QuickBooks Set Up For Flipper House Investors

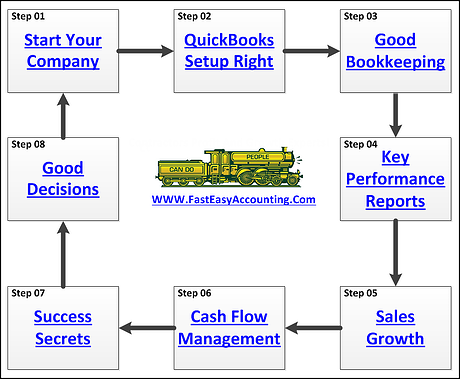

QuickBooks Set Up - By a QuickBooks expert in construction accounting to work specifically for flipper house investors on whatever year and version of QuickBooks you own because we have worked with QuickBooks since it first arrived in the early 1990's in DOS.

Which QuickBooks Edition - Is right for you? It depends on your annual sales volume and what QuickBooks Reports you want to have.

QuickBooks Pro - Works well for flipper house investors with less than five homes per year because your QuickBooks Reporting needs are not great.

QuickBooks Premier Contractor - Is what we recommend for flipper house investors with more than five homes per year currently or projected in the next 12 months. The difference in cost is very small compared to the potential value.

The Most Important - Part of QuickBooks Setup for contractors is having a QuickBooks expert with a deep background in construction accounting who understands what your particular construction company needs. Among other things you need a fast and easy way to monitor the financial health of your construction company. QuickBooks Premier Contractors Edition provides a running scorecard of Key Performance Reports and when used with Business Process Management Tools like what 10 minutes of waste costs their company.

More Flipper House Contractor QuickBooks

Digital Products Available HERE!

Here Are Some Things To Consider:

-

You use QuickBooks to track all the costs and generate Complex Payment Applications Item Estimates vs. Actuals, Job Profitability Summary and Job Profitability Detail Reports to monitor progress so the QuickBooks setup is critical

-

Your Chart of Accounts is focused Goods Sold Accounts (COGS) to allocate project costs

-

Your QuickBooks expert can setup the Five Key Performance Indicators (KPI) to monitor the financial health of the business

-

Your QuickBooks setup will need 1,000 to 5,000 Items setup to track all the costs of the construction process from beginning to end in order to get the reports you need

-

QuickBooks Setup for a flipper house investor requires a mix of Direct, Indirect, COGS and only a few WIP accounts

-

You need a simple way to track and get paid for retention

-

The day to day input is also the second most difficult and to be done properly requires accounting staff with specialized training in construction accounting

-

Our experience has been that flipper house investors are sensitive to the ups and downs of the housing market which means rock solid QuickBooks reports are critical

-

In order for you to reach their full potential of your business you will need an overall strategy including a Business Plan for Contractors

-

And of course Cheap Bookkeeping is the one area where short term savings is overwhelmed by making bad decisions based upon inaccurate QuickBooks reports

Having Used - A number of accounting programs over the years we believe when your QuickBooks setup is done correctly by a QuickBooks expert in construction accounting is the best, hands down, no contest! For flipper house investors the tiny amount of money difference between QuickBooks Pro and QuickBooks Premier Contractor Edition is worth the investment for the additional a Contractor Reports alone. Upgrading every year is a “no brainer” because of all the new features and if a contractor’s construction accounting staff only saves only 10 minutes a day the savings will more than pay for the program.

When You Become A Client - Then we can tap into our resources of knowledge and strategy banks. We use the reports hidden in your QuickBooks in order to diagnose and understand your construction business and develop plans and help you implement a path to success for you and you alone because every contractor has unique Strengths, Weaknesses, Opportunities and Threats (S.W.O.T. Analysis) that when understood can lead to a Strategic Roadmap which cannot help but make a lot of money.

If You Are A Contractor You Deserve To Be Wealthy

Because You Bring Value To Other People's Lives!

This Is One More Example of how Fast Easy Accounting is helping construction company owners just like you put more money in the bank to operate and grow your construction company. Construction accounting is not rocket science; it is a lot harder than that and a lot more valuable to people like you and me so stop missing out! Call Sharie 206-361-3950 or sharie@fasteasyaccounting.com and schedule your no charge one-hour consultation.

Profitable Contractors and Construction Company owners have known about the value of outsourced bookkeeping services and contractor coaching services like ours for a long time and now you know about it too!

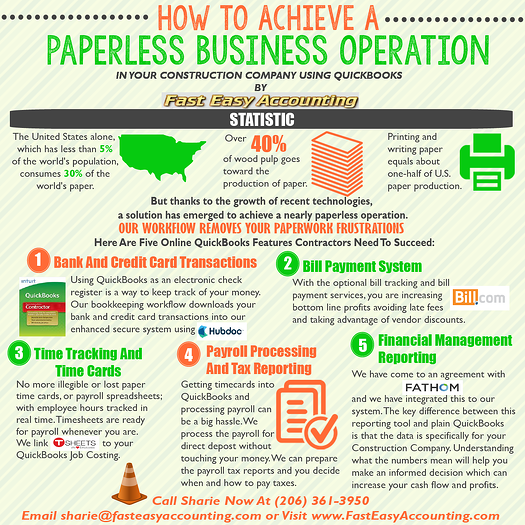

We Scan Your Receipts And Invoices link the appropriate transactions to QuickBooks or Xero Accounting Online depending on the construction accounting service you are using and provide ongoing Cloud Based Contractors Bookkeeping Services by accountants who understand construction.

Thinking About Outsourcing Your Contractors Bookkeeping Services?

Click On The Button Below To Download A Free Guide

Need Help Now?

Call Sharie 206-361-3950

sharie@fasteasyaccounting.com

Xero Outsourced Construction Accounting Services

QuickBooks Outsourced Construction Bookkeeping Services

We Are Construction Accounting Experts Specializing In Construction Bookkeeping Services For Contractors All Across The USA Including Alaska And Hawaii

About The Author:

Randal DeHart, PMP, QPA is the co-founder of Business Consulting And Accounting in Lynnwood Washington. He is the leading expert in outsourced construction bookkeeping and accounting services for small construction companies across the USA. He is experienced as a Contractor, Project Management Professional, Construction Accountant, Intuit ProAdvisor, QuickBooks For Contractors Expert and Xero Accounting Specialist and Bill.Com Certified Guru. This combination of experience and skill sets provides a unique perspective which allows him to see the world through the eyes of a contractor, Project Manager, Accountant and construction accountant. This quadruple understanding is what sets him apart from other Intuit ProAdvisors and Xero accountants to the benefit of all of the construction contractors he serves across the USA. Visit http://www.fasteasyaccounting.com/randal-dehart/ to learn more.

Randal DeHart, PMP, QPA is the co-founder of Business Consulting And Accounting in Lynnwood Washington. He is the leading expert in outsourced construction bookkeeping and accounting services for small construction companies across the USA. He is experienced as a Contractor, Project Management Professional, Construction Accountant, Intuit ProAdvisor, QuickBooks For Contractors Expert and Xero Accounting Specialist and Bill.Com Certified Guru. This combination of experience and skill sets provides a unique perspective which allows him to see the world through the eyes of a contractor, Project Manager, Accountant and construction accountant. This quadruple understanding is what sets him apart from other Intuit ProAdvisors and Xero accountants to the benefit of all of the construction contractors he serves across the USA. Visit http://www.fasteasyaccounting.com/randal-dehart/ to learn more.

Our Co-Founder Randal DeHart - Is a Certified PMP (Project Management Professional) with several years of construction project management experience. His expertise is construction accounting systems engineering and process development. His exhaustive study of several leading experts including the work of Dr. W. Edward Deming, Michael Gerber, Walter A. Shewhart, James Lewis and dozens of others was the foundation upon which our Construction Bookkeeping System is based and continues to evolve and improve. Follow Randal on Google+

Our Co-Founder:

![]() Sharie DeHart, QPA, is the President of Business Consulting And Accounting (Fast Easy Accounting) in Lynnwood, Washington. She is the leading expert in managing outsourced construction bookkeeping and accounting services companies and cash management accounting for small construction companies across the USA. She encourages Contractors and Construction Company Owners to stay current on their tax obligations. She offers insights on managing the remaining cash flow to operate and grow their construction company sales and profits so they can put more money in the bank. Call 206-361-3950 or sharie@fasteasyaccounting.com.

Sharie DeHart, QPA, is the President of Business Consulting And Accounting (Fast Easy Accounting) in Lynnwood, Washington. She is the leading expert in managing outsourced construction bookkeeping and accounting services companies and cash management accounting for small construction companies across the USA. She encourages Contractors and Construction Company Owners to stay current on their tax obligations. She offers insights on managing the remaining cash flow to operate and grow their construction company sales and profits so they can put more money in the bank. Call 206-361-3950 or sharie@fasteasyaccounting.com.