How Construction Business Owners Can Overcome Digital Hurdles

Posted by Sharie DeHart on Fri, Jan 03, 2025

Topics: Systems And Processes, QuickBooks Year End Closeout, Technology For Your Construction Company, Happy New Year, Construction Systems And Processes, Year End Tips For Construction Contractors

The Year-End Financial Checklist For Construction Business Owners

Posted by Sharie DeHart on Fri, Dec 27, 2024

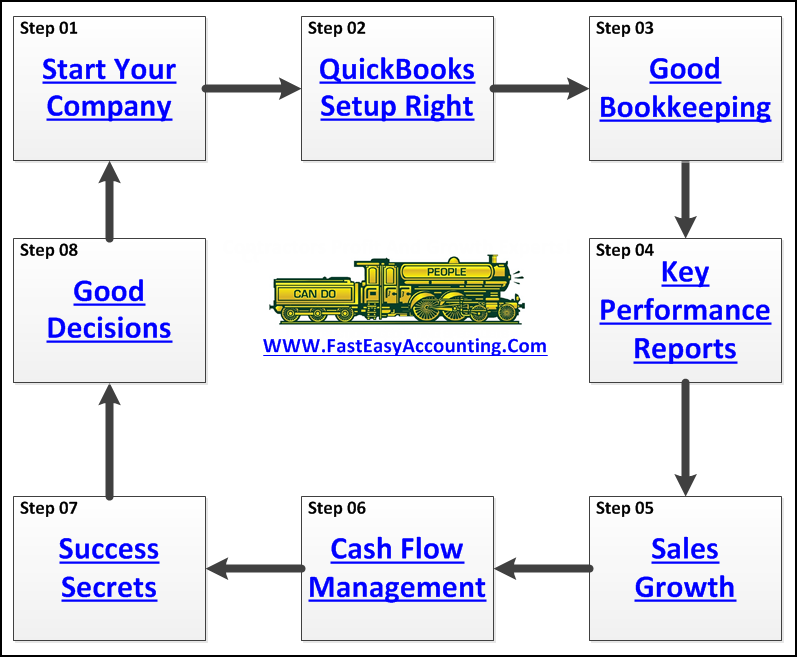

As the year draws to a close, construction business owners find themselves in a critical period of reflection and preparation. The year's end is a time to celebrate past successes and an opportunity to assess financial health and strategize for the coming year. A thorough year-end financial checklist can help ensure your business is on solid footing as you move forward.

Access to the best available tools and information is vital in almost any operation but is especially crucial in the competitive construction and home service industry. To help with your year-end tasks, take advantage of our exclusive 40% discount on Bookkeeping Templates (consulting, bookkeeping review, and outsourced accounting subscriptions excluded) and Construction Accounting Academy classes now through January 6, 2025. you can use our promo code YEAREND40.

Topics: QuickBooks Year End Guide, Systems And Processes, QuickBooks Year End Closeout, Xero Year End Closeout, Happy New Year, Happy Holidays, Construction Systems And Processes, Year End Tips For Construction Contractors

How To Prevent Your Construction Company's Yearly Cycle Of Chaos

Posted by Sharie DeHart on Fri, Dec 16, 2022

The year is almost over. Fourth-quarter and year-end deadlines are approaching. Most construction business owners who reach out to us describe this as their "Year End Madness" to prepare their documents for the tax accountant.

The end of the year tends to be chaotic for construction company owners, but it's an excellent time to get some extra housekeeping done for your business. If you're on QuickBooks, you can click the Help Menu; depending on the year and version you're using, you can access the Year-End Guide, which will show you how to wrap up your business year. It's not an easy process, but it's all worth it.

Why? Because tax preparers will take what you give them - they don't have the time, and it's much work that you've paid for, but a good tax preparer will know how much you can save if you can track your money. Bottomline - pay your taxes right, but it doesn't have to be more than what you owe.

Topics: QuickBooks Year End Closing Tips For Contractors, Construction Bookkeeping And Accounting, QuickBooks Year End Closeout, Contractor Tips, Reducing costs, Year End Tips For Construction Contractors

Taking a bit of time to clean-up QuickBooks and prepare it before giving it to your tax preparer could save you hundreds or even thousands of dollars in income taxes.

Topics: QuickBooks Year End Closing Tips For Contractors, QuickBooks Year End Guide, QuickBooks Year End Closeout

Ask A Bookkeeper Easy End Of The Year QuickBooks / Xero Accounting

Posted by Randal DeHart on Thu, Nov 21, 2013

Topics: QuickBooks Year End Closeout, Xero Year End Closeout