Construction Company Failure Is Always Preceded By Bad Bookkeeping!

Three Places Contractors Learn The True Value Of Accurate, True, And Reliable Financial And Job Costing Reports:

- When they get sick and tired or working long hours and getting nowhere so they hire a construction accounting firm like ours

- When the get a "Wake Up Call" in the form of a bookkeeper who embezzles a lot of money, a huge tax bill or some other major financial surprise

- When they realize it is "Game Over" they are out of money and out of places to borrow money and defer payments and heading to bankruptcy

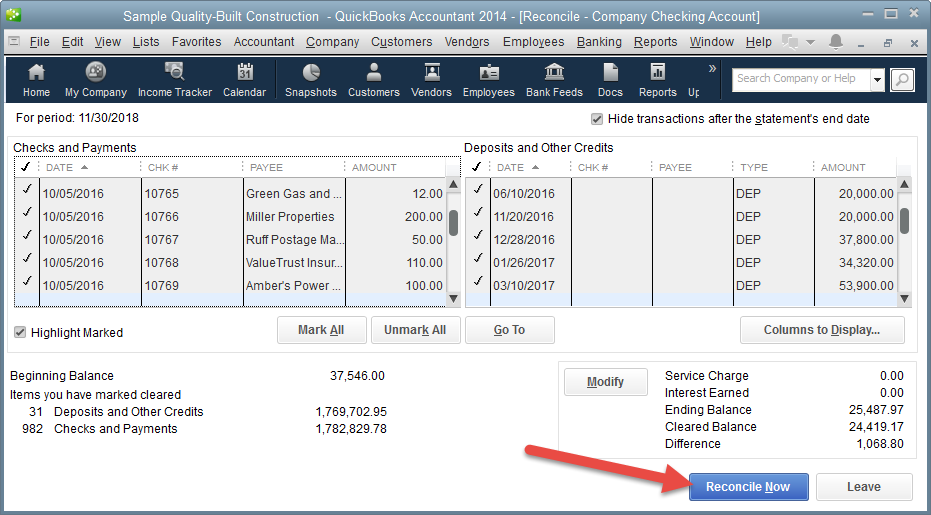

The construction company owner who buys QuickBooks and hires a regular bookkeeper to "put stuff into QuickBooks" and then ignores all of the financial and job costing reports generated from their QuickBooks file is driving their construction company into financial doom.

Part of the blame rests on Intuit the maker of QuickBooks because their marketing strategy implies that anyone regardless of their understanding of accounting principles can use QuickBooks and if you are a contractor all you need is QuickBooks for Contractors. It sets up contractors for failure by playing to their self-image of strongman and strongwomen who are rough and tumble and can do anything. In too many cases these contractors end up feeling inadaquate, experience huge disappointments feeling like they are the only people on earth who cannot figure out how to use QuickBooks.

Most of these contractors give up trying to make QuickBooks do what they want and lower their expectations to just knowing how much money is in the checkbook, Key Performance Indicator #1, and ignoring the other four Key Performance Indicators. In the end it is like driving a car in the pitch-black darkness, on the freeway, with a tiny flashlight at 60 MPH and being shocked and dismayed when it crashes, rolls in the ditch and burns.

How do you know if need to hire a construction accountant? It’s simple. If you don’t fully understand the difference between a Balance Sheet, Profit and Loss, and Profit and Loss By Job you need help.

Still not convinced?

You may need construction accountant if:

3. QuickBooks setup included “Inventory Items" and "Non-Inventory Items" to use when invoicing customers. QuickBooks inventory is extremely complicated and it can distort all your financial, job costing reports and cause you a HUGE TAX PROBLEM later on down the road.

4. QuickBooks setup mixed up expense accounts with vendor names or income accounts with customer names.

5. QuickBooks setup creates payees using the type “Other” because the person you’re paying doesn’t seem to be a “Vendor.”

6. QuickBooks setup created a bank account for your personal checking account to record owner contributions and/or distributions.

7. QuickBooks setup Chart of Accounts has sub-accounts; however, transactions are posted to the primary accounts.

8. QuickBooks setup for “items” was linked to the wrong accounts in the Chart of Accounts.

9. QuickBooks setup did not add Credit Card account types and credit card statements are input using journal entries.

10. The last reason you might need a contractors bookkeeping service that specializes in QuickBooks for contractors is you pull up your Profit and Loss report and think to yourself, “This doesn’t look right.”

This Is Only The Tip - Of the Iceberg. Everything we publish in our blog posts, articles in other websites, and anything you can find on the web is nothing compared to what is available to you as our client. We show only the basic tools to open your mind to the possibilities that are available to you. The best finish carpentry tools in the hands of a golf professional without proper carpentry training will not produce anything near to what a skilled finish carpenter can. The same can be said about the best construction business consulting and accounting tools in the hands of a skilled finish carpenter. And I say that with respect and admiration for everyone in construction.

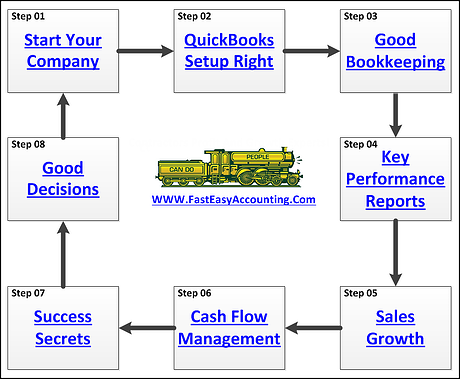

When You Become A Client - Then we can tap into our resources of knowledge and strategy banks. We use the reports hidden in your QuickBooks in order to diagnose and understand your construction business and develop plans and help you implement a path to success for you and you alone because every contractor has unique Strengths, Weaknesses, Opportunities and Threats (S.W.O.T. Analysis) that when understood can lead to a Strategic Roadmap which cannot help but make a lot of money.

If You Are A Contractor You Deserve To Be Wealthy

Because You Bring Value To Other People's Lives!

This Is One More Example of how Fast Easy Accounting is helping construction company owners just like you put more money in the bank to operate and grow your construction company. Construction accounting is not rocket science; it is a lot harder than that and a lot more valuable to people like you and me so stop missing out! Call Sharie 206-361-3950 or sharie@fasteasyaccounting.com and schedule your no charge one-hour consultation.

Profitable Contractors and Construction Company owners have known about the value of outsourced bookkeeping services and contractor coaching services like ours for a long time and now you know about it too!

We Scan Your Receipts And Invoices link the appropriate transactions to QuickBooks or Xero Accounting Online depending on the construction accounting service you are using and provide ongoing Cloud Based Contractors Bookkeeping Services by accountants who understand construction.

Thinking About Outsourcing Your Contractors Bookkeeping Services?

Click On The Button Below To Download A Free Guide

Need Help Now?

Call Sharie 206-361-3950

sharie@fasteasyaccounting.com

Xero Outsourced Construction Accounting Services

QuickBooks Outsourced Construction Bookkeeping Services

We Are Construction Accounting Experts Specializing In Construction Bookkeeping Services For Contractors All Across The USA Including Alaska And Hawaii

About The Author:

Randal DeHart, PMP, QPA is the co-founder of Business Consulting And Accounting in Lynnwood Washington. He is the leading expert in outsourced construction bookkeeping and accounting services for small construction companies across the USA. He is experienced as a Contractor, Project Management Professional, Construction Accountant, Intuit ProAdvisor, QuickBooks For Contractors Expert and Xero Accounting Specialist and Bill.Com Certified Guru. This combination of experience and skill sets provides a unique perspective which allows him to see the world through the eyes of a contractor, Project Manager, Accountant and construction accountant. This quadruple understanding is what sets him apart from other Intuit ProAdvisors and Xero accountants to the benefit of all of the construction contractors he serves across the USA. Visit http://www.fasteasyaccounting.com/randal-dehart/ to learn more.

Randal DeHart, PMP, QPA is the co-founder of Business Consulting And Accounting in Lynnwood Washington. He is the leading expert in outsourced construction bookkeeping and accounting services for small construction companies across the USA. He is experienced as a Contractor, Project Management Professional, Construction Accountant, Intuit ProAdvisor, QuickBooks For Contractors Expert and Xero Accounting Specialist and Bill.Com Certified Guru. This combination of experience and skill sets provides a unique perspective which allows him to see the world through the eyes of a contractor, Project Manager, Accountant and construction accountant. This quadruple understanding is what sets him apart from other Intuit ProAdvisors and Xero accountants to the benefit of all of the construction contractors he serves across the USA. Visit http://www.fasteasyaccounting.com/randal-dehart/ to learn more.

Our Co-Founder Randal DeHart - Is a Certified PMP (Project Management Professional) with several years of construction project management experience. His expertise is construction accounting systems engineering and process development. His exhaustive study of several leading experts including the work of Dr. W. Edward Deming, Michael Gerber, Walter A. Shewhart, James Lewis and dozens of others was the foundation upon which our Construction Bookkeeping System is based and continues to evolve and improve. Follow Randal on Google+