Contractors Reflect On This Year's Results As The Last Quarter Begins

![]()

![]()

![]() Going into the last Quarter of the year. Time for some basic reflection about taxes. Officers in S-Corps tend to take payroll later in the year. Now is the time if you have not already been taking payroll. Don't wait until it is time to prepare your Construction Company tax return.

Going into the last Quarter of the year. Time for some basic reflection about taxes. Officers in S-Corps tend to take payroll later in the year. Now is the time if you have not already been taking payroll. Don't wait until it is time to prepare your Construction Company tax return.

Next review your Estimated personal Taxes paid to the IRS. How much did you pay in taxes for the current year? Internal Revenue expects that you have paid a percentage Federal Taxes before the end of the year.

Reviewing Federal Withholding for yourself and your employees to avoid surprises when your annual taxes are filed. Contractors who file as a Sole Prop or as an LLC fining as a Sole Prop tend to forget that payroll taxes on their net income is due. I call this “Chef’s Surprise” as it is based on Net Income. Everyone wants the last few jobs to pay before the end of the year.

![]()

![]()

![]() As the Sole Prop or 1099 Contractor, the amount due will be both the employer and employee portions (combined is 15.3% + federal income taxes) Refer to your Tax Accountant about the ability to claim the employer portion as a deduction on your taxes.

As the Sole Prop or 1099 Contractor, the amount due will be both the employer and employee portions (combined is 15.3% + federal income taxes) Refer to your Tax Accountant about the ability to claim the employer portion as a deduction on your taxes.

Time for some basic reflection about your bookkeeping methods

How are you keeping track of your income and expenses?

Do you use software or on a paper system?

Many Contractors use Shoeboxes, Cardboard Boxes and paper bags

![]()

![]()

![]() The issue comes when your Banker, Liability Insurance Company, Worker’s Comp Insurance Company, Bonding Company or State Agency or Internal Revenue want reports. I have seen some manual systems that are quite good.

The issue comes when your Banker, Liability Insurance Company, Worker’s Comp Insurance Company, Bonding Company or State Agency or Internal Revenue want reports. I have seen some manual systems that are quite good.

![]()

![]()

![]() I remember the days pre-computer days where I used an oversized 13 Column Pad. It worked, not a great as the multiple ledgers and from there that first version of Quicken was wonderful. Now using QuickBooks which can be customized is fantastic. Being in Washington State where sales tax is destination based – customization is the key to easy reporting. Other states have different reporting requirements.

I remember the days pre-computer days where I used an oversized 13 Column Pad. It worked, not a great as the multiple ledgers and from there that first version of Quicken was wonderful. Now using QuickBooks which can be customized is fantastic. Being in Washington State where sales tax is destination based – customization is the key to easy reporting. Other states have different reporting requirements.

Additional reflection is needed when multiple partners are involved

- Is it an active partner or someone who is behind the scenes (investment versus day-to-day activities)?

- Is each partner doing what you expect them to do?

- There are additional challenges when multiple partners are not actively engaged.

- The net profit is divided based on the percentage of ownership.

![]()

![]()

![]() Many times, partners have different visions for the company.

Many times, partners have different visions for the company.

- Growth Of The Company (How Big, How Fast)

- How Much Money To Take Out of Company

- Reinvestment Of Profits Into The Company

- Should They Add A Vehicle (new or used)

- What Tools And Equipment To Purchase

- Compensation For Employees

- Compensation For Owners

Decisions Happen Every Minute For Working Construction Contractors

![]()

![]()

![]() The most frustrating situation happens when one partner is actively working in the day-to-day activities, and the other partner is a “Manager” and is practicing “Seagull Management” but is never there for the day-to-day activities.

The most frustrating situation happens when one partner is actively working in the day-to-day activities, and the other partner is a “Manager” and is practicing “Seagull Management” but is never there for the day-to-day activities.

![]()

![]()

![]() It is easy to say I’m working on the business. Reality is that it may not have the same meaning to all partners. Working on the business is Planning, Marketing, Doing Active Things in the business.

It is easy to say I’m working on the business. Reality is that it may not have the same meaning to all partners. Working on the business is Planning, Marketing, Doing Active Things in the business.

![]()

![]()

![]() I have heard many stories where One Partner tells the other partner (while managing from afar) You need to be doing [fill in the blank]

I have heard many stories where One Partner tells the other partner (while managing from afar) You need to be doing [fill in the blank]

- The sales are not that high you have plenty of time

- The paperwork is not that much; it will only take you 10 -15 minutes [a week, a month] to do it

- Or saying “After The Fact: that decisions you made were not the ones I would have made.

![]()

![]()

![]() It is easy for the person Not Doing The Work - to say, we (Meaning YOU) what should or should not have done [fill in the blank]. This happens a lot when partners are not in the same city. Or to say I can’t because you are better at [fill in the blank]. The last thing you need is for someone else to assign you a task to do. As a Construction Contractor, there is no shortage of “tasks to do” in running your Contracting Business.

It is easy for the person Not Doing The Work - to say, we (Meaning YOU) what should or should not have done [fill in the blank]. This happens a lot when partners are not in the same city. Or to say I can’t because you are better at [fill in the blank]. The last thing you need is for someone else to assign you a task to do. As a Construction Contractor, there is no shortage of “tasks to do” in running your Contracting Business.

![]()

![]()

![]() These sort of challenges is one of the reasons we recommend being an S-Corp. It is easier to have a business relationship with someone that is something other than a 50-50%. It is by EXCEPTION that multiple partners will be equally invested in the company. (Time, Money and Effort).

These sort of challenges is one of the reasons we recommend being an S-Corp. It is easier to have a business relationship with someone that is something other than a 50-50%. It is by EXCEPTION that multiple partners will be equally invested in the company. (Time, Money and Effort).

![]()

![]()

![]() Usually, the Construction Company is weighted with one partner doing more, spending additional hours in the Construction Side of the Work to bring in the money or save on employee hours.

Usually, the Construction Company is weighted with one partner doing more, spending additional hours in the Construction Side of the Work to bring in the money or save on employee hours.

![]()

![]()

![]() Many times, that same partner is asking their spouse to pitch in and do the bookkeeping without pay because it will benefit them in the long run. Then it becomes two people actively working in the business for the financial benefit of one. If spouses are paid on payroll – they are valued.

Many times, that same partner is asking their spouse to pitch in and do the bookkeeping without pay because it will benefit them in the long run. Then it becomes two people actively working in the business for the financial benefit of one. If spouses are paid on payroll – they are valued.

(It can be the gesture more than the money)

As an S-Corp owner’s payroll will better reflect activity in the business. Life Happens!

![]()

![]()

![]() If one of the owners is working fewer hours due to personal reasons; there is compensation that can be more easily given to the other working owners above and beyond the net profit of the company. Easier to facilitate a Loan To Shareholder as needed. When you discuss in the beginning, it Saves “White Noise” and “Hard Feelings.” later.

If one of the owners is working fewer hours due to personal reasons; there is compensation that can be more easily given to the other working owners above and beyond the net profit of the company. Easier to facilitate a Loan To Shareholder as needed. When you discuss in the beginning, it Saves “White Noise” and “Hard Feelings.” later.

![]()

![]()

![]() Years ago; I read a book that described how one partner was very upfront in saying.

Years ago; I read a book that described how one partner was very upfront in saying.

- Why should I work so hard when I know you will?

- I can just sit back and get my share of the profits without doing much of anything! (not an exact quote)

- It was just a story, but a few times when meeting with Construction Partners that attitude has come through.

![]()

![]()

![]() Not all partnerships have problems. I know of several who have been friends and partners for decades. Partners discussed their roles and how to work together. It is awesome! I am always glad to talk to them and catch up.

Not all partnerships have problems. I know of several who have been friends and partners for decades. Partners discussed their roles and how to work together. It is awesome! I am always glad to talk to them and catch up.

The Rest Of The Year Will Go By Fast Halloween Is Almost Here

It Is Time To Review Your Current Year Construction Accounting

How are you currently handling your bookkeeping?

![]()

![]()

![]() If you are comfortable Doing It Yourself and just want a little TLC - we can help.

If you are comfortable Doing It Yourself and just want a little TLC - we can help.

![]()

![]()

![]() Additional resources are on FastEasyAccount.com (website) and FastEasyAccountingStore.com (store)

Additional resources are on FastEasyAccount.com (website) and FastEasyAccountingStore.com (store)

![]()

![]()

![]() We accept all major credit cards and PayPal. Also available PayPal credit offers six months same as cash.

We accept all major credit cards and PayPal. Also available PayPal credit offers six months same as cash.

![]()

![]()

![]() We Help A Little Or A Lot Depending On Your Needs. Do you want to explore a QuickBooks file cleanup, or discuss Outsourced Accounting? Offer One Hour Free Consulting. Sometimes Contractors use just to vent about business stuff, and for a variety of reasons, all I can do is be the ear on the end of the phone and offer suggestions.

We Help A Little Or A Lot Depending On Your Needs. Do you want to explore a QuickBooks file cleanup, or discuss Outsourced Accounting? Offer One Hour Free Consulting. Sometimes Contractors use just to vent about business stuff, and for a variety of reasons, all I can do is be the ear on the end of the phone and offer suggestions.

![]()

![]()

![]() Never am I going to be nasty about your bookkeeping no matter how “icky or artistic” you have been. We are here to help with your assistance we can create a file with good reports that are useful to you.

Never am I going to be nasty about your bookkeeping no matter how “icky or artistic” you have been. We are here to help with your assistance we can create a file with good reports that are useful to you.

![]()

![]()

![]() Remember your financials are based on the documents you provide in person, electrically, or by using our document management system. Unfortunately, many tools used on Star Trek are still not available.

Remember your financials are based on the documents you provide in person, electrically, or by using our document management system. Unfortunately, many tools used on Star Trek are still not available.

![]()

![]()

![]() Year-End Planning Tip: As the economy and your cash flow is improving, do you have all the tools and equipment you want or need? If purchases are made before December 31st, it is a deduction for the current year.

Year-End Planning Tip: As the economy and your cash flow is improving, do you have all the tools and equipment you want or need? If purchases are made before December 31st, it is a deduction for the current year.

Looking forward to being of assistance.

About The Author:

![]()

![]()

![]() Sharie DeHart, QPA is the co-founder of Business Consulting And Accounting in Lynnwood Washington. She is the leading expert in managing outsourced construction bookkeeping and accounting services companies and cash management accounting for small construction companies across the USA. She encourages Contractors and Construction Company Owners to stay current on their tax obligations and offers insights on how to manage the remaining cash flow to operate and grow their construction company sales and profits so they can put more money in the bank. http://www.fasteasyaccounting.com/sharie-dehart/ 206-361-3950 or sharie@fasteasyaccounting.com

Sharie DeHart, QPA is the co-founder of Business Consulting And Accounting in Lynnwood Washington. She is the leading expert in managing outsourced construction bookkeeping and accounting services companies and cash management accounting for small construction companies across the USA. She encourages Contractors and Construction Company Owners to stay current on their tax obligations and offers insights on how to manage the remaining cash flow to operate and grow their construction company sales and profits so they can put more money in the bank. http://www.fasteasyaccounting.com/sharie-dehart/ 206-361-3950 or sharie@fasteasyaccounting.com

![]()

![]()

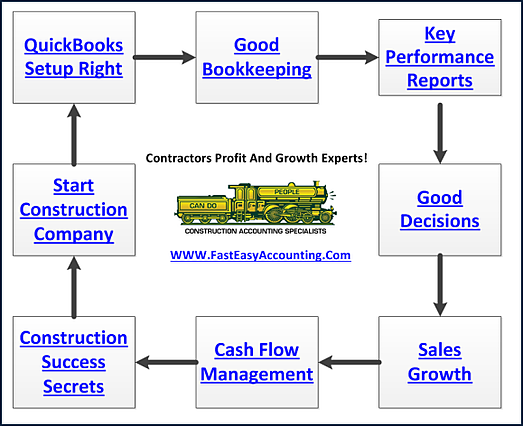

![]() When You Become A Client - Then we can tap into our resources of knowledge and strategy banks. We use the reports hidden in your QuickBooks in order to diagnose and understand your construction business and develop plans and help you implement a path to success for you and you alone because every contractor has unique Strengths, Weaknesses, Opportunities and Threats (S.W.O.T. Analysis) that when understood can lead to a Strategic Roadmap which cannot help but make a lot of money.

When You Become A Client - Then we can tap into our resources of knowledge and strategy banks. We use the reports hidden in your QuickBooks in order to diagnose and understand your construction business and develop plans and help you implement a path to success for you and you alone because every contractor has unique Strengths, Weaknesses, Opportunities and Threats (S.W.O.T. Analysis) that when understood can lead to a Strategic Roadmap which cannot help but make a lot of money.

We Remove Contractor's Unique Paperwork Frustrations

-

Speed1x

-

Quality1080p

Thanks for reporting a problem. We'll attach technical data about this session to help us figure out the issue. Which of these best describes the problem?

Any other details or context?

-

Speed1x

-

Quality1080p

Thanks for reporting a problem. We'll attach technical data about this session to help us figure out the issue. Which of these best describes the problem?

Any other details or context?

![]()

![]()

![]() For Construction Company Owners who do not need the full power of a QuickBooks for contractors and want 24/7 online access we offer Xero Accounting Online, and we have a custom setup for construction companies. Click Here For More.

For Construction Company Owners who do not need the full power of a QuickBooks for contractors and want 24/7 online access we offer Xero Accounting Online, and we have a custom setup for construction companies. Click Here For More.

![]()

![]()

![]() This Is One More Example of how Fast Easy Accounting is helping construction company owners all across the USA including Alaska and Hawaii put more money in the bank to operate and grow your construction company. Construction accounting is not rocket science; it is a lot harder than that, and a lot more valuable to people like you so stop missing out! Call Sharie 206-361-3950 or sharie@fasteasyaccounting.com and schedule your no charge one-hour consultation.

This Is One More Example of how Fast Easy Accounting is helping construction company owners all across the USA including Alaska and Hawaii put more money in the bank to operate and grow your construction company. Construction accounting is not rocket science; it is a lot harder than that, and a lot more valuable to people like you so stop missing out! Call Sharie 206-361-3950 or sharie@fasteasyaccounting.com and schedule your no charge one-hour consultation.

![]()

![]()

![]() Profitable Contractors and Construction Company owners have known about the value of outsourced bookkeeping services and contractor coaching services like ours for a long time, and now you know about it too!

Profitable Contractors and Construction Company owners have known about the value of outsourced bookkeeping services and contractor coaching services like ours for a long time, and now you know about it too!

![]()

![]()

![]() Thank You For Reading This Far, And I Hope You Understand we really do care about you and all contractors regardless of whether or not you ever hire our services.

Thank You For Reading This Far, And I Hope You Understand we really do care about you and all contractors regardless of whether or not you ever hire our services.

![]()

![]()

![]() We Scan Your Receipts, And Invoices link the appropriate transactions to QuickBooks or Xero Accounting Online depending on the construction accounting service you are using and provide ongoing Cloud Based Contractors Bookkeeping Services by accountants who understand construction.

We Scan Your Receipts, And Invoices link the appropriate transactions to QuickBooks or Xero Accounting Online depending on the construction accounting service you are using and provide ongoing Cloud Based Contractors Bookkeeping Services by accountants who understand construction.

Our Contractor Bookkeeping Services System Is A System

Thinking About Outsourcing Your Contractors Bookkeeping Services To Save Time And Money?

Click On The Button Below To Download A Free Guide

Business Process Management (BPM) For Contractors

Need Help Now?

Call Sharie 206-361-3950

sharie@fasteasyaccounting.com

Xero Outsourced Construction Accounting Services

QuickBooks Outsourced Construction Bookkeeping Services

We Are Also Xero Accounting Experts Specializing In Construction Bookkeeping Services

PS: For The Do-It-Yourself Construction Bookkeeper Our Store Has Chock-Full Of QuickBooks Setup Templates, QuickBooks Chart of Accounts And More.

Most Contractors Setup QuickBooks Desktop Version In One Of Three Ways:

![]()

![]()

![]() #1 EZ Step Interview inside QuickBooks Setup

#1 EZ Step Interview inside QuickBooks Setup

#2 Asked Their Tax Accountant To Setup QuickBooks

#3 They Attended A How To Setup QuickBooks Class Or Seminar