Bookkeepers Who Will Destroy Your Construction Company

When the world economy collapsed beginning in 2008, a lot companies went out of business, and one of the hardest hit sectors was construction. Thousands of bookkeepers were suddenly out of a job, and many of them began to freelance taking on a few clients in order to pay rent and keep food on the table.

As the economy continues to improve a lot of them are finding jobs with contractors like you because of the security that comes with having a stable income. The problem is they have been accustomed to having lots of free time during office hours to chat on their cell phones, surf the web, spend time on Facebook and other social media sites; not buckling down and getting work done, right and on time.

In addition, most of them have not kept up with the advances in Construction Accounting Technology let alone keeping the construction bookkeeping skills updated.

What happens when he or she realizes they were earning $30 an hour as a freelance bookkeeper and now they are slaving away in your cramped office with no snacks, beverages, using outdated hardware and software for $10 an hour?

Psychologists refer to it as mental stress or "Cognitive Dissonanse" or "Mental Noise" or "The Chattering Monkeys of the Mind."

According to Wikipedia Leon Festinger's theory of cognitive dissonance focuses on how humans strive for internal consistency. An individual who experiences inconsistency (dissonance) tends to become psychologically uncomfortable and is motivated to try to reduce this dissonance—as well as actively avoid situations and information likely to increase it.[1]

Perception Is Reality

Freelance bookkeepers average approximately 4 hours of paid work a day. In their minds, they are worth $30 an hour, and you are ripping them off by paying them 1/3 of what they perceive are worth.This thinking begins to consume them, and in since most bookkeepers have a Driver Personality it means they are confronted with the primal fear of all Driver Personalities

"You Are Taking Advantage Of Me And I Am Going To Get Even!

There are several ways this plays out and the two most common are embezzlement and becoming a Bad Bookkeeper

#01 - Don't Hire A Bad Bookkeeper Click Here For More...

#02 - Understand The Employee Theft 10-10-80 Rule - Discovered over many years of experience and first-hand observation by auditors, accountants, fraud examiners, anyone involved in detecting employee theft.

Ten Percent - Of all employees including bookkeepers will steal in a variety of ways from office supplies, petty cash, graft, kickbacks, and payoffs from your suppliers, vendors and sub-contractors and even hundreds of thousands or even millions of dollars. They will do it regardless of how many security systems are in place because they lack integrity and have a "taker's" entitlement paradigm that states: "It Is Better To Take Than To Make." They cannot be stopped, only caught! And only then if you have systems in place and if you can convince the criminal justice system to take action, good luck with that!

Ten Percent - Of all employees including bookkeepers will never steal because they have integrity and a "Producer's" paradigm that states: "It Is Better To Make Than To Take." In the end, these are the people who will add so much value to your company you cannot help but reward them with more money, benefits and recognition. Because if you do not they will be recruited by your competitors. This is another example of Leveling, click here to learn more.

Eighty Percent - Of all employees including bookkeepers will steal if they feel certain they can get away with it and if circumstances allow for it due to weak integrity and a sense of "Redistributing The Wealth, But Not The Work Or The Responsibility"

#03 - Your Bookkeeper - Asks for signature authority on your checking / savings / payroll accounts

#04 - Your Bookkeeper - Has a lifestyle that seems above what they are earning

#05 - Your Bookkeeper - Takes Records Home to work on or they want to work in the office when no one is around (Fraudulent activities are easier when nobody is around).

#06 - Your Bookkeeper - Refuses to take a vacation.

#07 - Your Bookkeeper - Gets defensive when you or your CPA asks questions.

#08 - Your Bookkeeper - Has access to your credit/debit cards.

#09 - Your Bookkeeper - Receives mail-order packages at work.

#10 - Your Bookkeeper - Has QuickBooks in a complete mess and you cannot understand any of it.

#11 - You Bookkeeper - Tries to explain away delinquency tax notices.

#12 - Your Bookkeeper - Insists on picking up the daily mail.

#13 - Your Bookkeeper - Is the primary contact for your company's banks, auditors, creditors, etc.

#14 - Your Bookkeeper - Misplaces payroll receipts, deposit records, supplier letters, and estimates.

#15 - Your Bookkeeper - Makes the bank deposits and they seem to be too small.

#16 - Your Bookkeeper - Show signs of a drinking, drug, or gambling problem or family financial problems.

#17 - Your Bookkeeper - Suggested they could save money by getting rid of the outside accounting firm.

#18 - Your Bookkeeper - Gets angry when you ask for a QuickBooks report

#19 - Your Bookkeeper - Tries to blame the previous Bookkeeper or outside accounting firm for messy QuickBooks

#20 - Your Bookkeeper - Does not get along well with other employees and staff members.

#21 - Paying bills with Cashiers Checks - When you look it up on the internet it will only show as a withdrawal

There Are More Warning Signs - To be aware of and action steps you can take.

Bad Bookkeeper Tell Tale Signs

They train the contractor like an organ grinder trains a monkey, click here to learn more

They refuse to invest time and money in continuing education because they know everything

They are passive aggressive and will study you and your staff to learn how to manipulate everyone

They are masters at gaining power over you, your staff, and new employees and outside suppliers

They hate change and will fight tooth and nail to stop it, or they will destroy your company!

They know you're responsible for taxes, fines, penalties and interest; so this is where they get even

They know how to increase your quarterly tax return costs, click here to learn more

They understand that bookkeeping is 90% repetitive transactions and 10% complex transactions

They don't know what to do with complex transactions, so they put them wherever they feel like

They have side jobs working for other companies or an entire bookkeeping business on the side

They decide how much integrity, if any; your company has and they tell everyone who will listen

They create a miserable work environment causing turnover in your staff which costs you money

They make your customers and clients feel unwelcome and unappreciated which costs you money

They act as if they are serving time in jail and do the minimum required to keep their job

They say things to suggest businesses are bad and construction company owners are the worst

They are jealous of your success and even more so if they ever had a failed construction business

They don't learn anything new; why should they, nobody is reviewing the QuickBooks

They never learn anything new unless the company pays for the training and it is on the clock

They quit when the tax return is being prepared because QuickBooks is a mess and they're caught

They come in a little bit late every morning and leave a little bit early to make up for it

They bait you with drama, nasty comments and minor actions to find your tolerance limit

They get even with you for every perceived injustice against themselves and society as a whole

They keep you busy with lots of mindless crap to divert attention from why the books are a mess

They let you think you are in control of the bookkeeping and the bookkeeper until it is too late

They make you think they are looking out the best interest of the company, LOL!

They let the work expand to fill whatever time you are willing to pay them to get it done

When they quit or get fired, expect to hear: “Chaos, panic and disorder...my work here is done”

They become indispensable in order to take time off whenever they please and hold you hostage

They negotiate for additional perks, benefits, changes, and elimination of personal accountability

They network for a better job with your clients, suppliers, vendors and your competitors

They represent themselves to outsiders as the owner or manager with decision-making authority

They text, message, e-mail, surf the web, chat on the phone and socialize on company time

They train you to leave them alone by getting upset or angry whenever you want anything

They work hard at causing just enough chaos, so owner does not earn more than the bookkeeper

When your business fails, they tell everyone you were incompetent, and they saw it coming

They live in a chaotic, neurotic, psychotic, selfish, disorganized, blame game environment

They work through lunch to leave earlier in the day (At the office for 7 hours and get paid for 8)

Question - What happens when the person in control of QuickBooks is unhappy with you?

Answer - The same thing that happens when the person who cooks your food is unhappy with you!

--------------------------------------------------------------------------------------

In The End - Bad Bookkeepers will leave you with unfiled and unpaid taxes, gasping, upset, with tear stained checks, wide-eyed, stupid, mouth open, standing in the middle of the highway of business success staring at the remains of your business, crashed, rolled over, upside down, in the ditch, on fire, with flames belching from all sides with no hope in sight.

And then things get real ugly as you recall reading The General Contractor And The River Of Construction Commerce and realize all of this could have been avoided!

I have seen bad bookkeepers ruin too many businesses, especially construction businesses. In most cases, it was Bookkeeper Incompetence or Bookkeeper Embezzlement, and in other cases, it appears to me there may have been some deliberate identity theft; however, I cannot be certain.

All I know for sure is that I have witnessed business failures that have led to divorce, families destroyed, finances wiped out and people living on the streets. In a few extreme cases I know of contractors that have taken their own lives and it needs to stop!

--------------------------------------------------------------------------------------

Replace Your Wealth Prevention Tool Before It Is Too Late!

Outsource Your Bookkeeping Now

You went into business for yourself for a variety of reasons and in most cases you thought all you had to do was get good jobs, do the work and you would make a lot of money. In a very short while you got a rude wake-up-call and your reality check bounced. You found out getting the jobs and doing the work was only a small part of being a contractor. What started out as an adventure turned into something not as fun as you thought it would be and then it degenerated into a nightmare as you discovered the three accounting nightmares all contractors face. #1 Calculating And Processing Payroll #2 Calculating And Filing A Slew Of Tax Returns #3 Figuring Out Which Customers And Jobs Are Profitable And Which Ones To Avoid Like The Plague

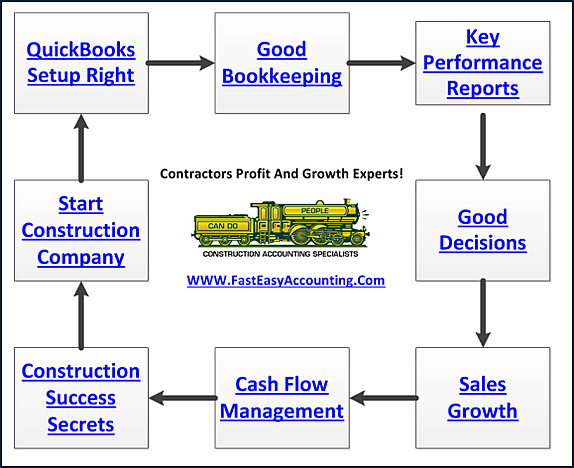

Our Contractor Bookkeeping Services System Is A System

Profitable Construction - Companies have known about the value of outsourced bookkeeping services for a long time and now you know about it too We Scan Your Receipts And Invoices link the appropriate transactions to QuickBooks or Xero Accounting Online depending on the construction accounting service you are using and provide ongoing Cloud Based Contractors Bookkeeping Services by accountants who understand construction.

We Scan Your Receipts And Invoices link the appropriate transactions to QuickBooks or Xero Accounting Online depending on the construction accounting service you are using and provide ongoing Cloud Based Contractors Bookkeeping Services by accountants who understand construction.

For Construction Company Owners who do not need the full power of QuickBooks for contractors and want 24/7 online access we offer Xero Accounting Online and we have custom setup for construction companies. Click Here For More.

Business Process Management (BPM) For Contractors

Thinking About Outsourcing Your Contractors Bookkeeping Services?

Click On The Button Below To Download A Free Guide

Fill Out The Form And Get The Help You Need!

Need Help Now?

Call Sharie 206-361-3950

sharie@fasteasyaccounting.com

Xero Outsourced Construction Accounting Services

QuickBooks Outsourced Construction Bookkeeping Services

We Are Xero Accounting Experts Specializing In Construction Bookkeeping Services

About The Author:

Randal DeHart, PMP, QPA is the co-founder of Business Consulting And Accounting in Lynnwood Washington. He is the leading expert in outsourced construction bookkeeping and accounting services for small construction companies across the USA. He is experienced as a Contractor, Project Management Professional, Construction Accountant, Intuit ProAdvisor, QuickBooks For Contractors Expert and Xero Accounting Specialist and Bill.Com Certified Guru. This combination of experience and skill sets provides a unique perspective which allows him to see the world through the eyes of a contractor, Project Manager, Accountant and construction accountant. This quadruple understanding is what sets him apart from other Intuit ProAdvisors and Xero accountants to the benefit of all of the construction contractors he serves across the USA. Visit http://www.fasteasyaccounting.com/randal-dehart/ to learn more.

Randal DeHart, PMP, QPA is the co-founder of Business Consulting And Accounting in Lynnwood Washington. He is the leading expert in outsourced construction bookkeeping and accounting services for small construction companies across the USA. He is experienced as a Contractor, Project Management Professional, Construction Accountant, Intuit ProAdvisor, QuickBooks For Contractors Expert and Xero Accounting Specialist and Bill.Com Certified Guru. This combination of experience and skill sets provides a unique perspective which allows him to see the world through the eyes of a contractor, Project Manager, Accountant and construction accountant. This quadruple understanding is what sets him apart from other Intuit ProAdvisors and Xero accountants to the benefit of all of the construction contractors he serves across the USA. Visit http://www.fasteasyaccounting.com/randal-dehart/ to learn more.

Our Co-Founder Randal DeHart - Is a Certified PMP (Project Management Professional) with several years of construction project management experience. His expertise is construction accounting systems engineering and process development. His exhaustive study of several leading experts including the work of Dr. W. Edward Deming, Michael Gerber, Walter A. Shewhart, James Lewis and dozens of others was the foundation upon which our Construction Bookkeeping System is based and continues to evolve and improve. Follow Randal on Google+

Our Co-Founder:

![]() Sharie DeHart, QPA, is the President of Business Consulting And Accounting (Fast Easy Accounting) in Lynnwood, Washington. She is the leading expert in managing outsourced construction bookkeeping and accounting services companies and cash management accounting for small construction companies across the USA. She encourages Contractors and Construction Company Owners to stay current on their tax obligations. She offers insights on managing the remaining cash flow to operate and grow their construction company sales and profits so they can put more money in the bank. Call 206-361-3950 or sharie@fasteasyaccounting.com.

Sharie DeHart, QPA, is the President of Business Consulting And Accounting (Fast Easy Accounting) in Lynnwood, Washington. She is the leading expert in managing outsourced construction bookkeeping and accounting services companies and cash management accounting for small construction companies across the USA. She encourages Contractors and Construction Company Owners to stay current on their tax obligations. She offers insights on managing the remaining cash flow to operate and grow their construction company sales and profits so they can put more money in the bank. Call 206-361-3950 or sharie@fasteasyaccounting.com.