All Accounting Is Not Created Equal

Have you ever compared your QuickBooks Profit & Loss Report to your annual Income Tax Return and scratched your head trying to figure out why the numbers are so different? If you have, you are not alone because there are two different types of Accounting, and they serve two different purposes.

Internal Accounting External Accounting

Focused On The Needs Of The Contractor Focused On The Needs Of The Tax Return

Tax Accounting Vs. Management Accounting

Tax Accounting Is external; its purpose is reporting income, preparing tax forms and making certain you pay your fair share of taxes and perhaps a little extra. For example Quarterly Tax Reporting, annual tax returns, state, county, city and local business and occupation taxes and sales tax reporting.

Tax Accountants Are good people, and they have their place in the accounting world. Regular accounting, bookkeeping and contractors bookkeeping and accounting are not something they should be doing. No different than Professional Bookkeepers and construction accountants should not be preparing annual tax returns.

QuickBooks File And The IRS - Is something you should be aware of and how important it is more than ever to have everything in your QuickBooks clean and up to date. Read More..

Tax Accounting Is important and so is the tail on a dog! Just understand the tail does not wag the dog! It is important that you understand tax accounting has very little to do with helping you run your business and everything to with paying taxes and keeping the tax preparer's boss, the government happy!

Management Accounting Is internal; its purpose is to help you operate and grow your construction business profitably. For example The Five Key Performance Indicators, Cash Reports, Receivables, Payables, Profit and Loss, Balance Sheet, Job Costing, Job Profitability Analysis.

Business Process Management For Contractors Includes:

- The 80/20 Rule

- M.A.P,

- Marketing

- Accounting

- Production

- Sales

- Invoicing

- Payroll

- When to grow the business, what markets to serve, when to hire more people, loans, lines of credit, bonds, performance bonds, insurance cost savings, business planning and your overall construction company business strategy.

Contractors Bookkeeping And Accounting Is completely different from standard accounting systems primarily because contractors take their entire business inside trucks and vans to people's homes and businesses to perform services, deliver and install products. Standard accounting when people go to the businesses to shop and buy products and services.

Construction Accounting Is a specialty similar to the difference between a family doctor and a brain surgeon Read More. Construction accounting cannot be learned; it has to be understood. To become a construction accountant, you must spend years working on construction sites to understand the industry and then with a foundation in standard accounting you can understand it.

If You Allow Your Accounting To be dictated by the whims and wishes of the tax accountant you could be losing a lot of money! Because the entire Chart of Accounts will be structured in a way that makes it easier and quicker for them to prepare the tax report one day a year. Because saving you money on your tax bill is not what they are paid to do; they are paid to fill out tax returns.

What Contractors Say When They Find Us

We Have Fixed Hundreds Of QuickBooks That Were "setup" By Tax Accountants

See what our clients say and when are finished they are amazed and very happy because they can get the reports they need to operate and grow their construction businesses and we make it easy for the tax accountant to fill out the annual tax return and get more deductions, so you pay fewer taxes. We can help you too, simply fill out the form on the right or call us 206-361-3950 or email sharie@fasteasyaccounting.com to get started!

We Do Not Prepare Annual Tax Returns For two reasons. Number one, we are focused on maintaining our status as the premier contractors bookkeeping and accounting specialists in the world. Number two we firmly believe in "Trust But Verify" by having a Board of Advisors watching over each other and your business. Read More..

Please Don't Think We Are Hard on tax accountants please understand that we have great relationships with a lot of tax accountants. We have tax accountants review our QuickBooks and prepare our business and personal returns for over thirty years, and we refer a lot of business to a variety of tax accountants.

We Remove Contractor's Unique Paperwork Frustrations

For Construction Company Owners who do not need the full power of a QuickBooks for contractors and want 24/7 online access we offer Xero Accounting Online and we have custom setup for construction companies. Click Here For More.

This Is One More Example of how Fast Easy Accounting is helping construction company owners all across the USA including Alaska and Hawaii put more money in the bank to operate and grow your construction company. Construction accounting is not rocket science; it is a lot harder than that and a lot more valuable to people like you so stop missing out! Call Sharie 206-361-3950 or sharie@fasteasyaccounting.com and schedule your no charge one-hour consultation.

Profitable Contractors and Construction Company owners have known about the value of outsourced bookkeeping services and contractor coaching services like ours for a long time and now you know about it too!

Thank You For Reading This Far And I Hope You Understand we really do care about you and all contractors regardless of whether or not you ever hire our services.

We Scan Your Receipts And Invoices link the appropriate transactions to QuickBooks or Xero Accounting Online depending on the construction accounting service you are using and provide ongoing Cloud Based Contractors Bookkeeping Services by accountants who understand construction.

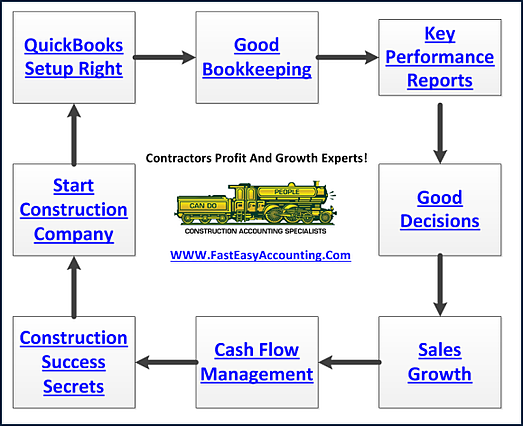

Our Contractor Bookkeeping Services System Is A System

Thinking About Outsourcing Your Contractors Bookkeeping Services To Save Time And Money?

Click On The Button Below To Download A Free Guide

Business Process Management (BPM) For Contractors

Need Help Now?

Call Sharie 206-361-3950

sharie@fasteasyaccounting.com

Xero Outsourced Construction Accounting Services

QuickBooks Outsourced Construction Bookkeeping Services

We Are Xero Accounting Experts Specializing In Construction Bookkeeping Services

About The Author:

Randal DeHart, PMP, QPA is the co-founder of Business Consulting And Accounting in Lynnwood Washington. He is the leading expert in outsourced construction bookkeeping and accounting services for small construction companies across the USA. He is experienced as a Contractor, Project Management Professional, Construction Accountant, Intuit ProAdvisor, QuickBooks For Contractors Expert and Xero Accounting Specialist. This combination of experience and skill sets provides a unique perspective which allows him to see the world through the eyes of a contractor, Project Manager, Accountant, and construction accountant. This quadruple understanding is what sets him apart from other Intuit ProAdvisors and Xero accountants to the benefit of all of the construction contractors he serves across the USA. Visit http://www.fasteasyaccounting.com/randal-dehart/ to learn more.

Randal DeHart, PMP, QPA is the co-founder of Business Consulting And Accounting in Lynnwood Washington. He is the leading expert in outsourced construction bookkeeping and accounting services for small construction companies across the USA. He is experienced as a Contractor, Project Management Professional, Construction Accountant, Intuit ProAdvisor, QuickBooks For Contractors Expert and Xero Accounting Specialist. This combination of experience and skill sets provides a unique perspective which allows him to see the world through the eyes of a contractor, Project Manager, Accountant, and construction accountant. This quadruple understanding is what sets him apart from other Intuit ProAdvisors and Xero accountants to the benefit of all of the construction contractors he serves across the USA. Visit http://www.fasteasyaccounting.com/randal-dehart/ to learn more.

Our Co-Founder Randal DeHart - Is a Certified PMP (Project Management Professional) with several years of construction project management experience. His expertise is construction accounting systems engineering and process development. His exhaustive study of several leading experts including the work of Dr. W. Edward Deming, Michael Gerber, Walter A. Shewhart, James Lewis and dozens of others was the foundation upon which our Construction Bookkeeping System is based and continues to evolve and improve. Check out our Contractor Success Map Podcast on iTunes and Follow Randal on Google+