Contractors, Bookkeepers and Tax Accountants are trying to keep everything all in one place. That is great. A single bank account on the surface is the answer in simplicity.

Sharie’s Cash Management 101 Training I Teach Contractors Please Do Not Do This!

Why – when putting everything in one bank account; it could be a FINANCIAL DISASTER.

Go to Home Depot, Lowes or any other larger store.

Use your debit card; Drop or lose your debit card,

Someone finds it and buy stuff until he or she have spent all your money!

(may be a little harder with the chip but how many places can you run your debit card as a credit card?)

The point is that within a short time – All the money could be GONE!

ALL THE MONEY COULD BE GONE BEFORE YOU REALIZE THERE IS A PROBLEM

All the money is all the money and losing it could put a company out of business

Just as there are Common Sense rules about Sharie’s Cash Management 101Tips, there are common sense rules about mixing multiple companies in a single QuickBooks file:

- Does each company have its own Federal Tax ID number?

- If Yes, The Company needs its own QuickBooks File.

Everyone can own Multiple Companies

Depending on the structure if the financial statements are on a Schedule C And 1040 or 1120S (S-Corp) or other return that in turn rolls up into The Contractors personal 1040 return.

The annual tax return is pages and pages long (feels like a zillion if you have to make paper copies)

Your banker wants the 1st two pages of your personal 1040 Annual Tax Return.

If you need commercial accounts, Dun & Bradstreet wants the 1st two pages of your business tax return. Why because the 1st two pages is the summary of all the pages and worksheets that follow?

As a Construction Contractor, you need the details of the balance of the pages to run your business.

How do you know how much money each company is making?

I can think of several examples of multiple companies being in a Single QuickBooks File.

Husband has a Construction Company and Wife has a Non-Construction Company all mixed together.

Next example: Construction Company, Non-Construction Company plus a few Flipper houses for friends, and a few rental homes for themselves. Add in a few side jobs that are Professional Services.

The word MEGA-MESS comes to mind:

- The Liability Insurance Company will take the easy way out.

- What are Gross Sales for a specific date range? (all companies combined)

- The IRS will take the easy way out – You have one Federal Tax ID number

- Your Worker’s Comp Program will take the easy way out – What is the highest rate for the tasks?

- Apply that rate to all employees regardless of what their duties are (or which company)

- I know of a small company that everyone is charged the same Worker’s Comp rate because the combined office and shop space is small.

In Washington State – Plumbers are at the field rate for workers comp even when they are cleaning their truck at the shop. Why? Because Labor & Industries “Says – cleaning the truck is all part of the job.” No Lower Shop Rate is allowed.

Overhead is different for each of the following companies:

- Construction Company

- Non-Construction Company (could be day care, hair salon, espresso stand, etc.)

- Construction Management Services for Flipper houses for friends

- Professional Services as a 1099 Contractor

- Flippers House turned into Rentals

- Flippers House Sold

- Rental homes

Mixing Companies in a Single QuickBooks File:

- I can tell you "Please Don’t Do This!"

- Your Tax Accountant can tell you, "Please Don’t Do This!"

- Your Banker can tell you, "Please Don’t Do This!"

- The one person who won’t tell you not to do this is the In-House Bookkeeper. Why? They want to keep their job!

The Construction Bookkeeper will try to keep your chaos straight and fight a losing battle with reality. What will not happen is good Financial Reports.

The “What About’s” is just “White Noise” as The Contractor who insists on everything in a single QuickBooks file against all advice will benefit from “The Mess.” (Notice I did not say benefit in a positive way)

QuickBooks Desktop is fantastic for Construction Contractors to get good reports. (Remember, Garbage In = Garbage Out)

Reports cannot be better than the information given. Think Lumber – Standard & Better or Stud Grade is much better than the grade that is commonly referred to as airplane propellers. Specialty Lumber Yards have a variety of quality lumber.

A single project may have multiple grades of lumber. It’s a Science to use the right piece of lumber in the proper application to last the longest. Basics are that you can pound a nail in every kind of wood. Next Question – Which type of nail?

Everything about Accounting Especially Construction Accounting is the intertwined:

- There is a proper setup for Construction Contractors for good job costing reports.

- There is a proper setup for other Non-Construction related businesses

- Do you really want all the customers to all of the other business mixed into the Contractor QuickBooks file?

- Do you really want to be paying a higher liability insurance because it’s easier for the insurance company?

- Do you really want to try to add | subtract | tweak | remember What does count?

- What doesn’t count; when trying to figure out if you are Making Money or Losing Money.

- And if so – Which business is the Good One, and you want to expand?

- Which business are the Bad One and you need to let it go?

- Are you trying to re-invent the Wheel?

- Are you just trying to Be Cheap?

I would like to believe that you have a real desire to make changes that will make the lives around you easier and therefore you will get the financial and other job costing reports easily and efficiently.

Of course, if you hired an Admin Assistant who is expected to act as your Office Manager |In-House Bookkeeper and has No Bookkeeping or QuickBooks Skills than you pick the phrase that best suits you.

My suggestion:

- Sometimes More Is Better!

- Be open to Multiple Company QuickBooks files.

- Each Company should have its own bank account and their own credit card accounts.

- Rental Property: Use QuickBooks or specialized software for Rentals. Rentals have different needs.

With messy QuickBooks – each time money is moved between companies it usually Looks Like Income and by default treated as Income, and you could pay far more in taxes than you saved by mashing everything together.

- Government Agencies are always happy with messy books and over reporting of income and underreporting of expenses.

- Your checkbook may not be so happy when it comes time to pay the taxes.

- Annual Federal Income Taxes

- Self-Employment Taxes

- State & Local Taxes

- Licenses & Fees

- Sales Tax

Looking forward to helping you make 2017 be a Better Year?

Thinking Happy Thoughts.

Sharie

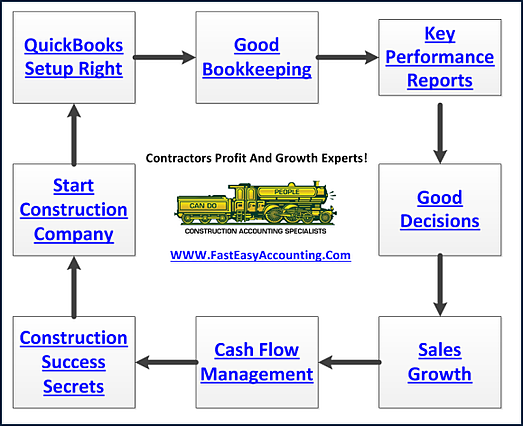

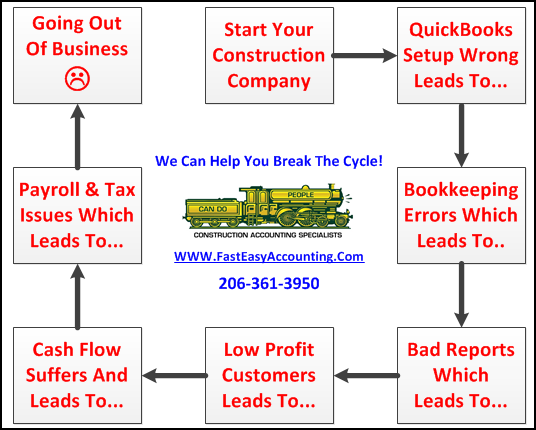

When You Become A Client - Then we can tap into our resources of knowledge and strategy banks. We use the reports hidden in your QuickBooks in order to diagnose and understand your construction business and develop plans and help you implement a path to success for you and you alone because every contractor has unique Strengths, Weaknesses, Opportunities and Threats (S.W.O.T. Analysis) that when understood can lead to a Strategic Roadmap which cannot help but make a lot of money.

We Remove Contractor's Unique Paperwork Frustrations

Thanks for reporting a problem. We'll attach technical data about this session to help us figure out the issue. Which of these best describes the problem?

Any other details or context?

For Construction Company Owners who do not need the full power of a QuickBooks for contractors and want 24/7 online access we offer Xero Accounting Online, and we have a custom setup for construction companies. Click Here For More.

This Is One More Example of how Fast Easy Accounting is helping construction company owners all across the USA including Alaska and Hawaii put more money in the bank to operate and grow your construction company. Construction accounting is not rocket science; it is a lot harder than that, and a lot more valuable to people like you so stop missing out! Call Sharie 206-361-3950 or sharie@fasteasyaccounting.com and schedule your no charge one-hour consultation.

Profitable Contractors and Construction Company owners have known about the value of outsourced bookkeeping services and contractor coaching services like ours for a long time, and now you know about it too!

Thank You For Reading This Far, And I Hope You Understand we really do care about you and all contractors regardless of whether or not you ever hire our services.

We Scan Your Receipts, And Invoices link the appropriate transactions to QuickBooks or Xero Accounting Online depending on the construction accounting service you are using and provide ongoing Cloud Based Contractors Bookkeeping Services by accountants who understand construction.

Our Contractor Bookkeeping Services System Is A System

Thinking About Outsourcing Your Contractors Bookkeeping Services To Save Time And Money?

Click On The Button Below To Download A Free Guide

Business Process Management (BPM) For Contractors

Need Help Now?

Call Sharie 206-361-3950

sharie@fasteasyaccounting.com

Xero Outsourced Construction Accounting Services

QuickBooks Outsourced Construction Bookkeeping Services

We Are Xero Accounting Experts Specializing In Construction Bookkeeping Services

About The Author:

Sharie DeHart, QPA is the co-founder of Business Consulting And Accounting in Lynnwood Washington. She is the leading expert in managing outsourced construction bookkeeping and accounting services companies and cash management accounting for small construction companies across the USA. She encourages Contractors and Construction Company Owners to stay current on their tax obligations and offers insights on how to manage the remaining cash flow to operate and grow their construction company sales and profits so they can put more money in the bank. http://www.fasteasyaccounting.com/sharie-dehart/ 206-361-3950 or sharie@fasteasyaccounting.com

PS: For The Do-It-Yourself Construction Bookkeeper Our Store Has Chock-Full Of QuickBooks Setup Templates, QuickBooks Chart of Accounts And More.

Most Contractors Setup QuickBooks Desktop Version In One Of Three Ways:

#1 EZ Step Interview inside QuickBooks Setup

#2 Asked Their Tax Accountant To Setup QuickBooks

#3 They Attended A How To Setup QuickBooks Class Or Seminar