Using QuickBooks For Your Land Acquisition, Land Development,

And Spec Home Building Company Looks Simple - But It's Not!

Many Land Developers and Spec Home Builders set up QuickBooks or hire someone to do it for them, and they do not understand the difference between Construction Accounting and Regular Accounting the results can be disastrous when you need Work-In-Progress, Job Costing, Estimates Vs. Actuals, Profit & Loss, and Balance Sheet Reports that accurately reflect the financial state of your Construction Company.

![]()

![]()

![]()

![]()

![]()

![]()

![]() The last thing you want to do in give your banker or investor a Profit & Loss Report showing your company is losing massive amounts of money simply because QuickBooks was set up wrong for your type of business.

The last thing you want to do in give your banker or investor a Profit & Loss Report showing your company is losing massive amounts of money simply because QuickBooks was set up wrong for your type of business.

![]()

![]()

![]()

![]()

![]()

![]()

![]() Knowing how to use Work-In-Progress, Direct and Indirect Construction Costs is key. Understanding Overhead, Other Expenses, and Other Income compounds are also important. Bankers, lenders, investors, construction company owners, and other stakeholders need accurate, timely reports. Proper QuickBooks set up, and Construction Accounting is the foundation to provide them.

Knowing how to use Work-In-Progress, Direct and Indirect Construction Costs is key. Understanding Overhead, Other Expenses, and Other Income compounds are also important. Bankers, lenders, investors, construction company owners, and other stakeholders need accurate, timely reports. Proper QuickBooks set up, and Construction Accounting is the foundation to provide them.

Here Are Some Things To Consider:

-

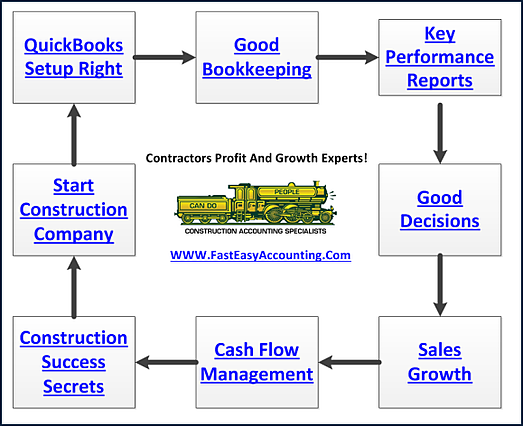

You can use QuickBooks Desktop to track all the costs and generate Complex Payment Applications Item Estimates vs. Actuals, Job Profitability Summary, and Job Profitability Detail Reports to monitor progress, so the setup QuickBooks process is critical and needs to be done by a QuickBooks expert in construction accounting.

-

Your QuickBooks needs a process to include the Key Performance Indicators For Contractor Success(KPI) to monitor the financial health of your construction company.

-

Your QuickBooks will need to have between 1,000 to 2,500 accounts in the Chart of Accounts to track WIP costs during the construction process from beginning to end to get the QuickBooks reports you need.

-

Your QuickBooks will need to have between 2,000 to 3,000 Cost Codes (QuickBooks Items) to track the detailed WIP Construction costs and facilitate the movement from WIP to Cost of Goods Sold when the project is complete and moved to company inventory or sold to an outside buyer.

-

You will need accounts and cost codes (QuickBooks Items) to track retention.

Save Time And Money By Taking On Demand Lorman Class With

Randal DeHart, PMP, QPA Master Construction Accountant!

Why Lorman?

In Addition To Lorman Online Training, You Can Buy The

QuickBooks Templates And Cost Codes We Use To Support

Our Outsourced Land Developer and Spec Home Builder Clients

Click On The Image Below To Learn More

About The Author:

Randal DeHart, PMP, QPA is the co-founder of Business Consulting And Accounting in Lynnwood Washington. He is the leading expert in outsourced construction bookkeeping and accounting services for small construction companies across the USA. He is experienced as a Contractor, Project Management Professional, Construction Accountant, Intuit ProAdvisor, QuickBooks For Contractors Expert and Xero Accounting Specialist. This combination of experience and skill sets provides a unique perspective which allows him to see the world through the eyes of a contractor, Project Manager, Accountant, and construction accountant. This quadruple understanding is what sets him apart from other Intuit ProAdvisors and Xero accountants to the benefit of all of the construction contractors he serves across the USA. Visit http://www.fasteasyaccounting.com/randal-dehart/ to learn more.

Our Co-Founder Randal DeHart - Is a Certified PMP (Project Management Professional) with several years of construction project management experience. His expertise is construction accounting systems engineering and process development. His exhaustive study of several leading experts including the work of Dr. W. Edward Deming, Michael Gerber, Walter A. Shewhart, James Lewis and dozens of others was the foundation upon which our Construction Bookkeeping System is based and continues to evolve and improve. Check out our Contractor Success Map Podcast on iTunes and Follow Randal on Google+

Download the Contractors APP today from the App Store or Android Store

Access Code: FEAHEROS

Click here to download the App on Android:

Click here to download the App on iOS:

Simply scan the QR code or search for ‘MyAccountants’ in the App Store and enter the Access code: FEAHEROS to utilize the powerful App features and capabilities, and benefit from having our Construction Accounting App at your fingertips, 24/7."

PS: Even if you are not a Construction Contractor you will find a plenty of benefits in the app so we invite you to download it too! It's Free so why not?

When You Become A Client - Then we can tap into our resources of knowledge and strategy banks. We use the reports hidden in your QuickBooks in order to diagnose and understand your construction business and develop plans and help you implement a path to success for you and you alone because every contractor has unique Strengths, Weaknesses, Opportunities and Threats (S.W.O.T. Analysis) that when understood can lead to a Strategic Roadmap which cannot help but make a lot of money.

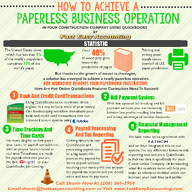

We Remove Contractor's Unique Paperwork Frustrations

For Construction Company Owners who do not need the full power of a QuickBooks for contractors and want 24/7 online access we offer Xero Accounting Online, and we have a custom setup for construction companies. Click Here For More.

This Is One More Example of how Fast Easy Accounting is helping construction company owners all across the USA including Alaska and Hawaii put more money in the bank to operate and grow your construction company. Construction accounting is not rocket science; it is a lot harder than that, and a lot more valuable to people like you so stop missing out! Call Sharie 206-361-3950 or sharie@fasteasyaccounting.com and schedule your no charge one-hour consultation.

Profitable Contractors and Construction Company owners have known about the value of outsourced bookkeeping services and contractor coaching services like ours for a long time, and now you know about it too!

Thank You For Reading This Far, And I Hope You Understand we really do care about you and all contractors regardless of whether or not you ever hire our services.

We Scan Your Receipts, And Invoices link the appropriate transactions to QuickBooks or Xero Accounting Online depending on the construction accounting service you are using and provide ongoing Cloud Based Contractors Bookkeeping Services by accountants who understand construction.

Our Contractor Bookkeeping Services System Is A System

Thinking About Outsourcing Your Contractors Bookkeeping Services To Save Time And Money?

Click On The Button Below To Download A Free Guide

Business Process Management (BPM) For Contractors

Need Help Now?

Call Sharie 206-361-3950

sharie@fasteasyaccounting.com

Xero Outsourced Construction Accounting Services

QuickBooks Outsourced Construction Bookkeeping Services

We Are Xero Accounting Experts Specializing In Construction Bookkeeping Services

PS: For The Do-It-Yourself Construction Bookkeeper Our Store Has Chock-Full Of QuickBooks Setup Templates, QuickBooks Chart of Accounts And More.

Most Contractors Setup QuickBooks Desktop Version In One Of Three Ways:

![]()

![]()

![]()

![]()

![]()

![]()

![]() #1 EZ Step Interview inside QuickBooks Setup

#1 EZ Step Interview inside QuickBooks Setup

#2 Asked Their Tax Accountant To Setup QuickBooks

#3 They Attended A How To Setup QuickBooks Class Or Seminar

And QuickBooks Does Not Work The Way They Want It Too!

The Answer:

#1 Click Here To Buy An Entire QuickBooks Setup For Your Specific Contracting Company

#2 Click Here To Buy Just The Chart Of Accounts For Your Specific Contracting Company

Download the Contractors APP today from the App or Android store