Many contractors with expensive high-end construction software are re-examining if QuickBooks for Contractors is all they really need and if switching over to it makes sense.

The first thing we ask is which of The Four Types of Contractors best describes your company?

Salt of The Earth

Dog And Pickup Truck

Professional

Enterprise Level

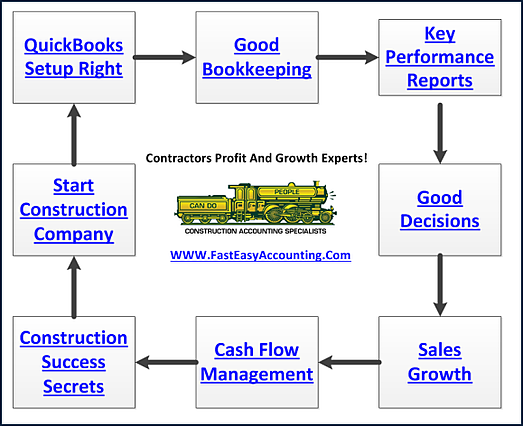

Having used several high-end construction software programs costing over $60,000 and a few low-cost programs under $500 like QuickBooks and Peachtree, and some of the free online bookkeeping programs; I have arrived at the conclusion that for contractors with annual sales volume under $5,000,000 the only answer is QuickBooks For Contractors. For an in-depth comparison of QuickBooks versions, click here.

We started using QuickBooks when it was first released in DOS version in the early 1990s and had been raving fans of it ever since. It's had problems and growing pains; however, Intuit, the parent company of QuickBooks, is good about finding and fixing the issues as evidenced by the number of contractors using it compared to their competitors.

#01 Setup

This is the most critical and least understood part of the selection process (before you set up QuickBooks for Contractors, click here). A correctly set up QuickBooks contractor file will do everything a contractor with less than $5,000,000 in sales will need, including generating reports for:

-

Monthly And Quarterly Tax Returns

-

Sales Tax Returns

-

Payroll Processing

-

Payroll Tax Returns, 941 and 940

-

Contractor Invoicing

-

Work In Progress (WIP) Reporting

-

Preparing Pay Application Invoicing For Remodel

-

Preparing Pay Applications For Tenant Improvement (TI)

-

Job Deposit Tracking

-

Retention Tracking

-

Insurance Audit Support Service

-

QuickBooks Financial Reports

-

Job Costing Reports

Setup is the most expensive hidden cost of all. Anyone who suggests the average contractor can buy construction software and have it up and running in less than 200 hours in a span of several months is stretching the truth. There is a big difference between selling construction software and setting it up to use it.

QuickBooks Setup Has Three Main Phases: Chart of Accounts, Item List, Customers, Vendors, Employees, Payroll; Clean up the existing data; and input the transactions that are behind.

You can do it yourself = 200 hours x $10 an hour you could earn flipping burgers (opportunity cost) adds $2,000 to the value of the software.

Give it to your bookkeeper = 200 hours x $25.29 (Paid $15.00 per hour plus taxes and overhead) adds $5,058 to the cost of the software.

In most cases, you can outsource the complicated and costly QuickBooks Setup, and Job Costing Reports to us, get it done right in a fraction of the time and cost of any other option, and we can clean up QuickBooks existing data and input your back-work or as we call it QuickBooks Catch-Up.

From our extensive knowledge base of Construction Accountants and studying highly profitable contractor's QuickBooks setup files we have developed a library of QuickBooks for contractor modules that we use to build your custom QuickBooks Contractor files in a fraction of the time and at a lower cost. It has made us the leader in setup QuickBooks for Contractors.

#02 Bloat

The more the software costs, the more bells and whistles it has or as I like to say "bloat." Software bloat is construction deceiving because it looks like something you've got to have or you are missing out, the good news is you're not. It merely adds fluff and filler to jack up the price just like college and university textbooks which are sold by the pound.

#03 Construction Bookkeepers Talent Pool

The more expensive the construction software, the more dependent you will be on the developer for tech support and training.

When you pay $1,000 for two days of training for your bookkeeper and their time 16 hours x $25.29 = $404.64 plus lunch $10 x 2 = $20 and parking $10 x 2 = $20 for a total of $1,444.64, they have increased skill sets, and they will ask for a raise or seek employment elsewhere!

Worse yet what if you don't pay for training and they learn by trial and error on your payroll? Do you know What Ten Minutes A Day Costs Your Company?

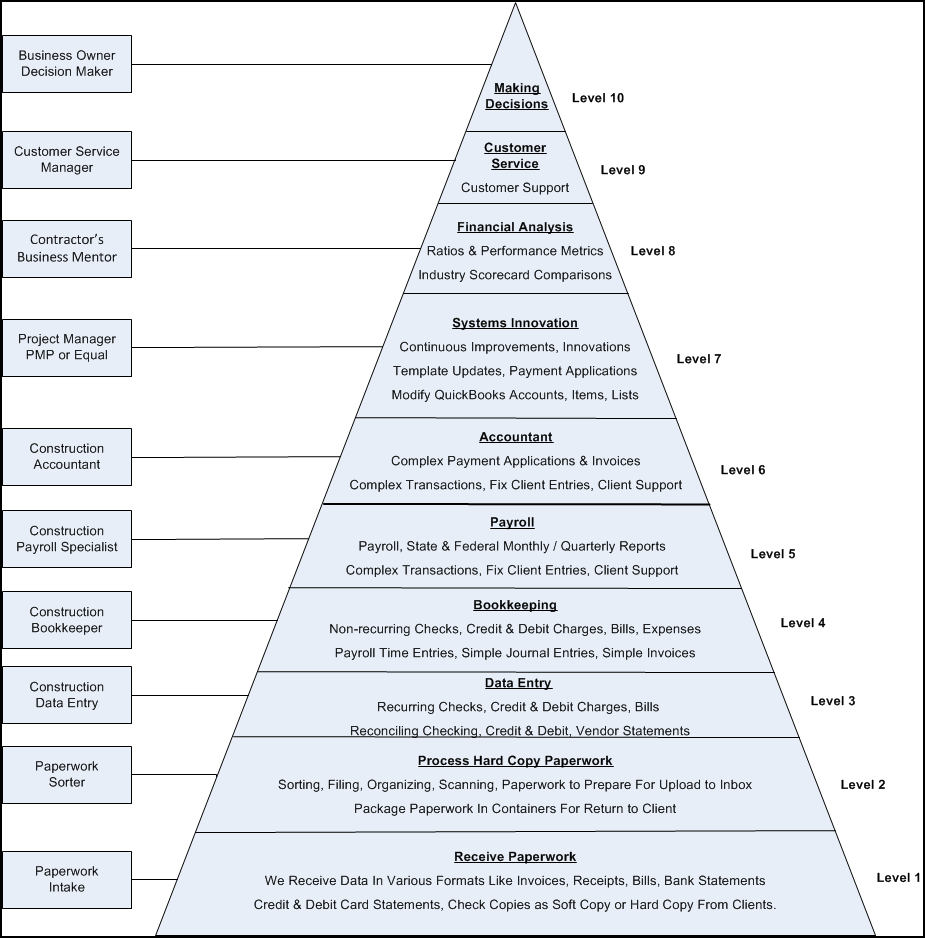

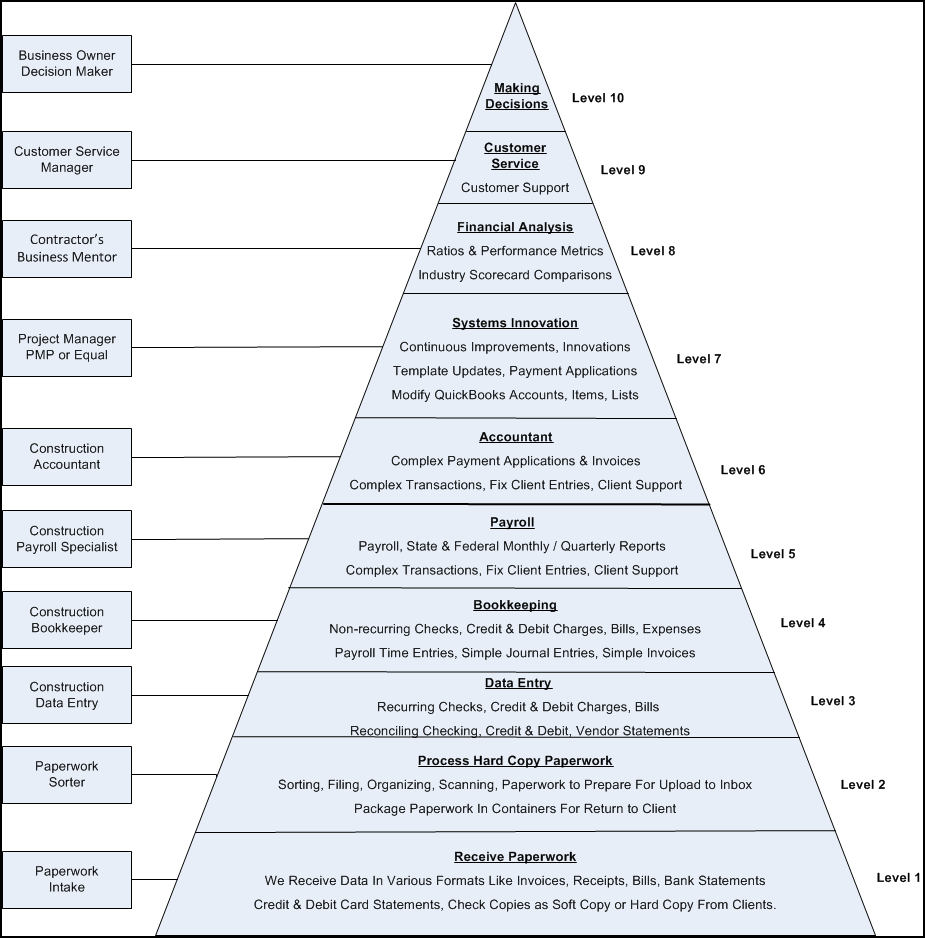

#04 Contractors Bookkeeping Services System

Everything in your construction company that makes money follows a process that is called "CONTROL". For example the steps for building a new house are: Foundation | Framing | Mechanical | Roofing | Finish | Clean up. Everything in your construction company that does costs money and do not follow a logical process is called "CHAOS".

Construction bookkeeping services is a system with a logical process, and when it is followed, you make money; when it is not, it costs you money.

#05 Cloud-Based Construction Software

Cloud-Based Construction Software Is no longer a luxury reserved for enterprise-level contractors. Any contractor using QuickBooks Contractors desktop version can have it too.

We offer a way for you to access the full desktop version of QuickBooks Contractor with all of the built-in reports and the ability to print on your local desktop printer, email, or have documents linked to individual transactions.

You can do just about anything you are doing now with QuickBooks Contractor on your desktop except losing your data due to computer failure, weather, earthquake, flood, fire or other disasters because it is on a secured cloud server with multiple redundant backups and power supplies.

You can even access your QuickBooks Contractor financial reports in the cloud without having to open QuickBooks.

In conclusion:

Consider these five hidden costs when choosing the right construction accounting software for your company. Have a recovery plan in case the entire software crashes during updates/upgrades - this will even cost you more money. The best finish carpentry tools in the hands of a golf professional without proper carpentry training will not produce anything near to what a skilled finish carpenter can. The same can be said about the best construction business consulting and accounting tools in the hands of a skilled finish carpenter. And I say that with respect and admiration for everyone in construction.

Randal DeHart, PMP, QPA is the co-founder of Business Consulting And Accounting in Lynnwood, Washington. He is the leading expert in outsourced construction bookkeeping and accounting services for small construction companies across the USA. He is experienced as a Contractor, Project Management Professional, Construction Accountant, Intuit ProAdvisor, QuickBooks For Contractors Expert and Xero Accounting Specialist. This combination of experience and skill sets provides a unique perspective which allows him to see the world through the eyes of a contractor, Project Manager, Accountant, and construction accountant. This quadruple understanding is what sets him apart from other Intuit ProAdvisors and Xero accountants to the benefit of all of the construction contractors he serves across the USA. Visit http://www.fasteasyaccounting.com/randal-dehart/ to learn more.

Randal DeHart, PMP, QPA is the co-founder of Business Consulting And Accounting in Lynnwood, Washington. He is the leading expert in outsourced construction bookkeeping and accounting services for small construction companies across the USA. He is experienced as a Contractor, Project Management Professional, Construction Accountant, Intuit ProAdvisor, QuickBooks For Contractors Expert and Xero Accounting Specialist. This combination of experience and skill sets provides a unique perspective which allows him to see the world through the eyes of a contractor, Project Manager, Accountant, and construction accountant. This quadruple understanding is what sets him apart from other Intuit ProAdvisors and Xero accountants to the benefit of all of the construction contractors he serves across the USA. Visit http://www.fasteasyaccounting.com/randal-dehart/ to learn more.

Our Co-Founder Randal DeHart - Is a Certified PMP (Project Management Professional) with several years of construction project management experience. His expertise is construction accounting systems engineering and process development. His exhaustive study of several leading experts including the work of Dr. W. Edward Deming, Michael Gerber, Walter A. Shewhart, James Lewis and dozens of others was the foundation upon which our Construction Bookkeeping System is based and continues to evolve and improve. Check out our Contractor Success Map Podcast on iTunes.

The Information Shown Below Is From Fast Easy Accounting

Download the Contractors APP today from the App Store or Android Store

Access Code: FEAHEROS

Click here to download the App on Android:

Click here to download the App on iOS:

Simply scan the QR code or search for ‘MyAccountants’ in the App Store and enter the Access code: FEAHEROS to utilize the powerful App features and capabilities, and benefit from having our Construction Accounting App at your fingertips, 24/7."

PS: Even if you are not a Construction Contractor you will find a plenty of benefits in the app so we invite you to download it too! It's Free so why not?

When You Become A Client - Then we can tap into our resources of knowledge and strategy banks. We use the reports hidden in your QuickBooks in order to diagnose and understand your construction business and develop plans and help you implement a path to success for you and you alone because every contractor has unique Strengths, Weaknesses, Opportunities and Threats (S.W.O.T. Analysis) that when understood can lead to a Strategic Roadmap which cannot help but make a lot of money.

We Remove Contractor's Unique Paperwork Frustrations