In an attempt to save money, the cheap contractor does the following and ends up spending the most money and earning a tiny profit because they believe in Maximizing over Optimizing. In the short run Maximizing can payoff; however, in the long run it never does.

This article is a bit strong and it could offend some folks. If it offends you, please accept my sincere apologies. I tend to tell it straight and not sugar coat anything because I have been involved in the construction industry most of life beginning with working in my Step Father's construction company after school in the mid 1960's.

During my lifetime, I have seen too many contractors work hard, never have enough money to retire. Some of them die from exhaustion and others just wore themselves out and lived their final years in poverty and only a few, less than 5% ever made enough money from owning and operating their construction company and outside investments to retire early enough and enjoy a comfortable lifestyle.

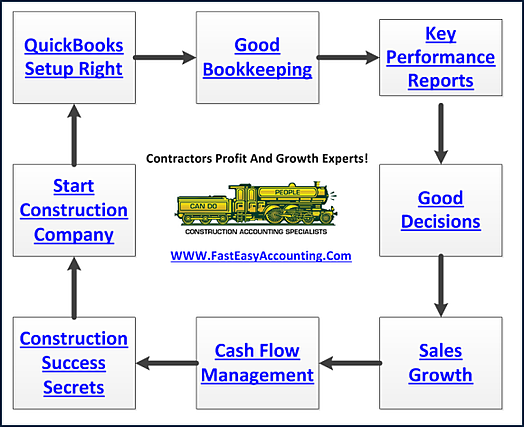

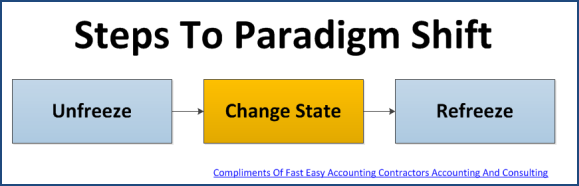

Part of our mission here at Fast Easy Accounting is to help as many contractors as we can to shift their Paradigm and become one of the top 5%. To learn more about Paradigm Shift click here.

Overloaded Construction Vehicles Cost More Money Than They Save

Example #01 They overload their vehicles beyond what they are designed to carry

They believe the truck manufacturer "Low-Balls" the Gross Vehicle Weight Rating (GVWR). For a short read on this subject, click here to download a white paper. For more in depth information on GVWR please visit Model Minimum Uniform Crash Criteria they have extensive data on this subject.

Excess Weight Causes:

- Premature tire failure $$$

- Replacing brakes more often $$$

- Lower gas mileage $$$

- Wears out engines, transmissions, suspensions faster $$$

- If you are involved in a traffic collision and the attorneys get involved it could cost you everything you own and then some $$$$$$$

- Google "Does an overloaded truck have legal implications in a car wreck" and you will get over 2,000,000 results

Cheap Tools Cost More Money Than They Save

Example #02 They buy the cheapest tools they can find

They believe buying tools based on the price not the Total Cost Of Ownership (TCOO). The total cost of ownership has to take into account what ten minutes waste cost your construction company

Cheap Tools Waste Time And Money:

- The bargain basement priced shovels that break the first day you try to use it $$$

- The cheap light weight hammer that splinters and sends shrapnel flying everywhere $$$

- The low priced sazall, drill or circular saw that falls apart after a week $$$

- The thin gauged extension cords that cannot provide enough power to do the job $$$

- Damaged power cords that are hazardous and when OSHA finds them you pay lots of fines and penalties $$$$$$$

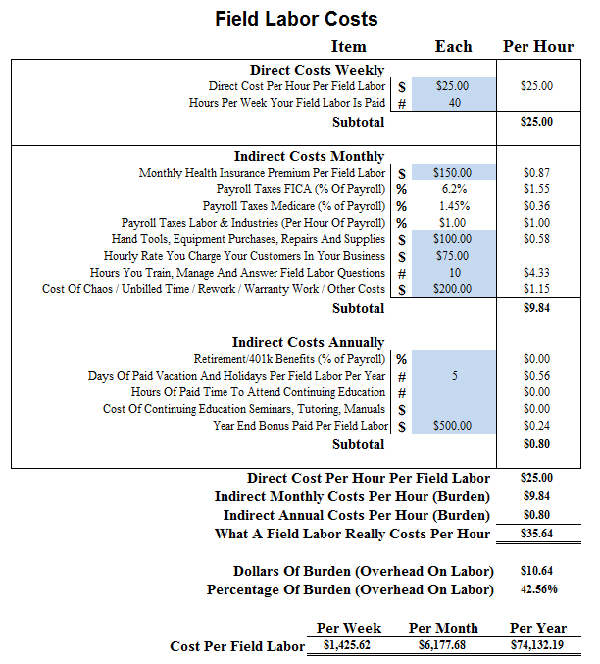

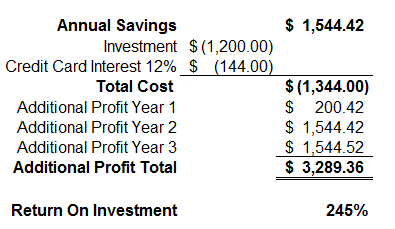

Make More Money Faster - With productivity gains. See the chart below:

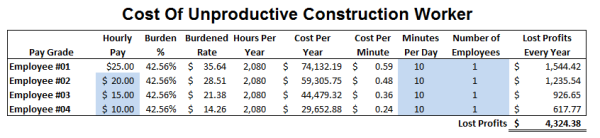

Every Ten Minutes Your Construction Worker Costs You $5.94

Every Ten Minutes A Day Of Unproductive Construction Worker Labor:

For Employee #01 Could Cost The Company $1,544.42 Each Year

At 10% Profit You Need $15,544.20 More Sales To Maintain Profit Margin

For Example - Your best construction worker asks for a tool:

-

It costs $1,200.00

-

It will save ten minutes a day in labor

-

It will last 3 years

-

The standard response is the company can't afford it!

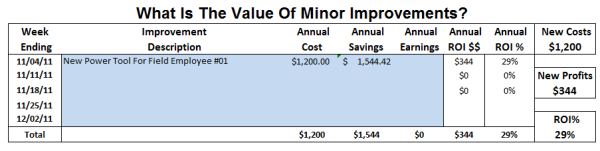

Highly Profitable - Construction company owners ask their construction accountant to calculate the projected the Return on Investment (ROI) is and then consult their Strategic Business Plan to make an informed decision.

In This Example - It may make sense to finance the purchase even if it means using a credit card at 12% interest because the net return is $3,289.36, which is 245% ROI. See below:

QuickBooks Online Is A Recipe For Disaster For Contractors

Example #03 They try to make QuickBooks Online work

QuickBooks Online is a great product for many companies, but not construction. The primary reason is contractors are one of the few companies that pack their entire company into trucks and vans, drive it to their customer's location. Then they put together a custom built product which means the margin for error is enormous and break even calculations are a moving target can only be done in a properly Setup QuickBooks File Designed Specifically For Construction Accounting.

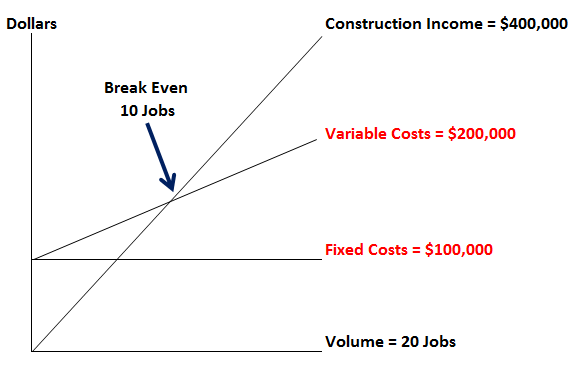

The graph below is a sample result of our proprietary Excel worksheet using data from QuickBooks reports

Most companies have a fixed location where customers come to them and they sell prepackaged products which they know exactly how much margin they need to sell everything for in order to earn a profit and stay in business so their company breakeven is very simple to calculate.

Contractors Using QuickBooks Online May Experience Some The Following Issues

-

Limited Job Costing Reporting

-

Limited Sales Tax Reporting

-

Limited Custom Reports

-

Limited Report Formatting

-

Limited Detail On Reports

-

Limited Filtering Of Reports

-

Limited To One Window

-

Limited Tech Support

-

Limited 3rd Party Apps

-

Slow Response Time

-

Wasting Time Moving Between Windows

-

Cannot Easily Link Multiple Companies

-

Payroll Issues

-

Importing multiple transactions

-

Importing IIF Files

-

Updating Chart of Accounts

-

Work-In-Process (WIP) Reports

-

No Inventory Reporting

-

Problems With Retention Held Reports

-

Problems With Retention Due Reports

-

Purchase Order Tracking

-

Job Progress Invoice Tracking

-

Corrupted Trial Balance Reports

-

Corrupted Financial Reports

-

Cannot Create Item Reports

-

Cannot Backup Before Performing Major Revisions

-

Too Many People In The File

-

QuickBooks Online Is Like A Doorknob Where Everyone Gets A Turn

-

Not Enough Controls To Keep Amateurs From Really Causing Problems

-

Tax Accountants in an effort to make QuickBooks online easier for them

-

Pages Regularly Become Unresponsive The Program Needs To Be Restarted

QuickBooks Online is a great program for small companies including some non-profit organizations but it is not suited for a serious construction contractor with more than two projects a month and generating more than $500 a year in sales.

Most Construction Companies started using QuickBooks Online so they could get to their QuickBooks Pro or QuickBooks For Contractors file anywhere they have internet access 24/7.

We Can Move Your QuickBooks Online File Into Our Private Cloud Server And Provide You With The Full Power Of QuickBooks Desktop Version Online In The Cloud!

Access QuickBooks Desktop Version From Your PC or Mac

Highly Skilled Technicians Maintain The Software

And We Maintain Your QuickBooks File

Push A Button And Have

-

Paperless System For You To Store, Print, E-mail Documents

-

Microsoft Is On The Server For You To Use

-

Microsoft Excel Is On The Server For You To Use

-

Key Performance Reports Every Contractor Needs

-

Cash Report anytime YOU want it!

-

Receivables report anytime YOU want it!

-

Payables report anytime YOU want it!

-

Profit & Loss statement anytime YOU want it!

-

Balance Sheet report anytime YOU want it!

-

Job Costing report anytime YOU want it!

-

Estimates Vs. Actuals report anytime YOU want it!

-

Frequently Asked Questions And Answers Click Here

The Screenshots Below Were Taken In Our Lynnwood Washington Office

QuickBooks For Contractors Is Running Smoothly On Cloud Based High-Speed Servers 1,000+ Miles Away!

Tucked Securely In A Building With Armed Guards

With Highly Skilled Technicians Maintaining It

All QuickBooks Files Are Backed Up Every Night On A Secured Server

Access Windows QuickBooks Desktop Version From PC or Mac

English Speaking, U.S. Based Technicians Maintain The Server

QuickBooks Software Updates Are Automatically Applied

We Provide Your QuickBooks Maintenance And Support

Frequently Asked Questions And Answers Click Here

But Wait There's More!

Our Contractor Clients Have 24/7 Access To QuickBooks Contractor Financial Reports!

Just when you thought our special brand of outsourced contractor bookkeeping services couldn't possibly get any better...it does...yet again!

We provide professional contractor bookkeeping services primarily for construction company owners with annual sales volume $0 - $5,000,000 using the full desktop version of QuickBooks For Contractors which rests on an Intuit Approved Commercial Hosting Service.

On demand 24/7 internet cloud based access to your QuickBooks Reports including Profit & Loss, Balance Sheet, Receivables, Payables and more without having to own or open QuickBooks For Contractors!

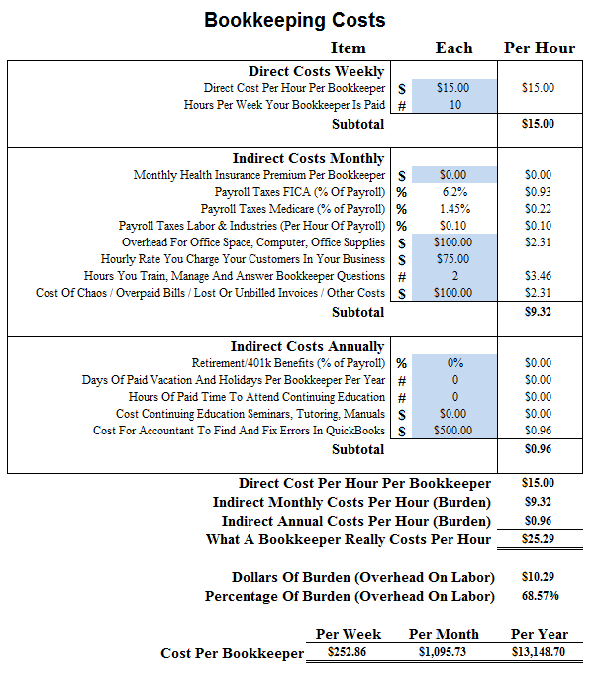

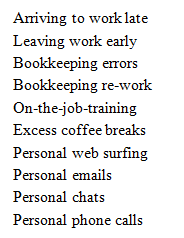

Example #04 They get the cheapest bookkeeper they can find

The cheap contractor thinks all bookkeepers are the same; however, they bristle at the suggestion all contractors are the same. It is true that almost anyone can do bookkeeping because 95% of it is boring and only 5% is sheer terror. However when the regular bookkeeper attempts to do construction accounting that is like watching a naked person, covered in honey getting into a fight with a grizzly bear in the woods; it never ends well.

Until Your Construction Company - Reaches at least $5 million in annual sales you cannot afford to hire a qualified bookkeeper or construction accountant full-time to put on your accounting staff because there is no such thing as a part-time qualified bookkeeper or construction accountant.

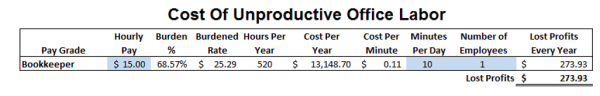

For Example - You Hire someone with bad habits who is a Cheap Bookkeeper part time at $15.00 an hour for 10 hours a week thinking you will save money. The problem with that is you may not understand the true cost to have them on your payroll, including overhead, is closer to $25.29 per hour. See the chart below:

Every Ten Minutes Your Bookkeeper Wastes Costs You Money!

Every Ten Minutes A Day Of Unproductive Office Labor:

Could Cost Your Company $273.93 Every Year

At 10% Profit You Need $2,739.30 More Sales To Maintain Profit Margin

Everybody Loses When A Contractor Goes Out Of Business Or Worse Yet Bankrupt!

It May Seem Harsh - In order to survive and thrive as a contractor you must make certain your employees are focused on their job during the time you are PAYING THEM TO WORK! You must do whatever it takes to enforce the rules of engagement for producing results at your contracting company or be prepared to work for some other contractor and live under their rules.

Plugging Some Of The Little Leaks Listed Above Can Be Done Without Spending A Dime!

Some Will Require Investment; Consult Your Construction Accountant For Advice!

In Some Cases - We can do more work for less money by providing you with real construction bookkeeping and accounting + payroll processing + monthly and quarterly tax reports + year end W-2, W-3 + profit and growth management consulting + financial and job costing reports + paperless data storage and more at a lower overall cost and as an added bonus show you how to make more money than you are now!

Two Contractors Doing Similar Work - For similar customers with the similar direct and indirect construction costs will have massively different KPI Reports including the Profit and Loss Statements. Size matters when it comes to piles of money and bigger profits!

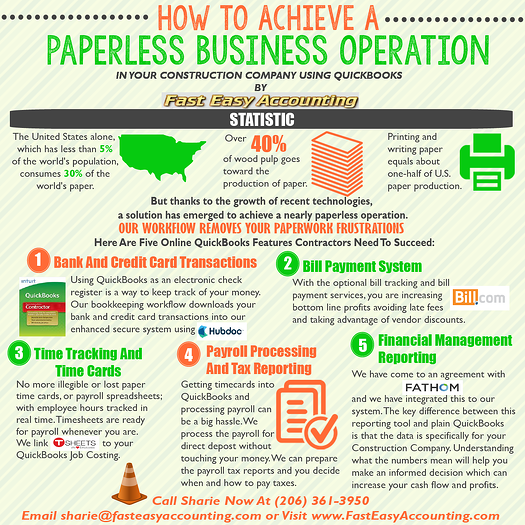

We Remove Contractor's Unique Paperwork Frustrations

For Construction Company Owners who do not need the full power of QuickBooks for contractors and want 24/7 online access we offer Xero Accounting Online and we have custom setup for construction companies. Click Here For More.

This Is One More Example of how Fast Easy Accounting is helping construction company owners all across the USA including Alaska and Hawaii put more money in the bank to operate and grow your construction company. Construction accounting is not rocket science; it is a lot harder than that and a lot more valuable to people like you so stop missing out! Call Sharie 206-361-3950 or sharie@fasteasyaccounting.com and schedule your no charge one-hour consultation.

Profitable Contractors and Construction Company owners have known about the value of outsourced bookkeeping services and contractor coaching services like ours for a long time and now you know about it too!

We Scan Your Receipts And Invoices link the appropriate transactions to QuickBooks or Xero Accounting Online depending on the construction accounting service you are using and provide ongoing Cloud Based Contractors Bookkeeping Services by accountants who understand construction.

Our Contractor Bookkeeping Services System Is A System

Thinking About Outsourcing Your Contractors Bookkeeping Services To Save Time And Money?

Click On The Button Below To Download A Free Guide

Business Process Management (BPM) For Contractors

Need Help Now?

Call Sharie 206-361-3950

sharie@fasteasyaccounting.com

Xero Outsourced Construction Accounting Services

QuickBooks Outsourced Construction Bookkeeping Services

We Are Xero Accounting Experts Specializing In Construction Bookkeeping Services

About The Author:

Randal DeHart, PMP, QPA is the co-founder of Business Consulting And Accounting in Lynnwood Washington. He is the leading expert in outsourced construction bookkeeping and accounting services for small construction companies across the USA. He is experienced as a Contractor, Project Management Professional, Construction Accountant, Intuit ProAdvisor, QuickBooks For Contractors Expert and Xero Accounting Specialist. This combination of experience and skill sets provides a unique perspective which allows him to see the world through the eyes of a contractor, Project Manager, Accountant and construction accountant. This quadruple understanding is what sets him apart from other Intuit ProAdvisors and Xero accountants to the benefit of all of the construction contractors he serves across the USA. Visit http://www.fasteasyaccounting.com/randal-dehart/ to learn more.

Randal DeHart, PMP, QPA is the co-founder of Business Consulting And Accounting in Lynnwood Washington. He is the leading expert in outsourced construction bookkeeping and accounting services for small construction companies across the USA. He is experienced as a Contractor, Project Management Professional, Construction Accountant, Intuit ProAdvisor, QuickBooks For Contractors Expert and Xero Accounting Specialist. This combination of experience and skill sets provides a unique perspective which allows him to see the world through the eyes of a contractor, Project Manager, Accountant and construction accountant. This quadruple understanding is what sets him apart from other Intuit ProAdvisors and Xero accountants to the benefit of all of the construction contractors he serves across the USA. Visit http://www.fasteasyaccounting.com/randal-dehart/ to learn more.

Our Co-Founder Randal DeHart - Is a Certified PMP (Project Management Professional) with several years of construction project management experience. His expertise is construction accounting systems engineering and process development. His exhaustive study of several leading experts including the work of Dr. W. Edward Deming, Michael Gerber, Walter A. Shewhart, James Lewis and dozens of others was the foundation upon which our Construction Bookkeeping System is based and continues to evolve and improve. Check out our Contractor Success Map Podcast on iTunes and Follow Randal on Google+