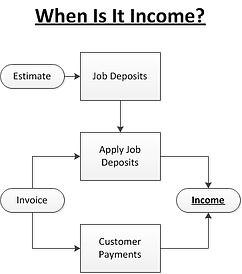

The one burning question contractors want to know: When is it income?

When money comes into the business, at some point it turns into income. " Money goes in and out of my business and I don't understand when it is income and when it is not ". Without proper tracking and matching of income and expenses, most construction companies never know if they made a profit until the job is over.

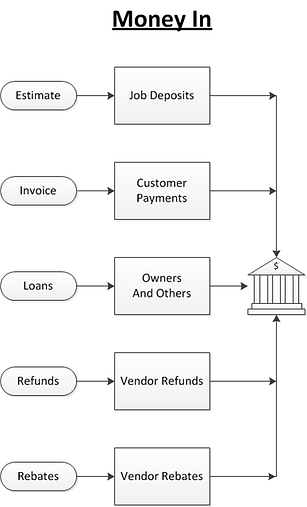

The Diagram Below Shows Five Ways Money Comes In

-

Job Deposit - Customer signs a contract and gives the contractor a down payment check - (Not Income)

-

-

Loans - Contractor, outside investors, banks loan money to the business - (Not Income)

-

Refunds - Contractor returns unused material gets money back - (Not Income)

-

Rebate - Contractor gets a rebate when buying a new truck - (Not Income)

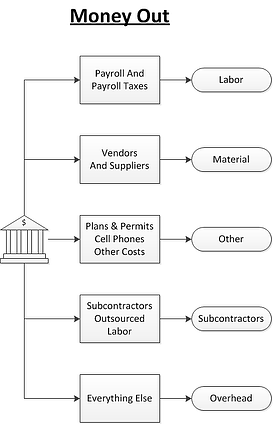

The Diagram Below Shows Five Ways Money Goes Out

-

Labor - Payroll and taxes because contractors can get more make good money with qualified labor - (Not Income)

-

Material - Takes money to make money and you need material to build and repair things - (Not Income)

-

Other - Costs you need to operate a mobile business like construction - (Not Income)

-

Subcontractors - Do what you do best and outsource the rest - (Not Income)

-

Overhead - Everything not directly related to field work - (Not Income)

The Diagram Below Shows When It Is Income

-

Job Deposit - Applied to an Invoice the money is - (Income)

I hope this quick overview helps answers some of the questions you may have about construction bookkeeping and accounting. This diagram is intended for residential contractors. Commercial contractors Invoicing is a bit more complex.

If you enjoyed this you may want to review the 80/20 Rule and our Cash Flow Diagram

About The Author:

Randal DeHart, PMP, QPA is the co-founder of Business Consulting And Accounting in Lynnwood Washington. He is the leading expert in outsourced construction bookkeeping and accounting services for small construction companies across the USA. He is experienced as a Contractor, Project Management Professional, Construction Accountant, Intuit ProAdvisor, and QuickBooks For Contractors Expert. This combination of experience and skill sets provides a unique perspective which allows him to see the world through the eyes of a contractor, Project Manager, Accountant and Construction Accountant. This quadruple understanding is what sets him apart from other Intuit ProAdvisors and accountants to the benefit of all of the construction contractors he serves across the USA. Visit http://www.fasteasyaccounting.com/randal-dehart/ to learn more.

Randal DeHart, PMP, QPA is the co-founder of Business Consulting And Accounting in Lynnwood Washington. He is the leading expert in outsourced construction bookkeeping and accounting services for small construction companies across the USA. He is experienced as a Contractor, Project Management Professional, Construction Accountant, Intuit ProAdvisor, and QuickBooks For Contractors Expert. This combination of experience and skill sets provides a unique perspective which allows him to see the world through the eyes of a contractor, Project Manager, Accountant and Construction Accountant. This quadruple understanding is what sets him apart from other Intuit ProAdvisors and accountants to the benefit of all of the construction contractors he serves across the USA. Visit http://www.fasteasyaccounting.com/randal-dehart/ to learn more.

Our Co-Founder Randal DeHart - Is a Certified PMP (Project Management Professional) with several years of construction project management experience. His expertise is construction accounting systems engineering and process development. His exhaustive study of several leading experts including the work of Dr. W. Edward Deming, Michael Gerber, Walter A. Shewhart, James Lewis and dozens of others was the foundation upon which our Construction Bookkeeping System is based and continues to evolve and improve. Check out our Contractor Success Map Podcast on iTunes.

OUTSOURCED ACCOUNTING FOR

THE BUSY CONTRACTOR

IN A MOBILE ENVIRONMENT

Download the Contractors APP today from the App Store or Android Store

Access Code: FEAHEROS

Click here to download the App on Android:

Click here to download the App on iOS:

Simply scan the QR code or search for ‘MyAccountants’ in the App Store and enter the Access code: FEAHEROS to utilize the powerful App features and capabilities, and benefit from having our Construction Accounting App at your fingertips, 24/7."

PS: Even if you are not a Construction Contractor you will find a plenty of benefits in the app so we invite you to download it too! It's Free so why not?