Tax Time! Corporate Income Tax Returns are due to the IRS by September 15th for S-Corp and LLC’s filing as an S-Corp

Other types of corporations may be in a fiscal year with varied due dates.

The only exception is any emergency extensions granted due to hurricanes (Harvey) or others.

Personal Income Tax Returns are due to the IRS by October 15th which falls on the weekend and extended to Monday, October 16th.

Keeping Paper Documents is necessary. Most contractors go from one extreme to the other.

One extreme is saving everything for decades, and the other is tossing everything out.

What To Save?

What To Toss Out?

We no longer need to print and save every document in file folders and keep adding new file cabinets.

Happiness is every document that can be retrieved electronically at any time in the future.

Sharie's Seven Paper Tips...

Sharie’s Paper Tip 101

Save your receipts. If you have it in paper Get a file box and toss in all the gas, food, misc receipts paid by credit card. Make a note on the receipt. You have the receipt for backup. I remember a story where someone needed to prove where they were. Charges on the credit card statement weren't enough.

Sharie’s Paper Tip 201

Make individual file folders for your state taxes, quarterly payroll reports, W-2’s, 1099’s.

Other helpful folders are for your Bond, Liability Insurance, Worker’s Comp Insurance, Tools, Office Equipment and Cell Phones. All the statements you may need to reference over and over again and Receipts with extended warranties.

Sharie’s Paper Tip 301

Print a copy of the Contract with your client (electronic signatures is fantastic) use a service that will time and date stamp in case you have an issues. Contracts are great in case of dispute. If all goes well, then The Signed Contract is just another piece of paper. I have heard stories of customers altering the contract, and the contractor did not double check. Magically things happen with software. Be sure what the client signs are the same copy of the contract you sent them and expected to be signed.

Sharie’s Paper Tip 401

Take credit cards. Use multiple services if that is what is available. If you use a service to send your contracts for signature and they have a Merchant Services; then sign up for it. Everything that happens seamlessly is the best. Approval Now + Authorization of Payment means you have real money (their money) to start the job.

OPM (means using Other Peoples Money – meaning you are using the Client’s money to start, continue and finish the job). Build in the Merchant Services Fee into your pricing. Cost of doing business.

Many contractors lost money on Groupon Coupons as customers only would do the One or Two Rooms as was prepaid on the coupon. (Example Carpet Cleaning – Drywall Patching)

Sharie’s Paper Tip 501

Use an invoice built on Excel. Word is pretty and is needed for all the descriptions. But to properly get the money, you expect to be paid Contractors need a form that adds up the money.

Do not call all the payments a Job Deposit all the way from beginning to end. Call it a Statement, Progress Invoice, once work is approved it is no longer an Estimate or a Work Order. If you are in a sales tax state (Washington State) and need to collect sales tax; then be sure to add sales tax to every invoice.

Customers have selective memory. Be sure to use “Plus Applicable Sales Tax” on the Estimate, Contact and all future billings. If sales tax increases you need to be able to pass the increases on to the customer.

Sharie’s Tip 601

Contractors who are doing remodel projects like to have job costing. To achieve basic job costing reports the accounting software needs to know what job the expenses should apply to.

Many contractors will create a single file folder and drop all of the individual receipts in it.

This is handy if they have outsourced their bookkeeping and needed to give their bookkeeping to others to enter into an accounting software (QuickBooks)

One simple way to add more detail for bookkeeping is to have accounts with the primary supplier. The person at the counter will ask you if you have a PO (Purchase Order). Purchase Order does not need to be complicated. Job Name and Job Address. Why both name and address?

Because the name that pays the bill may not be the same as the Nick Name that you know your client as.

Examples: Bob, Bobby, Rob, Robby, Robert or Bill, Billy, Will, William may be the same person to you but not to the bank, credit card company.

Always exciting when Spouse, Family member or good friend helps pay your invoice. From Accounting side; next week, next month, next year will you remember which job the individual receipts are tied to?

Sharie’s Tip 701

For larger projects – file folder for each invoice especially if you are billing Time & Material or Cost Plus.

Keep good records; customers will randomly want to confirm the cost of some or all of the items.

- Does your customer want copies of all receipts?

- Does your customer want to nit pick the price of each 2x4, cost of temp? Service and every dump fee?

- Does your customer Agree Verbally To Change Orders but give excuses when asked to confirm changes on paper or by email?

- Does your customer hide when you ask for payment?

To be better able to assist, we have added our FastEasyAccountingStore.com for the convenience of clients who want to do their bookkeeping and need additional Chart of Accounts and Items Lists to make their QuickBooks File work more efficiently. Option available for Contractors using QuickBooks Desktop (US Version) using our server and continue to do their bookkeeping.

Contractors who want more hands on help to Set Up QuickBooks and want to consider Outsourced Accounting Services using QuickBooks Desktop (access optional) We have a process that begins with chatting about your needs, how and what you are currently doing with your bookkeeping.

Clients range from Brand New Contractor to Seasoned Contractor whether you are currently using Shoe Box, Excel Sheets, QuickBooks Desktop, QuickBooks Online or nothing at all we can help.

Looking forward to being of assistance.

Enjoy your day.

Sharie

About The Author:

Sharie DeHart, QPA is the co-founder of Business Consulting And Accounting in Lynnwood Washington. She is the leading expert in managing outsourced construction bookkeeping and accounting services companies and cash management accounting for small construction companies across the USA. She encourages Contractors and Construction Company Owners to stay current on their tax obligations and offers insights on how to manage the remaining cash flow to operate and grow their construction company sales and profits so they can put more money in the bank. http://www.fasteasyaccounting.com/sharie-dehart/ 206-361-3950 or sharie@fasteasyaccounting.com

When You Become A Client - Then we can tap into our resources of knowledge and strategy banks. We use the reports hidden in your QuickBooks in order to diagnose and understand your construction business and develop plans and help you implement a path to success for you and you alone because every contractor has unique Strengths, Weaknesses, Opportunities and Threats (S.W.O.T. Analysis) that when understood can lead to a Strategic Roadmap which cannot help but make a lot of money.

We Remove Contractor's Unique Paperwork Frustrations

Thanks for reporting a problem. We'll attach technical data about this session to help us figure out the issue. Which of these best describes the problem?

Any other details or context?

For Construction Company Owners who do not need the full power of a QuickBooks for contractors and want 24/7 online access we offer Xero Accounting Online, and we have a custom setup for construction companies. Click Here For More.

This Is One More Example of how Fast Easy Accounting is helping construction company owners all across the USA including Alaska and Hawaii put more money in the bank to operate and grow your construction company. Construction accounting is not rocket science; it is a lot harder than that, and a lot more valuable to people like you so stop missing out! Call Sharie 206-361-3950 or sharie@fasteasyaccounting.com and schedule your no charge one-hour consultation.

Profitable Contractors and Construction Company owners have known about the value of outsourced bookkeeping services and contractor coaching services like ours for a long time, and now you know about it too!

Thank You For Reading This Far, And I Hope You Understand we really do care about you and all contractors regardless of whether or not you ever hire our services.

We Scan Your Receipts, And Invoices link the appropriate transactions to QuickBooks or Xero Accounting Online depending on the construction accounting service you are using and provide ongoing Cloud Based Contractors Bookkeeping Services by accountants who understand construction.

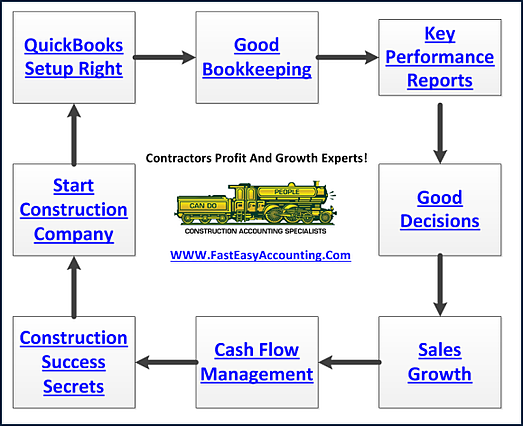

Our Contractor Bookkeeping Services System Is A System

Thinking About Outsourcing Your Contractors Bookkeeping Services To Save Time And Money?

Click On The Button Below To Download A Free Guide

Business Process Management (BPM) For Contractors

Need Help Now?

Call Sharie 206-361-3950

sharie@fasteasyaccounting.com

Xero Outsourced Construction Accounting Services

QuickBooks Outsourced Construction Bookkeeping Services

We Are Also Xero Accounting Experts Specializing In Construction Bookkeeping Services

PS: For The Do-It-Yourself Construction Bookkeeper Our Store Has Chock-Full Of QuickBooks Setup Templates, QuickBooks Chart of Accounts And More.

Most Contractors Setup QuickBooks Desktop Version In One Of Three Ways:

#1 EZ Step Interview inside QuickBooks Setup

#2 Asked Their Tax Accountant To Setup QuickBooks

#3 They Attended A How To Setup QuickBooks Class Or Seminar