Topics: How To Lower Your Tax Bill, Construction Accounting, Annual Tax Return, Income Tax Preparation Checklist, Contractor, Contractor Tips

Highly Profitable Contractors Control Who Receives Company Information

Posted by Sharie DeHart on Fri, Sep 29, 2017

You Have Ultimate Control On Who Has Or Receives

Information About Your Contracting Company

Financials statements are based on the information you provided. I know this is not a statement that any contractor wants to hear about their bookkeeping. It is easier to blame the bookkeeper for missing information. The primary keeper of all the documents is you, your spouse, your employees, your suppliers, your bank, your credit card company. The Key work is done by you, or whoever assists you have the power to give information to outsiders about your Construction Company.

Who wants details about your business?

- Internal Revenue Service

- State Revenue Agencies

- State Payroll Agencies

- Other State Agencies

- Worker’s Compensation Provider

- General Liability Insurance Provider

Depending on the report it may be monthly (sales tax, business excise tax, other state business tax reports) Quarterly reports include all payroll related forms to State and Federal (Internal Revenue). Personal story. If you have any data that you can include relating to your list, include that in your introduction, too.

Read MoreTopics: Contractor Bookkeeping, 80 20 Rule, Annual Tax Return

Contractors View Of The Numbers And Tax Accountants View Are Totally Different

When Tax Accountants Review The Financial Statements The Year Has Ended

The Tax Accountant’s Role Is To Review The Previous Year Financial History based on the information provided create and file the Annual Federal Tax Return, Annual State Tax Return, and other Local or Payroll Returns. Washington State is a sales tax driven state. Other states have a State Income Tax, and others yet have a blend of both.

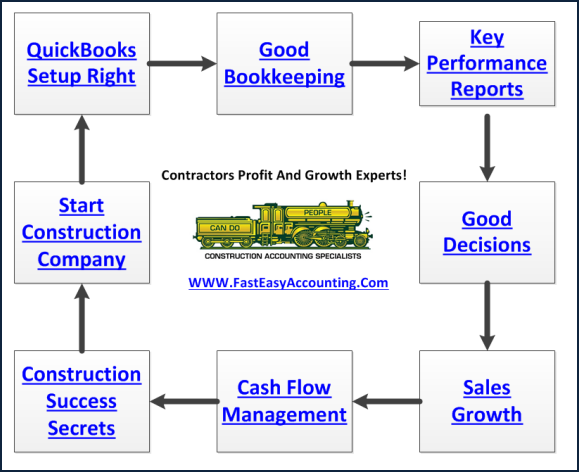

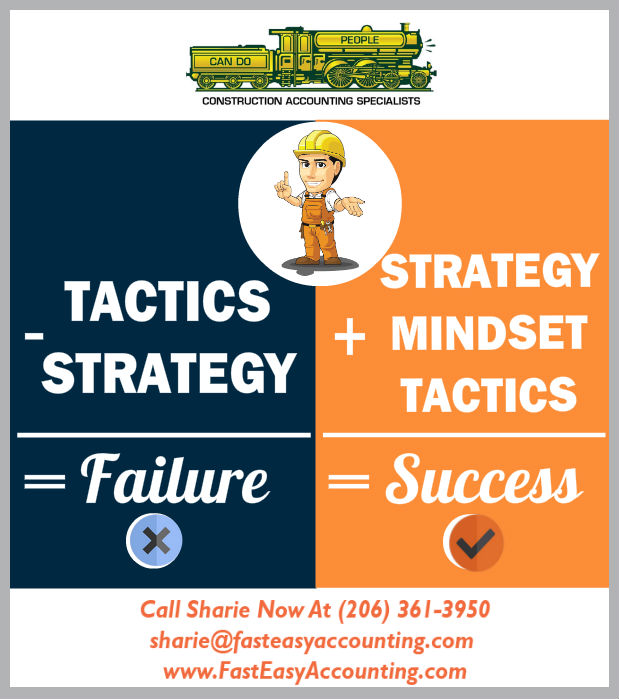

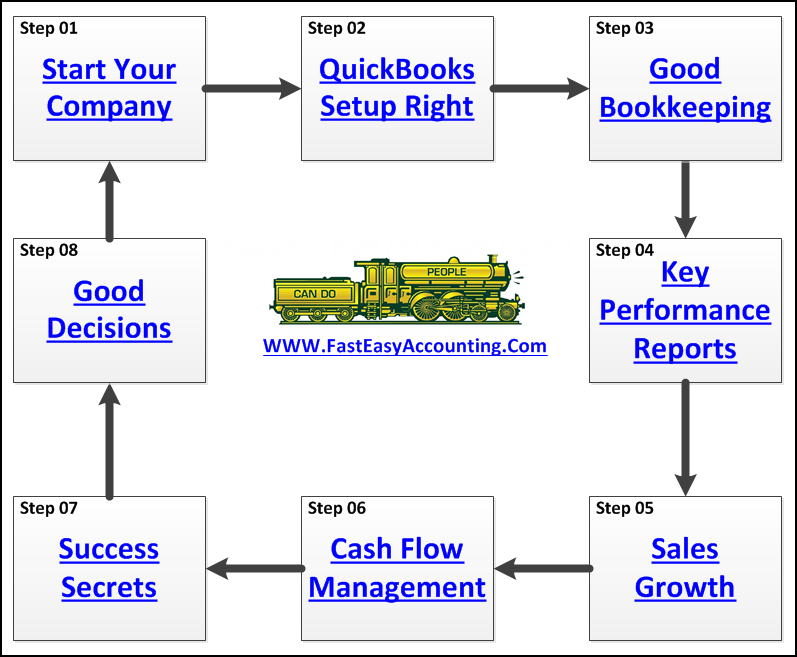

The Contractors Role Is To Review What Is Happening Now and make Strategic Decisions about what to know in order to have a brighter financial future. The best way to do that is to have QuickBooks Setup to deliver your 5 Key Performance Indicators (KPI) in 5 minutes a day at 5 pm or whatever time is best for you. We call them the 5 At 5 For 5, and we can set them up in your QuickBooks for you! Click here to learn more.

Read More

Topics: Profit and Growth Strategies For Contractors, Annual Tax Return, construction company strategy

Happy New Year

It’s almost the end of the year and time to decide if your employees deserve a Bonus. You may call it a

Generic Employee Bonus, Christmas Bonus, Holiday Bonus or Year End Bonus

Giving An Employee Bonus Comes Down To Cash Flow

Read More

Topics: QuickBooks Year End Guide, Annual Tax Return, Happy New Year

Annual Taxes And Job Costing From The View Of The Contractor

Posted by Sharie DeHart on Fri, Sep 09, 2016

The First Question You May Ask Yourself Is

Why Doesn’t My Tax Accountant Help Me With Job Costing?

They are Tax Accountants, not Construction Accountants and may not know the answers. You may think they are just keeping it a secret. Sometimes you may think they don’t know what they are doing, and maybe I need to get a new tax accountant.

My Advice is Stop, take a deep breath. Is your tax accountant doing a good job with your annual taxes? If the answer is YES. Please keep them, they are doing what they are supposed to do.

Topics: Job Costing Reports, Annual Tax Return, Tax Accountants, Taxes

Why You Need To Keep Bookkeeping And Tax Preparation Separate

Posted by Randal DeHart on Thu, Feb 23, 2012

Topics: Annual Tax Return, Tax Accountants, IRS Audit Of QuickBooks