Does QuickBooks Frustrate You? If You Answered "Yes" You Are Not Alone!

99.99% of all QuickBooks Issues can be traced back to two root causes:

- How QuickBooks setup was done originally

- How transactions are put into QuickBooks

QuickBooks Makes Construction Accounting

Look Easy As Microwave Popcorn

How many advertisements have you seen by Intuit, the maker of QuickBooks that makes it appear like accounting is so simple a five year old can do it. The truth is Intuit is a sales and marketing firm that sells and markets software. And QuickBooks is one of the big winners for them because it has removed a lot of the pain associated with accounting; but it is still accounting and certain principles still apply. For example "Debits" are on the left and when they are not we give them "Credit".

When you write a check in QuickBooks you can impact up to 27 different tables and hundreds of reports which means in the end there are thousands of things that can go wrong. Even those of us with a deep background in accounting have known for years there are several things QuickBooks allows users to do which can lead them down harmful paths. One of the worst ideas ever in the history of QuickBooks is putting your bank and credit card account numbers inside QuickBooks. I suspect this was done in response to users asking for it.

Don’t assume that QuickBooks will keep an uninformed bookkeeper or user for making mistakes and don't assume it will stop your from doing something that will cause financial harm to your construction company because it WON'T! Understand that QuickBooks is just a tool like a hammer is a tool and hammers do not know which nail to drive into which piece of wood.

The problem is that bookkeeper not trained in construction accounting don’t know which nails to drive where inside QuickBooks so they just start “hammering” and causing untold damage. What happens too often is they open the box, load the program, and start using it without help or guidance. This works fine for small phone apps, games and programs, like Publisher because if you make a mistake in Publisher the damage is limited to only one file. You can see and immediately correct your mistake and it doesn't impact your taxes, job costing reports, obtaining a loan, or running your construction company!

But if you or your contractors bookkeeper makes mistakes in your QuickBooks for Contractors file it might be months or years before anyone finds it and only then if they know what to look for in the financial and job costing reports to know if they are seriously wrong.

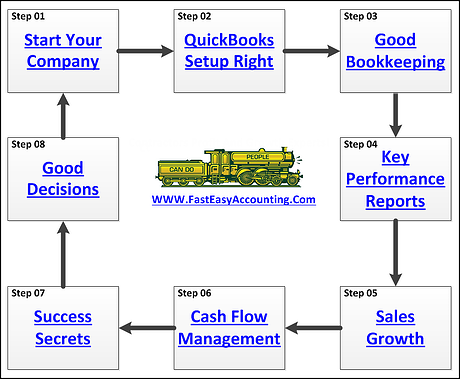

QuickBooks For Contractors Setup

Did someone setup QuickBooks by trying to follow the built in in template inside QuickBooks and you figured out you cannot get any of the financial and job costing reports you need to operate and grow your construction company?

Proper QuickBooks Setup Is Your Treasure Map

The Chart of Accounts Is The Foundation Of Your QuickBooks Setup - And if your QuickBooks setup was done by a QuickBooks Expert in construction accounting and maintained correctly you are riding high and living well! If not, we can fix just about any QuickBooks setup by performing a QuickBooks cleanup and importing all of the transactions into a fresh QuickBooks file that we have customized just for your construction company.

We Perform QuickBooks Setup - Since we are QuickBooks experts in construction accounting and we work specifically for contractors on whatever year and version of QuickBooks you own. We have worked with QuickBooks since it first arrived in the early 1990's in DOS.

Having used a number of accounting programs over the years we believe when your QuickBooks setup is done correctly is the best, hands down, no contest! For the construction trades the tiny amount of money difference between QuickBooks Pro and QuickBooks Premier Contractor Edition is worth the investment for the additional a Contractor Reports alone. Upgrading every year is a “no brainer” because of all the new features and if a contractor’s construction accounting staff only saves only 10 minutes a day the savings will more than pay for the program.

Starting in 1991 we invested ten years to develop several customized QuickBooks setup templates and there have been thousands of improvements since then. We have QuickBooks setup templates for all of Construction Contractors shown below and more...

| Brand New Construction Companies | Handyman Contractors |

| Cabinet Installers | Handywoman Contractors |

| Carpentry Construction Companies | HVAC Contractors |

| Carpet Installers | Insulation Contractors |

| Commercial Tenant Improvement Contractors | Interior Designers |

| Concrete Contractors | Land Development Contractors |

| Construction Companies | Landscape Contractors |

| Construction Managers | Masonry Contractors |

| Contracting Companies | Mold Remediation Companies |

| Contractors | Moss Removal Companies |

| Custom Deck Contractors | Painting Contractors |

| Custom Home Builders | Plumbing Contractors |

| Demolition Contractors | Pressure Washing Companies |

| Drywall Contractors | Remodel Contractors |

| Electrical Contractors | Renovation Contractors |

| Emerging Contractors | Restoration Contractors |

| Excavation Contractors | Roofing Contractors |

| Finish Millwork Contractors | Spec Home Builders |

| Flipper House Contractors | Specialty Contractors |

| Flooring Contractors | Subcontractors |

| Framing Contractors | Sub-Contractors |

| General Contractors | Trade Contractors |

| Glass Installation Contractors | Underground Contractors |

| Gutter Installation Contractors | Utility Contractors |

Our QuickBooks Setup For Construction Company Contractors Includes:

-

User Permissions and limits

-

Company Information Window with EIN and contact

-

Chart of Accounts Direct Construction Costs

-

Chart of Accounts Indirect Construction Costs

-

Chart of Accounts Work-In-Progress For Land Developers

-

Chart of Accounts Work-In-Progress For Land Development Into Lots

-

Chart of Accounts Work-In-Progress For Spec Builders

-

Chart of Accounts Work-In-Progress For Spec Home Into Rentals

-

Chart of Accounts Over Billings For Earned Value Reports

-

Chart of Accounts Under Billings For Earned Value Reports

-

Chart of Accounts Retention From Your Customers

-

Chart of Accounts Retention For Your Subcontractors

-

Chart of Accounts Job Deposits From Your Customers

-

Chart of Accounts Indirect Construction Costs

-

Chart of Accounts Prepaid Expenses

-

Chart of Accounts Job Deposits

-

Chart of Accounts Fixed Assets

-

Chart of Accounts Depreciation

-

Chart of Accounts Intercompany Transfers

-

Chart of Accounts Payroll

-

Chart of Accounts Payroll Taxes

-

Chart of Accounts Payroll Tax Liabilities

-

Chart of Accounts Customer Discounts

-

Chart of Accounts Bad Debts

-

Chart of Accounts Customer Checks Returned From Bank

-

Chart of Accounts Employee Loans And Repayments

-

Chart of Accounts Jobsite Costs

-

Chart of Accounts Warranty Work

-

Chart of Accounts Sales Tax Errors

-

Chart of Accounts Mobilization

-

Chart of Accounts De-Mobilization

-

Chart of Accounts Leases

-

Chart of Accounts Purchases

-

Chart of Accounts Marketing

-

Chart of Accounts Advertising

-

Chart of Accounts Owner Loans And Repayments

-

Chart of Accounts Special Accounts For Sole Proprietors

-

Chart of Accounts Special Accounts For LLC Corporations

-

Chart of Accounts Special Accounts For Sub-S Corporations

-

Chart of Accounts Special Accounts For Partnerships

-

Chart of Accounts Special Accounts For LLP Limited Partnerships

-

Chart of Accounts Special Accounts Flipper Houses

-

Chart of Accounts Credit Cards

-

Chart of Accounts Lines Of Credit

-

Chart of Accounts Short Term Loans

-

Chart of Accounts Long Term Loans

-

Chart of Accounts Spec House Construction Loans

-

Chart of Accounts Land Development Construction Loans

-

Chart of Accounts General And Administrative

-

Chart of Accounts Occupancy Costs

-

Chart of Accounts Triple Net Leasing Costs

-

Chart of Accounts Technology

-

Chart of Accounts Professional Fees

-

Chart of Accounts Taxes

-

Chart of Accounts Licenses

-

Chart of Accounts Insurance Builders Risk.

-

Chart of Accounts Insurance Vehicles

-

Chart of Accounts Insurance Liability

-

Chart of Accounts Insurance Health And Dental

-

Chart of Accounts Financing Costs

-

Chart of Accounts Interest Earned

-

Chart of Accounts Gain And Loss On Fixed Assets

-

Chart of Accounts Estimates

-

Chart of Accounts Sales Orders

-

Chart of Accounts Purchase Orders

-

Item List Direct Construction Costs

-

Item List Indirect Construction Costs

-

Item List Construction Job Deposit

-

Item List Construction Labor Costs

-

Item List Construction Material Costs

-

Item List Construction Other Costs

-

Item List Construction Subcontractors Costs

-

Item List CSI Codes For Commercial Construction

-

Item List Bid Bond Deposits

-

Item List Sales Tax For Cities (Updated When It Changes)

-

Item List Sales Tax For Counties (Updated When It Changes)

-

Item List Sales Tax For State (Updated When It Changes)

-

Item List Land Developers Direct Costs

-

Item List Land Developers Indirect Costs

-

Item List Spec Home Builders Direct Costs

-

Item List Spec Home Builders Indirect Costs

-

Item List Retention Held By Customers

-

Item List Retention Holding For Subcontractors

-

Item List Work-In-Progress Costs For Land Developers

-

Item List Work-In-Progress Transfer Costs For Land Developers

-

Item List HUD-1 Statement Transfer Costs For Land Developers

-

Item List Work-In-Progress Costs For Spec Home Builders

-

Item List Work-In-Progress Transfer Costs For Spec Home Builders

-

Item List HUD-1 Statement Transfer Costs For Spec Home Builders

-

Item List Work-In-Process Transfer Costs For Spec Home Builders

-

Retention Tracking For Your Customers And Trade / Subcontractors

-

Payroll For Your Employees

-

Payroll Sick Days

-

Payroll Vacation Days

-

Payroll Loans Setup And Tracking

-

Payroll Loan Repayment Setup And Tracking

-

Payroll Reimbursement Setup And Tracking

-

Payroll Garnishment Setup And Tracking

-

Payroll Child Support Setup And Tracking

-

Payroll Tax Table

-

Owners Time To Job For Job Costing Without Affecting Financial Report

-

Preferences In 23 Categories Each One With Multiple Decision Points

-

Price Level List

-

Billing Rate List

-

Sales Tax Code List

-

Other Names List

-

Customer Profile List

-

Vendor Profile List

-

Templates List

-

Memorized Transaction List

-

Memorized Reports List

-

QuickBooks Automatic Backup On Remote Server

-

All Expenses And Costs Recorded In Chart of Accounts, Not Items

-

All Work In Process Recorded in Chart of Accounts, Not Items

-

Retention Hold By Your Customers

-

Retention Hold For Subcontractors

-

Job Deposits From Customers

-

Employee Type Tracking - Field

-

Employee Type Tracking - Admin

-

Employee Type Tracking - Sales

-

Employee Type Tracking - Operations

-

Employee Type Tracking - Officers

-

Employee Loans - Field

-

Employee Loans - Admin

-

Employee Loans - Sales

-

Employee Loans - Operations

-

Employee Reimbursements - Field

-

Employee Reimbursements - Admin

-

Employee Reimbursements - Operations

-

Employee Reimbursements - Sales

-

Employee Reimbursements - Officers

-

Payroll Preparation - Field

-

Payroll Preparation - Admin

-

Payroll Preparation - Sales

-

Payroll Preparation - Operations

-

Payroll Preparation - Officers

-

Payroll Tax Reporting – 941

-

Payroll Tax Reporting - 940

-

Payroll Tax Reporting - 940

-

Payroll Tax Reporting - W-2

-

Payroll Tax Reporting - W-3

-

Insurance Audit Reporting

-

Insurance Audit Support (Business Consulting And Accounting Office)

-

Bank Reconciliations

-

Credit Card Reconciliations

-

Business And Occupation Tax Reporting - Monthly

-

Business And Occupation Tax Reporting - Quarterly

-

Business And Occupation Tax Reporting - Annually

-

Sales Tax Reporting - Monthly

-

Sales Tax Reporting - Quarterly

-

Sales Tax Reporting - Annually

-

Petty Cash Register

-

Fixed Asset Tracking

-

Monthly Depreciation Transactions

-

Intercompany Transfers

-

Security Deposits Tracking

-

Loan To Shareholders / LLC Members / Partners

-

Cost of Goods Sold - Direct Costs

-

Cost of Goods Sold - Indirect Costs

-

Your company Schedule of Values

-

Prevailing Wage Reports

-

Work-In-Process Reporting

-

Tool Lease Tracking

-

Vehicle Lease Tracking

-

Equipment Lease Tracking

-

Schedule of Values For Job Costing

-

QuickBooks Default Schedule of Values

-

Fixed List Of Your company Schedule of Values

-

Your company Schedule of Values For Each Project

-

Construction Specification Institute 16 Basic Cost Codes

-

Heavy Equipment Allocation

-

Occupancy Expense - Office

-

Occupancy Expense - Shop

-

Marketing Cost Tracking By Chart of Accounts

-

Vehicle Costs – Admin / Sales / Operations / Officer

-

Other Income Tracking

-

Other Expense Tracking

-

Investment Property Tracking

-

Upload Documents To Inbox

-

Read, Print And E-Mail Documents

-

24/7 Access To Web Based Online Financial Reports

-

Paperless Server Vault Options

-

Web Based Reports

-

Excel Based Payment Applications

Our QuickBooks setup process for a construction company like yours may require more or less than what I am showing here and for some of you this was too much information.

Our construction company clients offer a lot of feedback regarding what they would like their QuickBooks contractor to do and we listen to each and every request and look for ways to add those enhancements and more.

On average each QuickBooks setup template will have 50 enhancements a year. We test them on our server and when they are proven to work we manually update each and every client that has their QuickBooks contractor file on our server. And then we test each update on every client QuickBooks contractor file to make certain it will work.

Most of the time our clients do not even know when a template update happened, they just know it works a little bit better and something that was a problem no longer is a problem.

The one BIG PROBLEM we caution you about is be careful when you tell another contractor about all the reports and how Fast And Easy your QuickBooks contractor works because in most cases they will not believe you. It is the difference between QuickBooks setup the easy way and QuickBooks setup the hard way!

QuickBooks Setup - By a QuickBooks expert in construction accounting to work specifically for contractors on whatever year and version of QuickBooks you own because we have worked with QuickBooks since it first arrived in the early 1990's in DOS.

Which QuickBooks Edition - Is right for you? It depends on your annual sales volume and what QuickBooks Reports you want to have.

QuickBooks Pro - Works well for all contractors with less than $250,000 annual volume because yourQuickBooks Reporting needs are not great.

QuickBooks Premier Contractor - Is what we recommend for contractors with more than $250,000 annual volume currently or projected in the next 12 months. The difference in cost is very small compared to the potential value.

The Most Important - Part of QuickBooks Setup for contractors is having a QuickBooks expert with a deep background in construction accounting who understands what your particular construction company needs. Among other things you need a fast and easy way to monitor the financial health of your construction company. QuickBooks Premier Contractors Edition provides a running scorecard of Key Performance Reports and when used with Business Process Management Tools like what 10 minutes of waste costs their company.

Five Types Of Construction Firms Need QuickBooks Setup On Premier Contractor Edition:

New Construction Speculative - Land developers, home builders and light commercial builders. These are the contractors who build something in hopes a buyer will emerge during or shortly after the building is built and they need QuickBooks setup so that it will:

-

Your QuickBooks setup is put together so you can track all your construction and overhead costs and generate Bank Draws and Work-In-Progress (WIP) reports against budgeted estimates to monitor progress.

-

Your QuickBooks setup for your Chart of Accounts needs to be focused WIP Assets with a few Cost of Goods Sold Accounts (COGS) to allocate the sale of the building

-

Your QuickBooks expert can setup the Five Key Performance Indicators (KPI) to monitor the financial health of the business

-

You need between 200 and 6,000 Items setup to track all the costs of the construction process from the ground up through the roof and final cleanup

-

This is the most difficult QuickBooks Premier Contractor Edition to setup because there is a mix of Direct, Indirect, WIP and COGS accounts

-

The day to day input is also the most difficult and needs to be handled by accounting staff with specialized training in construction accounting

-

You will need a simple yet effective way to keep track of retention and your QuickBooks expert in construction accounting can set it up to meet your needs

-

Your income can be sporadic and extremely sensitive to the ups and downs of the new construction market which is why you need a strategy with an external focus on the global housing market.

-

In order for your Spec Builder Company to reach its full potential you will need an overall strategy including a Business Plan for Contractors

-

We believe a lot of speculative builders go bankrupt because they do not have accurate reports to base decisions on and that is as direct result of trying to save money with Cheap Bookkeeping

New Construction Custom - Builders of residential and light commercial buildings have special QuickBooks setup needs:

-

You use QuickBooks to track all the costs and generate Complex Payment Applications, Item Estimates vs. Actuals, Job Profitability Summary and Job Profitability Detail Reports to monitor progress

-

Your QuickBooks setup for the Chart of Accounts has a lot of Goods Sold Accounts (COGS) to allocate project costs

-

Your QuickBooks expert can setup the Five Key Performance Indicators (KPI) to monitor the financial health of the business

-

You will have between 500 to 2,500 Items setup to track all the costs of the construction process from the ground up through the roof and final cleanup

-

This is the second most difficult QuickBooks setup is Premier Contractor Edition because there is a mix of Direct, Indirect, COGS and only a few WIP accounts

-

The day to day accounting and bookkeeping input is the second most difficult and to be done properly requires accounting staff with specialized training in construction accounting

-

You will need a simple yet effective way to keep track of retention and your QuickBooks expert in construction accounting can set it up to meet your needs

-

Our experience has been your group generates a relatively unstable income and is somewhat sensitive to the ups and downs of the new construction custom built market

-

In order for your Custom Home Building Company to reach its full potential you need a Construction Business Strategy including a Business Plan for Contractors

-

We believe a lot of custom builders go bankrupt because they do not have accurate reports to base decisions on and that is as direct result of trying to save money with Cheap Bookkeeping

Remodel - Residential And Light Commercial Tenant Improvement Contractors QuickBooks Setup:

-

You use QuickBooks to track all the costs and generate Complex Payment Applications Item Estimates vs. Actuals, Job Profitability Summary and Job Profitability Detail Reports to monitor progress

-

Your Chart of Accounts is focused Goods Sold Accounts (COGS) to allocate project costs

-

You need the Five Key Performance Indicators (KPI) to monitor the financial health of the business

-

Your QuickBooks setup will need 1,000 to 5,000 Items setup to track all the costs of the construction process from beginning to end in order to get the reports you need

-

This is the third most difficult QuickBooks setup in Premier Contractor Edition because there is a mix of Direct, Indirect, COGS and only a few WIP accounts

-

The day to day input is also the second most difficult and to be done properly requires accounting staff with specialized training in construction accounting

-

You will need a simple yet effective way to keep track of retention and your QuickBooks expert in construction accounting can set it up to meet your needs

-

Our experience has been your group generates a stable income and is not as sensitive to the ups and downs of the new construction market

-

In order for you to reach their full potential of your business you will need an overall strategy including a Business Plan for Contractors

-

And of course Cheap Bookkeeping is the one area where short term savings is overwhelmed by making bad decisions based upon inaccurate QuickBooks reports

Trade contractors - QuickBooks Setup For Plumbers, Electricians, HVAC, Flooring, Sheetrock, Painters, Landscapers and others:

-

You use QuickBooks to track all the costs and generate Simple Invoices which can then be input into QuickBooks Premier Contractor Edition

-

Your QuickBooks setup for the Chart of Accounts is usually focused Goods Sold Accounts (COGS) to allocate project costs

-

You will need to pay close attention to the Five Key Performance Indicators (KPI) to monitor the financial health of the business because your sales cycle is so short

-

You will need 500 to 2,500 Items in your QuickBooks setup to track all the costs of the construction process from beginning to end

-

This is the fourth most difficult QuickBooks setup is the Premier Contractor Edition because there is a mix of Direct, Indirect, COGS accounts

-

You day to day input is also the third most difficult and to be done properly requires accounting staff with specialized training in construction accounting

-

You will need a simple yet effective way to keep track of retention and your QuickBooks expert in construction accounting can set it up to meet your needs

-

Our experience has been your group generates the most stable income and you are not as sensitive to the ups and downs of the new construction market

-

In order to reach their full potential of your Trade Construction Business you will need an overall strategy including a Business Plan for Contractors

-

And of course Cheap Bookkeeping is the one area where short term savings is overwhelmed by making bad decisions based upon inaccurate QuickBooks reports

Service and Repair - QuickBooks setup for companies like drain cleaners, emergency service electricians and others:

-

You use QuickBooks setup needs to be able to track all the costs and generate Simple Invoices which can then be input into QuickBooks Premier Contractor Edition

-

Your QuickBooks setup for the Chart of Accounts is usually focused Goods Sold Accounts (COGS) to allocate project costs

-

You will need to closely monitor the daily changes in the Five Key Performance Indicators (KPI) to understand the financial health of your business

-

Your QuickBooks setup will need between 500 to 2,500 Items setup to track all the costs of the construction process from beginning to end

-

This is the fourth most difficult QuickBooks setup for Premier Contractor Edition because there is a mix of Direct, Indirect, COGS accounts

-

The day to day input is also the third most difficult and to be done properly requires accounting staff with specialized training in construction accounting

-

You will need a simple yet effective way to keep track of retention and your QuickBooks expert in construction accounting can set it up to meet your needs

-

Our experience has been your generates a very stable income because you are not as sensitive to the ups and downs of the new construction market

-

In order to reach your full business potential you need an strategy including a Business Plan for Contractors

-

And of course Cheap Bookkeeping is the one area where short term savings is overwhelmed by making bad decisions based upon inaccurate QuickBooks reports

This Is Only The Tip - Of the Iceberg. Everything we publish in our blog posts, articles in other websites, and anything you can find on the web is nothing compared to what is available to you as our client. We show only the basic tools to open your mind to the possibilities that are available to you. The best finish carpentry tools in the hands of a golf professional without proper carpentry training will not produce anything near to what a skilled finish carpenter can. The same can be said about the best construction business consulting and accounting tools in the hands of a skilled finish carpenter. And I say that with respect and admiration for everyone in construction.

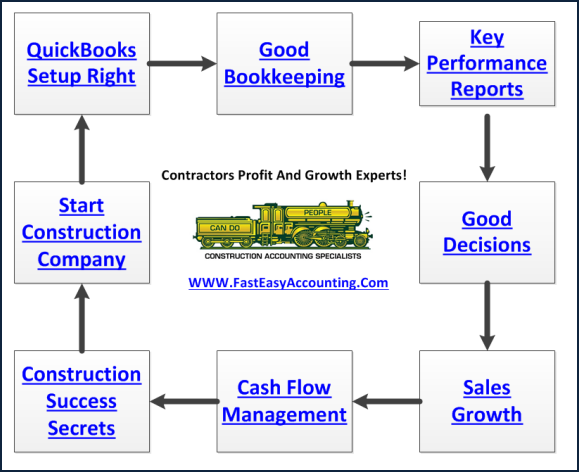

When You Become A Client - Then we can tap into our resources of knowledge and strategy banks. We use the reports hidden in your QuickBooks in order to diagnose and understand your construction business and develop plans and help you implement a path to success for you and you alone because every contractor has unique Strengths, Weaknesses, Opportunities and Threats (S.W.O.T. Analysis) that when understood can lead to a Strategic Roadmap which cannot help but make a lot of money.

If You Are A Contractor You Deserve To Be Wealthy

Because You Bring Value To Other People's Lives!

This Is One More Example of how Fast Easy Accounting is helping construction company owners just like you put more money in the bank to operate and grow your construction company. Construction accounting is not rocket science; it is a lot harder than that and a lot more valuable to people like you and me so stop missing out! Call Sharie 206-361-3950 or sharie@fasteasyaccounting.com and schedule your no charge one-hour consultation.

Profitable Contractors and Construction Company owners have known about the value of outsourced bookkeeping services and contractor coaching services like ours for a long time and now you know about it too!

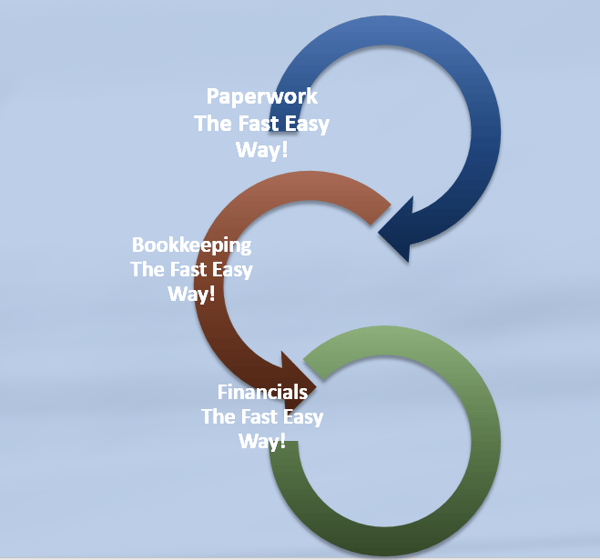

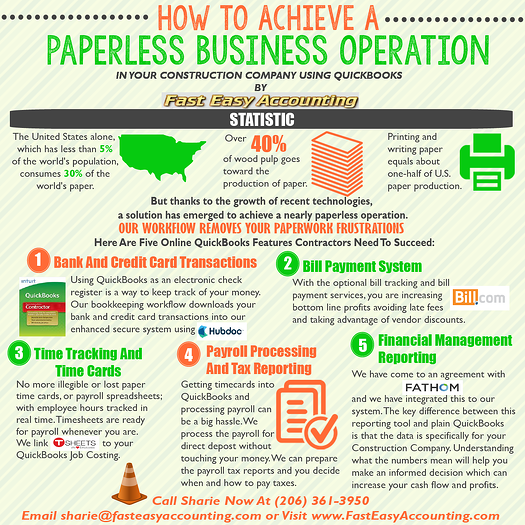

We Scan Your Receipts And Invoices link the appropriate transactions to QuickBooks or Xero Accounting Online depending on the construction accounting service you are using and provide ongoing Cloud Based Contractors Bookkeeping Services by accountants who understand construction.

Thinking About Outsourcing Your Contractors Bookkeeping Services?

Click On The Button Below To Download A Free Guide

Need Help Now?

Call Sharie 206-361-3950

sharie@fasteasyaccounting.com

Xero Outsourced Construction Accounting Services

QuickBooks Outsourced Construction Bookkeeping Services

We Are Construction Accounting Experts Specializing In Construction Bookkeeping Services For Contractors All Across The USA Including Alaska And Hawaii

About The Author:

Randal DeHart, PMP, QPA is the co-founder of Business Consulting And Accounting in Lynnwood Washington. He is the leading expert in outsourced construction bookkeeping and accounting services for small construction companies across the USA. He is experienced as a Contractor, Project Management Professional, Construction Accountant, Intuit ProAdvisor, QuickBooks For Contractors Expert and Xero Accounting Specialist and Bill.Com Certified Guru. This combination of experience and skill sets provides a unique perspective which allows him to see the world through the eyes of a contractor, Project Manager, Accountant and construction accountant. This quadruple understanding is what sets him apart from other Intuit ProAdvisors and Xero accountants to the benefit of all of the construction contractors he serves across the USA. Visit http://www.fasteasyaccounting.com/randal-dehart/ to learn more.

Randal DeHart, PMP, QPA is the co-founder of Business Consulting And Accounting in Lynnwood Washington. He is the leading expert in outsourced construction bookkeeping and accounting services for small construction companies across the USA. He is experienced as a Contractor, Project Management Professional, Construction Accountant, Intuit ProAdvisor, QuickBooks For Contractors Expert and Xero Accounting Specialist and Bill.Com Certified Guru. This combination of experience and skill sets provides a unique perspective which allows him to see the world through the eyes of a contractor, Project Manager, Accountant and construction accountant. This quadruple understanding is what sets him apart from other Intuit ProAdvisors and Xero accountants to the benefit of all of the construction contractors he serves across the USA. Visit http://www.fasteasyaccounting.com/randal-dehart/ to learn more.

Our Co-Founder Randal DeHart - Is a Certified PMP (Project Management Professional) with several years of construction project management experience. His expertise is construction accounting systems engineering and process development. His exhaustive study of several leading experts including the work of Dr. W. Edward Deming, Michael Gerber, Walter A. Shewhart, James Lewis and dozens of others was the foundation upon which our Construction Bookkeeping System is based and continues to evolve and improve. Follow Randal on Google+