Practical Tax Season Tips For Construction Business Owners

Posted by Sharie DeHart on Fri, Jan 12, 2024

Topics: How To Lower Your Tax Bill, Save Money On Income Taxes, Sales Tax, Tax Accountants, Reduce Taxes, Taxes, Contractor Tips

Contractors want to maintain control without making any changes. "Keep doing the same thing but expecting a different result."

Throwing the receipts in a shoebox (behind or under the seat in the truck) is the favorite way to deal with paperwork. This is "Under Managing" and frustrates everyone around them who is playing "Where's Waldo?" Job costing is nonexistent; bills are usually paid late, customers are unbilled, lost, and forgotten.

On the other hand, micromanaging every detail is an over-reaction from years of doing as little bookkeeping as possible to prepare the tax return. Knowing what to do, however, will stop you from making a big mess of it.

Topics: How To Lower Your Tax Bill, Construction Profits, Construction Accounting, Reduce Taxes, Contractor, Contractor Tips, Contractor Operating Tips

Topics: How To Lower Your Tax Bill, Construction Accounting, Annual Tax Return, Income Tax Preparation Checklist, Contractor, Contractor Tips

You Could Be Paying Too Much Taxes With The Wrong Bookkeeper!

Posted by Randal DeHart on Fri, Jun 01, 2012

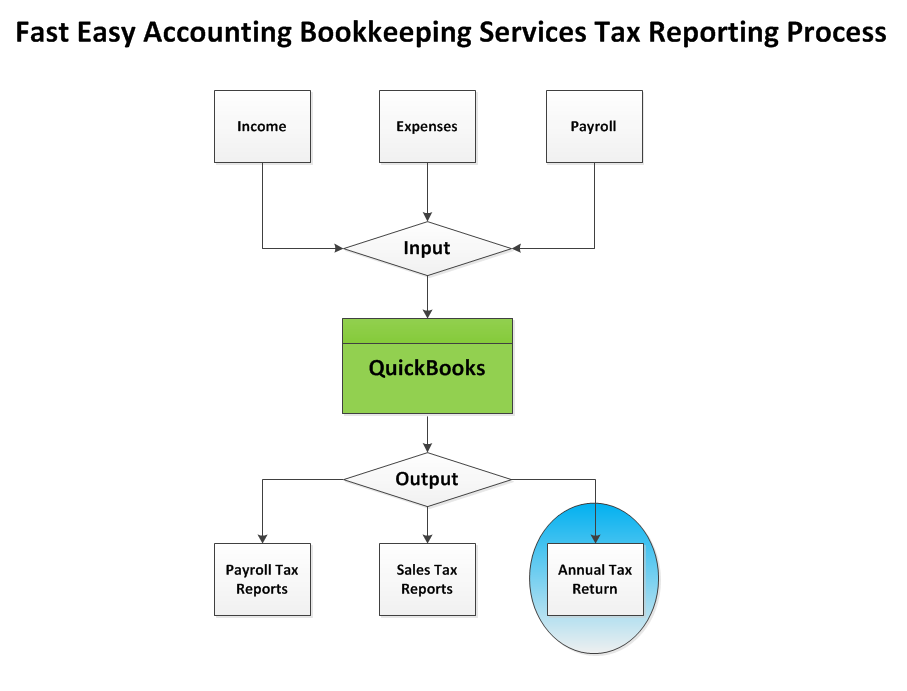

Your Tax Bill Is Based On Reports From Your QuickBooks Construction Accounting System

QuickBooks For A Tiny Company - But not any construction company, can be setup and maintained by just about anyone who can fog a mirror. Setting Up QuickBooks and Maintaining QuickBooks for a construction company is a whole different thing. It is the difference between flying a tiny remote control toy plane at the park on a sunny afternoon and piloting a Boeing 787 jetliner with your company and everyone depending on it aboard.

Topics: How To Lower Your Tax Bill