If you are a contractor, you know what to look for when you need to hire skilled construction workers. The longer you have been in construction, the more experience you have including a sixth sense about who is likely to be a good fit for your construction company team and who is not.

You can spot wanna-bees, clowns, and firebrands in an instant, and you know that if you are thinking about firing someone; you are already fifteen minutes too late!

99.99% of Construction is "Tangible" which means you can judge it using your five senses. You can See, Hear, Touch, Smell and Taste it and you know when it is good or bad.

99.99% of construction accounting is "Intangible" including financing, taxes, payroll processing, payment applications, financial statements, cash management which means you may have to rely on your gut-feeling to know when someone perhaps is not a good fit.

I have a deep background both in construction, having owned and operated successful construction companies and construction accounting.

Just so we are clear, if you suspect I want the opportunity to work with you, you are 100% right! But, I know what you need is proof that I know what I am doing so let me condense several decades of experience into these twelve warning signs you hired the wrong contractor bookkeeping service.

Here are these twelve Signs You Hired The Right Contractor Bookkeeping Service

Sign #02

Your contractor, bookkeeping services firm offers flat-rate pricing for your contractor bookkeeping services needs.There are situations when a contractor is better off with a flexible rate schedule including pre-determined hourly rates depending on the skill level required, but only if there are complex construction accounting needs or if the construction company owners or managers want direct command and control of the contractor bookkeeping services.

Sign #03

Your contractor, bookkeeping services firm, is open and honest with you and answers your questions with easy to understand language not "accounting speak" and respects you as an intelligent business owner.Sign #04

When you provide the data and paperwork on time your contractor bookkeeping services firm gets their work done on time.The reason we love it so much is our contractor's bookkeeping system reverses the typical 95% / 5% ratio. In most bookkeeping services, 95% of the time they don't know what to do most of the paperwork they encounter, so they try to remember what we did with the last one just like it, and they hope the financial and job costing reports don't get screwed up. And only 5% of the transactions are simple and easy.

Even something as simple as knowing where to classify fuel or food can be a nightmare for the bookkeeping services staff without at least 10,000 hours in construction accounting.

- Construction vehicles for use on streets and roads

- Construction vehicles for off road use

- Generators

- Cut-off saws

- Air compressors

- Other power tools

- Admin vehicle company owned

- Field employee vehicle as reimbursement

- Admin employee vehicle as reimbursement

- Sales employee vehicle as reimbursement

- Operations employee vehicle as reimbursement

- Officer or Owner vehicle as reimbursement

Food Costs Could Go Into Any One Of A Half-Dozen Accounts For Example:

- Field employee meals (different tax deduction than straight meals)

- Meals for office employees

- Entertainment

- Office meetings

- Charitable donations

- Gifts for clients

If a transaction is put into the wrong account, the financial statements will present a vastly different picture to the contractor regarding which jobs are profitable and which ones are not. In the end, it could mean the difference between success and failure because if you rely on Profit And Loss By Job Reports to know which jobs to bid on and which ones to ignore.

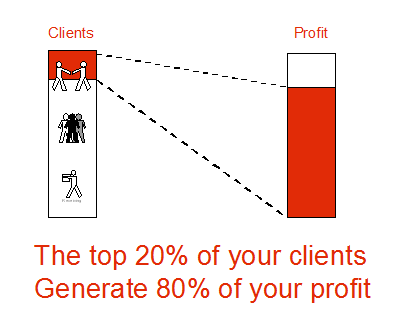

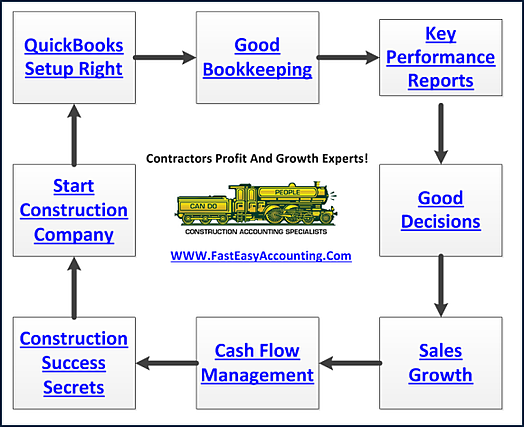

Year over year and regardless of the economy one thing never changes; 20% of the contractors earn and keep 80% of the profits. The reason is they have a Business Process Management Strategy like our Contractors Success M.A.P. that tells them how, what, when, where and why to focus their limited resources on the M.A.P. = Marketing / Accounting / Production.

The 80/20 Rule Combined With Business Process Management

Can Improve Your Life In Ways You Never Dreamed Possible!

-

20% of your customers normally generate 80% of your net profit.

-

20% of the goods or services you sell contribute 80% of your revenue

-

20% or 2 out of 10 of your staff create 80% of the value for your customers.

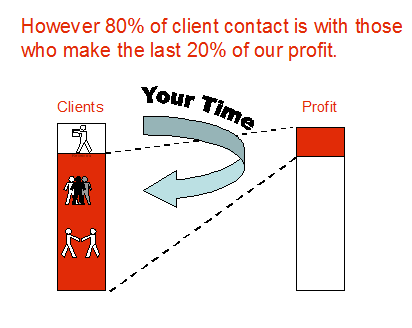

The frightening consequence of the 80/20 rule is that 8 out of 10 hours we spend at work drive almost no value to the bottom line and the biggest drain is trying to save money doing our own contractor bookkeeping instead of reviewing the Key Performance Indicator (KPI) Reports. Through our contractors bookkeeping services system you can access them 24/7 without opening QuickBooks for Contractors.

The most important value good bookkeeping brings to a business is an understanding of where your 20% is hidden.

By generating daily reports that uncover the best customers, jobs, services, or products, you will soon see how you can refocus your internal efforts on doing more good work.

This is the great contribution a company receives from good QuickBooks® data and from using QuickBooks® the ‘right-way’.

For insights on how to develop a Business Plan click here

Sign #05

Your contractors bookkeeping services firm works out of their home. Home based businesses are great for many people, and they make a lot of sense; except when it comes to dealing with your construction company's sensitive financial data.

The last thing you want is for your contracting company records to be sitting on someone's kitchen table open and inviting for anyone and everyone to see, touch, read and spy on you construction company. It happens more than you could imagine or could believe unless it has happened to you or someone you know and trust.

Just as bad is when your cheap bookkeeper has little kids with sticky fingers, and they get peanut butter and jelly on your construction company receipts.

By far, the scariest cheap bookkeeping services are the ones run by the wife, girlfriend or office worker of your competitor who likes to share your client list, estimates, and financial records...OUCH! That happens more than you could imagine or believe.

Sign #06

Your contractors bookkeeping services firm internet presence is professional, clean and packed full of helpful, useful information and has at least 10,000 pages.

A website is no longer a luxury and at a minimum to be taken seriously your contractors bookkeeping services should active in at least 20 different social media sites including a presence on LinkedIn, Facebook, Twitter and Google+ to name a few.

The best way to know if your contractors bookkeeping services firm has an internet presence is simply doing a google search on them. Google FastEasyAccounting.com and you will find over 9,000 results as of 10-17-14. Google our Co-Founder Randal DeHart, and you will find over 58,000 results as of 10-17-14.

Sign #07

Your contractors bookkeeping services firm does not close sales; they open relationships. No high pressure or scares tactics to get you to buy. We do not close sales; we open relationships. Hiring a Contractors Bookkeeping service is something we take rather seriously and deliberately.

We are a small privately held contractors bookkeeping services firm with a process to invite new contractors like you into our family of clients. It starts with a No Charge Consultation and mutual interview to determine if there is a basis to build a mutually beneficial relationship.

Next, we review your QuickBooks file to determine how and if we can meet your construction accounting needs.

Lastly, Sharie contacts you to present one of more custom solutions that we put together to fit your construction company's individual needs because no two contractors are the same. Sharie reviews it with you, and you decide to engage our services when you are ready.

Sharie will not attempt to close you because as I said before, "we do not close sales; we open relationships" so if we are not a good fit simply say so and we will leave you alone. In the future, if you change your mind, you are always welcome to contact us again.

Sign #08

Your contractors bookkeeping services firm carefully explains your bookkeeping options and lets you decide what it best for you.

We can serve 99.99% of construction, and contracting companies in the USA including Alaska and Hawaii with annual sales volume from $0 start up to $5,000,000 with a flat rate weekly or monthly fee that does not change unless your needs change.

Our construction accounting services system takes the guesswork out of contractors bookkeeping services and leaves good solid, repeatable bookkeeping processes that work day in and day out.

However, some contractors want control over their construction accounting services including what, when, where and how their Contractor Bookkeeping and Accounting services are handled and if this describes you then rest assured we have you covered.

You can have access to the same secure; Intuit Approved Cloud Based Hosting Service, which includes the same QuickBooks desktop as all of our contractor clients and instead of our construction accounting services system.

In these cases, we can design a reasonable hourly contractor accounting service package to fit your needs and allow you reasonable command and control on how QuickBooks is setup and maintained.

Sign #09

Your contractors bookkeeping services firm follows up regularly to make sure you are very satisfied with the services you are receiving. We have a simple answer, we keep in contact with you as much or as little as you desire and more importantly we earn your business every month. No long-term contracts, you vote with your dollars to keep us or let us go.

We do everything we can, within reason, to keep you, improve our services, innovate and add value every day. Don't take my word for it see what our clients say Click Here.

Sign #10

Your contractors bookkeeping services firm has QuickBooks ProAdvisors on staff is one of many certifications they need to consider a viable bookkeeping service for the Contractors. Yes, it costs money, $549 per year and the ProAdvisor has to take a test and recertify on the new QuickBooks edition every year.

Sign #11

Your contractors bookkeeping services firm takes a proactive approach to supporting your construction company needs outside of simply providing the bookkeeping services and they offer recommendations to help you get more from their services, save money, or improve your construction company profit and productivity.

We have entire sections of our website devoted to helping your construction company become more profitable, streamline your operations and become more productive. For example, check out the strategy and construction psychology sections.

Sign #12

Your contractors bookkeeping services firm offers you a way to access your QuickBooks desktop version 24/7/365 from any web enabled device. Including top notch English speaking tech support staff!

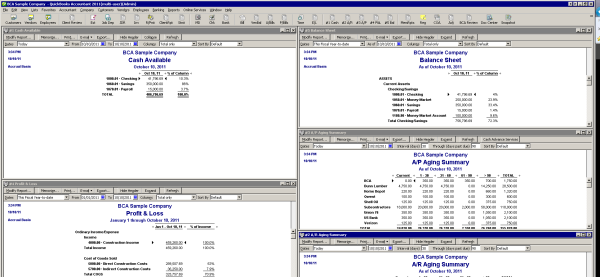

The Screenshots Below Were Taken In Our Lynnwood Washington Office

QuickBooks Is 1,000+ Miles Away Running On High-Speed Servers

Tucked Securely In A Building With Armed Guards

With Highly Skilled Technicians Maintaining It

Want to learn how to hire an honest, competent, and reliable contractors bookkeeping services firm? Download our FREE Business Advisory Guide at Contractors-bookkeeping-services-guide-for-construction-accounting-and-bookkeeping/

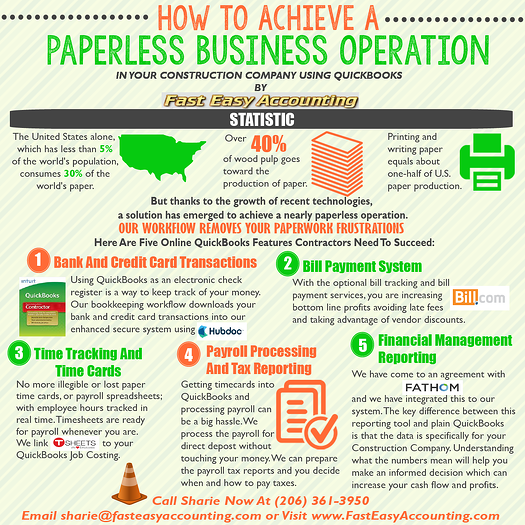

We Remove Contractor's Unique Paperwork Frustrations

For Construction Company Owners who do not need the full power of QuickBooks for contractors and want 24/7 online access we offer Xero Accounting Online and we have custom setup for construction companies. Click Here For More.

This Is One More Example of how Fast Easy Accounting is helping construction company owners all across the USA including Alaska and Hawaii put more money in the bank to operate and grow your construction company. Construction accounting is not rocket science; it is a lot harder than that and a lot more valuable to people like you so stop missing out! Call Sharie 206-361-3950 or sharie@fasteasyaccounting.com and schedule your no charge one-hour consultation.

Profitable Contractors and Construction Company owners have known about the value of outsourced bookkeeping services and contractor coaching services like ours for a long time and now you know about it too!

We Scan Your Receipts And Invoices link the appropriate transactions to QuickBooks or Xero Accounting Online depending on the construction accounting service you are using and provide ongoing Cloud Based Contractors Bookkeeping Services by accountants who understand construction.

Our Contractor Bookkeeping Services System Is A System

Thinking About Outsourcing Your Contractors Bookkeeping Services To Save Time And Money?

Click On The Button Below To Download A Free Guide

Business Process Management (BPM) For Contractors

Need Help Now?

Call Sharie 206-361-3950

sharie@fasteasyaccounting.com

Xero Outsourced Construction Accounting Services

QuickBooks Outsourced Construction Bookkeeping Services

We Are Xero Accounting Experts Specializing In Construction Bookkeeping Services

About The Author:

Randal DeHart, PMP, QPA is the co-founder of Business Consulting And Accounting in Lynnwood Washington. He is the leading expert in outsourced construction bookkeeping and accounting services for small construction companies across the USA. He is experienced as a Contractor, Project Management Professional, Construction Accountant, Intuit ProAdvisor, QuickBooks For Contractors Expert and Xero Accounting Specialist. This combination of experience and skill sets provides a unique perspective which allows him to see the world through the eyes of a contractor, Project Manager, Accountant and construction accountant. This quadruple understanding is what sets him apart from other Intuit ProAdvisors and Xero accountants to the benefit of all of the construction contractors he serves across the USA. Visit http://www.fasteasyaccounting.com/randal-dehart/ to learn more.

Randal DeHart, PMP, QPA is the co-founder of Business Consulting And Accounting in Lynnwood Washington. He is the leading expert in outsourced construction bookkeeping and accounting services for small construction companies across the USA. He is experienced as a Contractor, Project Management Professional, Construction Accountant, Intuit ProAdvisor, QuickBooks For Contractors Expert and Xero Accounting Specialist. This combination of experience and skill sets provides a unique perspective which allows him to see the world through the eyes of a contractor, Project Manager, Accountant and construction accountant. This quadruple understanding is what sets him apart from other Intuit ProAdvisors and Xero accountants to the benefit of all of the construction contractors he serves across the USA. Visit http://www.fasteasyaccounting.com/randal-dehart/ to learn more.

Our Co-Founder Randal DeHart - Is a Certified PMP (Project Management Professional) with several years of construction project management experience. His expertise is construction accounting systems engineering and process development. His exhaustive study of several leading experts including the work of Dr. W. Edward Deming, Michael Gerber, Walter A. Shewhart, James Lewis and dozens of others was the foundation upon which our Construction Bookkeeping System is based and continues to evolve and improve. Check out our Contractor Success Map Podcast on iTunes and Follow Randal on Google+