Contractors Bookkeeping Service Nine Critical Steps

Construction Bookkeeping Is something you understand then you learn. Hundreds of contractors and regular bookkeepers have told us how easy QuickBooks is to use and yet they cannot understand why QuickBooks for Contractors is so hard to use and it is getting harder every year and I agree with them.

I Have Used QuickBooks For 25 Years and in the early years the DOS versions were very easy because it had a fraction of the features it has in 2016 and the reports were bare bones.

There Are Apps that make almost everything easy including accounting software. Too many contractors find out too late the old adage "You get what you pay for" still applies.

Cheap Construction Accounting Is The Most Expensive Accounting On Planet Earth

Operating A Backhoe is easy too! I found out just how easy it is to find underground utilities and bring them to the surface with the greatest of ease like the daring young man flying man on the trapeze. A gentle tug on a lever and water was gushing everywhere! It was very entertaining and extremely costly!

This Is Susan's* Story she answered an help wanted ad from a General Contractor, Brutus Hardway*, who was looking for a super cheap bookkeeper with a deep understanding of construction accounting they had to know how to make his QuickBooks For Contractors give him the QuickBooks financial reports and Job Costing Reports he needed to operate and grow his construction company. Brutus offered Susan $15.00 an hour for 10 hours a week. Susan as a good heart and she had QuickBooks experience, but not using QuickBooks For Contractors so she contacted us and I invested an hour of my time at no charge to share a quick overview of what I call the Contractors Bookkeeping Service Nine Critical Steps.

A Short While Later - I stopped by to see how everything was going for Susan and her employer. We reviewed the Nine Steps to see how she was using what she had learned.

*The names have been changed to protect the real identity of Susan and Brutus

Contractors Bookkeeping Services Nine Steps

Step #1 Sort Paper Into Manageable Piles And Be Quick About It!

Susan Let Paperwork Pile Up as the contractors, construction workers, USPS mail carrier, shipping and receiving clerks, warehouse workers and other folks that stopped by her desk to leave a few pieces of paper for her to deal with. Always remember the ocean is a collection of drops of water. The piles of paperwork were growing high and wide.

Step #2 Simple Data Entry

After The Sorting was finally done Susan was beginning to enjoy putting in checks, bills and simple invoices because it was easy especially when she did not bother doing the hard work of entering Job Costing information.

Step #3 Payroll And Tax Reporting

Payroll And Tax Reporting - Can bring out the worst in people as Susan soon discovered. In fact some of the other employees suggested she was ready to bite the next person who turned their time card in late and expected to get paid on time!

Step #4 Reconciling Bank, Credit Card And Supplier Statements

Reconciling Statements was something Susan could not grasp during our brief chat because at all of her previous jobs that was never done because it was just too hard! Susan said reconciliations were just a waste of time and busy work and she flat out refused to do them.

When Brutus's Checks Started Bouncing like a box of rubber balls dumped on a concrete floor from a 10' high ladder partly because suppliers were being paid twice for the same bills and partly because checks were written outside of QuickBooks and none of the banks were ever reconciled Brutus got concerned and invited his outside QuickBooks expert and construction accounting and bookkeeping services specialist, Randal, to come to the office and train Susan how to reconcile bank, credit card and vendor statements.

After 20 Hours Of Attempting To Condense the most important critical parts of a 10,000 construction accounting services skill set that Susan needed to be effective and efficient in her position of contractors bookkeeping services over a 5 day period at $150 per hour with Brutus's investment in Susan's training which totaled $3,000 Susan had just enough training to do the reconciliation part of the job.

Randal's Patience Were Wearing Thin because Susan talked, argued and continually interrupted the training tell Randal how different things were at her previous jobs, where the contractors all went bankrupt.

Susan Recalled At Her Previous Job She Had Plenty Of Paid Time To shop online, surf the web, text her friends and train her boss like an organ grinder trains a monkey. Susan wanted to talk endlessly about how stupid and ignorant her previous contractor bosses were and how none of them knew anything about operating a construction company. If they all would have listened to Susan none of them would have ever gone bankrupt. Susan loved to brag about posting a running commentary on Facebook and describing in living color and great detail how incompetent her previous contractor bosses were and how she knew every one of the construction companies was going bankrupt. Randal just ignored it and continued to attempt to train her in construction bookkeeping.

Brutus Knew Susan Needed A Lot More Training; however, Brutus was not about to spend any more money on any direct training. So, Brutus kept Susan on his payroll longer than he should have because he was too stubborn to admit to himself that he could outsource his bookkeeping to us for less than what he was paying for Susan's training in the form of bounced checks, missed quarterly tax returns and payments which lead to costly penalties and interest, lost early payment discounts and other expensive mistakes.

During The Quarterly Construction Bookkeeping Services Review Randal showed Brutus a production report that revealed the cost of having Susan on the payroll for twelve weeks was in excess of $1,000.00 a week when Brutus had expected to only spend $150.00 a week plus a little money for payroll taxes and overhead. Brutus was not a happy construction company owner.

Step #5 Complex Journal Entries

Brutus Was Surprised To learn that complex journal entries like entering a HUD-1 statements and complex Payment Applications similar to the G702 and G703 format was something else Susan knew absolutely nothing about.

Susan Refused to tolerate any more training from Randal because she decided those things Brutus wanted were not in her contractors bookkeeping services job description.

When A Contractors Bookkeeper refuses to do something related to the construction bookkeeping services and the accounting functions of the construction company it is usually a sign of bad bookkeeper traits. Brutus would have saved a lot of time, money and heartache if he had simply paid attention.

After Several Rounds Of Losing Money On Progress Payments Brutus Outsourced the complex journal entries, HUD-1 Statements and complex payment applications to Fast Easy Accounting because the construction bookkeeping services work needed to be done right and on time.

Step #6 Prepare Tax Reports

Susan Had Filed the Payroll quarterly tax return at her previous job, never on time. She would eventually get around to doing them and when Brutus asked about them so became the "Drama Queen Nightmare" until Brutus finally left her alone to do them when she was good and ready.

Step #7 Key Performance Indicators

The KPI - Key Performance Indicators are simply five reports take five minutes and they give the construction company owner a snap shot of how the business is doing financially and taken seriously can lead to some serious cash flow coming into their business, and staying there.

They Are - Cash Available / Accounts Receivable / Accounts Payable / Profit And Loss / Balance Sheet as shown below: For more detail click here

Brutus Asked Susan - To prepare and print the Five Key Performance Indicators and have them on his desk every day by five PM. As it turned out Susan had more important things to do with the time Brutus was paying her that involved Facebook, Pinterest and Twitter so when Brutus asked about them she would get upset and a bit angry then remind Brutus about some other pressing problem he needed to handle (see bookkeepers train their boss like an organ grinder trains a monkey). Her plan worked because after a while Brutus was trained to quit asking Susan any questions.

Step #7 B No Key Performance Indicators

Brutus Got A Disturbing Call from a friendly competitor who said he was going bankrupt and asked if Brutus wanted to buy his tools and equipment before the auction. Brutus asked what happened and the fellow mumbled something about a bad bookkeeper took some money, unfiled and overdue taxes, material suppliers cut him off for not paying his bills, his employees quit because their payroll checks bounced and they took a bunch of tools and equipment to the pawn shop and the local, state and Federal tax agencies were auditing him for non-payment.

Step #8 The 5x5 Business Stabilizers

Brutus Remembered reading an article titled The General Contractor And The River Of Construction Commerce and there was something about the Five People On Your Board of Advisors and some other information that he could review because he certainly did not want his construction company going bankrupt!

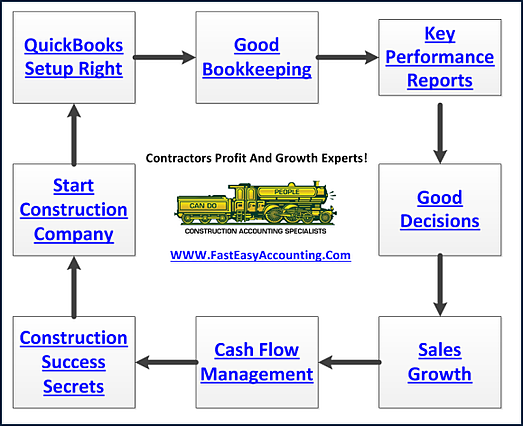

Step #9 Good Bookkeeping Leads To Informed Decisions

Brutus Contacted Sharie discovered that we offer more than just Construction Bookkeeping Services and that we have an entire Business Process Management System (BPM) for construction companies like his and got his business on track.

Susan Found Employment with another construction company at lower hourly pay and more hours. She had to use her car to run errands, get coffee for the boss in addition to attempting to perform the duties of a contractors bookkeeping services specialist. When nobody was watching she shopped and played games on the internet, updated her Facebook page and other social media sites, instant messaged her friends and talked with them for hours on her cell phone.

All is well that ends well and everybody went home happy!

We Remove Contractor's Unique Paperwork Frustrations

For Construction Company Owners who do not need the full power of QuickBooks for contractors and want 24/7 online access we offer Xero Accounting Online and we have custom setup for construction companies. Click Here For More.

This Is One More Example of how Fast Easy Accounting is helping construction company owners all across the USA including Alaska and Hawaii put more money in the bank to operate and grow your construction company. Construction accounting is not rocket science; it is a lot harder than that and a lot more valuable to people like you so stop missing out! Call Sharie 206-361-3950 or sharie@fasteasyaccounting.com and schedule your no charge one-hour consultation.

Profitable Contractors and Construction Company owners have known about the value of outsourced bookkeeping services and contractor coaching services like ours for a long time and now you know about it too!

Thank You For Reading This Far And I Hope You Understand we really do care about you and all contractors regardless of whether or not you ever hire our services.

We Scan Your Receipts And Invoices link the appropriate transactions to QuickBooks or Xero Accounting Online depending on the construction accounting service you are using and provide ongoing Cloud Based Contractors Bookkeeping Services by accountants who understand construction.

Our Contractor Bookkeeping Services System Is A System

Thinking About Outsourcing Your Contractors Bookkeeping Services To Save Time And Money?

Click On The Button Below To Download A Free Guide

Business Process Management (BPM) For Contractors

Need Help Now?

Call Sharie 206-361-3950

sharie@fasteasyaccounting.com

Xero Outsourced Construction Accounting Services

QuickBooks Outsourced Construction Bookkeeping Services

We Are Xero Accounting Experts Specializing In Construction Bookkeeping Services

About The Author:

Randal DeHart, PMP, QPA is the co-founder of Business Consulting And Accounting in Lynnwood Washington. He is the leading expert in outsourced construction bookkeeping and accounting services for small construction companies across the USA. He is experienced as a Contractor, Project Management Professional, Construction Accountant, Intuit ProAdvisor, QuickBooks For Contractors Expert and Xero Accounting Specialist. This combination of experience and skill sets provides a unique perspective which allows him to see the world through the eyes of a contractor, Project Manager, Accountant and construction accountant. This quadruple understanding is what sets him apart from other Intuit ProAdvisors and Xero accountants to the benefit of all of the construction contractors he serves across the USA. Visit http://www.fasteasyaccounting.com/randal-dehart/ to learn more.

Randal DeHart, PMP, QPA is the co-founder of Business Consulting And Accounting in Lynnwood Washington. He is the leading expert in outsourced construction bookkeeping and accounting services for small construction companies across the USA. He is experienced as a Contractor, Project Management Professional, Construction Accountant, Intuit ProAdvisor, QuickBooks For Contractors Expert and Xero Accounting Specialist. This combination of experience and skill sets provides a unique perspective which allows him to see the world through the eyes of a contractor, Project Manager, Accountant and construction accountant. This quadruple understanding is what sets him apart from other Intuit ProAdvisors and Xero accountants to the benefit of all of the construction contractors he serves across the USA. Visit http://www.fasteasyaccounting.com/randal-dehart/ to learn more.

Our Co-Founder Randal DeHart - Is a Certified PMP (Project Management Professional) with several years of construction project management experience. His expertise is construction accounting systems engineering and process development. His exhaustive study of several leading experts including the work of Dr. W. Edward Deming, Michael Gerber, Walter A. Shewhart, James Lewis and dozens of others was the foundation upon which our Construction Bookkeeping System is based and continues to evolve and improve. Check out our Contractor Success Map Podcast on iTunes and Follow Randal on Google+