Contractors Are Torn Between Over Or Under Managing Their Bookkeeping

Contractors want to maintain control without making any changes. “Keep doing the same thing but expecting a different result.”

Throwing the receipts in a shoebox (behind or under the seat in the truck) is the favorite way to deal with paperwork.

This is “Under Managing” and frustrates everyone around them who is playing “Where’s Waldo.” Job costing is nonexistent; bills are usually paid late, customers are unbilled, lost and forgotten.

Micromanaging Every Detail Is An Over-Reaction From Years Of

Doing As Little Bookkeeping As Possible To Get The Tax Return Prepared

Just Don't Let Not Knowing What To Do Stop You From Making A Mess Of It

Frustrated Contractors Call Me Every Day And Say:

- I can’t get any reports

- I don’t like the reports I am getting

- My tax accountant is not answering all of my questions

- How can I improve my business?

Frustrated In House Bookkeepers Call Me

- Bookkeepers inherit the “CRAP” from everyone who worked in QuickBooks before they arrived and are expected to produce good reports.

- Bookkeepers are expected to use:

- Old Equipment

- One Or Two Tiny Monitors

- Dot Matrix Printer (or equal – the noise an old printer makes when printing is unforgettable)

Do you how long it takes to print on old equipment? Will it print a picture, jpg, pdf? It is a false saving to not buy new equipment. (What are 10 minutes costing you) Are you practicing “Seagull Management?” Fly in, make snap decisions without any facts, details or understanding of the paperwork after it leaves your hand and Flies Out?

Expect Good Reports, “You Know One When You See It” But No Clue What Is Needed To Get It There

Frustrated Spouses Call Me because spouses usually get “Seagull Management” from the contractor. The in-house Bookkeeper, gets that and “Zap Management.” That is when people learn what to do by doing something wrong and getting "Zapped" by the contractor in the form of an insult or nasty comment and the process continues until the Bookkeeper shuts down and doesn't do much of anything at all.

Under both styles, the core problem does not lie with whoever is doing the contractor bookkeeping the source is the Contactor and how the Contractor thinks about their business. How the Contractor reacts at the moment to a crisis? Making dozens or hundreds of decisions (moment by moment activity) every day is part of what being a Contractor is all about. In a way that non-contractors or even their employees do not understand. Embrace it and decisions will come easier.

Is Accounting A Valuable Component Of Your Contracting Company

Or Is It An Expense? M.A.P. Vs. P.A.M.

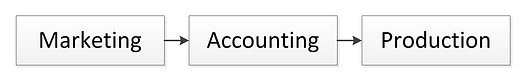

M.A.P. = Marketing Accounting Production

“Success In Construction Is A Simple Discipline Practiced Every Day” - Randalism

This Is The Least Popular - and yet the most profitable way to operate a construction company. Contractors are thinking and acting like a business person.

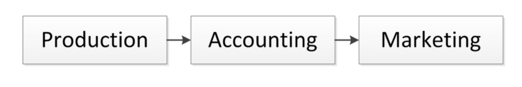

P.A.M. = Production Accounting Marketing

“Failure In Construction Is A Few Simple Errors Repeated Every Day” - Randalism

This Is The Most Popular - and yet the hardest and least profitable way to operate a construction company. Contractors are thinking and doing what they did while working for somebody else instead of thinking and doing what a business person does.

Is Construction Accounting a necessary expense for Taxes Only and no value otherwise (many contractors think only in the “cost” as an “expense” and anybody can do the bookkeeping in 10 minutes a day or less?

Are good Goods Tools important?

- Computer, Monitor, Printer, Fax Machine, Scanner?

- Desk, Chair, Good Lighting, File Cabinet?

- Pens, Pencils, Paperclips, Paper, File Folders, Reams of Paper?

- Telephone, Radio?

- Central Heating And Air Conditioning?

- Access to Clean Well Stocked Restroom?

- Accounting Software On Your Desktop Computer, Laptop, Notebook?

- Backup Cloud Storage, Flash Drive Or Other?

- Is Payroll being processed using the IRS booklet?

I have heard lots and lots of stories about all of these things or should I say lack of those things and more.

Modern technology is for more than storing family pictures.

Contractors try to control bookkeeping details

How does good Accounting add value to your business?

- What is worth to you?

- What is the value of Your Time?

- Knowing the Three “O's Financial Reports.”

- Does It help in Keeping Your Customers Happy?

- In Keeping Your Vendors and Suppliers happy and paid on time?

- If know the answers to these questions is important; then having a properly setup Accounting System should be a priority.

- If Low Price is King, then Shoebox Method and a Manual Bookkeeping System could be the answer.

- Go to any office supply store and they may still carry the Bookkeeping Booklet with packages of forms.

- If Super Basic is a Free or Low Priced Online Accounting System is all you need to file taxes there are hundreds of them.

- Basic Software is where QuickBooks comes into play.

- QuickBooks can grow and expand as your contracting company grows.

- QuickBooks is affordable for every business owner. Even Brand New Contractors starting out.

- It’s most basic function is a checkbook, and from there it is really how much value do you want to from it?

Think Transportation. How you got around as a child, pre-teen, teenager, young adult, older adult?

- Walk Everywhere

- Get a Skateboard

- Bicycle

- Moped

- Used Car (Remember your 1st car?)

- New Car

- Bigger Car

- Van

- SUV

- Truck

- Bigger Truck

How you use QuickBooks is the same

- Keep it simple – Check Book, Invoice Program

- Add a little more to get a few reports,

- Improve the setup a little more for Financial Statements

- Better Financial Statements

- Job Costing Reports

Now as you add more detail (think a painting class, starts with a blank canvas) you need to provide data, receipts, invoices, customer payments, customer details. Accounting in its most basic form is “Garage In = Garbage Out” which sounds very tacky. It is unrealistic to expect Spouse, In-House Bookkeeper, or Outside Accounting Services to be able to provide good, clean, detailed reports without good information from the field, project manager, contractor. Everyone around you cannot guess what job the receipt goes to or why you bought it by looking a receipt.

As a contractor, you understand clearly about the proper tools. My favorite tool is a three-pound sledgehammer. Why because it gives me the most leverage to pound the nail in. (of course, I can’t pull a nail out with it) My answer is a 16P nail works for everything. The funny thing is that Randal does not agree.

Randal has a specific framing hammer that was his favorite when he needed one all the time.

I’ll bet yours is a very specific make, model of a nail gun if your trade is carpentry related.

My point is that the tools for the office are often the first to be cut, last to be upgraded and usually always considered unnecessary. In a bad economy, everyone makes choices on what is important. What to keep, what to chop. Which tool is the most important to buy? In that case, I will be the first to say tools for the field are the most important. As the budget improves; the business tools need to be added into the mix and move up to the top.

Providing Outsourced Accounting and Bookkeeping Services is one of the ways where we actually help with the budget. If bookkeeping is not your skillset, that is ok. We use QuickBooks; we know where to put the transactions into the software. It is optional for clients to have access to their QuickBooks file.

We recommend they have access, but it is not required. If a client wants access to their QuickBooks file; then Intuit requires they own a current copy. If not – We explain where you can save money.

- Saving – Do not need to buy QuickBooks PC Version

- Saving – Do not need to have a new Computer to support QuickBooks

- Saving – Can Access QuickBooks from your existing PC | MAC | IPad | Tablet

- Keep QuickBooks up to date with a proper setup for Construction Contractors

- Keep QuickBooks up to date with the latest Sales Tax Rates (WA State Only)

- Keep QuickBooks up to date, rebuilding the file on a regular basis.

- Keep QuickBooks on a server, with a Commercial Host approved by Intuit.

- Provide annual financial statements for you to pass on to your Tax Accountant

Look forward to chatting with you on “How We Can Help” and is it a good fit for both parties.

I enjoy chatting even when I have to explain that a Contractor’s company to too large to be an Outsourced Accounting Client. We chat and look for ways that are helpful, referrals that may be useful.

Thanks to everyone who is finding the “Perfect” accounting solution on our FastEasyAccountingStore.com

Thinking Happy Thoughts for everyone as we all dodge, bob and weave around the bad weather.

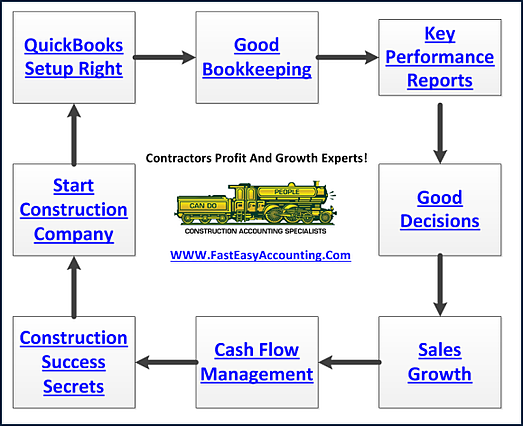

When You Become A Client - Then we can tap into our resources of knowledge and strategy banks. We use the reports hidden in your QuickBooks in order to diagnose and understand your construction business and develop plans and help you implement a path to success for you and you alone because every contractor has unique Strengths, Weaknesses, Opportunities and Threats (S.W.O.T. Analysis) that when understood can lead to a Strategic Roadmap which cannot help but make a lot of money.

We Remove Contractor's Unique Paperwork Frustrations

Thanks for reporting a problem. We'll attach technical data about this session to help us figure out the issue. Which of these best describes the problem?

Any other details or context?

For Construction Company Owners who do not need the full power of a QuickBooks for contractors and want 24/7 online access we offer Xero Accounting Online, and we have a custom setup for construction companies. Click Here For More.

This Is One More Example of how Fast Easy Accounting is helping construction company owners all across the USA including Alaska and Hawaii put more money in the bank to operate and grow your construction company. Construction accounting is not rocket science; it is a lot harder than that, and a lot more valuable to people like you so stop missing out! Call Sharie 206-361-3950 or sharie@fasteasyaccounting.com and schedule your no charge one-hour consultation.

Profitable Contractors and Construction Company owners have known about the value of outsourced bookkeeping services and contractor coaching services like ours for a long time, and now you know about it too!

Thank You For Reading This Far, And I Hope You Understand we really do care about you and all contractors regardless of whether or not you ever hire our services.

We Scan Your Receipts, And Invoices link the appropriate transactions to QuickBooks or Xero Accounting Online depending on the construction accounting service you are using and provide ongoing Cloud Based Contractors Bookkeeping Services by accountants who understand construction.

Our Contractor Bookkeeping Services System Is A System

Thinking About Outsourcing Your Contractors Bookkeeping Services To Save Time And Money?

Click On The Button Below To Download A Free Guide

Business Process Management (BPM) For Contractors

Need Help Now?

Call Sharie 206-361-3950

sharie@fasteasyaccounting.com

Xero Outsourced Construction Accounting Services

QuickBooks Outsourced Construction Bookkeeping Services

We Are Xero Accounting Experts Specializing In Construction Bookkeeping Services

About The Author:

Sharie DeHart, QPA is the co-founder of Business Consulting And Accounting in Lynnwood Washington. She is the leading expert in managing outsourced construction bookkeeping and accounting services companies and cash management accounting for small construction companies across the USA. She encourages Contractors and Construction Company Owners to stay current on their tax obligations and offers insights on how to manage the remaining cash flow to operate and grow their construction company sales and profits so they can put more money in the bank. http://www.fasteasyaccounting.com/sharie-dehart/ 206-361-3950 or sharie@fasteasyaccounting.com

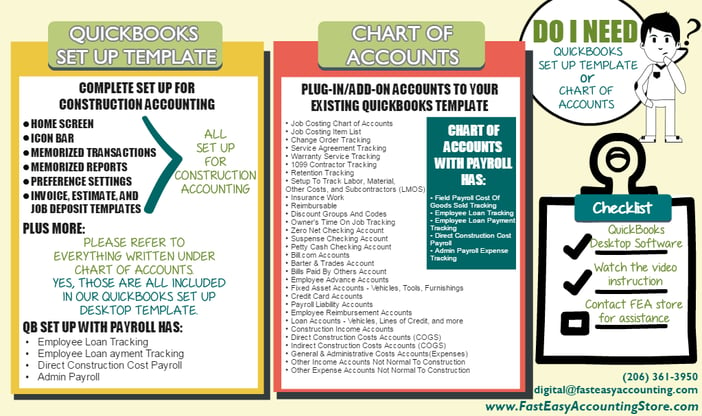

PS: For The Do-It-Yourself Construction Bookkeeper Our Store Has Chock-Full Of QuickBooks Setup Templates, QuickBooks Chart of Accounts And More.

Most Contractors Setup QuickBooks Desktop Version In One Of Three Ways:

#1 EZ Step Interview inside QuickBooks Setup

#2 Asked Their Tax Accountant To Setup QuickBooks

#3 They Attended A How To Setup QuickBooks Class Or Seminar

And QuickBooks Does Not Work The Way They Want It Too!

The Answer:

#1 Click Here To Buy An Entire QuickBooks Setup For Your Specific Contracting Company

#2 Click Here To Buy Just The Chart Of Accounts For Your Specific Contracting Company