When you do not immediately pay the invoice, some insurance companies will mark this as late and subject you to a late charge. Based on where the Out of State payment needs to be mailed to, it may be impossible to send (by regular mail) and be received on time.

Hence – Online Payments are Accepted. The benefit to The Contractor is proof that the payment was made with a time and date stamp (print) and usually an auto-generated email as backup confirmation that the payment was made.

Overpaying subcontractors can quickly happen if checks are written on the job site. When using handwritten checks, use "Carbon-less Checks" to have a written record of payments made. The charges can be added to the Bookkeeping System without waiting to clear.

Bookkeeping Issues

Sometimes Accounts Payable will have transactions in Accounts Payable that do not belong there. It is easy to put transactions in the Accounts Payable (A/P) Aging Summary and then forget about them. QuickBooks does not automatically look to see if you put something in Accounts Payable when writing a check.

Short-cutting and putting in a bill will distort the financial statements and will not have a clear understanding of details. For example, credit card balances or monthly payments. Credit cards like checking and savings accounts must have all their transactions entered and reconciled.

Taxes due to the Internal Revenue Service, State, and Local Payroll taxes or Sales tax-related obligations. Employee or owner's child support payments do not belong in Accounts Payable.

Payments to and from the company and between owners are Owners Draw, Loan to Members, or Loan To Shareholder, and related transactions do not belong in Accounts Payable because you are not an outside vendor.

Do not create a bill for the company to pay. Anytime it is a company expense, the company should pay direct. There is nothing messier than constant reimbursements to the owner by the company. A bill with no detail looks like a bogus payment to the owner trying to make money out of the company that is being masked as an expense.

The old saying "Devil In The Details" Transactions in QuickBooks need to be explainable without any need to have a story problem to go with it. The Memo line in QuickBooks is short for a reason – less is better and more transactions are better than fewer transactions. Annual tax returns are many pages giving the detail (which may be stated repeatedly on numerous pages). As with Accounts Receivable, the same type of detail applies to Accounts Payable (A/P) Aging Summary.

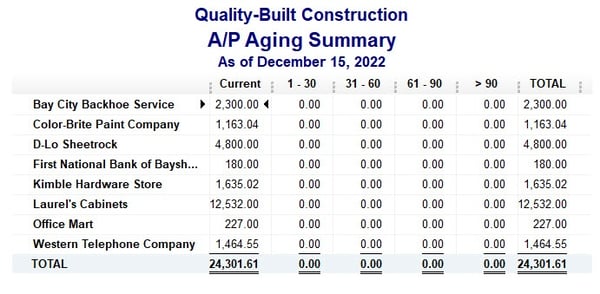

Are the transactions Current, 1-30, 31-60, 61-90, >90 and Total?

Add in the dimension of payment can be done from multiple banks and credit card accounts, and in the case of suppliers, Credit may be applied. Any time there are unpaid balances, the first place to look is, did the amount get paid directly from the checking account? Was the amount slightly different (including a late charge or additional vendor bill not entered into QuickBooks)?

Again if transactions are in as Accounts Payable, they should not appear to be overinflated expenses. To be in QuickBooks under Accounts Payable, the transaction is entered as a bill. Any payments paid directly by the checkbook do not automatically know that a bill has been created. Same with any payment made with a credit card; there is no link between the credit card payment and the bill unless QuickBooks is told the bill was paid by credit card.

Negative numbers in the Accounts Payable (A/P) Summary mean that the vendor was paid as a bill without any bill being entered. The Accounts Payable aging report reflects how long it takes you to pay your bills.

Unless you have won the lottery (which we all want to do), you must collect before paying your bills. The favorite way for Contractors to pay their bills is to Collect a job deposit, buy a new vehicle, tools, or equipment and then pay any outstanding invoices. When paying Old Bills with New Money (not money collected from the job that the bills were associated with) is "Robbing Peter To Pay Paul" (author unknown).

I get it. It is a more natural number to know. How much the customer owes you (especially if the job is Time and Material or Cost Plus) is hard. Not all of the bills may not have arrived from your Vendors or Subcontractors.

Then there is the issue of how you billed. Was it straightforward for the customer to pay you? You may forget or forgive the bill and receive payment from your customer, but it is unrealistic to expect or hope that your Vendors, Suppliers, or Subcontractors will do the same. What is guaranteed is that the Bills will come and continue to occur.

Final thoughts

Bills, bills, and more bills are set up on auto-pay so they will get their money. The question is, how will you pay the bills? When will you pay the bills? Are you paying with Income from Customers? Credit Cards racking up your debt? The line of Credit which, again, is racking up debt? Personal savings or investments? (borrowing from tomorrow to pay for yesterday) Borrowing on your House? Borrowing from a Pay Day Type of Lender (some take repayment daily automatically from your banking account)? Borrowing from the Government by not filing and paying by the due dates?

Keeping up and paying bills is a challenge in the best of times. With proper bookkeeping, you can know: Whom You Owe, When Your Payment Is Due; if you plan, you can pay the balance in full. Moreover, my favorite is not double pay if it can be avoided.

It is a big deal to know the rules. Sometimes asking for a payment plan is the only option. If it is necessary, ask nicely, ask politely, ask as long of time pay as possible, for as small of a monthly payment as they will give you. It is better to double up on a low payment (to pay off sooner) than have a large payment that is impossible to pay.

Again, I am here to help you a little or a lot, depending on your construction business needs. Schedule your free consultation here.

About The Author:

![]() Sharie DeHart, QPA is the co-founder of Business Consulting And Accounting in Lynnwood, Washington. She is the leading expert in managing outsourced construction bookkeeping and accounting services companies and cash management accounting for small construction companies across the USA. She encourages Contractors and Construction Company Owners to stay current on their tax obligations and offers insights on how to manage the remaining cash flow to operate and grow their construction company sales and profits so they can put more money in the bank. Call 1-800-361-1770 or sharie@fasteasyaccounting.com

Sharie DeHart, QPA is the co-founder of Business Consulting And Accounting in Lynnwood, Washington. She is the leading expert in managing outsourced construction bookkeeping and accounting services companies and cash management accounting for small construction companies across the USA. She encourages Contractors and Construction Company Owners to stay current on their tax obligations and offers insights on how to manage the remaining cash flow to operate and grow their construction company sales and profits so they can put more money in the bank. Call 1-800-361-1770 or sharie@fasteasyaccounting.com

OUTSOURCED ACCOUNTING FOR

THE BUSY CONTRACTOR

IN A MOBILE ENVIRONMENT

|

|

|

|

Download the Contractors APP today from the App Store or Android Store

Access Code: FEAHEROS

Click here to download the App on Android:

Click here to download the App on iOS:

Simply scan the QR code or search for ‘MyAccountants’ in the App Store and enter the Access code: FEAHEROS to utilize the powerful App features and capabilities, and benefit from having our Construction Accounting App at your fingertips, 24/7."

PS: Even if you are not a Construction Contractor you will find a plenty of benefits in the app so we invite you to download it too! It's Free so why not?