Do You Feel Like The System Is Rigged To Keep You From

Getting Financing For Your Construction Company?

Well, it is! There I said and I stand by it 100%. In most cases it's not your fault! The problem is you using painting a word picture to show how well your Construction Company is doing and describing all the new and exciting projects you are bidding on and expect to get while your Financial Reports are telling the banker or lender the exact opposite!

Prior to the 1960's Contractors and Bankers had a personal one-on-one relationship. They got to know you, like you and trust you which made getting a loan fast and easy. Then starting in the 1960's lenders started using The RMA more than ever before to influence their decisions.

What you don't know about business is 100X worse than what you know about doing the work you love doing so very much.

Being Unaware Of The Rules Of Business Causes Many Contractors To Believe:

- Working Harder Will Solve Any Problem...

- Staying In Business Long Enough Means They Will Win...

- That One Good Job Will Fix All Of My Cash Flow Problems...

- Explain Their Situation To All Of The Bankers, Suppliers, Lenders...

In the end what you don't know can slowly and painfully drag you and your Construction Company into a deep hole of debt, discouragement, depression and despair long after you have run out of time, money and energy.

"If You Know The Answers The Questions Will Not Bother You" - Randalism

The Risk Management Association (RMA)

In 1914, The Robert Morris Club (RMA) was formed to help businesses and bankers exchange credit information. It was named after Robert Morris who was a signer of the Declaration of Independence and was believed to be the primary financier of the Revolutionary War.

The RMA developed several tools among them was a system of Ratios that we use today to study financial statements of all companies in all industries.

The banking and lending industry has enormous databases and artificial intelligence software from places like The Risk Management Association (http://www.rmahq.org/) that allows them to separate the good contractor risks from the bad ones. It generates recommendations based on complex algorithms much more complex than any gambling casino and with a much higher payoff.

One of the keys to getting a banker, lender or bonding company to consider your construction company for financing is the way your financial statements are presented. In particular, your construction company Profit & Loss and Balance Sheet.

A banker, lender or bonding agent logs into their RMA account and fills out electronic forms, answers questions about your construction company and inputs specific numbers in specific blanks that are taken directly from your construction company Profit & Loss and Balance Sheet. Any construction accountant worth his or her salt knows exactly how to setup QuickBooks correctly for this process to take place.

If a contractor gives their banker, lender or bonding agent a set of financial reports that do not conform to the RMA requirements they may or may not try to extrapolate the numbers need using Excel or some other program.

In most cases they be very polite, and thank you for "applying" before giving you the "We will let you know as soon as we know anything" speech. I know this because I have heard it from many bankers, lenders and bonding agents who are frustrated because they know you are a good client and they know you are a man or woman of integrity that can be trusted to pay the loan back, on time, with all of the interest.

The RMA and other reports show where your contracting company stands in relation to other contracting companies serving similar geographic and demographic markets.

Each major category, Sales, Cost of Goods Sold, Overhead, Other Expenses and Other Income are rated on a scale of top 25%, middle 50% and bottom 25%.

Ideally all of the numbers on your Profit & Loss and Balance Sheet falls somewhere in the middle 50%. Whenever a contractor "forgets" to declare all of their income or "overstate their expenses" it will show up here like a red flag.

Finally a Z-Score is compiled which is a formula for predicting bankruptcy. Edward I. Altman published it in 1968. The formula may be used to predict the probability that a firm will go into bankruptcy within two years. Although not 100% accurate it is a useful tool, similar to a tape measure is not 100% accurate yet still useful.

This is why sometimes a contractor with excellent credit cannot get a loan or line of credit and yet another contractor with only good credit can get financing.

Ten Little Things Hindering You From Getting Loans For

Your Contracting Company Which Can Be Fixed

The following can be found by doing a bit of work in Excel and getting the raw data from your Financial Statements. Or by Clicking On This Link To Learn More About Our Contractors Management Reporting Service.

#01 Current Ratio

A ratio of cash on hand to accounts payable of less than 1:1. Ideally, this ratio should be 2:1 or 2.5:1.

#02 Bill Paying History

Poor payment records, judgments, liens, bankruptcy, etc. for the firm and/or principals on credit agency reports.

#03 Unpaid Taxes

Make certain your payroll taxes, income taxes, sales taxes are paid and you have cash reserves in a separate bank account

#04 License Issues

Unlicensed contractors and those with expired licenses are a huge red flag! Don't do this!

#05 Bonding Issues

Contractors who can't get bonded or if your bonding capacity has been cut or your current bonding company refuses to renew it figure out why and get it resolved quickly.

#06 Financial Statements

Profit & Loss and Balance Sheet not current, formatted wrong or worse yet you feel the need to explain them.

#07 Job Status Reports

List of current jobs you are working on with a breakdown of how much you have in job deposits vs. how much you have spent. In other words are you in competition with the bank by lending your customers and clients money in the form of Labor, Material and Subcontractors which is exactly what happens when a contractor does not keep getting draw checks against work that has been done and has at least a 10% residual.

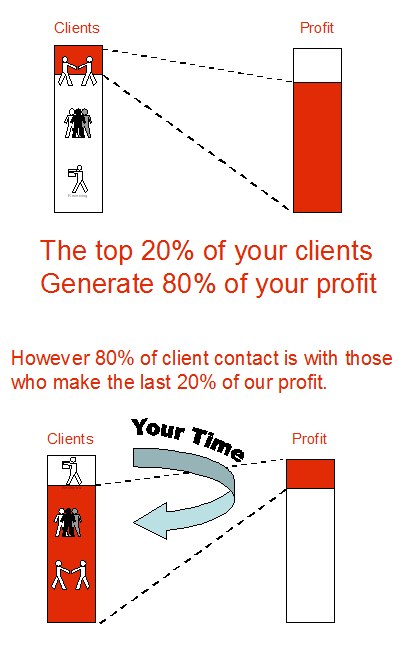

#08 Everybody Is Your Customer Which Means You Have No Clients

Bankers and lenders may ask you to describe the people you work for and if you start the conversation talking about your Customers they will presume you are one of those contractors stuck in your "Do Gooder Phase" where most people enter in their 20's and grow out of in their 30's; doing lots of work for friends and family who are "On a Budget" and persuade you to work for FREE or even less!

#09 Working On Jobs Outside Your Area Of Expertise

If you are a residential remodeler and darn good at it don't fool yourself into thinking, you can just as easily be a spec home builder or worse yet someone who can work on commercial tenant improvement projects. The skills, tools, specialty contractors and work flows are different for each of these areas.

#10 Working On Jobs Outside Your Geographic Area

Windshield time kills profits! The only people who make money on windshield time are the construction workers. Sharp bankers and lenders will ask about this one. Make sure you have Job Profitability Reports to show why you are working outside your geographic area.Our Workflow Removes Your Paperwork Frustrations

For Construction Company Owners who do not need the full power of QuickBooks for contractors and want 24/7 online access we offer Xero Accounting Online and we have custom setup for construction companies. Click Here For More.

This Is One More Example of how Fast Easy Accounting is helping construction company owners all across the USA including Alaska and Hawaii put more money in the bank to operate and grow your construction company. Construction accounting is not rocket science; it is a lot harder than that and a lot more valuable to people like you so stop missing out! Call Sharie 206-361-3950 or sharie@fasteasyaccounting.com and schedule your no charge one-hour consultation.

Profitable Contractors and Construction Company owners have known about the value of outsourced bookkeeping services and contractor coaching services like ours for a long time and now you know about it too!

Thank You For Reading This Far And I Hope You Understand we really do care about you and all contractors regardless of whether or not you ever hire our services.

We Scan Your Receipts And Invoices link the appropriate transactions to QuickBooks or Xero Accounting Online depending on the construction accounting service you are using and provide ongoing Cloud Based Contractors Bookkeeping Services by accountants who understand construction.

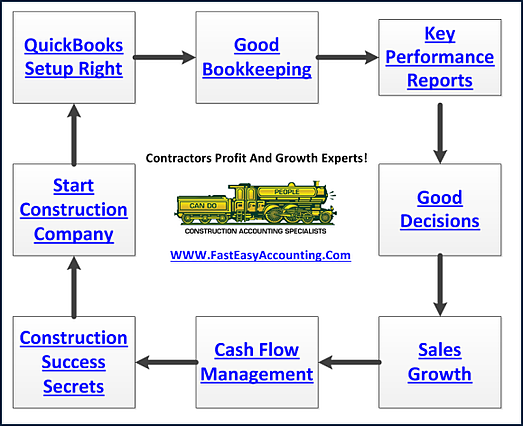

Our Contractor Bookkeeping Services System Is A System

Thinking About Outsourcing Your Contractors Bookkeeping Services To Save Time And Money?

Click On The Button Below To Download A Free Guide

Business Process Management (BPM) For Contractors

Need Help Now?

Call Sharie 206-361-3950

sharie@fasteasyaccounting.com

Xero Outsourced Construction Accounting Services

QuickBooks Outsourced Construction Bookkeeping Services

We Are Xero Accounting Experts Specializing In Construction Bookkeeping Services

About The Author:

Randal DeHart, PMP, QPA is the co-founder of Business Consulting And Accounting in Lynnwood Washington. He is the leading expert in outsourced construction bookkeeping and accounting services for small construction companies across the USA. He is experienced as a Contractor, Project Management Professional, Construction Accountant, Intuit ProAdvisor, QuickBooks For Contractors Expert and Xero Accounting Specialist. This combination of experience and skill sets provides a unique perspective which allows him to see the world through the eyes of a contractor, Project Manager, Accountant and construction accountant. This quadruple understanding is what sets him apart from other Intuit ProAdvisors and Xero accountants to the benefit of all of the construction contractors he serves across the USA. Visit http://www.fasteasyaccounting.com/randal-dehart/ to learn more.

Randal DeHart, PMP, QPA is the co-founder of Business Consulting And Accounting in Lynnwood Washington. He is the leading expert in outsourced construction bookkeeping and accounting services for small construction companies across the USA. He is experienced as a Contractor, Project Management Professional, Construction Accountant, Intuit ProAdvisor, QuickBooks For Contractors Expert and Xero Accounting Specialist. This combination of experience and skill sets provides a unique perspective which allows him to see the world through the eyes of a contractor, Project Manager, Accountant and construction accountant. This quadruple understanding is what sets him apart from other Intuit ProAdvisors and Xero accountants to the benefit of all of the construction contractors he serves across the USA. Visit http://www.fasteasyaccounting.com/randal-dehart/ to learn more.

Our Co-Founder Randal DeHart - Is a Certified PMP (Project Management Professional) with several years of construction project management experience. His expertise is construction accounting systems engineering and process development. His exhaustive study of several leading experts including the work of Dr. W. Edward Deming, Michael Gerber, Walter A. Shewhart, James Lewis and dozens of others was the foundation upon which our Construction Bookkeeping System is based and continues to evolve and improve. Check out our Contractor Success Map Podcast on iTunes and Follow Randal on Google+