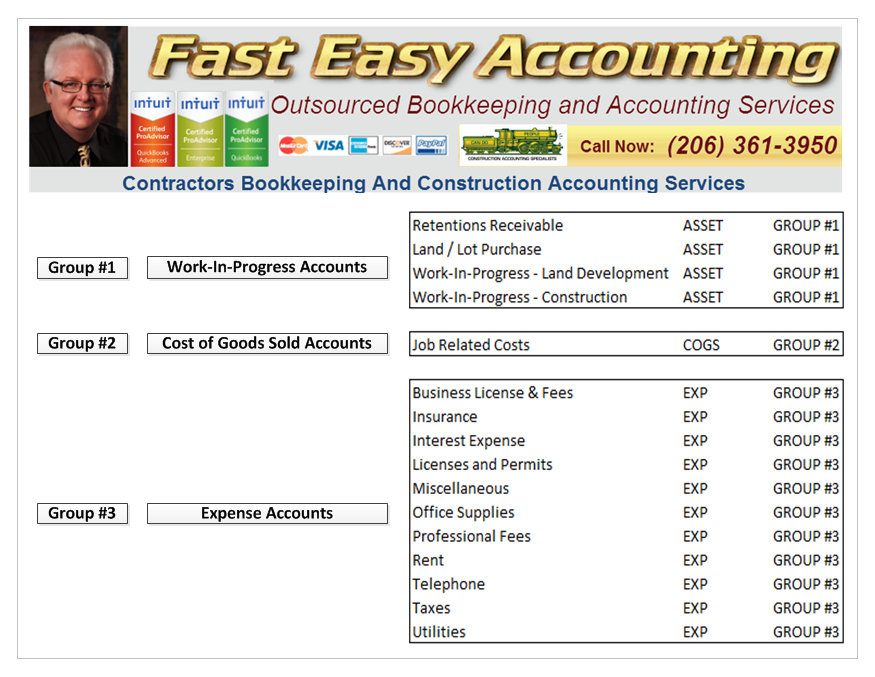

Contractors often ask us if they can buy our Chart Of Accounts with Cost of Goods Sold and import them into their QuickBooks Desktop file or their QuickBooks Online file. The answer is yes!

Click here for QuickBooks Desktop Chart of Accounts with Cost of Goods Sold

Click here for QuickBooks Online Chart of Accounts with Cost of Goods Sold

Direct Costs are tied to the jobs (field labor, material, and other cost items) Office material (pencils, paper, toner, etc. are overhead) Yes, an accountant could say these many pencils are used in the field, and that notepad is used in the truck.

The answer is the dividing line of what the DIRECT COSTS to the job and those are Cost of Goods Sold (COGS).

Read More

Topics:

Invoicing,

We Know Construction Accounting,

QuickBooks For Contractors,

Construction Bookkeeping

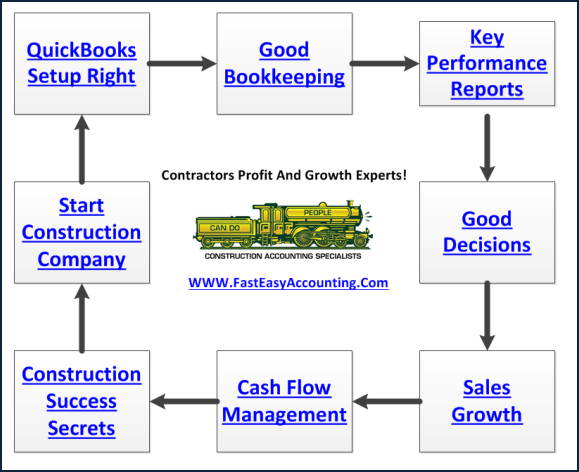

I would like to start my blog post by asking you to reflect on your WHY. Pause for a while and think about the reason or reasons why you started your business. I highly doubt that your answer is rooted in accounting tasks or involved any type of bookkeeping project at the slightest. It is apparent that you’re passionate about what you do and you love working in the construction industry, be your own boss, and have the freedom you’ve dreamed of.

I admit, small business owners - like myself, have learned to make the most of the resources we have. And as an entrepreneur, tend to take on the challenge of wearing multiple hats. Marketing your business, answering phone calls, responding to emails, scheduling appointments – to name a few. However, I am reminding you now that being a company owner and doing your accounting and bookkeeping requires a totally different skill set from being a construction expert in your field. When it comes to your financials, it would be wise to take a step back and let someone who specializes in bookkeeping do it for you. Not just any accountant or bookkeeper, but see to it that they are Construction Bookkeeping and Accounting Professionals.

Read More

Topics:

QuickBooks For Contractors,

Construction Bookkeeping,

QuickBooks Setup Do It Yourself,

QuickBooks Construction Accounting,

Assisted Do-It-Yourself Contractor Bookkeeping

Creating an invoice for the entire project seems like it is the simplest way to track payments and have the current balance. The harsh reality is that if all of the work is NOT done, accounts receivable is reflecting a balance due that is NOT REAL. Without proper tracking and matching of income and expenses, most construction companies never know if they made a profit until the job is over.

However, due to your work’s nature, as construction contractors provide services on a per-job operation, issuing invoices make it all the more challenging and difficult than it has to be. The good news is that it doesn't have to stay that way. Consider the following invoicing errors contractors make and take actionable steps on how to avert them.

Read More

Topics:

Invoicing,

QuickBooks For Contractors,

Construction Bookkeeping,

Payment Applications

Common Issues With Accounts Payable

It is easy to put transactions in Accounts Payable (A/P) Aging Summary, and them forget about them. When writing a check from the checking QuickBooks does not automatically go look to see if you put something in Accounts Payable. Sometimes Accounts Payable will have transactions in Accounts Payable that do not belong there.

Read More

Topics:

QuickBooks For Contractors,

Construction Bookkeeping,

KPI,

accounts receivable for contractors

Challenges Of Keeping Accounts Receivable Simple And Up To Date

Creating an invoice for the entire project seems like it is the simple way to track payments and have the current balance. The harsh reality is that if all of the work is NOT done Accounts receivable is reflecting a balance due that is NOT REAL.

Read More

Topics:

QuickBooks For Contractors,

Construction Bookkeeping,

KPI,

accounts receivable for contractors

Construction Bookkeepers Without Training Is A Common Problem

Many Construction Bookkeepers start out as Admin Assistants and get promoted to doing the Contractor's Bookkeeping in their free time. They were not hired to be a bookkeeper but as an office person who does a little data entry.

This method not too bad if the employee stays a long time and grows with the company from owner working solo to gradually adding a few employees one at a time because as Randal says:

Growing By The Inch Is A Cinch; Growing By The Yard Is Hard!

Read More

Topics:

Construction Bookkeeping,

Contractors Bookkeeping Services

Bad Bookkeepers Have 38 Traits In Common

It is important to understand the difference between Professional Bookkeepers, Regular Bookkeepers and Bad Bookkeepers.

- Regular Bookkeepers learned most if not everything they know about bookkeeping by experience and by letting you pay for their education in the form of excess taxes, fines, penalties, un-invoiced work, overpaying bills and late fees. It is painful for them and you. They have good intentions and do not want to cause contractors any grief and they are sincere with their apologies. Of the thousands of Regular Bookkeepers I have met they all have good hearts and really do mean well.

- Bad Bookkeepers also learned most if not everything they know about bookkeeping by experience and by letting you pay for their education in the form of excess taxes, fines, penalties, un-invoiced work, overpaying bills and late fees. It is painful for you but not for them. They have bad intentions and will cause contractors as much grief as possible and are quick to blame everyone else when something goes wrong. Of the dozens of Bad Bookkeepers I have met they all have a bad opinion of contractors and business in general.

On to the 38 traits

Read More

Topics:

Bad Bookkeepers,

Professional Bookkeepers,

Bookkeeping,

Construction Bookkeeping,

Bookkeeper

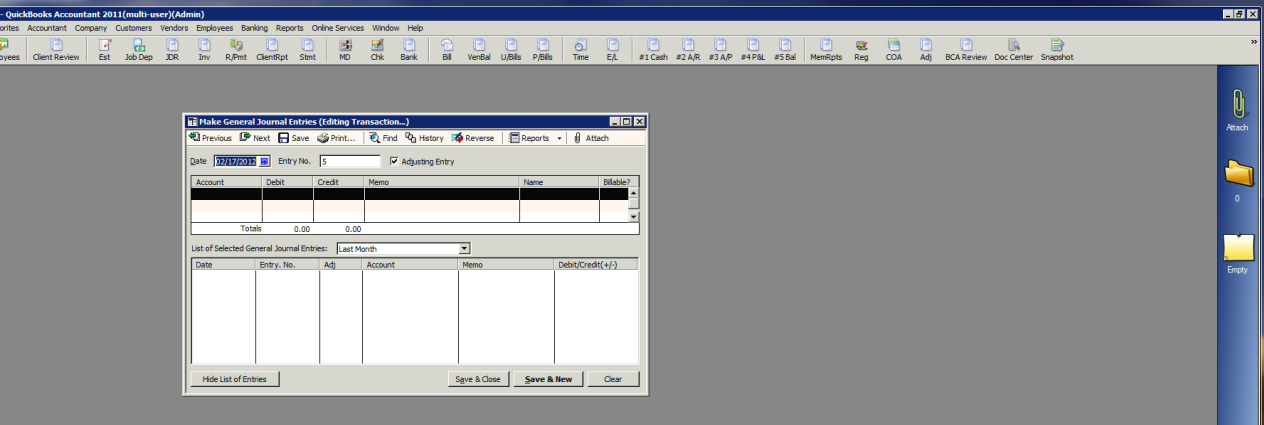

It Is Tax Time Again - And if your tax preparer sends you a bunch of "Journal Entries" for your QuickBooks call Sharie 206-361-3950 or email her Sharie@FastEasyAccounting.com and we can help you with it.

Read More

Topics:

Construction Bookkeeping,

contractors bookkeeping and accounting,

Tax Accountants,

Journal Entries