Contractors View Of The Numbers And Tax Accountants View Are Totally Different

When Tax Accountants Review The Financial Statements The Year Has Ended

The Tax Accountant’s Role Is To Review The Previous Year Financial History based on the information provided create and file the Annual Federal Tax Return, Annual State Tax Return, and other Local or Payroll Returns. Washington State is a sales tax driven state. Other states have a State Income Tax, and others yet have a blend of both.

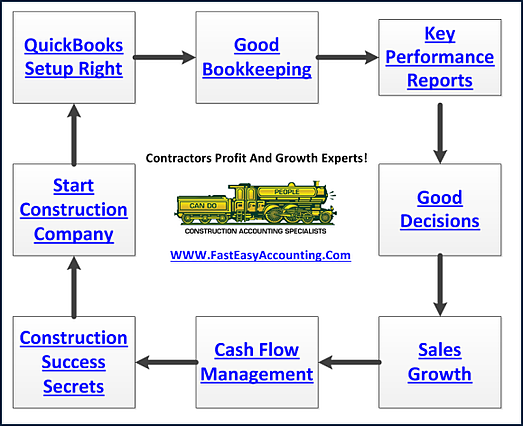

The Contractors Role Is To Review What Is Happening Now and make Strategic Decisions about what to know in order to have a brighter financial future. The best way to do that is to have QuickBooks Setup to deliver your 5 Key Performance Indicators (KPI) in 5 minutes a day at 5 pm or whatever time is best for you. We call them the 5 At 5 For 5, and we can set them up in your QuickBooks for you! Click here to learn more.

Every Construction Contractor Should Have A Tax Accountant Prepare And File Your Annual Tax Returns

Congress passes a ton of laws which each one could have zillion pages with addendums and other attachments that will make all the individual bills even harder to understand. Tax Accountants need to keep track of all of these changes. Changes – Question is What impacts Yesterday, Today and Tomorrow. A single bill may include all three possibilities.

The condensed Version of the U.S. Master Tax Guide [year] (copies provided by your local Payroll Services) is very similar to size and font of the OSHA Book. In other words, the U.S. Master Tax Guide, is “Fat” like how the telephone books used to be. When discussing the U.S. Master Tax Guide it is a book and can be described as a “Thick Book With Very Tiny Print.”

Just The Book that everyone wants to read on a warm, cold, hot, sunny, rainy, cloudy Saturday afternoon. (Not - for those who might be missing my humor). I have copies of several years of U.S. Master Tax Guides, and every one of them is 1000 pages. Remember this is the condensed version referencing only the Most Common tax issues. I expect my Tax Accountant to know The Answer to everything that I may encounter and how to properly deal with it on my annual tax return.

Once The Tax Accountant Has Your Financial Statements It Is All “After The Fact” Accounting.

The end of the year has passed. Many of us automatically file an extension so it may be closer to September so “The Past” really is the past. Way past time to say, I wish I had done this instead. You can say it – It just won’t change the outcome of previous decisions.

There are limited “things” the Tax Accountant can move, change or adjust. The year is over. The real question is “How Much Do I Have To Pay?” If you have paid into the Internal Revenue Service via W-2 or Estimated Taxes, hopefully, the amount due will be close to Zero.

Tax Accountants Are Busy, And Everyone Wants Their Returns Filed. Yes, you can be the first one on your block to get your taxes done but is that a good idea? In my opinion, as a business owner, you do not want your Tax Accountant to roar through your tax return, get it done quick, without really reviewing your individual circumstances. Side note, those with College Students on Financial Aid always need to have their returns completed early to meet the Federal Deadlines.

Everyone usually receives from their Tax Accountant a “Tax Booklet” with check sheets to help prepare for documents the Tax Accountant needs to complete the Annual Tax Return. Usually, this Tax Booklet is geared towards what the Tax Accountant needs to complete the Personal Return.

Tax Accountant is hoping everything is in the Business Financial Statements and there are just a few things left to do to be able to complete the annual Business Return.

Tax Accountants Are Paid To Fill Out Tax Returns Not Save You Money Or Be Your Mentor

We Are Paid To Do Your Contractor Bookkeeping And Be Your Profit And Growth Mentor

Tax Preparers Normally Only Do The Following:

- Figure Out The Vehicle and Equipment Depreciation

- Look for missing expenses (usually not very hard)

- Ask for Cash Receipts (only in passing)

- Review Meals and Entertainment (big-ticket meals or excessive meals)

- Review for items that are really Owner Draws, Loan to Members or Loans To Shareholders

- Owner Equity put into the company (only if they see it)

- Other Assets (Job Deposits | WIP)

- Other Liabilities (Short or Long Term Notes)

- Petty Cash (will ask if you have Cash On Hand)

- Suspense (should be cleared out to Zero)

- Ask My Accountant (need to have receipts and details to help identify who, what it is for)

- Anything that looks Odd (Tax Accountant does not want an audit, so it is better you overpay taxes)

Tax Accountants Work With Messy And Incomplete Records To Do Their Job

They appreciate a good set of Financials from a Contractors Bookkeeping Services (Fast Easy Accounting). Sometimes Tax Accountants have to be the “Big Person” and refuse future service until the bookkeeping is in a more organized set of financials that they can use. The last thing a Tax Accountant wants is an audit.

Finally, the Tax Accountant is ready to start all over and review your Personal Income and Deductions, and then they are able to produce for you two Annual Tax Returns. Depends on the individual returns, and when you are filing whether you can file the returns electronically. Hopefully, you have paid enough in personally to be able to receive a refund.

Tax Accountants Rarely Have Time To Give You More Than The Basics toward Tax Planning beyond the different IRA’s and 401K’s. The Reality is that most of the time The Contractor is ready to leave because the whole process is similar to going to The Doctor. The entire experience of taxes leaves you the Contractor feeling exposed. You know that funny feeling where you have on “The Gown” and your blood pressure immediately rises when the doctor walks in and closes the door.

Contractors View of the Financial Statements

Contractors are just a little bit annoyed if they want real answers about their business and discover the Tax Accountant is really good at rolling up the numbers and having a Tidy Tax Return but most of them are clueless about construction.

The Contractor wonders why if they are both looking at the same numbers on the Financial Statements that the Tax Accountant cannot or will not be more helpful with answers needed in running their business.

The Short Answer Is There Is A Vast Difference Between Regular Accounting and Construction Accounting. Tax Accountants are a generalist and understand Regular Accounting. Tax Accountants have to be to be able to complete the maximum number of client’s tax return. In their world, the expenses are similar for all businesses. It starts out with Income – Expenses = Net Income or Net Loss. The bottom line number on a Schedule C is Net Income or Loss and is the same for all the businesses. S-Corps have its own return with the numbers passing through to your personal annual Tax Return.

My opinion is Tax Accountants like Personal Tax Returns better because they are like sweet, decadent desserts; whereas Contractor's Business Tax Returns are the vegetables (which is great if you love vegetables) because they have to deal with the Contract's Business Tax Return before they can get to the fun stuff. Or maybe it is just a business decision because everyone has a Personal Tax Return and only some of us have a Business Tax Return.

All phases of accounting, and bookkeeping are a specialty including Tax Accounting, General Accounting and Construction Accounting.

Generally, Contractors Are Not Trying To Play “Stump The Wizard” when they are asking the Tax Accountant questions about their Financial Statements. Many contractors will have their Tax Accountant prepare Payroll, Payroll Tax Reports, State and Local Tax Reports (sales tax). Does the Tax Accountant understand your business, even a little bit? If the Tax Accountant does not work with sales tax issues on a regular basis, the contractor may have to explain the rules that impact them to their Tax Accountant.

Each state is different is what and how they collect State and Local taxes. The most common thing is that “They Do.” The most basic question Contractors ask is “Am I Making Money Or Losing Money”? The next question is “Where Did I Make Money? It should be an easy question to answer.

Unfortunately, when everyone is doing everything but tracking the paperwork and the money there are no answers to be found.

Without A System, It Is Impossible To Know If Your Employees Are Wasting Time And If Material Is Being Wasted

This does not mean having a drone flying overhead watching their every move to start with by asking 5 simple questions:

- Do they have the Right Tools and Equipment?

- Do they know your expectations?

- Do they feel they are being paid fairly?

- Are they a Willing Worker and doing the job?

- Will they use an electronic Time Card? (T-Sheets)

In most states, Laborers and Apprentices have the exact same Worker’s Compensation rate as the Lead Person on the job. Skill level is different, and the Contractor is always balancing the Cost of Wages against Value of The Skill of Each Worker.

Contractors are always faced with variables including costs that continue to rise after the bid has been accepted. A small hurricane can impact the cost of building material across the country. One little snow storm and delay truckers and the goods they carry. One little bit of sunshine is okay for days but months and months where is it not normal can be a huge deal. In Winter, you expect snow in the mountains to go skiing, rain in the Spring for flowers, the sun in the Summer to play, and a little frost in the Fall on the pumpkins.

With changing weather patterns, we all need to adapt. We are in the greater Puget Sound (Seattle area), and for years it was 350 days of rain, winter rain, spring rain, fall rain, maybe 15 days of summer. Today it snowed! Last week it snowed and the week before it snowed. Good News, the snow did not stay long and for the most part did not impact schools. At the same time, other places around the USA had different experiences.

Contractors Play A Type Of Sports Game Every Day Without The Rewards Of A Fat Guaranteed Contract.

They go Up To Bat, Jump Through Hoops, Run Down The Field all in hopes of securing The Call, Creating The Bid, Closing The Sale, Preforming The Work, Getting Paid. Have a Life.

Contractors want to know “Are I Making Money” or “Losing Money” now “Which Job?”

Should I be doing “More of This” and “Less of That?”

Sometimes is a little hard for The Contractor to be Happy and Full of Smiles

When a project Goes Over Budget, you Gave Away Free Change Orders to Keep The Customer Happy and Discovered Material Is Way Over Budget.

If The Contractor has 30 day accounts the final bills are still coming in after the project is complete. If it is a Time and Material billing and the final invoice was created too soon; it is almost impossible to get additional funds from the customer. It is by exception, that additional funds can be collected and remember to get signed Change Orders and paid promptly over waiting to the end of the project.

Many times Contractors think they have made money based on the fact that all the bills got paid and there was some money left over. With poor bookkeeping it is hard to know because the checking account may be reflecting checks that have not cleared, deposits from the next job, personal funds deposited back into the account to cover last minute expenses and forgotten.

Good Construction Bookkeeping is the solution

A little bit of effort towards Job Costing can be very helpful in understanding the numbers. The Key is asking the Right Professional the right question. Tax Accountants understand how to roll all the numbers up from the different aspects of your personal and business life into a summary Tax Return for the Internal Revenue Service.

Construction Accountants understands the numbers in your business and where to properly put them. Your Banker looks at both sets of numbers and decides if you are credit worthy for a loan. Get a Board of Advisors NOW!

The Contractor and Contractor’s Spouse look at the numbers and either Smile and say “WOW” or Frown and Say “Ouch” “Oh Crap” or something much more descriptive.

No matter which way the numbers are from Fantastic to In The Toilet The Next Step is Now What Do We Do?

We are here to help. Let’s Chat!

Wishing You The Best Every Day.

Sincerely,

Sharie DeHart

Sharie 206-361-3950

When You Become A Client - Then we can tap into our resources of knowledge and strategy banks. We use the reports hidden in your QuickBooks in order to diagnose and understand your construction business and develop plans and help you implement a path to success for you and you alone because every contractor has unique Strengths, Weaknesses, Opportunities and Threats (S.W.O.T. Analysis) that when understood can lead to a Strategic Roadmap which cannot help but make a lot of money.

We Remove Contractor's Unique Paperwork Frustrations

Thanks for reporting a problem. We'll attach technical data about this session to help us figure out the issue. Which of these best describes the problem?

Any other details or context?

For Construction Company Owners who do not need the full power of a QuickBooks for contractors and want 24/7 online access we offer Xero Accounting Online, and we have a custom setup for construction companies. Click Here For More.

This Is One More Example of how Fast Easy Accounting is helping construction company owners all across the USA including Alaska and Hawaii put more money in the bank to operate and grow your construction company. Construction accounting is not rocket science; it is a lot harder than that, and a lot more valuable to people like you so stop missing out! Call Sharie 206-361-3950 or sharie@fasteasyaccounting.com and schedule your no charge one-hour consultation.

Profitable Contractors and Construction Company owners have known about the value of outsourced bookkeeping services and contractor coaching services like ours for a long time, and now you know about it too!

Thank You For Reading This Far, And I Hope You Understand we really do care about you and all contractors regardless of whether or not you ever hire our services.

We Scan Your Receipts, And Invoices link the appropriate transactions to QuickBooks or Xero Accounting Online depending on the construction accounting service you are using and provide ongoing Cloud Based Contractors Bookkeeping Services by accountants who understand construction.

Our Contractor Bookkeeping Services System Is A System

Thinking About Outsourcing Your Contractors Bookkeeping Services To Save Time And Money?

Click On The Button Below To Download A Free Guide

Business Process Management (BPM) For Contractors

Need Help Now?

Call Sharie 206-361-3950

sharie@fasteasyaccounting.com

Xero Outsourced Construction Accounting Services

QuickBooks Outsourced Construction Bookkeeping Services

We Are Xero Accounting Experts Specializing In Construction Bookkeeping Services

About The Author:

Sharie DeHart, QPA is the co-founder of Business Consulting And Accounting in Lynnwood Washington. She is the leading expert in managing outsourced construction bookkeeping and accounting services companies and cash management accounting for small construction companies across the USA. She encourages Contractors and Construction Company Owners to stay current on their tax obligations and offers insights on how to manage the remaining cash flow to operate and grow their construction company sales and profits so they can put more money in the bank. http://www.fasteasyaccounting.com/sharie-dehart/ 206-361-3950 or sharie@fasteasyaccounting.com

PS: For The Do-It-Yourself Construction Bookkeeper Our Store Has Chock-Full Of QuickBooks Setup Templates, QuickBooks Chart of Accounts And More.

Most Contractors Setup QuickBooks Desktop Version In One Of Three Ways:

#1 EZ Step Interview inside QuickBooks Setup

#2 Asked Their Tax Accountant To Setup QuickBooks

#3 They Attended A How To Setup QuickBooks Class Or Seminar

And QuickBooks Does Not Work The Way They Want It Too!

The Answer:

#1 Click Here To Buy An Entire QuickBooks Setup For Your Specific Contracting Company

#2 Click Here To Buy Just The Chart Of Accounts For Your Specific Contracting Company