QuickBooks Job Costing Reports

These Reports - Can only be found in the QuickBooks Premier Contractors Edition, QuickBooks Accountants Edition, And QuickBooks Enterprise Edition. Some of them are also available in the Professional Services edition.

We offer Job Costing Report Service click on button below to learn more

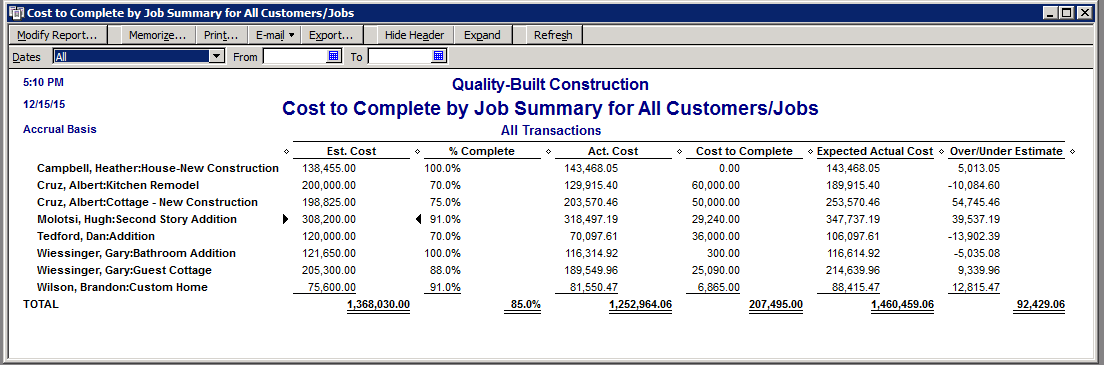

Costs to Complete by Job Summary - Once you enter an estimate for how far along each of your jobs are, this report will summarize the cost to complete each one of them that have active estimates. It also shows you how much you are over or under your estimate.

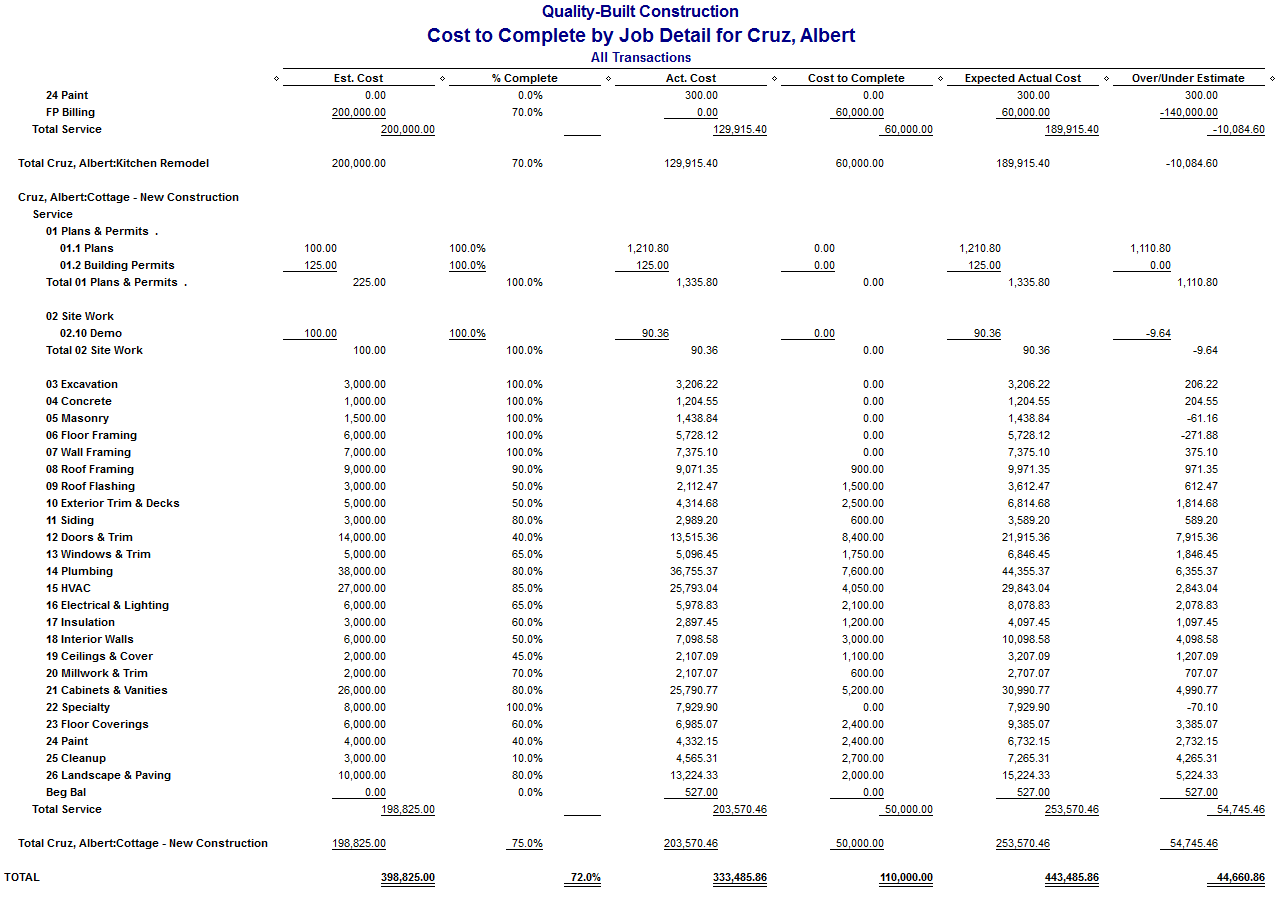

Costs to Complete by Job Detail - Report drills down to the detailed estimated cost by phase for whatever customer or job you select and it shows you how you are doing in relation to your estimate.

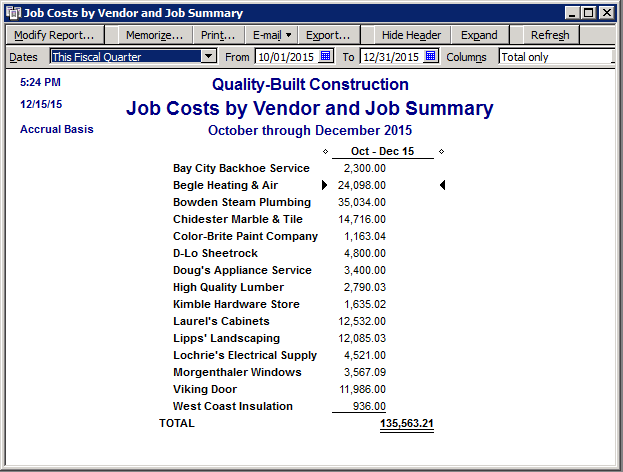

Job Costs by Vendor and Job Summary - Report lists the job costs you have incurred for each job or project and it is subtotaled by vendor.

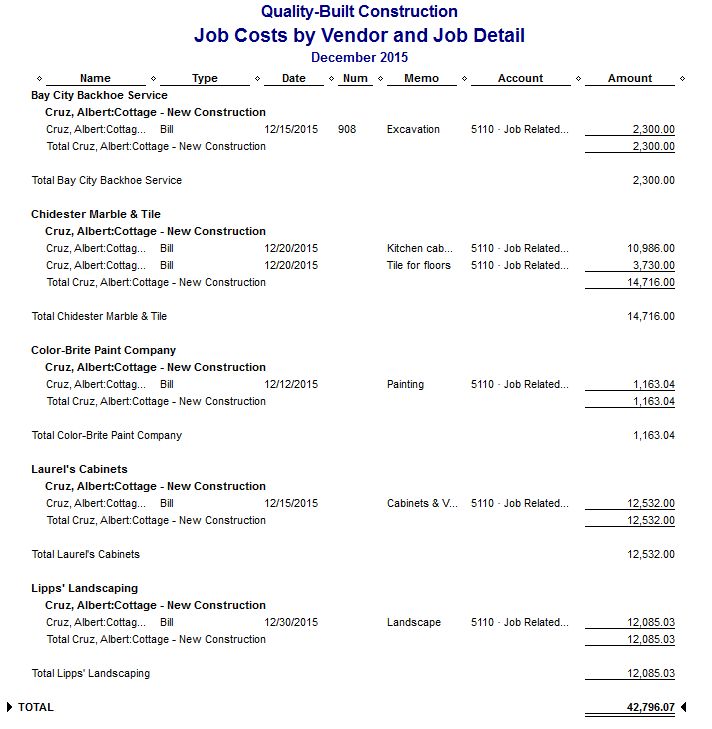

Job Costs by Vendor and Detail - Report shows a detailed list of all the job-related costs that you have incurred for each vendor, subtotaled by job.

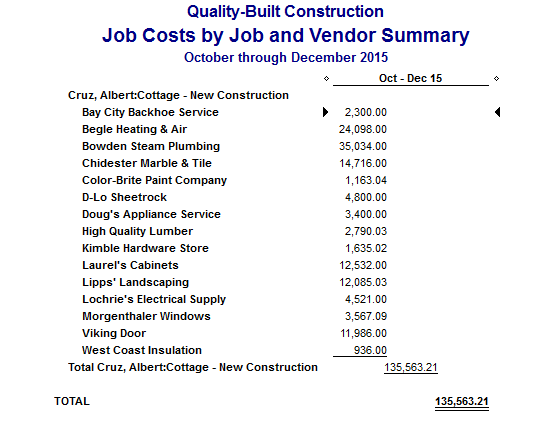

Job Costs Job and Vendor Summary - Report lists the job-related costs you have incurred for each vendor, subtotaled by job.

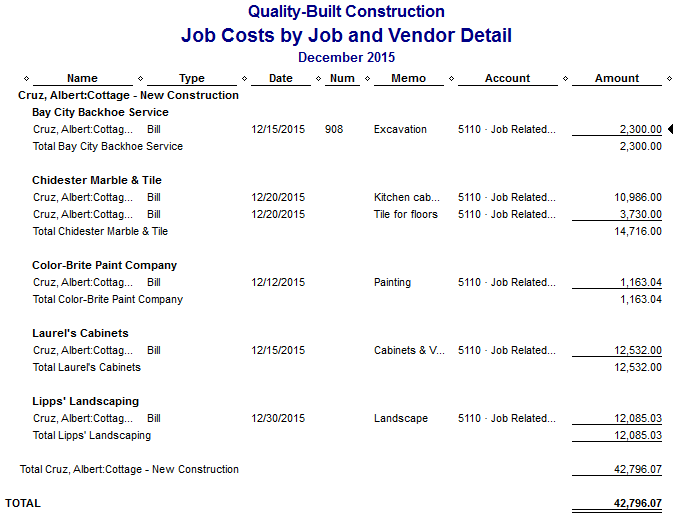

Job Costs by Job and Vendor Detail - Report shows a detailed list of the job-related costs you have incurred for each vendor, subtotaled by job.

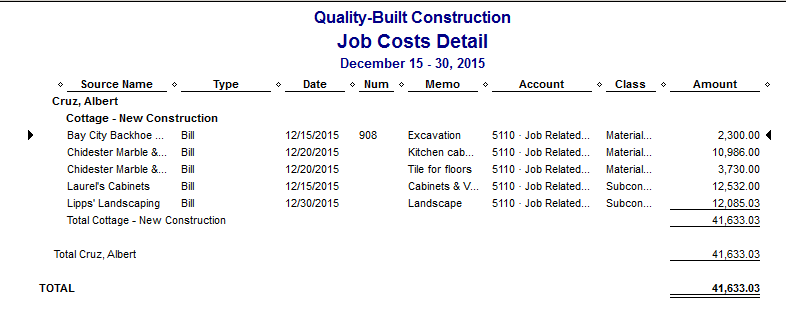

Job Costs Detail - Report lists all the costs you have for each job. This report is useful if you need to separate all material supplier purchases, subcontractors bills, and labor costs for each job.

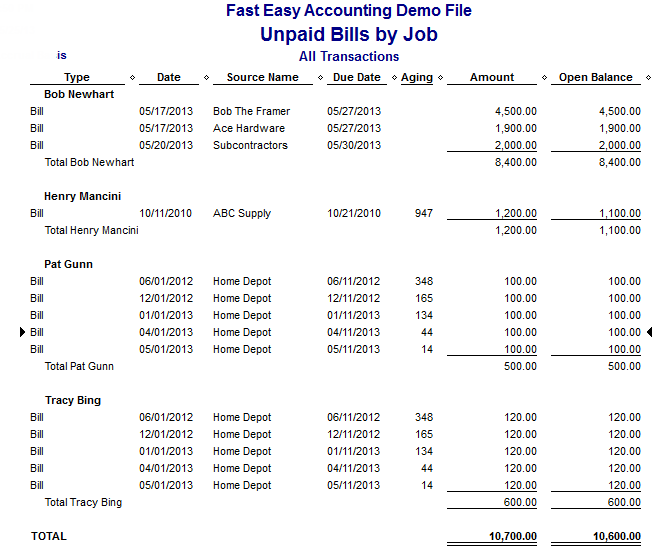

Unpaid Bills by Job - Report lists the bills you have not yet paid, separated by customers and jobs. It lists only bills with a customer or job associated with it. This report is useful if you wait to pay vendor bills for a specific job until you receive a payment from the customer; Pay-as-Paid.

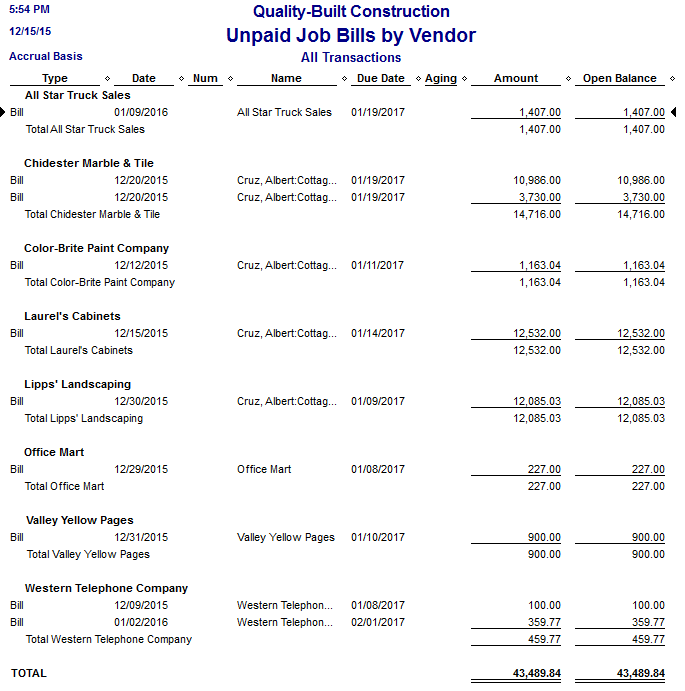

Unpaid Job Bills by Vendor - Report shows all bills you have not yet paid, sorted by vendor or subcontractor, and lists customer or jobs associated with each line item on the bill.

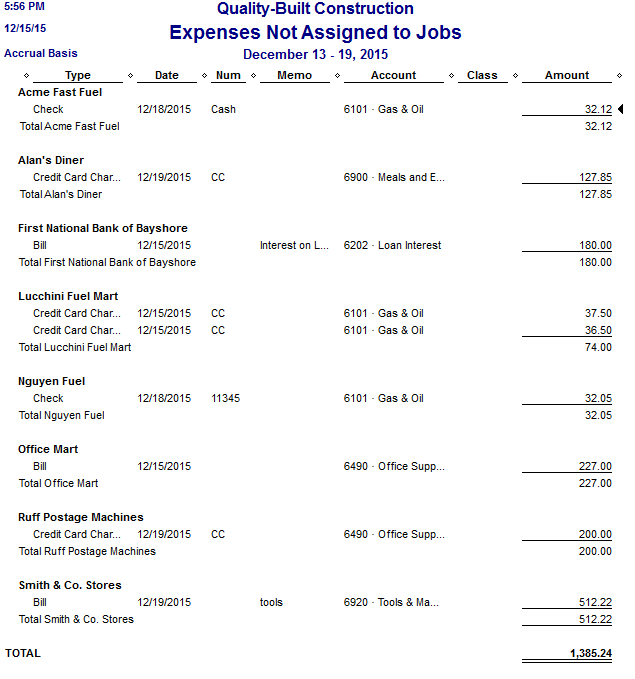

Expenses Not Assigned to Jobs - Report lists costs that have not been assigned to a customer or job, totaled by vendor. This report helps you find costs that may not have been passed along to your customers.

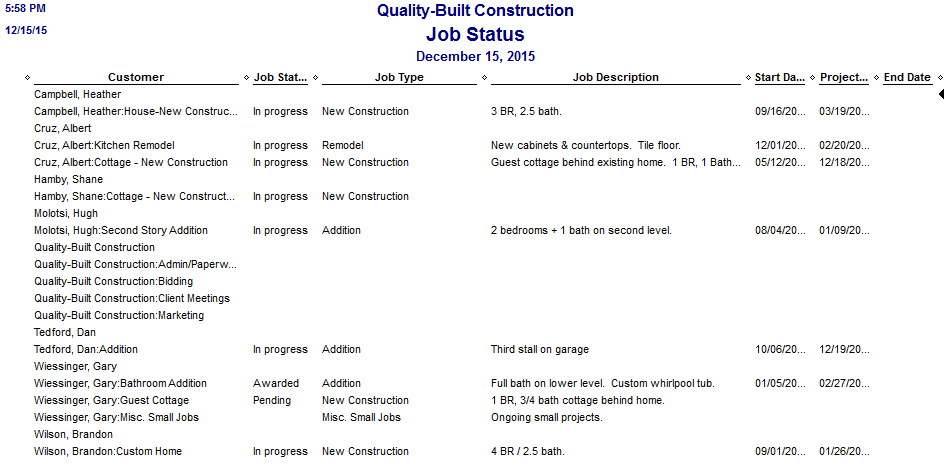

Job Status - Report lists information for each active customer and job.

Profitable Construction - Companies have known about the value of outsourced bookkeeping services for a long time and now you know about it too!

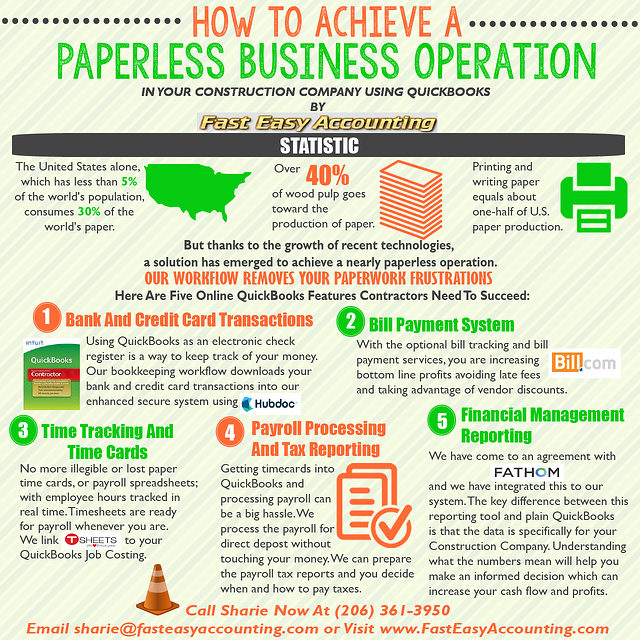

For Construction Company Owners who do not need the full power of QuickBooks for contractors and want 24/7 online access we offer Xero Accounting Online and we have custom setup for construction companies. Click Here For More.

We Scan Your Receipts And Invoices link the appropriate transactions to QuickBooks or Xero Accounting Online depending on the construction accounting service you are using and provide ongoing Cloud Based Contractors Bookkeeping Services by accountants who understand construction.

Thinking About Outsourcing Your Contractors Bookkeeping Services?

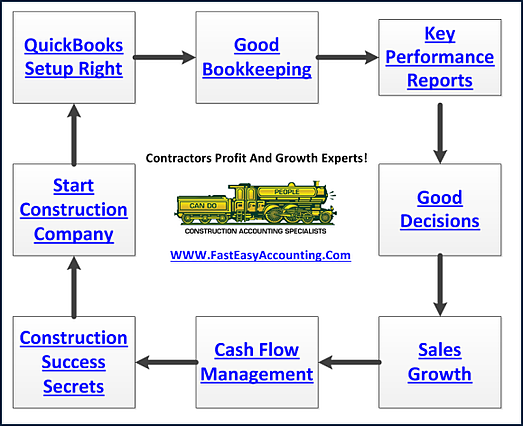

Our Contractor Bookkeeping Services System Is A System

Click On The Button Below To Download A Free Guide

Business Process Management (BPM) For Contractors

Fill Out The Form And Get The Help You Need!

Need Help Now?

Call Sharie 206-361-3950

sharie@fasteasyaccounting.com

Xero Outsourced Construction Accounting Services

QuickBooks Outsourced Construction Bookkeeping Services

We Are QuickBooks Experts Specializing In Construction Bookkeeping Services

About The Author:

Randal DeHart, PMP, QPA is the co-founder of Business Consulting And Accounting in Lynnwood Washington. He is the leading expert in outsourced construction bookkeeping and accounting services for small construction companies across the USA. He is experienced as a Contractor, Project Management Professional, Construction Accountant, Intuit ProAdvisor, QuickBooks For Contractors Expert and Xero Accounting Specialist and Bill.Com Certified Guru. This combination of experience and skill sets provides a unique perspective which allows him to see the world through the eyes of a contractor, Project Manager, Accountant and construction accountant. This quadruple understanding is what sets him apart from other Intuit ProAdvisors and Xero accountants to the benefit of all of the construction contractors he serves across the USA. Visit http://www.fasteasyaccounting.com/randal-dehart/ to learn more.

Randal DeHart, PMP, QPA is the co-founder of Business Consulting And Accounting in Lynnwood Washington. He is the leading expert in outsourced construction bookkeeping and accounting services for small construction companies across the USA. He is experienced as a Contractor, Project Management Professional, Construction Accountant, Intuit ProAdvisor, QuickBooks For Contractors Expert and Xero Accounting Specialist and Bill.Com Certified Guru. This combination of experience and skill sets provides a unique perspective which allows him to see the world through the eyes of a contractor, Project Manager, Accountant and construction accountant. This quadruple understanding is what sets him apart from other Intuit ProAdvisors and Xero accountants to the benefit of all of the construction contractors he serves across the USA. Visit http://www.fasteasyaccounting.com/randal-dehart/ to learn more.

Our Co-Founder Randal DeHart - Is a Certified PMP (Project Management Professional) with several years of construction project management experience. His expertise is construction accounting systems engineering and process development. His exhaustive study of several leading experts including the work of Dr. W. Edward Deming, Michael Gerber, Walter A. Shewhart, James Lewis and dozens of others was the foundation upon which our Construction Bookkeeping System is based and continues to evolve and improve. Follow Randal on Google+

Our Co-Founder:

![]() Sharie DeHart, QPA, is the President of Business Consulting And Accounting (Fast Easy Accounting) in Lynnwood, Washington. She is the leading expert in managing outsourced construction bookkeeping and accounting services companies and cash management accounting for small construction companies across the USA. She encourages Contractors and Construction Company Owners to stay current on their tax obligations. She offers insights on managing the remaining cash flow to operate and grow their construction company sales and profits so they can put more money in the bank. Call 206-361-3950 or sharie@fasteasyaccounting.com.

Sharie DeHart, QPA, is the President of Business Consulting And Accounting (Fast Easy Accounting) in Lynnwood, Washington. She is the leading expert in managing outsourced construction bookkeeping and accounting services companies and cash management accounting for small construction companies across the USA. She encourages Contractors and Construction Company Owners to stay current on their tax obligations. She offers insights on managing the remaining cash flow to operate and grow their construction company sales and profits so they can put more money in the bank. Call 206-361-3950 or sharie@fasteasyaccounting.com.