Practical Tax Season Tips For Construction Business Owners

Posted by Sharie DeHart on Fri, Jan 12, 2024

Topics: How To Lower Your Tax Bill, Save Money On Income Taxes, Sales Tax, Tax Accountants, Reduce Taxes, Taxes, Contractor Tips

In Construction, hiring Independent Contractors can get very expensive, very fast!

The Internal Revenue has a defined set of rules on what is the difference between an "Independent Contractor" and "Employee". With all the documentation in place, a person could still be classified in the eyes of the Internal Revenue Service as an "Employee."

When you hire 1099 contractors

You need to know that their state contractor's license, bond, and insurance are active. During audits, state agencies are now looking to check the bond and insurance. Anytime a contractor's license is suspended, the State may reclassify that person as an employee on your job.

Because all fifty states are working with other agencies looking to be sure employee rights are covered, and the state, local and federal payroll taxes are paid. As an employer among your responsibilities are these:

-

Pay workers’ compensation

-

Meet wage and hour requirements

-

Pay unemployment tax

-

Maintain a safe workplace

Topics: Contractors Bookkeeping Paperwork, Subcontractor 1099, QuickBooks For Contractors, Construction Bookkeeping, QuickBooks Construction Accounting, Taxes

Annual Taxes And Job Costing From The View Of The Contractor

Posted by Sharie DeHart on Fri, Sep 09, 2016

The First Question You May Ask Yourself Is

Why Doesn’t My Tax Accountant Help Me With Job Costing?

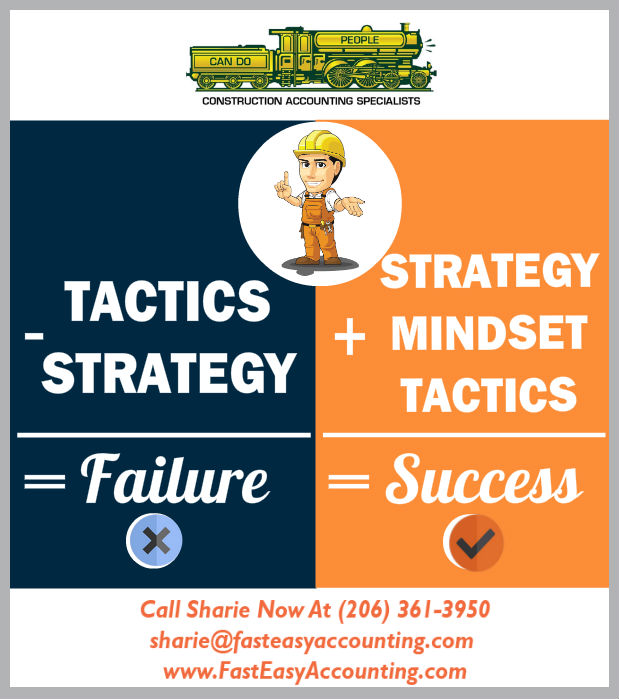

They are Tax Accountants, not Construction Accountants and may not know the answers. You may think they are just keeping it a secret. Sometimes you may think they don’t know what they are doing, and maybe I need to get a new tax accountant.

My Advice is Stop, take a deep breath. Is your tax accountant doing a good job with your annual taxes? If the answer is YES. Please keep them, they are doing what they are supposed to do.

Topics: Job Costing Reports, Annual Tax Return, Tax Accountants, Taxes

It is no secret that contractors are among the industries where many cash transactions take place and sometimes they get busy and forget to deposit the money in the bank, properly track it inside their contractors bookkeeping services system and pay the taxes on it.

From several decades of experience and observations as construction accountants serving contractors all across the USA including Alaska and Hawaii we have proof that contractors who cheat on their taxes lose out on enjoying big cash flow and profits in the long run.Topics: Taxes