QuickBooks Training Live Instructor Led Webinar For General Business Private Training By Appointment

With Private QuickBooks Training webinars you are in full control of the learning experience. You decide what you want to learn and how you want to learn it:

-

We can train you by working in your QuickBooks file.

-

We can diagnose QuickBooks issues and fix them.

-

We can diagnose QuickBooks issues and train you to fix them.

-

One to ten people from your company can attend training.

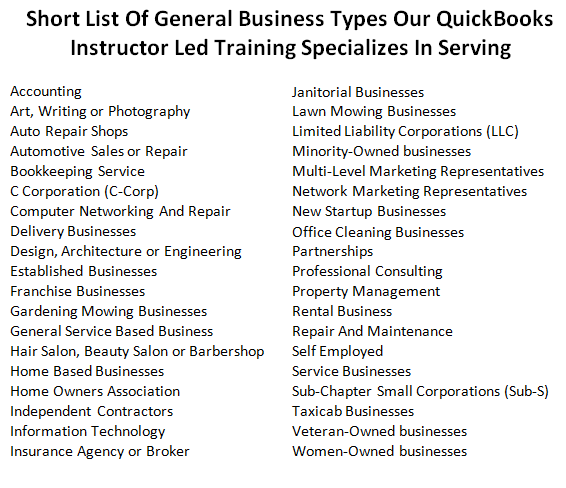

Our QuickBooks Training Programs are open to everyone not just contractors. We also offer Private QuickBooks Training for Contractors in classroom setting at our headquarters in Lynnwood Washington.

Your Instructor

Randal DeHart, PMP, QPA is the co-founder of Business Consulting And Accounting in Lynnwood Washington. He is the leading expert in Outsourced Construction Bookkeeping and Construction Accounting Services for small construction companies across the USA. Certified as a Project Management Professional (PMP) and an Intuit QuickBooks ProAdvisor. He is a QuickBooks expert having used QuickBooks from its first release in DOS version in the early 1990's through the most current version.

His construction experience includes new construction, commercial tenant improvement, residential remodel, service and repair, Commercial Journeyman Plumber (PL01) and owner operator of several construction companies, Project Management Professional and construction accountant.

His background provides a unique perspective which allows him to see the world through the eyes of a contractor, project manager and accountant and most important a construction accountant. This quadruple understanding sets him apart from other Intuit QuickBooks ProAdvisors and accountants in the arena.

QuickBooks Training General Business Webinar

If you do not see your business listed please contact Sharie 206-361-3950 or sharie@fasteasyaccounting.com

QuickBooks Training Program For General Business Details

QuickBooks Training Program For General Business Webinars - Will be offered using an online meeting service.

One To Ten People Can Attend - For the same low price. We encourage you to have everyone who will have anything to do with QuickBooks at the training session.

You Will Need High Speed Internet Access - If you have dial-up internet access, we strongly recommend that you get access to high-speed internet for your class.

You Will Need A Computer With - Speakers or headphone jack in order to hear the instructor via your computer. You'll be able to ask questions via chat or out loud if your computer is equipped with a microphone.

A Quiet Location Without Interruptions - To avoid distractions, we recommend you find a location where you won't be interrupted and can focus on the material.

Bring A List of Your QuickBooks Questions - This is your golden opportunity to have a QuickBooks expert to answer all of your QuickBooks questions except QuickBooks For Contractors or construction accounting. Make a list and bring it to class. Your instructor will do their best to answer all your questions.

In Depth Questions About QuickBooks For Contractors - And construction accounting issues are covered Private QuickBooks Training click here for more information.

QuickBooks File - We can train you by using your QuickBooks company file or one of our sample QuickBooks company files.

QuickBooks Versions And Years Supported:

-

QuickBooks Pro 2008 To Present Year

-

QuickBooks Premier 2008 To Present Year

-

QuickBooks Premier For Contractors 2008 To Present Year

-

QuickBooks Enterprise 2008 To Present Year

-

QuickBooks Enterprise For Contractors 2008 To Present Year

You Decide What - You want your private accounting instructor to train you on. Some business owners have found it helpful to have an outline like the one shown below to use as a menu to pick and choose. You are welcome to change direction and alter the course of your training as you see fit.

Most Popular QuickBooks Training Modules:

Level I - Basic Bookkeeping For General Business

Lesson 01: Getting Started

Lesson 02: Setting up QuickBooks

Lesson 03: Working with Lists

Lesson 04: Working with Bank Accounts

Lesson 05: Using other Accounts in QuickBooks

Lesson 06: Entering Sales Information

Lesson 07: Receiving Payments and Making Deposits

Lesson 08: Entering and Paying Bills

Level II - Basic Bookkeeping For General Business

Lesson 09: Analyzing Financial Data

Lesson 10: Setting up Inventory

Lesson 11: Tracking and Paying Sales Taxes

Lesson 12: Doing Payroll with QuickBooks

Lesson 13: Estimating and Progress Invoicing

Lesson 14: Tracking Time

Lesson 15: Customizing Forms and Writing QuickBooks Letters

Lesson 16: Multi-Currency

Summary

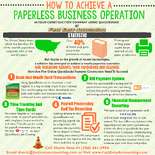

Mastering Accounting is a skill that requires a minimum of 10,000 hours of intense training and practice and many volumes of instruction manuals and workbooks.

Our Intent is to provide a brief overview of QuickBooks bookkeeping services. It is not to provide you with all of the skills required to become a fully qualified QuickBooks accountant that is able to serve all of the businesses listed above but to provide you with training in order to handle most of the QuickBooks bookkeeping services needs in your company.

Ongoing Support we offer fee based ongoing support for QuickBooks and QuickBooks for contractors regardless of whether or not you have taken any of our QuickBooks Training Programs For General Business or our QuickBooks Training Programs For Construction Contractors.

For More Information Contact Sharie 206-361-3950 or sharie@fasteasyaccounting.com

Click Here For More QuickBooks Training Options

Fill Out The Form And Get The Help You Need!

Need Help Now?

Call Sharie 206-361-3950

sharie@fasteasyaccounting.com