In the past, Construction Project Managers were laborers or served an apprenticeship in one of the skilled construction trades and were promoted to foreman. This meant many people were more comfortable in manual labor without management skills. And when "things" were put in charge of "people," the results were not usually favorable.

Because of this, many construction companies failed and went out of business due to the Cost of Chaos in their businesses. And it is still happening today.

In the late 20th century, construction and construction management were separated into individual disciplines, each with its methodologies, terms, and definitions.

Project Management Institute developed a set of standards and guidelines, including a glossary of terms to make it possible for construction project managers worldwide to have a common language to communicate.

In today's construction business world, there is a need for excellent project management. Highly skilled and qualified Construction Project Managers on your payroll can provide your company with another competitive advantage over your competition which could be like having a money tree in your backyard. As a result, you can put more money in the bank to operate and grow your construction business.

Whether you just started your construction business and are a one-person company (just looking to hire a subcontractor for other parts of your project) or a weathered construction company owner looking to regain skills to operate your business confidently, it is essential to prioritize these management guidelines:

1. Put together a solid advisory team

Starting a business and owning a construction business can be a lonely process, and thinking you can do it all yourself is the road to extra stress and pressure. Study successful business owners, and you'll find they have surrounded themselves with a strong group of advisers.

A typical core team would include an accountant, a lawyer, a banker, and a mentor, such as an experienced business person you admire. You can then add experts who can give you quality advice on specialist areas where you may lack skills, such as finance, production, marketing, or technology.

2. Choose the proper business structure – with advice

Should you start as a sole proprietor, a limited liability company, a partnership, or something else? Get advice, as each structure involves legal, regulatory, and tax issues.

Think beyond this year. Which structure will carry the most credibility with customers? What's the best system for expanding the business or taking in partners? What form would best suit future investors? Think also of succession – one day, you will want to sell or pass on the business to family, staff, or an outside buyer.

3. Sort out all compliance requirements

You don't want to be distracted by compliance issues once you're in business.

List everything you need to sort out now, from health and safety issues to permits and consents required from Federal, State, or local authorities. If you're starting a business from home, do you need permission? Will your business involve hazardous activities, noise, or toxic chemicals? If so, what licenses do you need, and what health and safety measures do you need to take?

What taxes do you have to pay, and when? What is a sound system for getting this done, so you don't miss any payments or incur penalties?

Make a checklist and work systematically through it with help from your advisers.

4. Set up well-built systems

Good business is all about substantial systems. To run your business well, you need efficient processes.

Time spent setting up simple but effective systems will pay off handsomely. Think about everything from production and work processes to service and billing. With good strategies, you can:

- Run the business more efficiently and delegate more confidently.

- Deliver efficient and consistent quality in products, services, and customer delivery.

- Train new staff more quickly if they have clear operating manuals to follow.

- Delegate or take time off with more confidence that others can follow operating manuals.

- Add value to your business in the eyes of a future buyer.

- Build the foundation you will need to future-proof your business.

5. Develop good credit management

You need a fast, efficient, consistent credit management process if you sell on credit. As a new business, you need the money owed to you as soon as possible to pay bills and lower your interest costs. Never let things slide, or some customers will treat you as a source of cheap finance. Key points:

- Check the credit standing of all new customers, even though you may be eager for their business.

- Make sure customers understand your terms of trade and sign an agreement with them.

- Set credit limits and a system to flag orders exceeding the agreed credit limit.

- Bill promptly and send statements out on time.

- Follow up on late payers immediately. Late payers must know you're always on their case. In order of effectivity, visit them, call them, or email them.

6. Deploy an exceptional accounting system

You need timely information to make the right business decisions. Get help from your accountant to set up an easy-to-operate accounting system.

A correctly set up construction accounting system should allow you to:

- Automatically download and categorize bank statement details, saving time and eliminating manual data entry errors.

- Generate instant profit and loss, budget, and other financial reports.

- View a quick dashboard summary of business performance.

- Bill customers, track payments, and flag overdue payments for your attention.

- Keep your cash flow position updated so you can update your forecasts.

- If you choose a cloud solution, you and your accountant get the added benefit of being able to access the information from any internet connection.

7. Identify and monitor your key drivers (KPIs)

Some Key Performance Indicators (KPIs), such as gross profit and net profit margins, are common to all businesses. But each company also has KPIs specific to its types, such as production units for a manufacturer, conversion rate of visitors into sales for a retailer, or billable hours per week for a service business like yours.

Get help from your financial advisor or accountant to identify the core drivers for your type of business. Then monitor them closely and set improvement goals.

Monitoring your KPIs will help you grow your business and show other stakeholders, such as lenders and investors, that you have your finger on the living pulse of your business.

8. Build good relationships with stakeholders

In addition to customers, lenders, investors, and suppliers are also important stakeholders in your business. Make a point of developing good relationships with all of them. As well as enhancing your business experience, good relationships will pay off handsomely in tough times.

Paying suppliers on time will develop a relationship you can draw on later to negotiate more acceptable payment terms if times get tough. Showing you have good money skills and can forecast cash flow crunches well in advance will build the confidence of your lenders and investors.

If necessary, learn what you don't know, such as financial management basics or construction bookkeeping and accounting.

Final thoughts

Too many construction businesses fail because the owner has not established efficient management systems. This typically happens because the construction company owner is so caught up in the day-to-day operations that the fundamentals of proper business management get forgotten. Often too, it must be said that the owner doesn't like bookkeeping or other administrative tasks, so these get put on the back burner.

The whole point about putting in sound systems is that they free you to spend more time working ON your business, not in it. Having weak systems is the road to stress and burnout. On the other hand, solid business systems will enable you to work smarter, not harder.

We help a little or a lot, depending on your needs. I look forward to being able to assist you with any option that best fits your company.

About The Author:

![]() Sharie DeHart, QPA, is the co-founder of Business Consulting And Accounting in Lynnwood, Washington. She is the leading expert in managing outsourced construction bookkeeping and accounting services companies and cash management accounting for small construction companies across the USA. She encourages Contractors and Construction Company Owners to stay current on their tax obligations and offers insights on managing the remaining cash flow to operate and grow their construction company sales and profits to put more money in the bank. Call 206-361-3950 or sharie@fasteasyaccounting.com

Sharie DeHart, QPA, is the co-founder of Business Consulting And Accounting in Lynnwood, Washington. She is the leading expert in managing outsourced construction bookkeeping and accounting services companies and cash management accounting for small construction companies across the USA. She encourages Contractors and Construction Company Owners to stay current on their tax obligations and offers insights on managing the remaining cash flow to operate and grow their construction company sales and profits to put more money in the bank. Call 206-361-3950 or sharie@fasteasyaccounting.com

When You Become A Client - Then we can tap into our resources of knowledge and strategy banks. We use the reports hidden in your QuickBooks to diagnose and understand your construction business and develop plans and help you implement a path to success for you and you alone because every contractor has unique Strengths, Weaknesses, Opportunities, and Threats (S.W.O.T. Analysis) that when understood can lead to a Strategic Roadmap which cannot help but make a lot of money.

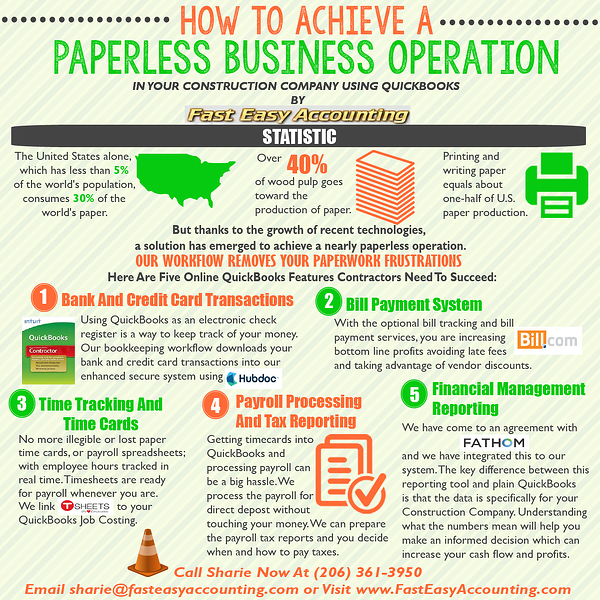

We Remove Contractor's Unique Paperwork Frustrations

Click On The Button Below To Download A Free Guide

Business Process Management (BPM) For Contractors

Need Help Now?

Call Sharie 206-361-3950

sharie.com

Xero Outsourced Construction Accounting Services

QuickBooks Outsourced Construction Bookkeeping Services

We Are Also Xero Accounting Experts Specializing In Construction Bookkeeping Services

PS: For The Do-It-Yourself Construction Bookkeeper, Our Store Has Chock-Full Of QuickBooks Setup Templates, QuickBooks Chart of Accounts, And More.

Most Contractors Setup QuickBooks Desktop Version In One Of Three Ways:

#1 EZ Step Interview inside QuickBooks Setup

#2 Asked Their Tax Accountant To Setup QuickBooks

#3 They Attended A How To Setup QuickBooks Class Or Seminar

And QuickBooks Does Not Work The Way They Want It Too!

The Answer:

#1 Click Here To Buy An Entire QuickBooks Setup For Your Specific Contracting Company

#2 Click Here To Buy Just The Chart Of Accounts For Your Specific Contracting Company