LMOS™

I, Randal DeHart developed the phrase LMOS, pronounced "Lee Moss" in 1980 as a way to get a better handle on Job Costing And Job Profitability for our construction accounting system. It was done with pencil and paper. It was painful, time-consuming, and boring. However, the reports I could generate were worth their weight in gold!

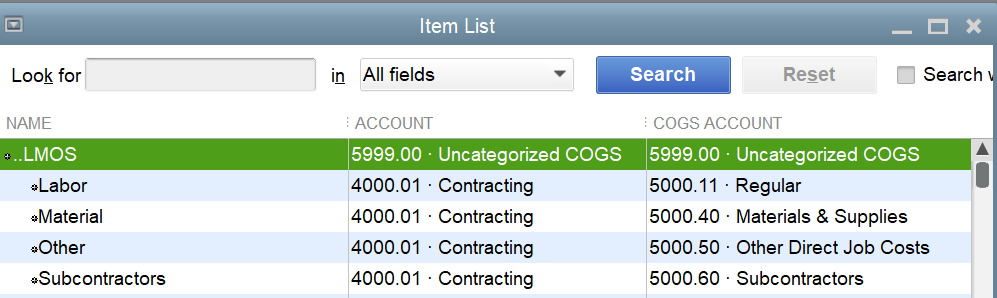

Shown below is a later rendition of LMOS as we use it in our QuickBooks For Contractors Template.

Every Cost Code was broken down into Labor, Material, Other, and Subcontractor or as we call it LMOS. For example Demolition is one of the tasks contractors perform. It has four different components for easy tracking of costs and as a foundation piece of Job Costing Reports:

- Demolition Labor > How much money was spent using the contractor's Labor?

- Demolition Material > How much money was spent on Material?

- Demolition Other > How much money was spent on Other costs like permits?

- Demolition Subcontractor > How much money on Subcontractors?

Which means we could determine cost of construction down to the granular level, run analysis and we knew which Cost Code tasks should be done in-house with our Labor and which ones should Subcontracted.

We Made Similar Calculations On Materials And Other Costs. We found giving the majority of business to one or two material suppliers and developing relationships with the branch managers of those suppliers we got better pricing and service. Saving 10 minutes a day getting material and streamlining other costs processes added substantial cash flow and profit to the bottom line.

LMOS takes a lot of time and effort to set up QuickBooks but it pays of in the long run.

After a while Contractors who do this know exactly when to use their Labor or Subcontractors. They know where to buy Material, and can track their what Other costs.

We Offer The Use Of LMOS In The Following Services

- Outsourced Accounting and ongoing day-to-day bookkeeping.

- Customized QuickBooks For Contractors set up.

- Clean up existing QuickBooks For Contractors file.

- Teaching our LMOS system as a part of setting up Job Costing reports.

- Teaching our LMOS system to implement more profitable business process management.

- Teaching our LMOS system so businesses can make informed decisions based on objective facts and figures vs. subjective opinions.

We are actively involved in teaching the benefits of our LMOS system and how to incorporate it into best practices for businesses. We conduct training on how to use our LMOS system on our podcast, as guest on other podcasts, participating in seminars, and online conferences.

LMOS helps them get a better understanding of costs. Without LMOS they have one large cost bucket for every cost code. With LMOS they can review the costs at a granular level and know when it is best to:

- Perform work with in-house Labor vs. Subcontracting.

- Buy Material locally vs. ordering it online.

- Use Other outside services to provide plans and permits.

- Subcontract outside services vs. investing in tools and equipment rarely used.

In our Construction Accounting Academy we have a class devoted entirely to teaching our LMOS system. It goes into detail how to set up LMOS in QuickBooks desktop.

Although LMOS is primarily used in the Construction industry it can be used in other industries that are project based and they need to break out costs for Labor, Material, Other and Subcontractors.

One example of an industry outside of construction that uses LMOS is the automobile restoration industry. They fix and repair vehicles that have been involved in crashes. This industry has internal Labor working on a variety of damaged vehicles. They purchase Material specific for each project. They have Other costs for example getting a new title or license for a restored vehicle. If they have need of heavy duty tools or equipment they rarely use they will Subcontract the work to another larger vendor.

Email Sharie@fasteasyaccounting.com

Or Call Sharie 1-800-361-1770

About The Author:

Randal DeHart, PMP, QPA is the co-founder of Business Consulting And Accounting in Lynnwood Washington. He is the leading expert in outsourced construction bookkeeping and accounting services for small construction companies across the USA. He is experienced as a Contractor, Project Management Professional, Construction Accountant, Intuit ProAdvisor, QuickBooks For Contractors Expert and Xero Accounting Specialist. This combination of experience and skill sets provides a unique perspective which allows him to see the world through the eyes of a contractor, Project Manager, Accountant, and construction accountant. This quadruple understanding is what sets him apart from other Intuit ProAdvisors and Xero accountants to the benefit of all of the construction contractors he serves across the USA. Visit http://www.fasteasyaccounting.com/randal-dehart/ to learn more.

Randal DeHart, PMP, QPA is the co-founder of Business Consulting And Accounting in Lynnwood Washington. He is the leading expert in outsourced construction bookkeeping and accounting services for small construction companies across the USA. He is experienced as a Contractor, Project Management Professional, Construction Accountant, Intuit ProAdvisor, QuickBooks For Contractors Expert and Xero Accounting Specialist. This combination of experience and skill sets provides a unique perspective which allows him to see the world through the eyes of a contractor, Project Manager, Accountant, and construction accountant. This quadruple understanding is what sets him apart from other Intuit ProAdvisors and Xero accountants to the benefit of all of the construction contractors he serves across the USA. Visit http://www.fasteasyaccounting.com/randal-dehart/ to learn more.

Our Co-Founder Randal DeHart - Is a Certified PMP (Project Management Professional) with several years of construction project management experience. His expertise is construction accounting systems engineering and process development. His exhaustive study of several leading experts including the work of Dr. W. Edward Deming, Michael Gerber, Walter A. Shewhart, James Lewis and dozens of others was the foundation upon which our Construction Bookkeeping System is based and continues to evolve and improve. Check out our Contractor Success Map Podcast on iTunes.

Our Co-Founder:

![]() Sharie DeHart, QPA, is the President of Business Consulting And Accounting (Fast Easy Accounting) in Lynnwood, Washington. She is the leading expert in managing outsourced construction bookkeeping and accounting services companies and cash management accounting for small construction companies across the USA. She encourages Contractors and Construction Company Owners to stay current on their tax obligations. She offers insights on managing the remaining cash flow to operate and grow their construction company sales and profits so they can put more money in the bank. Call 206-361-3950 or sharie@fasteasyaccounting.com.

Sharie DeHart, QPA, is the President of Business Consulting And Accounting (Fast Easy Accounting) in Lynnwood, Washington. She is the leading expert in managing outsourced construction bookkeeping and accounting services companies and cash management accounting for small construction companies across the USA. She encourages Contractors and Construction Company Owners to stay current on their tax obligations. She offers insights on managing the remaining cash flow to operate and grow their construction company sales and profits so they can put more money in the bank. Call 206-361-3950 or sharie@fasteasyaccounting.com.