So You Are Starting A Construction Company. Perhaps yours will be House Builder, Handyman Company, Specialty Contractor like a Plumber, Electrician, HVAC, Concrete Contractor or Landscape Company. Whatever it is congratulations you have or will be taking a big step toward being the Master of Your Own Destiny!

I Trust This List of Five Accounting Tips For Contractor Startups Will Help You

Many surveys and reports show nearly half of all new construction companies close their doors within the first five years of opening them. When we speak with contractors who failed most of them say it was due to lack of cash flow. Pretty obvious and yet when questioned all of them said they were "Blind-Sided" and were not aware they were running out of cash until it was too late.

There is a point when a contracting company starts to fail and nothing short of a massive cash infusion can stop it and a domino effect begins which is when a series of similar or related events occurring as a direct and inevitable result of one initial event.

Lack of cash holds up material deliveries, which causes labor to be idle and continue costing money and then payroll checks bounce and your construction workers take your tools and equipment to the pawn shop to get paid that way and the contracting company spirals down to its final end.

Construction Accounting Tip #01 - Open Three Business Checking Accounts

If you were to ask a lot of contractors about the big mistakes that they made when they first started out one of them are they wished that they had kept their business and personal expenses completely separate. Not only does it make the day-to-day contractor bookkeeping easier but it also makes monthly, quarterly and annual tax preparation smoother.

Checking Account 01 - Your primary checking account should not have any credit or debit cards attached to it. All money is deposited into this account and you make transfers into the other two accounts as needed. Order a small supply of three part voucher checks as shown below. It is a fast easy way to keep track of who was paid and have a reference of their Invoice number, dates and amounts.

Checking Account 02 - Payroll checking account should have just enough money in it to cover payroll with perhaps a small cushion of $100. This limits exposure to payroll fraud and this account should not have any credit or debit cards attached to it. You can transfer funds into this account to as needed from your primary account. No need for paper checks.

Checking Account 03 - Petty Cash checking account with $500 +/- this account should have debit cards that work like credit cards attached to it for making small purchases in the field. If you want to provide your foreman and forewomen with a debit card to be used as a credit card you can. NEVER give out the PIN number. You can transfer funds into this account to as needed from your primary account. No need for paper checks.

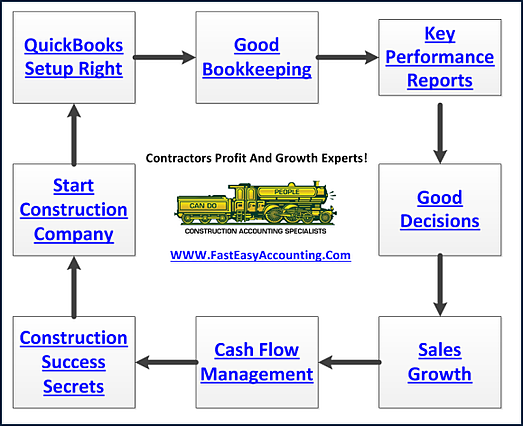

Construction Accounting Tip #02 - QuickBooks Desktop Version In The Cloud

There are thousands of accounting programs on the market and we have tried dozens of them including free ones like Wave and GnuCash, one of the more popular ones for contractors, is QuickBooks. If you are a contractor I strongly suggest QuickBooks desktop version in the cloud because it gives you all the flexibility to access QuickBooks remotely from a tablet, laptop, notebook, desktop and some phones. It is the Windows version of QuickBooks; however, it can be accessed from most Apple devices

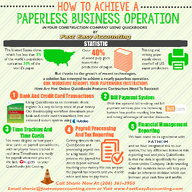

Construction Accounting Tip #03 - Backup Your Paper Records In The Cloud

This includes keeping the invoices that you send and receive, your paper and electronic receipts, keeping your employees’ records up to date and having proof of all of your expenses from equipment that you purchase, traveling you do and the office supplies that you’ve bought. There are several cloud based services to choose from. We use a paperless server version which allows us to scan a paper document and attach it to the individual transaction in QuickBooks for easy retrieval.

Drag And Drop Documents From Your Desktop, Laptop

Or Tablet Into Our Paperless Server

As usual we are on the forefront of contractor bookkeeping and outsourced accounting services for contractors by continually innovating to bring you new and improved, better and faster processes to help your save time and money by without additional cost by streamlining your paperwork and your contractor bookkeeping process.

In addition to all the ways listed in How To Get Paperwork To Us we have recently added Drag and Drop which if it only saves you ten minutes a day on your contractor bookkeeping could be worth hundreds or thousands of dollars annually to your bottom line! For more on how Ten Minutes A Day can make or break your construction company Click Here

Drag And Drop From Outlook Directly Into Our Paperless Server

Drag And Drop From Hotmail Directly Into Our Paperless Server

Drag And Drop From G-Mail Directly Into Our Paperless Server

Drag And Drop From Yahoo Mail Directly Into Our Paperless Server

Drag And Drop From Excel, Word And Other File Formats

Directly Into Our Paperless Server

Construction Accounting Tip #04 - Focus On Profitable Customers And Clients

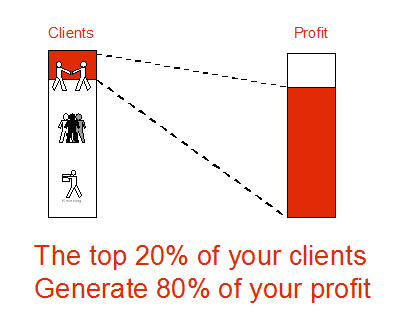

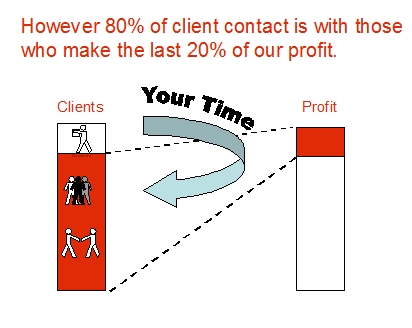

The 80/20 rule says that most contractors spend 8 out of 10 hours doing things that drive almost no value to the bottom line. The biggest drain is trying to save money doing your contractor bookkeeping instead of spending five minutes a day reviewing the Key Performance Indicator (KPI) Reports. Especially now when they can be accessed 24/7 without opening QuickBooks for Contractors.

By generating daily reports that uncover the best customers, jobs, services, or products, you will soon see how you can refocus your internal efforts on doing more good work.

This is the great contribution a company receives from good QuickBooks® data and from using QuickBooks® the ‘right-way’.

What are you good at and what do they love to pay you money to do for them? What jobs have you done that made a positive difference in people lives? What projects did you have so much fun doing that time seemed to fly by?

Construction Accounting Tip #05 - Develop A Business Plan

Develop Your Business Plan - Using the Eleven Steps Program and pay close attention to the marketing section because that is where you will decide what niche of the construction market you will dominate. Know that in time your company will become legendary to such a degree you clients will be raving fans and referrals will be part of your marketing strategy. Nordstrom has been very successful at this and it would be wise to learn from the leaders.

We Remove Contractor's Unique Paperwork Frustrations

For Construction Company Owners who do not need the full power of QuickBooks for contractors and want 24/7 online access we offer Xero Accounting Online and we have custom setup for construction companies. Click Here For More.

This Is One More Example of how Fast Easy Accounting is helping construction company owners all across the USA including Alaska and Hawaii put more money in the bank to operate and grow your construction company. Construction accounting is not rocket science; it is a lot harder than that and a lot more valuable to people like you so stop missing out! Call Sharie 206-361-3950 or sharie@fasteasyaccounting.com and schedule your no charge one-hour consultation.

Profitable Contractors and Construction Company owners have known about the value of outsourced bookkeeping services and contractor coaching services like ours for a long time and now you know about it too!

We Scan Your Receipts And Invoices link the appropriate transactions to QuickBooks or Xero Accounting Online depending on the construction accounting service you are using and provide ongoing Cloud Based Contractors Bookkeeping Services by accountants who understand construction.

Our Contractor Bookkeeping Services System Is A System

Thinking About Outsourcing Your Contractors Bookkeeping Services To Save Time And Money?

Click On The Button Below To Download A Free Guide

Business Process Management (BPM) For Contractors

Need Help Now?

Call Sharie 206-361-3950

sharie@fasteasyaccounting.com

Xero Outsourced Construction Accounting Services

QuickBooks Outsourced Construction Bookkeeping Services

We Are Xero Accounting Experts Specializing In Construction Bookkeeping Services

About The Author:

Randal DeHart, PMP, QPA is the co-founder of Business Consulting And Accounting in Lynnwood Washington. He is the leading expert in outsourced construction bookkeeping and accounting services for small construction companies across the USA. He is experienced as a Contractor, Project Management Professional, Construction Accountant, Intuit ProAdvisor, QuickBooks For Contractors Expert and Xero Accounting Specialist. This combination of experience and skill sets provides a unique perspective which allows him to see the world through the eyes of a contractor, Project Manager, Accountant and construction accountant. This quadruple understanding is what sets him apart from other Intuit ProAdvisors and Xero accountants to the benefit of all of the construction contractors he serves across the USA. Visit http://www.fasteasyaccounting.com/randal-dehart/ to learn more.

Randal DeHart, PMP, QPA is the co-founder of Business Consulting And Accounting in Lynnwood Washington. He is the leading expert in outsourced construction bookkeeping and accounting services for small construction companies across the USA. He is experienced as a Contractor, Project Management Professional, Construction Accountant, Intuit ProAdvisor, QuickBooks For Contractors Expert and Xero Accounting Specialist. This combination of experience and skill sets provides a unique perspective which allows him to see the world through the eyes of a contractor, Project Manager, Accountant and construction accountant. This quadruple understanding is what sets him apart from other Intuit ProAdvisors and Xero accountants to the benefit of all of the construction contractors he serves across the USA. Visit http://www.fasteasyaccounting.com/randal-dehart/ to learn more.

Our Co-Founder Randal DeHart - Is a Certified PMP (Project Management Professional) with several years of construction project management experience. His expertise is construction accounting systems engineering and process development. His exhaustive study of several leading experts including the work of Dr. W. Edward Deming, Michael Gerber, Walter A. Shewhart, James Lewis and dozens of others was the foundation upon which our Construction Bookkeeping System is based and continues to evolve and improve. Check out our Contractor Success Map Podcast on iTunes and Follow Randal on Google+