Strategies To Boost Construction Team Morale During Transitions

Posted by Sharie DeHart on Mon, Feb 03, 2025

Topics: Construction Bookkeeping, Systems And Processes, Winning Teams, Construction Systems And Processes, Boost Construction Profitability, Construction Team

The Budget Blueprint: Project Cost Control For Contractors

Posted by Sharie DeHart on Fri, Jan 24, 2025

Topics: Construction Bookkeeping, Systems And Processes, Construction Project Managment, Bookkeeper, Project Management, Construction Systems And Processes, Construction Bookkeeper, Project Budgeting

Topics: 10000 Hours of Bookkeeping Practice, Construction Bookkeeping, Systems And Processes, Bookkeeper, Construction Systems And Processes, Construction Bookkeeper

Practical Applications Of A Must-Read Book Into Your Small Business

Posted by Sharie DeHart on Fri, Jan 10, 2025

Topics: Construction Bookkeeping, Systems And Processes, Reading List, Construction Systems And Processes, contractor habits, Good Construction Business Owner Habits

Building On Solid Ground: Your Construction Bookkeeping Foundation

Posted by Sharie DeHart on Fri, Jul 05, 2024

Topics: Bookkeeping For Electrical Contractors, Bookkeeping For Commercial Tenant Improvement Cont, Bookkeeping For Custom Home Builders, Bookkeeping For Remodel Contractors, Bookkeeping Needs, Bookkeeping For Plumbing Contractors, Bookkeeping, Construction Bookkeeping, Systems, Construction Systems And Processes

A No-Fuss Record-Keeping Guide For Your Construction Business

Posted by Sharie DeHart on Fri, May 10, 2024

Managing a hectic schedule and complex projects can be challenging if you're a contractor. You must also ensure that your paperwork, documents, and contracts are in order. It's essential to keep a paper trail of your work and practice due diligence.

Keeping all your working documents in order shows that you treat your business, customers, and subcontractors responsibly. This is a mark of professionalism and can also help if you have an insurance or legal claim.

Contractor paperwork documentation and procedures

You should develop documentation and record-keeping procedures appropriate for your contracting operation or service if necessary. Once procedures are in place, it is equally important to ensure everyone understands and follows them.

Topics: Construction Bookkeeping, Construction Bookkeeping And Accounting, Bookkeeper, contractor bookeeping services, Contractor Guidance

Construction Accounting Concepts You Can Benefit From Today

Posted by Sharie DeHart on Fri, Jun 16, 2023

As a small business owner, you know that managing your finances is crucial to the success of your business. But with so many accounting principles and practices, it can be challenging to know where to start. That's where we come in! This guide will break down the essential accounting principles that every small construction business owner should know. We'll discuss how these principles can help you keep track of financial transactions, create accurate financial statements, and make informed decisions for your business. So, let's dive in, shall we?

Why Are Accounting Principles Important for Construction Businesses?

Accounting principles are the foundation for any successful business. They provide a uniform framework for recording and reporting financial transactions, ensuring consistency and accuracy in your financial records. By adhering to these principles, you'll be able to:

- Make better financial decisions based on accurate and reliable data

- Monitor your business's performance and identify areas for improvement

- Meet legal and regulatory requirements for financial reporting

- Build trust with investors, lenders, and other stakeholders

Topics: Construction Bookkeeping, Construction Accounting, outsourced construction accounting and bookkeeping, Cost of Goods Sold Vs. Expense, Job Costing, COGS

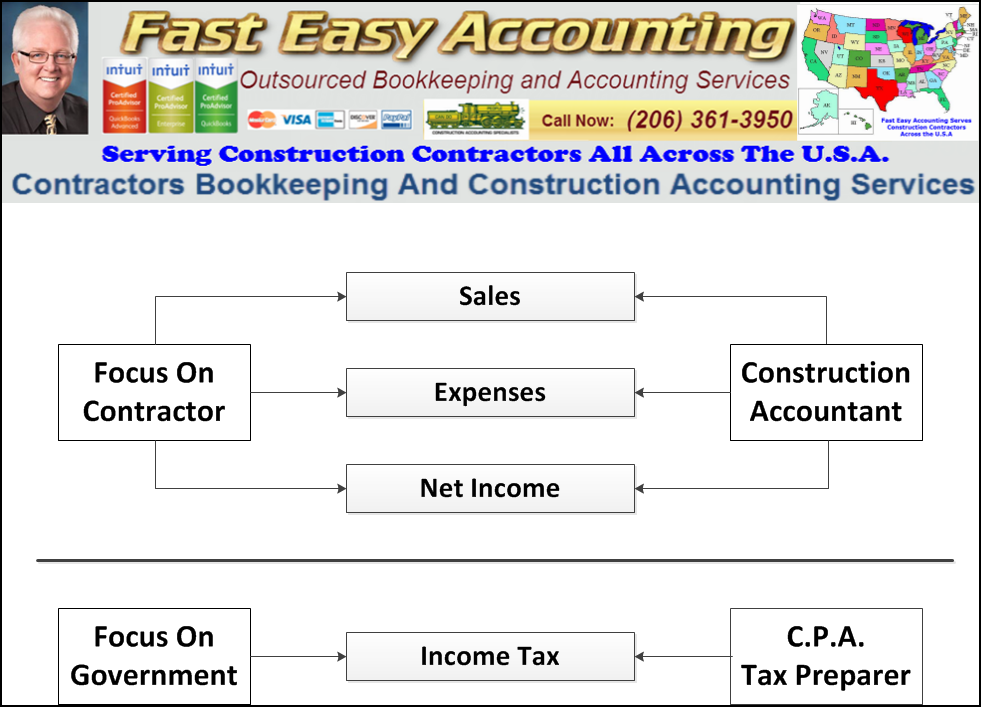

The Difference Between A Construction Accountant And A Tax Accountant

Posted by Sharie DeHart on Fri, Feb 17, 2023

You know what happens when you send your best Rough Carpenter that you pay piece work for framing spec from the ground up in all kinds of weather and working conditions to install some custom-made cherry wood cabinets with gold plated pulls and knobs in the home of your best client (who happens to be in the wealthiest neighborhood in your town). It is not a pretty sight.

Have you pictured a crew with muddy work gear and boots stepping onto your client's pristine floors? The dirty secret is that Tax Accountants operate like Rough Carpenters because they work fast and furious, and they are paid piece work. The main difference is that they earn the bulk of their annual income in three and a half months. This means they do not waste any time going through your receipts to ensure you get all the deductions you are entitled to.

Topics: CPA Vs Construction Accountant, When Contractors Need A CPA, Construction Bookkeeping, Construction Bookkeeping And Accounting, Construction Accountant Who Listens, CPA, Contractor Tips

Common Construction Payroll Implementation Errors You Can Easily Avoid

Posted by Sharie DeHart on Fri, Oct 28, 2022

Small business owners spend an average of eight hours monthly performing payroll functions. That's 12 business days a year that could be spent generating sales, prospecting new business opportunities, improving products or services, or servicing customers.

Upgrading or changing your payroll system comes with a ton of attractive benefits. Saving time and money, making everyone's account more manageable, and better integration are all excellent reasons to consider a change.

But if the switch is mishandled, the results can be catastrophic and lead to long-lasting problems. Read on for tips on avoiding a disastrous payroll system migration.

Topics: QuickBooks For Contractors, Construction Bookkeeping, Business Process Management For Contractors, Construction Project Managers, Construction Project Managment, Project Management, Project Management For Construction

Management Priorities For New And Experienced Construction Company Owners

Posted by Sharie DeHart on Fri, Oct 14, 2022

In the past, Construction Project Managers were laborers or served an apprenticeship in one of the skilled construction trades and were promoted to foreman. This meant many people were more comfortable in manual labor without management skills. And when "things" were put in charge of "people," the results were not usually favorable.

Because of this, many construction companies failed and went out of business due to the Cost of Chaos in their businesses. And it is still happening today.

In the late 20th century, construction and construction management were separated into individual disciplines, each with its methodologies, terms, and definitions.

Topics: QuickBooks For Contractors, Construction Bookkeeping, Business Process Management For Contractors, Construction Project Managers, Construction Project Managment, Project Management, Project Management For Construction