Field Vs. Office Battle

![]()

![]() Where did the insurrection between office and field start? Do you wonder why some Construction Contractors have ongoing rebellions between the two subgroups and other Contractors don't? Better yet what can you as a Contractor do about it and why should you care?

Where did the insurrection between office and field start? Do you wonder why some Construction Contractors have ongoing rebellions between the two subgroups and other Contractors don't? Better yet what can you as a Contractor do about it and why should you care?

Friction Costs Time And Money

![]()

![]() Start by visualizing what Ten Minutes Of Waste A Day Costs Your Bottom Line.

Start by visualizing what Ten Minutes Of Waste A Day Costs Your Bottom Line.

![]()

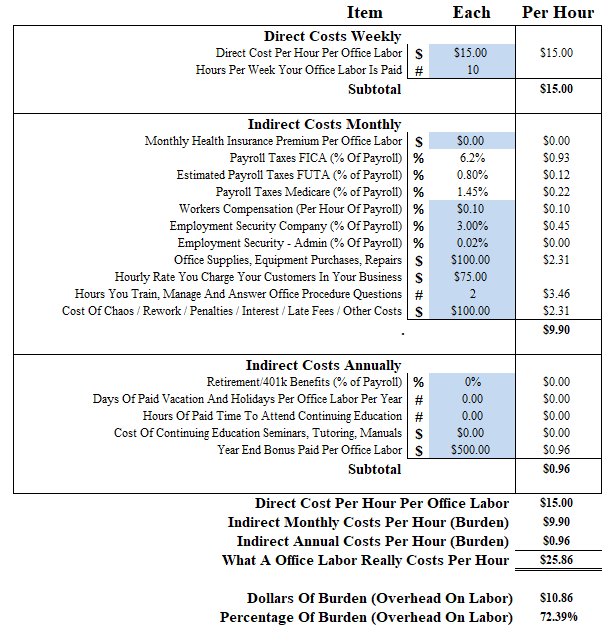

![]() For office staff multiply hourly wage by 1.75 to get a rough estimation of expense. Start with hourly wage + payroll taxes + overhead. Office staff earning $15.00 an hour with payroll taxes and overhead taxes costs roughly $25.86 an hour. $0.43 every minute or $1,120.56 Every Year. At 10% profit you would need $11,205.60 more sales to make up of the loss.

For office staff multiply hourly wage by 1.75 to get a rough estimation of expense. Start with hourly wage + payroll taxes + overhead. Office staff earning $15.00 an hour with payroll taxes and overhead taxes costs roughly $25.86 an hour. $0.43 every minute or $1,120.56 Every Year. At 10% profit you would need $11,205.60 more sales to make up of the loss.

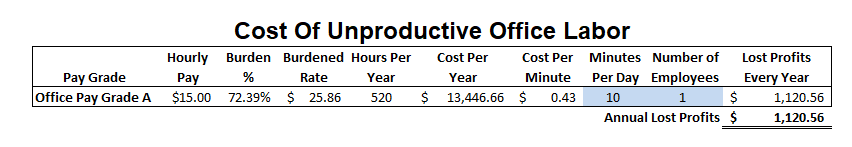

Estimated Bookkeeper Cost

![]()

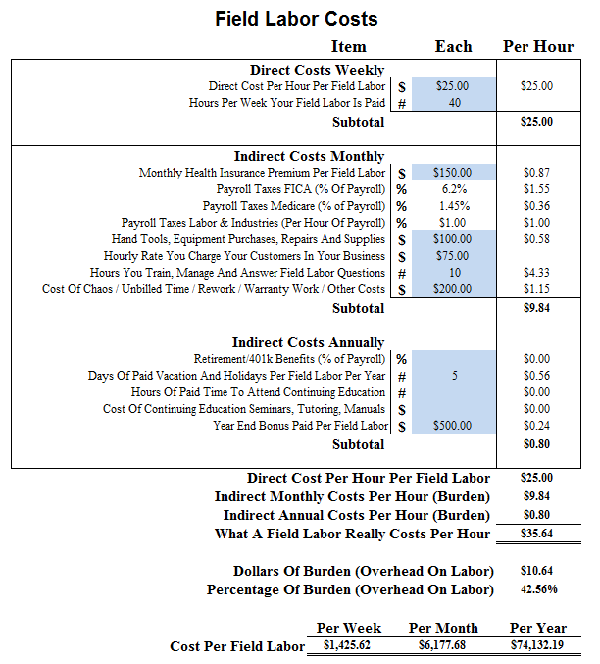

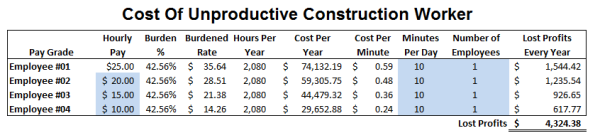

![]() For field multiply their hourly wage by 1.42 to get a rough estimation of what they cost your company in terms of hourly wage + payroll taxes + overhead. For example: Your field worker that you pay $25.00 an hour with payroll taxes and overhead taxes cost you roughly $35.64 an hour or roughly $0.59 every minute or $1,544.42 Every Year. At 10% profit you would need $15,444.20 more sales to make up of the loss.

For field multiply their hourly wage by 1.42 to get a rough estimation of what they cost your company in terms of hourly wage + payroll taxes + overhead. For example: Your field worker that you pay $25.00 an hour with payroll taxes and overhead taxes cost you roughly $35.64 an hour or roughly $0.59 every minute or $1,544.42 Every Year. At 10% profit you would need $15,444.20 more sales to make up of the loss.

Perception Is Reality

![]()

![]() Everyone has a conviction of how the reality. Yet not everyone is mature enough to appreciate "We Live In A World Of What Is; Not What Should Be" - Randalism. This is the elemental reason of misunderstandings which lead to massive declines in productivity, steep deteriorations in cash flow and profits. What Gets Measured Gets Managed. Find and stop cash flow leaks and profit drains by walking a mile in the shoes of both office staff and field workers.

Everyone has a conviction of how the reality. Yet not everyone is mature enough to appreciate "We Live In A World Of What Is; Not What Should Be" - Randalism. This is the elemental reason of misunderstandings which lead to massive declines in productivity, steep deteriorations in cash flow and profits. What Gets Measured Gets Managed. Find and stop cash flow leaks and profit drains by walking a mile in the shoes of both office staff and field workers.

Management By Walking Around

![]()

![]() Spend time in your office and become someone's assistant. Observe how they accomplish their work and understand what they do and why they do it. The number of steps required to process payroll will amaze you. If your construction company does Job Costing that adds several steps to preparing payroll and even more steps when entering receipts, bills, invoices, purchase orders, cash payments and checks.

Spend time in your office and become someone's assistant. Observe how they accomplish their work and understand what they do and why they do it. The number of steps required to process payroll will amaze you. If your construction company does Job Costing that adds several steps to preparing payroll and even more steps when entering receipts, bills, invoices, purchase orders, cash payments and checks.

![]()

![]() Oftentimes your office staff is working with misinformation. A receipt without a job name or address or any clue which job it goes too. A bank statement that only shows the date the check cleared, the check number and the amount without any information regarding who it went too, why or a job name. Office staff believes field workers are lazy and incompetent, field workers believe office staff is too nosy and wasting field workers time.

Oftentimes your office staff is working with misinformation. A receipt without a job name or address or any clue which job it goes too. A bank statement that only shows the date the check cleared, the check number and the amount without any information regarding who it went too, why or a job name. Office staff believes field workers are lazy and incompetent, field workers believe office staff is too nosy and wasting field workers time.

![]()

![]() Many times field workers will bring receipts for material, fuel, permits or something else they paid for personally to the office expecting to get reimbursed immediately. Most of the time the paperwork does not have the job name or any authorization from you or your management team and office staff is reluctant to just pay it. Again field workers judge office staff is trying to cheat them or at minimum playing power tripping games.

Many times field workers will bring receipts for material, fuel, permits or something else they paid for personally to the office expecting to get reimbursed immediately. Most of the time the paperwork does not have the job name or any authorization from you or your management team and office staff is reluctant to just pay it. Again field workers judge office staff is trying to cheat them or at minimum playing power tripping games.

![]()

![]() Reimbursements hidden cost. If field workers do not get instant action they will wantonly expend 10-15 minutes which costs the company $5.90 to $8.85 for their time plus $4.30 to $6.45 for your office staff for a subtotal between $10.20 to $15.30 and that does not include the hidden cost of operating the company vehicle which can range upwards of $2.75 or more a mile.

Reimbursements hidden cost. If field workers do not get instant action they will wantonly expend 10-15 minutes which costs the company $5.90 to $8.85 for their time plus $4.30 to $6.45 for your office staff for a subtotal between $10.20 to $15.30 and that does not include the hidden cost of operating the company vehicle which can range upwards of $2.75 or more a mile.

![]()

![]() Office workers are already overloaded and these interruptions increase their annoyance and strain to a new level which causes them to lash out at the field worker. And so begins the battle between field workers and office staff.

Office workers are already overloaded and these interruptions increase their annoyance and strain to a new level which causes them to lash out at the field worker. And so begins the battle between field workers and office staff.

![]()

![]() Spend time with your field workers and become someone's apprentice. Observe how they perform their work and understand what they do and why they do it. The number of steps required to mobilize on a job site and get tools, material and field workers in place is a process in itself.

Spend time with your field workers and become someone's apprentice. Observe how they perform their work and understand what they do and why they do it. The number of steps required to mobilize on a job site and get tools, material and field workers in place is a process in itself.

![]()

![]() Most of the time when field workers arrive at the job site they encounter blockages from weather, access, electricity, waster, restrooms / portable toilet access, missing plans / blueprints, missing / broken tools, other tradespeople in the way or not having done their part of the job which causes chain-reaction delays.

Most of the time when field workers arrive at the job site they encounter blockages from weather, access, electricity, waster, restrooms / portable toilet access, missing plans / blueprints, missing / broken tools, other tradespeople in the way or not having done their part of the job which causes chain-reaction delays.

![]()

![]() On top of all the other delays and setbacks the bean-counters, office staff, expects them to fill out a time-card with where they are and what they are doing (Cost Codes) and to write notes on every piece of paper before handing it to the bean-counter, office staff. The peeved field worker feels they have to do all the important work and all the office staff work too.

On top of all the other delays and setbacks the bean-counters, office staff, expects them to fill out a time-card with where they are and what they are doing (Cost Codes) and to write notes on every piece of paper before handing it to the bean-counter, office staff. The peeved field worker feels they have to do all the important work and all the office staff work too.

![]()

![]() Office and field are separate but equal. Each skill-set requires different working style and different cultures. It is your profession as the contractor to help everyone come together and understand each other's job and how it fits in the grand scheme of things.

Office and field are separate but equal. Each skill-set requires different working style and different cultures. It is your profession as the contractor to help everyone come together and understand each other's job and how it fits in the grand scheme of things.

![]()

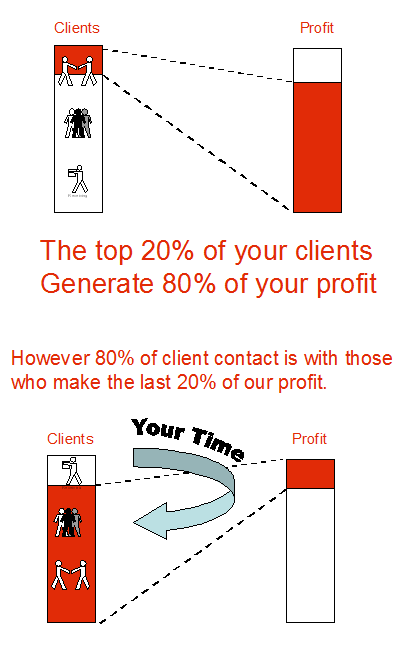

![]() Office ensures your contracting company has a steady flow of projects and develops timely reports to show which ones are profitable so you can pursue more of them and which ones are not profitable so you can avoid them in the future. It is the 80/20 Rule For Contractor Success. To do this, they need to chase after everything.

Office ensures your contracting company has a steady flow of projects and develops timely reports to show which ones are profitable so you can pursue more of them and which ones are not profitable so you can avoid them in the future. It is the 80/20 Rule For Contractor Success. To do this, they need to chase after everything.

How To Combine The 80/20 Rule With Business Process Management

The 80-20 Rule Combined With Business Process Management

Can Improve Your Life In Ways You Never Dreamed Possible!

-

20% Of The Construction Companies - Share the Top 80% of the profits which the owners and shareholders use to support lavish lifestyles because they know what to do when to do it and how to do it!

20% Of The Construction Companies - Share the Top 80% of the profits which the owners and shareholders use to support lavish lifestyles because they know what to do when to do it and how to do it! -

80% Of The Construction Companies - Share the Bottom 20% of the profits which the owners and shareholders use to support just above or just below average lifestyles because they don't know what to do, when to do it or how to do it!

80% Of The Construction Companies - Share the Bottom 20% of the profits which the owners and shareholders use to support just above or just below average lifestyles because they don't know what to do, when to do it or how to do it!

What Successful Contractors Do

![]()

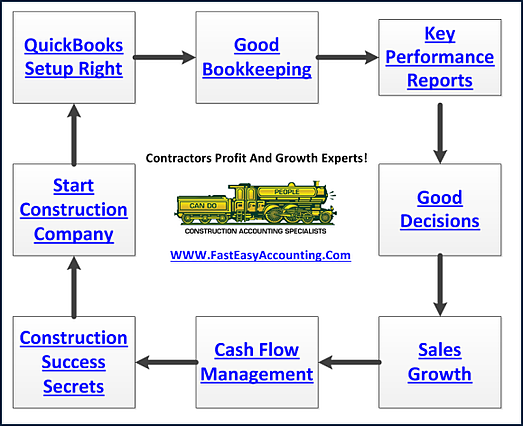

![]() Successful contractors understand how and why the business cycle of construction works and they stay focused on keeping work moving through the four components:

Successful contractors understand how and why the business cycle of construction works and they stay focused on keeping work moving through the four components:

- Acquiring customers and clients

- Doing the project as close to on-time and on budget as possible

- Get job deposits and timely progress payments

- Follow up with the customers and clients to monitor satisfaction and line up new projects

![]()

![]() The key is continuously refining your Contracting System to move from People Dependent To Process Dependent.

The key is continuously refining your Contracting System to move from People Dependent To Process Dependent.

Find The Right People

![]()

![]() Jim Collins authored the best seller Good To Great talks about getting the Right People. Dr W. Edward Deming wrote and spoke extensively about the willing worker and demonstrated with The Red Bead Experiment.

Jim Collins authored the best seller Good To Great talks about getting the Right People. Dr W. Edward Deming wrote and spoke extensively about the willing worker and demonstrated with The Red Bead Experiment.

Summary

![]()

![]() Field versus office battle can rob your contracting company of time, money and resources and eventually wear down even the toughest contractor. Enlightened contractors like you understand the value of developing your own unique Construction Contracting System which is a collection of documented repeatable process and operations manuals which is like to the Rubiks Cube that annoying yet fun toy that can entertain and frustrate you.

Field versus office battle can rob your contracting company of time, money and resources and eventually wear down even the toughest contractor. Enlightened contractors like you understand the value of developing your own unique Construction Contracting System which is a collection of documented repeatable process and operations manuals which is like to the Rubiks Cube that annoying yet fun toy that can entertain and frustrate you.

![]() When You Become A Client - Then we can tap into our resources of knowledge and strategy banks. We use the reports hidden in your QuickBooks in order to diagnose and understand your construction business and develop plans and help you implement a path to success for you and you alone because every contractor has unique Strengths, Weaknesses, Opportunities and Threats (S.W.O.T. Analysis) that when understood can lead to a Strategic Roadmap which cannot help but make a lot of money.

When You Become A Client - Then we can tap into our resources of knowledge and strategy banks. We use the reports hidden in your QuickBooks in order to diagnose and understand your construction business and develop plans and help you implement a path to success for you and you alone because every contractor has unique Strengths, Weaknesses, Opportunities and Threats (S.W.O.T. Analysis) that when understood can lead to a Strategic Roadmap which cannot help but make a lot of money.

We Remove Contractor's Unique Paperwork Frustrations

![]() For Construction Company Owners who do not need the full power of a QuickBooks for contractors and want 24/7 online access we offer Xero Accounting Online, and we have a custom setup for construction companies. Click Here For More.

For Construction Company Owners who do not need the full power of a QuickBooks for contractors and want 24/7 online access we offer Xero Accounting Online, and we have a custom setup for construction companies. Click Here For More.

![]() This Is One More Example of how Fast Easy Accounting is helping construction company owners all across the USA including Alaska and Hawaii put more money in the bank to operate and grow your construction company. Construction accounting is not rocket science; it is a lot harder than that, and a lot more valuable to people like you so stop missing out! Call Sharie 206-361-3950 or sharie@fasteasyaccounting.com and schedule your no charge one-hour consultation.

This Is One More Example of how Fast Easy Accounting is helping construction company owners all across the USA including Alaska and Hawaii put more money in the bank to operate and grow your construction company. Construction accounting is not rocket science; it is a lot harder than that, and a lot more valuable to people like you so stop missing out! Call Sharie 206-361-3950 or sharie@fasteasyaccounting.com and schedule your no charge one-hour consultation.

![]() Profitable Contractors and Construction Company owners have known about the value of outsourced bookkeeping services and contractor coaching services like ours for a long time, and now you know about it too!

Profitable Contractors and Construction Company owners have known about the value of outsourced bookkeeping services and contractor coaching services like ours for a long time, and now you know about it too!

![]() Thank You For Reading This Far, And I Hope You Understand we really do care about you and all contractors regardless of whether or not you ever hire our services.

Thank You For Reading This Far, And I Hope You Understand we really do care about you and all contractors regardless of whether or not you ever hire our services.

![]() We Scan Your Receipts, And Invoices link the appropriate transactions to QuickBooks or Xero Accounting Online depending on the construction accounting service you are using and provide ongoing Cloud Based Contractors Bookkeeping Services by accountants who understand construction.

We Scan Your Receipts, And Invoices link the appropriate transactions to QuickBooks or Xero Accounting Online depending on the construction accounting service you are using and provide ongoing Cloud Based Contractors Bookkeeping Services by accountants who understand construction.

Our Contractor Bookkeeping Services System Is A System

Thinking About Outsourcing Your Contractors Bookkeeping Services To Save Time And Money?

Click On The Button Below To Download A Free Guide

Business Process Management (BPM) For Contractors

Need Help Now?

Call Sharie 206-361-3950

sharie@fasteasyaccounting.com

Xero Outsourced Construction Accounting Services

QuickBooks Outsourced Construction Bookkeeping Services

We Are Xero Accounting Experts Specializing In Construction Bookkeeping Services

About The Author:

![]()

Randal DeHart, PMP, QPA is the co-founder of Business Consulting And Accounting in Lynnwood Washington. He is the leading expert in outsourced construction bookkeeping and accounting services for small construction companies across the USA. He is experienced as a Contractor, Project Management Professional, Construction Accountant, Intuit ProAdvisor, QuickBooks For Contractors Expert and Xero Accounting Specialist. This combination of experience and skill sets provides a unique perspective which allows him to see the world through the eyes of a contractor, Project Manager, Accountant, and construction accountant. This quadruple understanding is what sets him apart from other Intuit ProAdvisors and Xero accountants to the benefit of all of the construction contractors he serves across the USA. Visit http://www.fasteasyaccounting.com/randal-dehart/ to learn more.

Randal DeHart, PMP, QPA is the co-founder of Business Consulting And Accounting in Lynnwood Washington. He is the leading expert in outsourced construction bookkeeping and accounting services for small construction companies across the USA. He is experienced as a Contractor, Project Management Professional, Construction Accountant, Intuit ProAdvisor, QuickBooks For Contractors Expert and Xero Accounting Specialist. This combination of experience and skill sets provides a unique perspective which allows him to see the world through the eyes of a contractor, Project Manager, Accountant, and construction accountant. This quadruple understanding is what sets him apart from other Intuit ProAdvisors and Xero accountants to the benefit of all of the construction contractors he serves across the USA. Visit http://www.fasteasyaccounting.com/randal-dehart/ to learn more.

![]() Our Co-Founder Randal DeHart - Is a Certified PMP (Project Management Professional) with several years of construction project management experience. His expertise is construction accounting systems engineering and process development. His exhaustive study of several leading experts including the work of Dr. W. Edward Deming, Michael Gerber, Walter A. Shewhart, James Lewis and dozens of others was the foundation upon which our Construction Bookkeeping System is based and continues to evolve and improve. Check out our Contractor Success Map Podcast on iTunes and Follow Randal on Google+

Our Co-Founder Randal DeHart - Is a Certified PMP (Project Management Professional) with several years of construction project management experience. His expertise is construction accounting systems engineering and process development. His exhaustive study of several leading experts including the work of Dr. W. Edward Deming, Michael Gerber, Walter A. Shewhart, James Lewis and dozens of others was the foundation upon which our Construction Bookkeeping System is based and continues to evolve and improve. Check out our Contractor Success Map Podcast on iTunes and Follow Randal on Google+

PS: For The Do-It-Yourself Construction Bookkeeper Our Store Has Chock-Full Of QuickBooks Setup Templates, QuickBooks Chart of Accounts And More.

Most Contractors Setup QuickBooks Desktop Version In One Of Three Ways:

![]() #1 EZ Step Interview inside QuickBooks Setup

#1 EZ Step Interview inside QuickBooks Setup

#2 Asked Their Tax Accountant To Setup QuickBooks

#3 They Attended A How To Setup QuickBooks Class Or Seminar