reports you don’t know if the Customer has paid in full

- Without Customer Names in QuickBooks, there is no way to create Job Profitability Reports.

I agree – Day to day bookkeeping can be boring, tedious, or moments of sheer terror when you discover that all the money in the bank is already spent. It is NO Fun to not be able to go buy a new truck with that Job Deposit you just collected.

I want the fun stuff; not the Hard Stuff. Day to day bookkeeping is hard. One simple reason is that your brain replays all of the activity of each job every time it sees a receipt for that job. Can you say “Ground Hog Day” over and over and over again? There are “No Stories, No Baggage” they are just numbers tied to a specific customer to us. Because this we are able to enter in the transaction quickly.

In that respect, Outsourced Accounting For Contractors Like You will free your mind to be able to look or new jobs, focus on existing jobs, remember the previous jobs (good parts and filing the bad parts away for reference on what not to do again in the exact same way.)

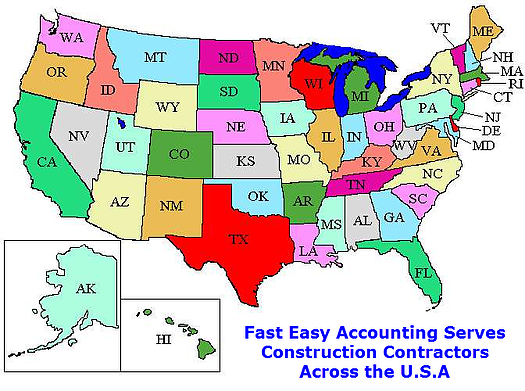

We Clean Up QuickBooks Files (Desktop Version). We Maintain QuickBooks Files For Contractors Like You All Across The USA Including Alaska And Hawaii

Some old, new, existing and previous clients have never, ever owned QuickBooks. With our system, it is not a requirement that our Clients own, review, or try to learn QuickBooks.

Some clients are want to have access to their QuickBooks file and are comfortable in entering the customer invoice directly into the file. For those clients, we welcome their participation.

We teach them how to use the Icon Bar to pull the reports that are important to them.

We do the rest (entering the transactions from the receipts provided, bank statements and credit card statements)

What we NEVER DO is pay your bills for you. We touch your account (to auto receive our own fees), but beyond that, we do not Pay Bills, Pay Payroll, Pay Taxes, Pay Loans, Pay Credit cards.

We never want any Government Agency to get the impression that we are decision makers as to whom you should pay When you should pay, and How much you should pay.

As our Client, you have the peace of mind that we are not going to do something improper with your money. It is your money. We are Paper Managers. We are a Production Shop. We want the Number to Add Up to a nicely. We want our Clients to have lots of Customers and to Make A Profit on every Job.

Always looking for the most efficient way to enter your data into QuickBooks, in a way that will give you beneficial reports, at a reasonable price and services that benefit both sides.

Are We The Most Expensive? No, We Try To Be Reasonable But We Are Not Free

Free, Perfect, Now is the business model of Internet Search Engines. But even the Search Engines have figured out how to have “Add-On Fee-Based Sales” The world works better when everyone buys something from a cup of coffee, tools, and equipment to that Brand New Truck or movie and dinner with someone special.

We welcome the following businesses from Brand New Contractor, Weekend Warrior, Handyman, Trade Contractor, Custom and Home Builders, Commercial Contractors and more.

We Serve Contractors Across The U.S.A.

We Help “A Little or A Lot” depending on your needs including on-going bookkeeping services. Remote web-based QuickBooks for contractors bookkeeping, accounting & quarterly tax reports. We specialize in contractors including general, specialty and trade contractors, home builders and commercial tenant improvement contractors.

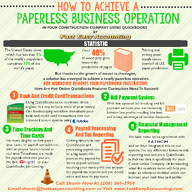

We Can Scan Your Important Receipts And Invoices to provide you with a CPA-ready packet for your tax return, and we provide ongoing Cloud Based Contractors Bookkeeping Services by accountants who understand construction.

Contractors Who Need Extensive Financial And Job Costing Reports we use QuickBooks Desktop In The Cloud. We serve new and seasoned contractors in residential, commercial, remodel and home building who need professional-grade contractor bookkeeping and accounting services including invoicing (Flat-Rate, Not-To-Exceed, Time & Material, Cost Plus), Washington State sales tax returns, payroll processing, quarterly tax reports, construction job deposits, work-in-progress, WIP, retention, residential and complex payment applications, liability insurance audits and business processes. For the “Best Value” we practice “Flat Rate” pricing whenever possible.

Does QuickBooks Frustrate You? If you answered "Yes" you are in good company. We invested over ten years developing several customized QuickBooks setup templates. We have QuickBooks setup templates for all of Construction Contractors shown below and more...

Short List Construction Contractors We Serve

We Serve Over 100 Types Of Contractors So If Your Type Of Company Is Not Listed

Please Do Not Be Concerned Because If You Are A Contractor

There Is A Good Chance We Can Help You!

Call Now: 206-361-3950

Contractor QuickBooks Digital Products Available HERE!

Construction Company Owners with specialty accounting and bookkeeping services needs. Our clients are brand new and seasoned small contractors in service and repair, residential, commercial, remodel and home building.

Company Size there is no such thing as ever being “Too Small” Many of our clients are one person construction companies with an idea and the desire to be in business for themselves. Hiring employees is optional. Clients include busy professionals and independent contractors who want someone else to deal with their piles of paperwork so they can do “The Fun Stuff” which is what they do best.

Whether You Are Working out of your truck, home, the local coffee shop, commercial office space or The SnoKing Contractors Center we are your best choice because we work remotely from our office in Lynnwood Washington.

Bookkeeping For Contractors In The U.S.A using QuickBooks enjoys using the desktop version you are familiar with on the internet inside a highly encrypted secure multi-user environment. This system allows you and your employees to work in QuickBooks at the same time. All you need is an internet connection, and you can save time, money and aggravation by reducing or eliminating computer network technicians.

In our world, it is common for the new contractor (to us) to bring in a shoe box, file box, and all the receipts under and behind the seat of the pickup truck (with or without coffee stains) It is the type of puzzle we like. We also like being about to create something that helps the contractor understand their numbers and be able to make decisions.

Only a small percentage of our Construction Contractor Clients want to have access to their QuickBooks file.

Existing Contractors who are local have the option of bringing their paperwork to us. More of them embrace the Document Management System and send all of the documents electronically. I talk to clients on the phone often; see in person randomly as needed. The fantastic solution that allows our Contractor Clients to focus on their Customers.

QuickBooks is just some place where we magically send the numbers to. Construction Contractors, Handyman Contractors, House Builders, Commercial Contractors and Trade Contractors like the QuickBooks reports; they just don’t want to watch or help the process of getting them from the pile of paper on their desk to QuickBooks.

Happiness is when we send our Contractor Client’s their Year End Financials to them

In turn, they meet their Tax Accountant and forward the Year End Financials, add personal documents, chat a few minutes and Leave. Leave knowing the Tax Accountant has what is needed to file the taxes.

We have Contractor Clients all across the USA. Depending on size, a number of employees, and some other factors on whether a Contractor is a “Good Fit” to be an Outsourced Client. For others, we can Setup, Cleanup QuickBooks file and return to the Client for Do-It-Yourself bookkeeping and / or Strategic Business Consulting to help your construction contracting company grow at a steady pace.

Staying on our Cloud Server is something that can be discussed on a case by case basis. (Very protective of the add-on products allowed on the server) Not all software plays well with each other.

Cloud-Based Remote Access To QuickBooks Desktop Version!

Paperless System For You To Store, Print, E-mail Documents

Microsoft Excel Is On The Server For You To Use

Your QuickBooks Desktop Version In The Cloud 24/7 Access!

Just A Few Mouse Clicks On PC Or Mac And Get:

-

The Key Reports You Need:

-

Cash Report anytime YOU want it!

-

Receivables report anytime YOU want it!

-

Payables report anytime YOU want it!

-

Profit & Loss statement anytime YOU want it!

-

Balance Sheet report anytime YOU want it!

-

Job Costing report anytime YOU want it!

-

Estimates Vs. Actuals report anytime YOU want it!

Looking Forward To Helping Your Contracting Company To Be More Successful

Offering tips and tidbits to Prospects and Clients, for example, Cash Management 101 according to Sharie (me) is the same for a larger company as the brand new contractor use just had his or her first sale.

Cash 101 is all about protecting the money. Losing a debit card with all the money is still All The Money no matter what size the business is.

Most contractors are on a thin profit margin. Forgetting to charge sales tax is a 10% or more hit.

Forgetting to get signed Changes Orders can be costly. The list can go on and on and on.

Welcome New Clients, Former Clients, and pleased to be of service to our Existing Clients

To our friends around the world, thanks for reading our blogs, listening to our Podcasts.

We keep adding products on the FastEasyAccounting.com/store to be of assistance.

If you need something special – Just Ask (we may be able to easily add it to the store)

We Help “A Little” or “A Lot” depending on your needs.

Thinking Happy Thoughts To Everyone Everywhere.

When You Become A Client - Then we can tap into our resources of knowledge and strategy banks. We use the reports hidden in your QuickBooks in order to diagnose and understand your construction business and develop plans and help you implement a path to success for you and you alone because every contractor has unique Strengths, Weaknesses, Opportunities and Threats (S.W.O.T. Analysis) that when understood can lead to a Strategic Roadmap which cannot help but make a lot of money.

We Remove Contractor's Unique Paperwork Frustrations

Thanks for reporting a problem. We'll attach technical data about this session to help us figure out the issue. Which of these best describes the problem?

Any other details or context?

For Construction Company Owners who do not need the full power of a QuickBooks for contractors and want 24/7 online access we offer Xero Accounting Online, and we have a custom setup for construction companies. Click Here For More.

This Is One More Example of how Fast Easy Accounting is helping construction company owners all across the USA including Alaska and Hawaii put more money in the bank to operate and grow your construction company. Construction accounting is not rocket science; it is a lot harder than that, and a lot more valuable to people like you so stop missing out! Call Sharie 206-361-3950 or sharie@fasteasyaccounting.com and schedule your no charge one-hour consultation.

Profitable Contractors and Construction Company owners have known about the value of outsourced bookkeeping services and contractor coaching services like ours for a long time, and now you know about it too!

Thank You For Reading This Far, And I Hope You Understand we really do care about you and all contractors regardless of whether or not you ever hire our services.

We Scan Your Receipts, And Invoices link the appropriate transactions to QuickBooks or Xero Accounting Online depending on the construction accounting service you are using and provide ongoing Cloud Based Contractors Bookkeeping Services by accountants who understand construction.

Our Contractor Bookkeeping Services System Is A System

Thinking About Outsourcing Your Contractors Bookkeeping Services To Save Time And Money?

Click On The Button Below To Download A Free Guide

Business Process Management (BPM) For Contractors

Need Help Now?

Call Sharie 206-361-3950

sharie@fasteasyaccounting.com

Xero Outsourced Construction Accounting Services

QuickBooks Outsourced Construction Bookkeeping Services

We Are Xero Accounting Experts Specializing In Construction Bookkeeping Services

About The Author:

Sharie DeHart, QPA is the co-founder of Business Consulting And Accounting in Lynnwood Washington. She is the leading expert in managing outsourced construction bookkeeping and accounting services companies and cash management accounting for small construction companies across the USA. She encourages Contractors and Construction Company Owners to stay current on their tax obligations and offers insights on how to manage the remaining cash flow to operate and grow their construction company sales and profits so they can put more money in the bank. http://www.fasteasyaccounting.com/sharie-dehart/ 206-361-3950 or sharie@fasteasyaccounting.com

PS: For The Do-It-Yourself Construction Bookkeeper Our Store Has Chock-Full Of QuickBooks Setup Templates, QuickBooks Chart of Accounts And More.

Most Contractors Setup QuickBooks Desktop Version In One Of Three Ways:

#1 EZ Step Interview inside QuickBooks Setup

#2 Asked Their Tax Accountant To Setup QuickBooks

#3 They Attended A How To Setup QuickBooks Class Or Seminar