Construction Contractors Need Help From Knowledgeable Advisors

![]()

![]()

![]() Everywhere there a Buzz Words and lots of people who say they are Experts in their field. Question is What the Expert knows is in a topic that is useful to you?

Everywhere there a Buzz Words and lots of people who say they are Experts in their field. Question is What the Expert knows is in a topic that is useful to you?

![]()

![]()

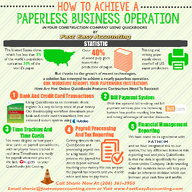

![]() Everyone wants to be paperless. It is not so much about saving a Tree as saving Time. How can I get to My Bookkeeper, My Accountant, My Tax Accountant the information they need to develop the reports?

Everyone wants to be paperless. It is not so much about saving a Tree as saving Time. How can I get to My Bookkeeper, My Accountant, My Tax Accountant the information they need to develop the reports?

![]()

![]()

![]() Most contractors tell me "Actually, I don’t want the reports I only want to know "scraps of information" so I can run My Business better. If there is an easy way to get the job done; I want to know it. There must be an App For That."

Most contractors tell me "Actually, I don’t want the reports I only want to know "scraps of information" so I can run My Business better. If there is an easy way to get the job done; I want to know it. There must be an App For That."

![]()

![]()

![]() There are several apps and we have one just for Construction Contractors. It does a lot but no app does everything.

There are several apps and we have one just for Construction Contractors. It does a lot but no app does everything.

One of the first questions I am asked is do I have to keep my receipts?

After all, I used my debit card, and it is all on the bank statement

![]()

![]()

![]() Bank Statements do not give all of the information needed to run your business. If you write a check, it will say When and How Much but not the “Who” and definitely not on WHY you wrote a check. Debit card transactions have Who, When and How Much; still no WHY.

Bank Statements do not give all of the information needed to run your business. If you write a check, it will say When and How Much but not the “Who” and definitely not on WHY you wrote a check. Debit card transactions have Who, When and How Much; still no WHY.

![]()

![]()

![]() My answer is Yes – Please. Many suppliers will take a product back IF you have a receipt. A few with your credit card will be able to find your transaction and be able to credit the purchase back to the card. For everyone else; your receipt is the fastest way to document you actually made the purchase.

My answer is Yes – Please. Many suppliers will take a product back IF you have a receipt. A few with your credit card will be able to find your transaction and be able to credit the purchase back to the card. For everyone else; your receipt is the fastest way to document you actually made the purchase.

![]()

![]()

![]() Stores return policy is as generous as they can be. But not everyone can offer 100% refund for something that is obviously worn out, purchased from somewhere else or sometime long ago.

Stores return policy is as generous as they can be. But not everyone can offer 100% refund for something that is obviously worn out, purchased from somewhere else or sometime long ago.

![]()

![]()

![]() We have all heard stories where dress clothes (with tags attached and hidden) are worn to a “fancy party” (New Year’s Eve’s) and next day returned to the store for a full refund. I don’t know of anyone personally who has done it but reading on the internet – many stores have changed return policies because of this type of customers (not clients). Kinda like being an “Unwelcome Pest” instead of a “Welcome Guest.”

We have all heard stories where dress clothes (with tags attached and hidden) are worn to a “fancy party” (New Year’s Eve’s) and next day returned to the store for a full refund. I don’t know of anyone personally who has done it but reading on the internet – many stores have changed return policies because of this type of customers (not clients). Kinda like being an “Unwelcome Pest” instead of a “Welcome Guest.”

![]()

![]()

![]() I was in a store who refused to accept a return from the customer in front of me. The clerk told the customer they had made Too Many Returns. We want to be the Welcomed Guest, be a good neighbor, friend, the benefit to our community as we provide “Goods and Services” to our friends and clients. Not everyone is a Good Client or Customer.

I was in a store who refused to accept a return from the customer in front of me. The clerk told the customer they had made Too Many Returns. We want to be the Welcomed Guest, be a good neighbor, friend, the benefit to our community as we provide “Goods and Services” to our friends and clients. Not everyone is a Good Client or Customer.

Tax Accountants are someone every Contractor should have. Why, when Turbo Tax can do it all?

Turbo Tax is in simple terms an “AI” programmed to fill in the blanks based on the information you give it. So as an AI, the software might be smarter than you and I; but remember that “The Computer” does not win whenever playing against “Chess Masters” and a “Real Person” has done the programming.

Here are the Should Have, Ought To Have, Maybe, Because [fill in the blank] with as many as you can think of and here are some more. You have already “Over Handled” your documents; especially if you are doing all of your own bookkeeping. I can’t afford to “Hire It Out” Sometimes your budget is “Toast!”

![]()

![]()

![]() Are you spending time doing the right things? The old saying “Sell Your Way Out Of A Problem” is true, but be sure you have done the right job for the right client, and the right price can only be answered when the accounting system has the proper information. The answer is a knowledgeable person between the keyboard and chair touching the keys. Hint - There is a difference between Void and Delete.

Are you spending time doing the right things? The old saying “Sell Your Way Out Of A Problem” is true, but be sure you have done the right job for the right client, and the right price can only be answered when the accounting system has the proper information. The answer is a knowledgeable person between the keyboard and chair touching the keys. Hint - There is a difference between Void and Delete.

![]()

![]()

![]() Quicken could work as an overgrown checkbook. What would it tell you? Wait, I took the easy step interview, synced to my bank; it has everything it needs! Does It? or does it have everything YOU think it needs to be based on what you know? If you are the Smarted Person in the room – Fantastic.

Quicken could work as an overgrown checkbook. What would it tell you? Wait, I took the easy step interview, synced to my bank; it has everything it needs! Does It? or does it have everything YOU think it needs to be based on what you know? If you are the Smarted Person in the room – Fantastic.

![]()

![]()

![]() Excited to meet someone who has read and understood everything on the internet. All information is “Free, Perfect, Now!” Still doesn’t mean it is useful information to anyone and everyone who reads it versus just tons of general data. We each have different opinions on “What Is Important.”

Excited to meet someone who has read and understood everything on the internet. All information is “Free, Perfect, Now!” Still doesn’t mean it is useful information to anyone and everyone who reads it versus just tons of general data. We each have different opinions on “What Is Important.”

Questions to ask your New or Existing Tax Accountant

- Explain the differences in Sole Proprietorship, Partnership, Limited Liability Company, S-Corporation.

- Now, What is the Difference when it comes to Taxes Hint – Self Employment Tax

- Some Respected Attorneys do not understand the differences between a Tax Point of View.

- Should I have my spouse as part of the company? Paid or Unpaid?

- Maybe I don’t need to add them if something happens to me [she|he] gets everything.

- I want to hire other Family Members to work in my company.

- Should I have them as an employee, part of management or own a portion of the company?

- I want my friends to be part of the company; we have a great time on Friday night.

- We all agree that they would be an asset. (Does the part “We All Agree” include your spouse?

- Occasionally Spouses find being supportive becomes a “Full Time” unpaid position.

![]()

![]()

![]() Is there a tax benefit to hiring my Teenage or College Children Part-time?

Is there a tax benefit to hiring my Teenage or College Children Part-time?

Your Tax Accountant’s role is to roll up your business life, personal life (including spouse, children, assets, home, retirement account, stock market accounts, odds and ends of side income) and file your business and personal income taxes. Some states do not have an Income Tax (Washington) but have numerous other taxes. Soda Tax, Sales tax, Vehicle tax, Property taxes that continue to increase and more.

![]()

![]()

![]() Have you ever played “Where’s Waldo” or walked through a “Corn Maze” to get in the spirit of Halloween? Being in business is challenging every day. There are no shortage demands on your time.

Have you ever played “Where’s Waldo” or walked through a “Corn Maze” to get in the spirit of Halloween? Being in business is challenging every day. There are no shortage demands on your time.

- Who is working for Who?

- What type of contractor do you want to be?

- General Contractor or Specialty Trade Contractor?

- Do you provide Design and Install or just Design or just Installation?

- Are you working directly with the Home Owner?

- Do you work as a Specialty Trade Contractor for a General Contractor?

- Are you being paid by the Owner or by the General Contractor”?

![]()

![]()

![]() Having employees can seem like You Are Working For Them Instead of Them Working For You (except you are paying in cash, loss of time, taxes, and other Cash and Non-Cash Benefits (which takes cash).

Having employees can seem like You Are Working For Them Instead of Them Working For You (except you are paying in cash, loss of time, taxes, and other Cash and Non-Cash Benefits (which takes cash).

- Do you have W-2 employees?

- Are you paying them to watch you work (under the premise of teaching them)?

- Do you have Specialty Trade Contractors work for you?

- Are they Bonded, Insured, carry their own Worker’s Comp policy?

- Are you treating your employees as 1099 contractors so avoid collecting and paying taxes?

- Hint – Use a Labor Service or Payroll Service. State Labor Laws can be complicated

It's All About Getting Paid

You Know How To Do The Work

Are You Getting Paid For It?

- Do you have a written contract or invoice that the Client signs?

- Do you set the payment schedule in your contracts?

- Do you receive Job Deposits on larger projects?

- Is the payment schedule set by Others?

- Have you given the owner of the property a “Notice To The Owner?”

- Followed by a “Notice Of Intent To Lien” if they decide you be doing “free work?”

- With a Specialty Contractor with a “Pay When Paid” clause?

![]()

![]()

![]() Are you working New Construction, Residential Remodels, Small Commercial Projects (TI’s)? They are each different. As a Construction Contractor, you understand the difference between the type of work you do.

Are you working New Construction, Residential Remodels, Small Commercial Projects (TI’s)? They are each different. As a Construction Contractor, you understand the difference between the type of work you do.

![]()

![]()

![]() It is important to verify that your Tax Accountant has a clue about what you do. As a Construction Contractor, you have many expenses that an “Independent Traveling Sales Person” would not have. It is by exception that a Construction Contractor completes a project without having any Leftover Stuff.

It is important to verify that your Tax Accountant has a clue about what you do. As a Construction Contractor, you have many expenses that an “Independent Traveling Sales Person” would not have. It is by exception that a Construction Contractor completes a project without having any Leftover Stuff.

![]()

![]()

![]() Outside Sales People tend to lease their vehicle and miles are usually freeway miles so taking a mileage deduction makes sense. The wear and tear on your vehicle are huge. Almost Always taking actual expenses is better.

Outside Sales People tend to lease their vehicle and miles are usually freeway miles so taking a mileage deduction makes sense. The wear and tear on your vehicle are huge. Almost Always taking actual expenses is better.

![]()

![]()

![]() You haul stuff from the supplier to the job site. You create a mess in the process of remodeling a house. That mess needs to be recycled, reused or taken to the dump. Scraps of lumber, cardboard, packing are just more stuff that makes a tour of your truck, van or trailer. Even if you have an On-Site Dumpster – There is still “Stuff” to be dealt with. Hint - Hopefully you can return the “Extras” to the supplier.

You haul stuff from the supplier to the job site. You create a mess in the process of remodeling a house. That mess needs to be recycled, reused or taken to the dump. Scraps of lumber, cardboard, packing are just more stuff that makes a tour of your truck, van or trailer. Even if you have an On-Site Dumpster – There is still “Stuff” to be dealt with. Hint - Hopefully you can return the “Extras” to the supplier.

![]()

![]()

![]() Many marketing firms will also offer to be your Business Coach. Again, this person needs to understand about your business. Numbers are great! Your Banker is your numbers best friend and understands the numbers on the Tax Return you receive from your Tax Accountant. Tax Accountant adds credibility that you did not do the job yourself. In other words, you are not making them up (or reducing them down).

Many marketing firms will also offer to be your Business Coach. Again, this person needs to understand about your business. Numbers are great! Your Banker is your numbers best friend and understands the numbers on the Tax Return you receive from your Tax Accountant. Tax Accountant adds credibility that you did not do the job yourself. In other words, you are not making them up (or reducing them down).

![]()

![]()

![]() The same thing applies when Bank requests Homeowner to HIRE A LICENSED CONTRACTOR to do the project, and the Bank pay the Contractor direct. Why, because with a set of prints the Licensed Construction Contractor knows What To Do and How To Do It! Construction Contractors cringe when they see on the news any buildings that collapse when Building Codes with good workmanship it could be prevented.

The same thing applies when Bank requests Homeowner to HIRE A LICENSED CONTRACTOR to do the project, and the Bank pay the Contractor direct. Why, because with a set of prints the Licensed Construction Contractor knows What To Do and How To Do It! Construction Contractors cringe when they see on the news any buildings that collapse when Building Codes with good workmanship it could be prevented.

![]()

![]()

![]() The first Question is: Has your Business Coach, Tax Accountant, or Banker ever worked with a Construction Contractor? If you are their First Construction Contractor Client; great as long as you know it!

The first Question is: Has your Business Coach, Tax Accountant, or Banker ever worked with a Construction Contractor? If you are their First Construction Contractor Client; great as long as you know it!

![]()

![]()

![]() As a New, Seasoned, or Returning Contractor if you are being compared to that Espresso Stand down the street that is a big deal. Hint – You have Cost of Goods Sold (COGS) and by exception Inventory.

As a New, Seasoned, or Returning Contractor if you are being compared to that Espresso Stand down the street that is a big deal. Hint – You have Cost of Goods Sold (COGS) and by exception Inventory.

![]()

![]()

![]() We are currently offering Online Classes. More classes to follow. Visit FastEasyAccountingStore.com for our Online Products for our friends in the United States, Canada, and other International Locations.

We are currently offering Online Classes. More classes to follow. Visit FastEasyAccountingStore.com for our Online Products for our friends in the United States, Canada, and other International Locations.

![]()

![]()

![]() Looking forward to being of assistance. In the meantime; Read Our Blogs, Listen To Our Podcasts.

Looking forward to being of assistance. In the meantime; Read Our Blogs, Listen To Our Podcasts.

Welcome Guest Posts. Participate in Joint Podcasts with other Service Providers featured on their sites.

![]()

![]()

![]() Download our Free Forms, Fill out a form telling us what 3rd Party Applications you use and how it is helpful. We want to pass on to other Construction Contractors helpful “Resources, Tips, and Tricks.”

Download our Free Forms, Fill out a form telling us what 3rd Party Applications you use and how it is helpful. We want to pass on to other Construction Contractors helpful “Resources, Tips, and Tricks.”

Enjoy your day.

In Conclusion:

![]()

![]() Helping Contractors around the world is one of the reasons we added the FastEasyAccountingStore.com

Helping Contractors around the world is one of the reasons we added the FastEasyAccountingStore.com

Follow our blogs, listen to Contractor Success M.A.P. Podcast. We Appreciate Our Visitors, Listeners, and Subscribers. – Thank You!!

![]()

![]() Please feel free to download all the Free Forms and Resources that you find useful for your business.

Please feel free to download all the Free Forms and Resources that you find useful for your business.

We are here to Help “A Little or A Lot” depending on your needs.

About The Author:

![]()

![]() Sharie DeHart, QPA is the co-founder of Business Consulting And Accounting in Lynnwood Washington. She is the leading expert in managing outsourced construction bookkeeping and accounting services companies and cash management accounting for small construction companies across the USA. She encourages Contractors and Construction Company Owners to stay current on their tax obligations and offers insights on how to manage the remaining cash flow to operate and grow their construction company sales and profits so they can put more money in the bank. http://www.fasteasyaccounting.com/sharie-dehart/ 206-361-3950 or sharie@fasteasyaccounting.com

Sharie DeHart, QPA is the co-founder of Business Consulting And Accounting in Lynnwood Washington. She is the leading expert in managing outsourced construction bookkeeping and accounting services companies and cash management accounting for small construction companies across the USA. She encourages Contractors and Construction Company Owners to stay current on their tax obligations and offers insights on how to manage the remaining cash flow to operate and grow their construction company sales and profits so they can put more money in the bank. http://www.fasteasyaccounting.com/sharie-dehart/ 206-361-3950 or sharie@fasteasyaccounting.com

Download the Contractors APP today from the App Store or Android Store

Access Code: FEAHEROS

Click here to download the App on Android:

Click here to download the App on iOS:

![]()

![]() Simply scan the QR code or search for ‘MyAccountants’ in the App Store and enter the Access code: FEAHEROS to utilize the powerful App features and capabilities, and benefit from having our Construction Accounting App at your fingertips, 24/7."

Simply scan the QR code or search for ‘MyAccountants’ in the App Store and enter the Access code: FEAHEROS to utilize the powerful App features and capabilities, and benefit from having our Construction Accounting App at your fingertips, 24/7."

![]()

![]() PS: Even if you are not a Construction Contractor you will find a plenty of benefits in the app so we invite you to download it too! It's Free so why not?

PS: Even if you are not a Construction Contractor you will find a plenty of benefits in the app so we invite you to download it too! It's Free so why not?

![]()

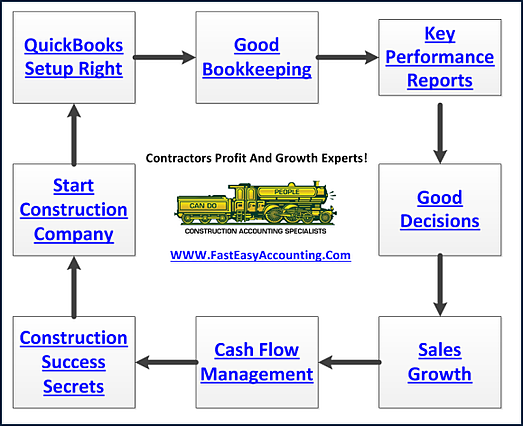

![]() When You Become A Client - Then we can tap into our resources of knowledge and strategy banks. We use the reports hidden in your QuickBooks in order to diagnose and understand your construction business and develop plans and help you implement a path to success for you and you alone because every contractor has unique Strengths, Weaknesses, Opportunities and Threats (S.W.O.T. Analysis) that when understood can lead to a Strategic Roadmap which cannot help but make a lot of money.

When You Become A Client - Then we can tap into our resources of knowledge and strategy banks. We use the reports hidden in your QuickBooks in order to diagnose and understand your construction business and develop plans and help you implement a path to success for you and you alone because every contractor has unique Strengths, Weaknesses, Opportunities and Threats (S.W.O.T. Analysis) that when understood can lead to a Strategic Roadmap which cannot help but make a lot of money.

We Remove Contractor's Unique Paperwork Frustrations

![]()

![]() For Construction Company Owners who do not need the full power of a QuickBooks for contractors and want 24/7 online access we offer Xero Accounting Online, and we have a custom setup for construction companies. Click Here For More.

For Construction Company Owners who do not need the full power of a QuickBooks for contractors and want 24/7 online access we offer Xero Accounting Online, and we have a custom setup for construction companies. Click Here For More.

![]()

![]() This Is One More Example of how Fast Easy Accounting is helping construction company owners all across the USA including Alaska and Hawaii put more money in the bank to operate and grow your construction company. Construction accounting is not rocket science; it is a lot harder than that, and a lot more valuable to people like you so stop missing out! Call Sharie 206-361-3950 or sharie@fasteasyaccounting.com and schedule your no charge one-hour consultation.

This Is One More Example of how Fast Easy Accounting is helping construction company owners all across the USA including Alaska and Hawaii put more money in the bank to operate and grow your construction company. Construction accounting is not rocket science; it is a lot harder than that, and a lot more valuable to people like you so stop missing out! Call Sharie 206-361-3950 or sharie@fasteasyaccounting.com and schedule your no charge one-hour consultation.

![]()

![]() Profitable Contractors and Construction Company owners have known about the value of outsourced bookkeeping services and contractor coaching services like ours for a long time, and now you know about it too!

Profitable Contractors and Construction Company owners have known about the value of outsourced bookkeeping services and contractor coaching services like ours for a long time, and now you know about it too!

![]()

![]() Thank You For Reading This Far, And I Hope You Understand we really do care about you and all contractors regardless of whether or not you ever hire our services.

Thank You For Reading This Far, And I Hope You Understand we really do care about you and all contractors regardless of whether or not you ever hire our services.

![]()

![]() We Scan Your Receipts, And Invoices link the appropriate transactions to QuickBooks or Xero Accounting Online depending on the construction accounting service you are using and provide ongoing Cloud Based Contractors Bookkeeping Services by accountants who understand construction.

We Scan Your Receipts, And Invoices link the appropriate transactions to QuickBooks or Xero Accounting Online depending on the construction accounting service you are using and provide ongoing Cloud Based Contractors Bookkeeping Services by accountants who understand construction.

Our Contractor Bookkeeping Services System Is A System

Thinking About Outsourcing Your Contractors Bookkeeping Services To Save Time And Money?

Click On The Button Below To Download A Free Guide

Business Process Management (BPM) For Contractors

Need Help Now?

Call Sharie 206-361-3950

sharie@fasteasyaccounting.com

Xero Outsourced Construction Accounting Services

QuickBooks Outsourced Construction Bookkeeping Services

We Are Also Xero Accounting Experts Specializing In Construction Bookkeeping Services

PS: For The Do-It-Yourself Construction Bookkeeper Our Store Has Chock-Full Of QuickBooks Setup Templates, QuickBooks Chart of Accounts And More.

Most Contractors Setup QuickBooks Desktop Version In One Of Three Ways:

![]()

![]() #1 EZ Step Interview inside QuickBooks Setup

#1 EZ Step Interview inside QuickBooks Setup

#2 Asked Their Tax Accountant To Setup QuickBooks

#3 They Attended A How To Setup QuickBooks Class Or Seminar

And QuickBooks Does Not Work The Way They Want It Too!

The Answer:

#1 Click Here To Buy An Entire QuickBooks Setup For Your Specific Contracting Company

#2 Click Here To Buy Just The Chart Of Accounts For Your Specific Contracting Company

Download the Contractors APP today from the App or Android store