Happy New Year

It’s almost the end of the year and time to decide if your employees deserve a Bonus. You may call it a

Generic Employee Bonus, Christmas Bonus, Holiday Bonus or Year End Bonus

Giving An Employee Bonus Comes Down To Cash Flow

Here Are Some Key Questions To Ask Yourself:

- Can I afford to give a bonus?

- Can I afford to give a Bonus to my employees?

- Do I want to give a Bonus to each of my employees?

- How do I decide how much Bonus should I give?

- Reality Check - Is Bonus Taxable?

Starting with the last question first. In most cases, it may be taxable. All forms of Income including Bonus is income to your employee. All income is subject to State, Federal Payroll Taxes and is part of the employee’s W-2.

The most common are to give your employee a set amount known as a ‘Net Check”. It would not quite seem the same to say here is your bonus for $200.00 but the actual check received is for $169.04. Your employee is going to think you are tacky, cheap and you can afford to give them a Big Bonus.

Instead, what you give the employee is a check for $200.00 and the company pays all the payroll taxes.

The value of the bonus is a lot higher when a check is grossed up (meaning you the employer pays all the taxes, company half, employee half of Social Security, Medicare, Federal Withholding, State, Local Taxes)

Review all the outstanding Employee Advances

When an Employee Advance is given, are the employees automatically setup on a repayment plan?

Or, in your mind, the Money is a Payroll Advance with a loose payment plan. You are expecting to sit down and work out something more defined later.

Later is 5 Minutes before you give them the check.

- Did your employee think the money was a non-taxed bonus?

- Did your employee think Non-taxable reimbursement because (fill in the blank)?

- Did your employee think was a Gift because (fill in the blank)?

- Did your employee think it is a net payroll check?

If your employee leaves, quits or gets fired, they usually expect their employee advance is paid in full. Either as a gift or was actually, all unpaid Employee Advances were net payroll checks. Usually, employees think all Payroll Advances as Net Payroll checks if they are planning to collect Unemployment.

As payroll, the amount of the check will increase their projected State Unemployment Benefits. Thinking of all my own clients over the years and with my clients with payroll; it has been by exception that the former employee will send money to cover an outstanding payment plan.

Without a written payment plan signed by the employee, Washington State does not allow the employer to withhold the remaining balance out of the employee’s final payroll check.

Sometimes an employee starts out as a 1099 Contactor. It can be a shock when converting a 1099 Contactor to a W-2 Employee for both the employee and the employer. Everyone is used to no taxes being taken out.

IRS Rule is anyone receiving over $600 or more for the calendar year needs to receive 1099 form

1099 Contractor need to meet the rules of being an Independent Contactor (Trade Contractor or General Contractor) otherwise they can be classified as an employee with back payroll taxes due.

Some states it is more common for Contactors to have mostly 1099 Contractors over formal W-2 Employees. All 1099 Contactors including your Trade Contractors and General Contractors need to be providing you with a https://www.irs.gov/pub/irs-pdf/fw9.pdf. https://www.irs.gov/pub/irs-pdf/fw9.pdf

In 2016 IRS expanded list of those who receive 1099’s to include Attorneys.

Quick Note: Merchant Service Providers, Online Merchant Service Providers are required to provide 1099’s to their clients.

IRS intends to levy increased penalties in 2017 for 1099 Non-File or Late Filers

IRS requires that 1099 be sent to the Independent Contractor and to the IRS. IRS has shorted the deadlines for 1099’s; they are now due on January 31, 2017, same as the employee’s W-2.

Reminder About Your Payroll – You have been putting it off and putting it off. It’s now time to make a decision. It is easy as a Sole Prop or a Member of an LLC treated as a Sole Proprietor No Payroll or W2 required. The rule is that all your Net Profit and Draws are subject to Payroll Tax.

Do not forget that as S-Corp Officers you must have a payroll with a W-2. You are an employee of the corporation and therefore required to have payroll. It does not have to be dollar for dollar on the amount in your Loan To Shareholder account, but it must be a reasonable wage. Your Tax Accountant can help determine “What Is Reasonable.”

Starting Off The New Year

If you contracting company is a Sole Proprietor you may want to consider changing your legal status to S-Corp starting January 1, 2017

If your contracting company is an LLC, you may want to consider filing the IRS Form 2553 to be taxed as an S-Corp or change to an S-Corp.

Year End Review – Time flies when everyone is busy

Start Now - Review your records for the following items:

- Missing Federal Tax ID’s and request the W-9.

- Have all your employees verify their pay stub for the correct address.

- Check Apartment numbers and zip codes. Have any of the neighborhoods been annexed into the city?

Other changes is the IRS Form I-9 was revised November 14, 2016 for new employees.

The new form will be mandatory to use in January 2017.

Year End Accounting Clean Up

- Your Tax Accountant will be sending your booklet with what they want for records.

- As you are looking to the New Year?

- What are the loose odds and ends missing for this year?

- Do you have a formal Accounting System?

- Does it need to be cleanup up the Accounting beyond the last couple of months?

- Do you have bank statements?

- Can you find all your receipts?

It all gets down to Time | Scope | Money

A good tax accountant can do Many Simple or Less Complicated Returns in the same amount of time it takes to do a Messy Complex Business Return. More Tax Returns become more Complex than is really necessary because the documents or lack of documents make it Messy and Hard To Deal With.

Your Reason To Turn It All Over To The Tax Accountant

It’s cheaper to have the Tax Accountant do it than hire a Bookkeeping Service and I don’t want to do it myself because it’s Hard.

Yes - The Tax Accountant can and maybe will do a workaround that is just enough to do the taxes. If you are missing 5%, 10%, 15% or even more; the tax accountant is going to use what you provided, and it will be by exception, your tax accountant will ask for missing documents or even notice they are missing.

Tax accountant will assume you gave them everything you had. When in reality you gave The Tax Accountant only what You thought The Tax Accountant needed versus all of the records that might save you additional money in taxes.

Only you can decide if the lack of good records was worth the low price. A good accounting system will help you make Better Decisions on what to buy when to buy and which type of jobs to accept? When you afford to accept payment plans from your clients? When is the need or ability to raise your prices!

Happy New Year – 2017 is just around the corner - Are you Ready?

Click Here For A Timeless Article About Year- End Closing Tips For QuickBooks

We Remove Contractor's Unique Paperwork Frustrations

Thanks for reporting a problem. We'll attach technical data about this session to help us figure out the issue. Which of these best describes the problem?

Any other details or context?

For Construction Company Owners who do not need the full power of a QuickBooks for contractors and want 24/7 online access we offer Xero Accounting Online and we have custom setup for construction companies. Click Here For More.

This Is One More Example of how Fast Easy Accounting is helping construction company owners all across the USA including Alaska and Hawaii put more money in the bank to operate and grow your construction company. Construction accounting is not rocket science; it is a lot harder than that and a lot more valuable to people like you so stop missing out! Call Sharie 206-361-3950 or sharie@fasteasyaccounting.com and schedule your no charge one-hour consultation.

Profitable Contractors and Construction Company owners have known about the value of outsourced bookkeeping services and contractor coaching services like ours for a long time and now you know about it too!

Thank You For Reading This Far And I Hope You Understand we really do care about you and all contractors regardless of whether or not you ever hire our services.

We Scan Your Receipts And Invoices link the appropriate transactions to QuickBooks or Xero Accounting Online depending on the construction accounting service you are using and provide ongoing Cloud Based Contractors Bookkeeping Services by accountants who understand construction.

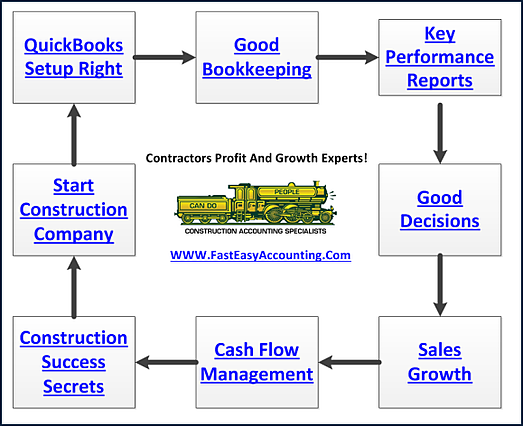

Our Contractor Bookkeeping Services System Is A System

Thinking About Outsourcing Your Contractors Bookkeeping Services To Save Time And Money?

Click On The Button Below To Download A Free Guide

Business Process Management (BPM) For Contractors

Need Help Now?

Call Sharie 206-361-3950

sharie@fasteasyaccounting.com

Xero Outsourced Construction Accounting Services

QuickBooks Outsourced Construction Bookkeeping Services

We Are Xero Accounting Experts Specializing In Construction Bookkeeping Services

About The Author:

Sharie DeHart, QPA is the co-founder of Business Consulting And Accounting in Lynnwood Washington. She is the leading expert in managing outsourced construction bookkeeping and accounting services companies and cash management accounting for small construction companies across the USA. She encourages Contractors and Construction Company Owners to stay current on their tax obligations and offers insights on how to manage the remaining cash flow to operate and grow their construction company sales and profits so they can put more money in the bank. http://www.fasteasyaccounting.com/sharie-dehart/ 206-361-3950 or sharie@fasteasyaccounting.com

PS: For The Do-It-Yourself Construction Bookkeeper Our Store Has Chock-Full Of QuickBooks Setup Templates, QuickBooks Chart of Accounts And More.

Most Contractors Setup QuickBooks Desktop Version In One Of Three Ways:

#1 EZ Step Interview inside QuickBooks Setup

#2 Asked Their Tax Accountant To Setup QuickBooks

#3 They Attended A How To Setup QuickBooks Class Or Seminar

And QuickBooks Does Not Work The Way They Want It Too!

The Answer:

#1 Click Here To Buy An Entire QuickBooks Setup For Your Specific Contracting Company

#2 Click Here To Buy Just The Chart Of Accounts For Your Specific Contracting Company