In Construction, hiring Independent Contractors can get very expensive, very fast!

The Internal Revenue has a defined set of rules on what is the difference between an "Independent Contractor" and "Employee". With all the documentation in place, a person could still be classified in the eyes of the Internal Revenue Service as an "Employee."

When you hire 1099 contractors

You need to know that their state contractor's license, bond, and insurance are active. During audits, state agencies are now looking to check the bond and insurance. Anytime a contractor's license is suspended, the State may reclassify that person as an employee on your job.

Because all fifty states are working with other agencies looking to be sure employee rights are covered, and the state, local and federal payroll taxes are paid. As an employer among your responsibilities are these:

-

Pay workers’ compensation

-

Meet wage and hour requirements

-

Pay unemployment tax

-

Maintain a safe workplace

Since our office is located in Lynnwood, WA, as example: Washington State Labor & Industries has several definitions to decide whether or not the contractor you hire is really a contractor or an employee, and here are a few:

1. Supervision: Do they perform the work free of your direction and control?

2. Separate business: Do they offer services that are different from what you provide?

3. Maintenance: Do they maintain and pay for a place of business that is separate from yours?

4. Location: Do they perform services in a location that is separate from your business or job sites?

5. Previously established business: Do they have an established, independent business that existed before you hired?

6. Required documentation: May includes other customers or advertising.

7. IRS Taxes: When you entered into the contract, was this person responsible for filing a tax return with the IRS for his or her business?

8. Necessary registrations: Are they up-to-date on their required local, county, State, and Federal business registrations?

Ask your State's Department of Revenue if their business license is active

If they are a construction contractor, check their contractor registration or electrical contractor's license. If they have employees, check their workers' compensation account and claim history. In Washington State, you can do it through The Department of Labor And Industries.

Do They Maintain A Useful Contractors Bookkeeping System?

Do they maintain their own set of bookkeeping records dedicated to the expenses and earnings of their business? Note: If you plan to treat your worker/subcontractor as an independent, make sure you can prove they are. For your protection, you should always ask the person you are hiring to show you a proof; otherwise, you could be liable for all of their employment taxes and all of the employer taxes plus fines and penalties.

Options for additional short term employees:

1. Use a temporary labor service

2. Hire a legitimate contractor

3. Add employee – pay all the taxes

Conclusion:

Some construction contractors are finding that by networking with other contractors and working together, they can increase production "on demand" without hiring additional staff. However, it is crucial to make sure they are following all the rules and regulations to stay out of trouble. Before treating someone like an independent contractor, we strongly advise you contact a reasonable construction attorney, and yes I understand, attorneys cost money; however, this is one time when it is money well spent.

About The Author:

![]() Sharie DeHart, QPA is the co-founder of Business Consulting And Accounting in Lynnwood, Washington. She is the leading expert in managing outsourced construction bookkeeping and accounting services companies and cash management accounting for small construction companies across the USA. She encourages Contractors and Construction Company Owners to stay current on their tax obligations and offers insights on how to manage the remaining cash flow to operate and grow their construction company sales and profits so they can put more money in the bank. Call 206-361-3950 or sharie@fasteasyaccounting.com

Sharie DeHart, QPA is the co-founder of Business Consulting And Accounting in Lynnwood, Washington. She is the leading expert in managing outsourced construction bookkeeping and accounting services companies and cash management accounting for small construction companies across the USA. She encourages Contractors and Construction Company Owners to stay current on their tax obligations and offers insights on how to manage the remaining cash flow to operate and grow their construction company sales and profits so they can put more money in the bank. Call 206-361-3950 or sharie@fasteasyaccounting.com

Download the Contractors APP today from the App Store or Android Store

Access Code: FEAHEROS

Click here to download the App on Android:

Click here to download the App on iOS:

Simply scan the QR code or search for ‘MyAccountants’ in the App Store and enter the Access code: FEAHEROS to utilize the powerful App features and capabilities, and benefit from having our Construction Accounting App at your fingertips, 24/7."

PS: Even if you are not a Construction Contractor you will find a plenty of benefits in the app so we invite you to download it too! It's Free so why not?

When You Become A Client - Then we can tap into our resources of knowledge and strategy banks. We use the reports hidden in your QuickBooks in order to diagnose and understand your construction business and develop plans and help you implement a path to success for you and you alone because every contractor has unique Strengths, Weaknesses, Opportunities and Threats (S.W.O.T. Analysis) that when understood can lead to a Strategic Roadmap which cannot help but make a lot of money.

We Remove Contractor's Unique Paperwork Frustrations

For Construction Company Owners who do not need the full power of a QuickBooks for contractors and want 24/7 online access we offer Xero Accounting Online, and we have a custom setup for construction companies. Click Here For More.

This Is One More Example of how Fast Easy Accounting is helping construction company owners all across the USA including Alaska and Hawaii put more money in the bank to operate and grow your construction company. Construction accounting is not rocket science; it is a lot harder than that, and a lot more valuable to people like you so stop missing out! Call Sharie 206-361-3950 or sharie.com and schedule your no charge one-hour consultation.

Profitable Contractors and Construction Company owners have known about the value of outsourced bookkeeping services and contractor coaching services like ours for a long time, and now you know about it too!

Thank You For Reading This Far, And I Hope You Understand we really do care about you and all contractors regardless of whether or not you ever hire our services.

We Scan Your Receipts, And Invoices link the appropriate transactions to QuickBooks or Xero Accounting Online depending on the construction accounting service you are using and provide ongoing Cloud Based Contractors Bookkeeping Services by accountants who understand construction.

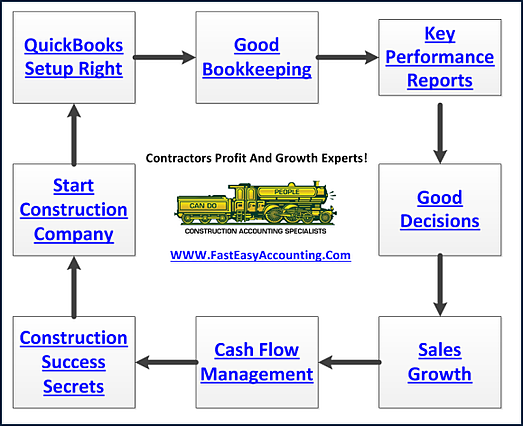

Our Contractor Bookkeeping Services System Is A System

Thinking About Outsourcing Your Contractors Bookkeeping Services To Save Time And Money?

Click On The Button Below To Download A Free Guide

Business Process Management (BPM) For Contractors

Need Help Now?

Call Sharie 206-361-3950

sharie.com

Xero Outsourced Construction Accounting Services

QuickBooks Outsourced Construction Bookkeeping Services

We Are Also Xero Accounting Experts Specializing In Construction Bookkeeping Services

PS: For The Do-It-Yourself Construction Bookkeeper Our Store Has Chock-Full Of QuickBooks Setup Templates, QuickBooks Chart of Accounts And More.

Most Contractors Setup QuickBooks Desktop Version In One Of Three Ways:

#1 EZ Step Interview inside QuickBooks Setup

#2 Asked Their Tax Accountant To Setup QuickBooks

#3 They Attended A How To Setup QuickBooks Class Or Seminar

And QuickBooks Does Not Work The Way They Want It Too!

The Answer:

#1 Click Here To Buy An Entire QuickBooks Setup For Your Specific Contracting Company

#2 Click Here To Buy Just The Chart Of Accounts For Your Specific Contracting Company

Download the Contractors APP today from the App or Android store