What You Should Expect From Your Bookkeeping System

First Important Principle In Construction Accounting:

Everything starts with Cash because Cash Is Fact; Profit Is An Opinion. All transactions in the bank account of your construction accounting system no matter if it is QuickBooks or Xero must be assigned to the proper accounts:

- Income

- Job Deposits

- Payroll

- Taxes

- Cost of Goods Sold (Direct and Indirect Costs including Labor, Material, Other and Subcontractors.

- Other costs including permits, plans, bills from suppliers and purchases on your personal credit cards.

- Overhead

Second Important Principle In Construction Accounting:

Tracking Income properly, Knowing how, when and where to put Customer Estimates, Customer Invoices, Customer Job Deposits and any Retainage Withheld, Vendor Refunds and Rebates.

Good Construction Accounting Is All About the Details

Payroll entered into QuickBooks (Employee, Check and Tax Detail depends on the Payroll Service used). Bank Reconciliations, Credit Card Reconciliations including Home Depot and Lowes, Vendor Statements verified and matched against invoices.

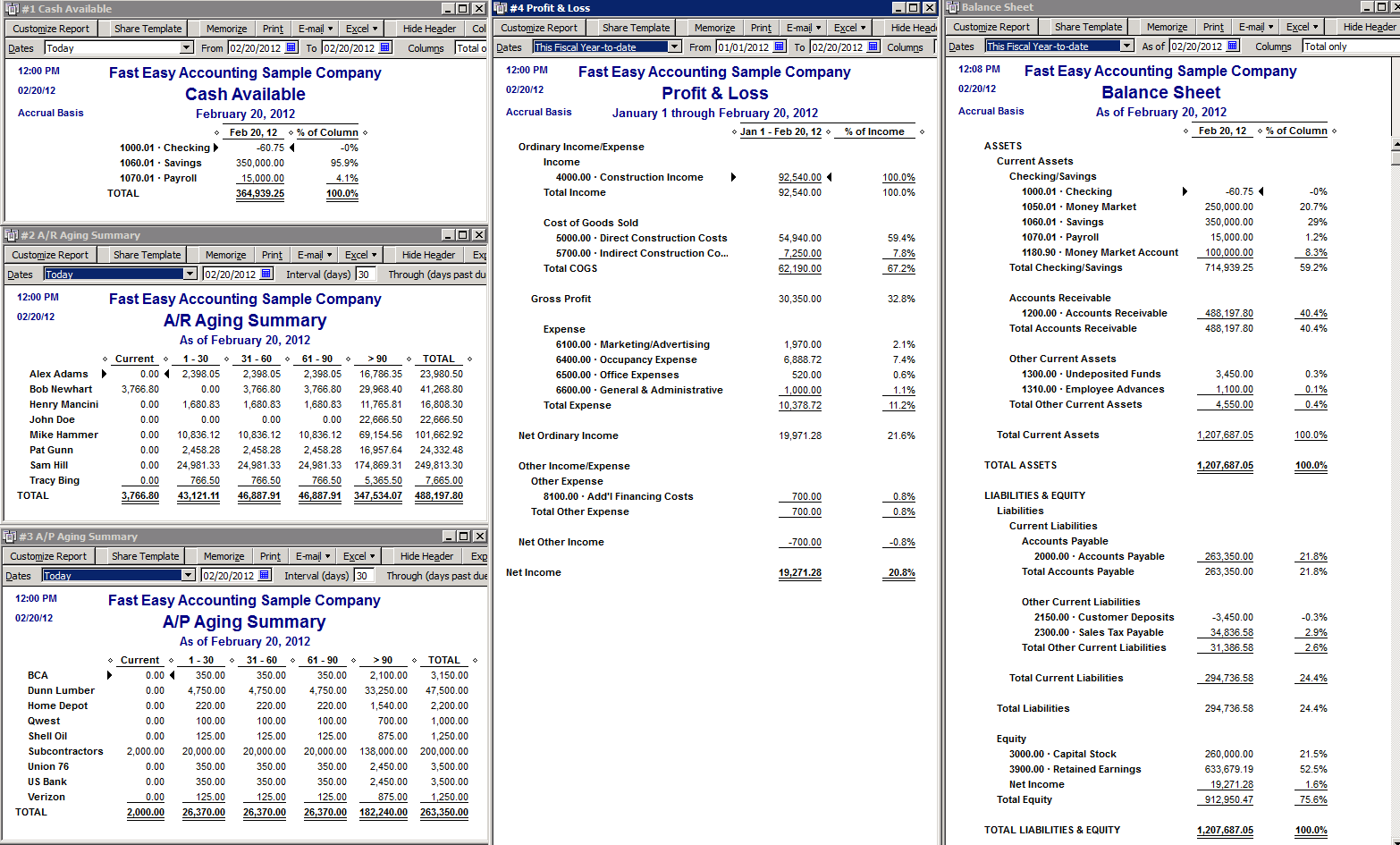

The Answers You Need To Operate And Grow Your Construction Company Are In Reports

To get accurate reports the paperwork details must be entered into your QuickBooks by following The Construction Accounting Method NOT The Regular Accounting Method.

The old saying “Garbage In = Garbage Out” is 100 times more true when it comes to Construction Accounting. When your bookkeeper takes shortcuts in the data entry, for example entering bulk numbers from credit statements for expenses in bulk instead of entering each transaction your Financial and Job Costing Reports are totally worthless.

You Need To Know Who is your customer, how much have you billed them, are there unbilled change orders? If you do not tell your bookkeeper and they do not put the information into QuickBooks how will you ever know, let alone get paid?

Who do you owe money unless you tell your bookkeeper? Who did you purchase material, labor, subcontractors, other items from, when and was it paid with cash, check, credit card or put on the charge account? If you do not tell your bookkeeper and they do not put the information into QuickBooks how will you ever know what the Job Costs are let alone Job Profitability?

QuickBooks needs to know how to allocate the costs (money spent) to give accurate Job Costing Reports.

Profit & Loss By Job provides useful reports, BUT only when the foundation of data has been entered properly.

Balance Sheet Report reflects the heath of the business – again QuickBooks can only report on the information given.

What kind of Basic Financial Reports can using Fast Easy Accounting’s Customized Setup Provide?

Every Contractor Should Have These Reports

No Matter Who Is Doing The Bookkeeping

Add The Next Layer of Construction Accounting – Here is where someone who knows Construction Accounting should be doing the bookkeeping. Many bookkeepers say they know Construction Accounting but are “Clueless About Doing Construction Accounting”. Just like many people know about being a passenger on a commercial jumbo jet but people “Clueless About Piloting A Jumbo Jet”.

Hint: a good clean, easy to understand QuickBooks setup does not need class tracking unless your construction company has multiple locations.

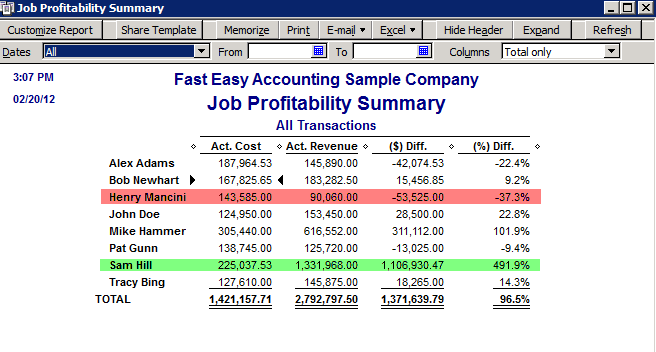

What kind of Job Costing Reports can using Fast Easy Accounting’s Customized QuickBooks Setup For Contractors Provide?

Job Profitability Summary Summarizes the profits your Construction Company earned from serving each construction customer within the date range you selected on the report.

The Key Column Is the Percentage (%) of Difference. This tells you which customers and clients are profitable and which ones are not. In this example it is Sam Hill is in the top twenty percent (20%) and Henry Mancini is in the bottom eighty percent (80%).

In Most Cases When I run this report for a contractor, after we have finished cleaning up QuickBooks, the contractors are amazed because more often than not their "Friends and Family" are the least profitable and the customers who make very little fuss or cause problems are the most profitable.

Profit & Loss by Job Shows you how much cash and profit you are making or losing on each job depending on the date range you selected.

The Key Column Is the Percentage (%) of Income. This tells you which of your customers are most profitable and least profitable. In this example it is Sam Hill is in the top twenty percent (20%) of the income scale and Henry Mancini is in the bottom eighty percent (80%).

Unbilled Costs by Job Report shows you a list of costs assigned to a specific customer or job that has not been billed.

The Key Column Is the "Billing Status" because as new costs are added this report will grow and as existing costs are Billed this report will shrink. Also any jobs that are Fixed Bid that appear in the "Billing Status" will need to be opened and fixed otherwise this report will become cluttered and useless.

Every Ninety Days Or Less - Replace your least profitable customer and replace them with someone who is like the people in the Top Twenty Percent (20%) and watch your profits soar!

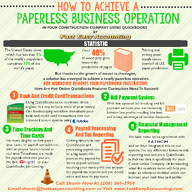

Fast Easy Accounting website can have so much detail that people get lost on it. So here is the short version of What We Do:

We Setup QuickBooks For All Kinds Of Contractors Handyman, Home Builders And Specialty Contractors

We provide QuickBooks Cleanup of existing transactions, enter Missing Transactions and provide ongoing Contractors Bookkeeping Services. We have a vendor who hosts QuickBooks (Desktop Version) in the Cloud Environment using a Commercial Host approved by Intuit (makers of QuickBooks).

Using 3rd Party Software that is user friendly to QuickBooks (not all 3rd Party Software works as well as advertised) we make the data collection of receipts and sending bank and credit card statements easy for our clients. With our web based financial reporting tool, our clients are able to review their financial statements 24/7; it comes with explanations in an easy to understand language with format (words, pictures and graphs) for the busy contractor without an accounting background to quickly review and make sense of the number. More detailed Job Costing Reports are available inside QuickBooks.

Why you need a Good Accounting System is to provide more answers than what the TAX Accountant needs to do your annual Federal and State Taxes. By the way NEVER EVER LET YOU TAX PREPARER DO YOUR CONTRACTOR BOOKKEEPING. Click here to learn why.

All construction contractors should be profitable....and IF and job is Not it is because the Construction Contractor made the informed decision to give the customer “A Bargain; because…..” not that they gave the customer a “Wild Guess” and had to take money out of their personal household funds to pay for the expenses of the job.

We Remove Contractor's Unique Paperwork Frustrations

For Construction Company Owners who do not need the full power of QuickBooks for contractors and want 24/7 online access we offer Xero Accounting Online and we have custom setup for construction companies. Click Here For More.

This Is One More Example of how Fast Easy Accounting is helping construction company owners all across the USA including Alaska and Hawaii put more money in the bank to operate and grow your construction company. Construction accounting is not rocket science; it is a lot harder than that and a lot more valuable to people like you so stop missing out! Call Sharie 206-361-3950 or sharie@fasteasyaccounting.com and schedule your no charge one-hour consultation.

Profitable Contractors and Construction Company owners have known about the value of outsourced bookkeeping services and contractor coaching services like ours for a long time and now you know about it too!

Thank You For Reading This Far And I Hope You Understand we really do care about you and all contractors regardless of whether or not you ever hire our services.

We Scan Your Receipts And Invoices link the appropriate transactions to QuickBooks or Xero Accounting Online depending on the construction accounting service you are using and provide ongoing Cloud Based Contractors Bookkeeping Services by accountants who understand construction.

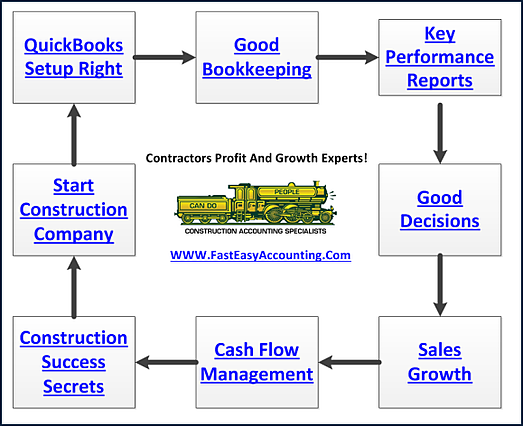

Our Contractor Bookkeeping Services System Is A System

Thinking About Outsourcing Your Contractors Bookkeeping Services To Save Time And Money?

Click On The Button Below To Download A Free Guide

Business Process Management (BPM) For Contractors

Need Help Now?

Call Sharie 206-361-3950

sharie@fasteasyaccounting.com

Xero Outsourced Construction Accounting Services

QuickBooks Outsourced Construction Bookkeeping Services

We Are Xero Accounting Experts Specializing In Construction Bookkeeping Services

About The Author:

Sharie DeHart, QPA is the co-founder of Business Consulting And Accounting in Lynnwood Washington. She is the leading expert in managing outsourced construction bookkeeping and accounting services companies and cash management accounting for small construction companies across the USA. She encourages Contractors and Construction Company Owners to stay current on their tax obligations and offers insights on how to manage the remaining cash flow to operate and grow their construction company sales and profits so they can put more money in the bank. http://www.fasteasyaccounting.com/sharie-dehart/