If your company is experiencing rapid growth, you might find yourself navigating a good news/bad news situation: while your sales figures climb, managing cash flow becomes increasingly complex, pushing you to seek additional financing to meet the rising demand.

Consider this scenario: A couple wanting to sell their house expresses interest in your remodeling service, presenting an exciting opportunity that could significantly elevate your construction business.

However, they have a requirement: they want the job done in three weeks.

Now, you're caught in a challenging position. Declining could mean missing out on a lucrative partnership, yet agreeing could strain your cash reserves.

You're not alone in this struggle; many businesses face similar hurdles when scaling operations or entering new partnerships, especially when balancing cash flow and the cost of fulfilling the project on time.

Read More

Topics:

Construction Bookkeeping And Accounting,

Construction Accountant Who Listens,

Banking,

Funding,

Construction Funding

Avoiding cash flow crises is crucial for the success and sustainability of your construction business. Managing cash flow is vital for small business owners. Poor cash flow management can create significant challenges even if your business is profitable.

Cash is a fact; Profit is an opinion

A cash crisis can be emotionally devastating and even kill your business. If you've ever had to beg, borrow, and steal to cover tomorrow's payroll, you know what I mean.

Understanding cash flow

Cash flow refers to the money moving in and out of your business. Cash inflows come from sales, interest earned, and investments. Cash outflows cover rent, payroll, bills, and supplier payments. Positive cash flow means your inflows exceed outflows, while negative cash flow indicates more money going out than coming in.

Read More

Topics:

QuickBooks Contractors Financial Reports,

cash report,

Cash Flow,

Construction Bookkeeping And Accounting,

Contractor Cash Flow Problems,

Increase Cash Flow,

Improve Construction Cash Flow

Understanding financial statements might sound daunting, but small business owners like you must stay on top of your game. Each financial report offers unique insights into your company's economic status.

As a construction contractor, your financial statements provide valuable insights into your company's financial health and are essential for making informed decisions. Let's look at the critical components of financial statements and why they matter to construction contractors.

Read More

Topics:

QuickBooks Contractors Financial Reports,

Construction Bookkeeping And Accounting,

Project Management,

Financial Modeling,

Financial Statement

Handling multiple projects simultaneously is a common challenge for small construction companies. While it can signify growth and success, it comes with its fair share of struggles. From resource allocation to maintaining quality and meeting deadlines, juggling several projects can be overwhelming. However, with the right strategies, it's possible to navigate these challenges successfully.

Staying organized is crucial. With numerous tasks, deadlines, and client expectations, implementing efficient organizational strategies is critical to success. Create a centralized system for storing project-related information such as contracts, plans, permits, and client communication. Utilize project management software or cloud-based storage solutions to ensure easy access and seamless collaboration with your team.

Read More

Topics:

Multiple Companies In QuickBooks,

Multiple QuickBooks Files,

Construction Bookkeeping And Accounting,

Systems And Processes,

Project Management,

Project Management For Construction

The recent cyber outage is a stark reminder of digital systems' vulnerability and potential impact on businesses, including those in the construction industry. This incident offers several critical lessons for construction bookkeeping.

As a contractor, your accounting and bookkeeping systems are vulnerable not only to cyber threats but also to software outages, which can compromise sensitive financial data and disrupt business operations.

In this blog post, we'll explore the implications of the recent cyber outage for construction accounting and bookkeeping and provide actionable tips to strengthen your defenses.

Read More

Topics:

Construction Bookkeeping And Accounting,

Systems And Processes,

security,

cybersecurity,

Construction Systems And Processes

Managing a hectic schedule and complex projects can be challenging if you're a contractor. You must also ensure that your paperwork, documents, and contracts are in order. It's essential to keep a paper trail of your work and practice due diligence.

Keeping all your working documents in order shows that you treat your business, customers, and subcontractors responsibly. This is a mark of professionalism and can also help if you have an insurance or legal claim.

Contractor paperwork documentation and procedures

You should develop documentation and record-keeping procedures appropriate for your contracting operation or service if necessary. Once procedures are in place, it is equally important to ensure everyone understands and follows them.

Read More

Topics:

Construction Bookkeeping,

Construction Bookkeeping And Accounting,

Bookkeeper,

contractor bookeeping services,

Contractor Guidance

Taking steps to create a good foundation in the early days of your business is essential for a sustainable and profitable future.

It's rare these days that your prospective leads happen to find your construction business and become a client with no work. Your company has to grab people's attention, turn curious visitors into leads and then convert those leads into sales.

Keep in mind: Marketing-Accounting-Production

Read More

Topics:

Construction Marketing,

Construction Bookkeeping And Accounting,

MAP vs. PAM,

Contractor Tips,

Construction Productivity,

Construction Organizational Change

How often have you hired someone with the expectation that they know how construction works, and then you found out they did not know about it? You are a master in the construction industry, so you recognize what to look for in your particular field and quickly observe if someone has the skillsets, and you proceed accordingly.

You know what happens when you send your best Rough Carpenter that you pay piece work for framing spec from the ground up in all kinds of weather and working conditions to install some custom-made cherry wood cabinets with gold plated pulls and knobs in the home of your best client (who happens to be in the wealthiest neighborhood in your town). It is not a pretty sight.

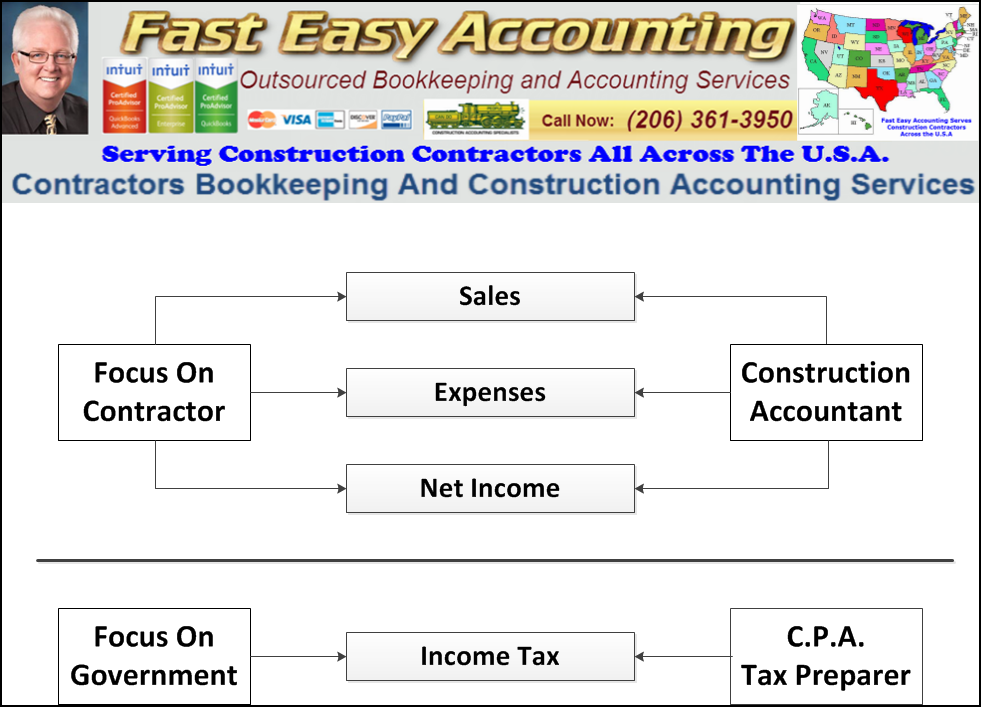

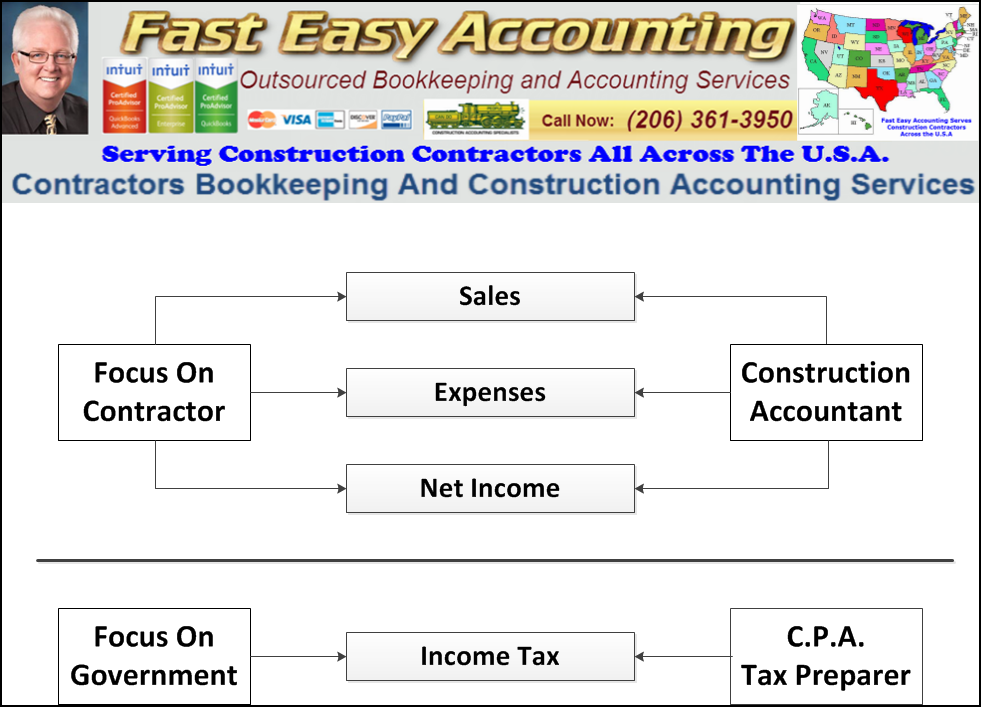

Have you pictured a crew with muddy work gear and boots stepping onto your client's pristine floors? The dirty secret is that Tax Accountants operate like Rough Carpenters because they work fast and furious, and they are paid piece work. The main difference is that they earn the bulk of their annual income in three and a half months. This means they do not waste any time going through your receipts to ensure you get all the deductions you are entitled to.

Read More

Topics:

CPA Vs Construction Accountant,

When Contractors Need A CPA,

Construction Bookkeeping,

Construction Bookkeeping And Accounting,

Construction Accountant Who Listens,

CPA,

Contractor Tips

Operating and growing your construction business requires more than functional and skilled employees, but it's an excellent start. You need a steady stream of quality, paying clients to keep your company afloat. Likewise, deciding on an online marketing plan can be overwhelming for company owners like you who are looking for affordable ways to nurture consistent, sustainable growth. With time in short supply, the key is to find one or two growth strategies that will get results at a minimal cost.

Building a construction business requires collaboration and partnership. The deployment of employees in a way that allows them to work together to problem-solve and act with a shared sense of urgency; and increasing brand awareness through an alliance with people in the industry are simple, cost-effective ideas for building your company within, in the office or job site, or externally through referral and online connections.

Read More

Topics:

Profit and Growth Strategies For Contractors,

Construction Bookkeeping And Accounting,

construction business partnership,

Boost Construction Profitability,

Construction Collaboration

Inflation has ballooned worldwide in recent months, and there's no question that small construction businesses are feeling the pinch. Supplies cost more, employees are hard to find, and your profits are shrinking.

This can lead to operating at a loss - spending more money than you make. Otherwise, you will eventually run out of cash reserves and be out of business. And while it's not uncommon, especially for new companies, it's still not ideal and shouldn't continue in the long term.

Be aware of what's going on in your industry and adjust. Customers judge a business based on perceived value. If you're at the bottom of the pack price-wise, they're likely to skip over you to get a good deal. Price yourself accordingly to attract quality clients.

Read More

Topics:

Construction Bookkeeping And Accounting,

Contractor Tips,

Improve Construction Cash Flow,

Boost Construction Profitability,

Inflation,

Construction Business Inflation