Recently a construction contractor and his wife came to our Construction Accounting office in Lynnwood Washington and related a rather interesting story about a freelance bookkeeper that was coming into their home office where they are operating a small construction company to work on their QuickBooks For Contractors company file.

They told how the freelance bad bookkeeper they hired never could get the bank reconciliation window in QuickBooks to match the bank statement. The bookkeeper would do a forced reconciliation which only compounded the problem causing their Financial Statements and Job Costing Reports to be less accurate and not as useful to them as they needed.

In addition to several major bookkeeping errors the bookkeeper insisted that she never did anything wrong and it was the bank's fault if she could not reconcile the bank statement with QuickBooks.

Furthermore the contractor and his wife were severely agitated because the freelance bookkeeper was caught in the master bedroom going through the couple's jewelry box and regularly inspecting everything in their bathroom medicine cabinet.

They had read several articles on our blog and a few dozen web pages on our website Fast Easy Accounting and listened to some of our Podcasts

Ten Solid Reasons Not To Have A Bookkeeper Come To Your Home Office

#01 - A Stranger In Your House. Yes you may be letting your construction workers come inside your home office but they rarely stay more than a few minutes and most of them are more interested in what is going on at the job-site than what is going on in your home and if they wander off into parts of your home they shouldn't you or your spouse or children are likely to notice and report it to you.

#02 - Going Through Your Belongings. Bookkeeping is boring and tedious which means the bookkeeper may need a break or a distraction. Since the bookkeeper is inside your home their movements tend to go unnoticed. Some bookkeepers are curious about what you have in your medicine cabinet, jewelry box, petty cash drawer and who knows what else they may find interesting.

#03 - Blackmail Opportunities. Many times contractors have told us about how the bookkeepers have snooped around the contractor's email, USPS mail, in their desk drawers and listened in on phone calls looking for opportunities to Get-Rich-Quick by finding something to black-mail the contractor with. In one case a Bad Bookkeeper discovered the contractor was having an affair with another married woman and used the information to get a raise in pay and be promoted to Office Manager. It lasted for a short while until the contractor broke off the affair and fired the Bookkeeper/Office Manager.#05 - QuickBooks Is A Disaster. No surprise there. You thought all accounting was the same and since the bookkeeper you hired worked for another construction company for several years before they filed bankruptcy they should know and understand construction accounting. In most cases not so because there is a world of difference between construction accounting and regular accounting. Look inside QuickBooks Chart of Accounts and if you see less than 25 Cost of Goods Sold Accounts chances are you have a regular bookkeeper, not a construction bookkeeper.

#07 - Bookkeeper Working In Your Home Office Can Embezzle Easier. Bookkeeper embezzlement is on the rise and the first thing any embezzler has to do is gain your trust. What better way to start then being invited into you home, the place where you are supposed to feel the most safe and secure. Click Here To Learn About The 21 Signs of Bookkeeper Embezzlement to protect yourself, your family and your assets.

#08 - Food Poisoning Or allergic Reactions. You have food and beverages in your house and some of the containers have been opened or never sealed in the first place like the milk jug, soda pop bottle, leftovers, fresh baked goods or any number of food and beverages. Unless you have a food handler's license or permit and the appropriate safeguards in place like a five star restaurant and a commercial restaurant liability insurance to protect you (I doubt your construction company liability policy will be much use, check with your insurance agent) and your bookkeeper becomes ill guess who is likely to pay all of the medical bills, time of work, rehabilitation and pain and suffering? You! And get in line with all of the other business owners who said "Nobody told me not to serve unsealed food and drink" because ignorance is no defense.

#09 - Sexual Harassment. It is too easy for the bookkeeper to claim sexual harassment since he or she is inside a private residence and not in a public place like an office building where there are more people. And just know it can be very costly for the you, the big bad contractor or your spouse to defend the claim regardless what happened or did not happen.

#10 - Your QuickBooks Files Walk Out The Door. Most contractors with a home based business never back up any of their files and especially there QuickBooks files and when the bookkeeper decides to leave all too often it is because QuickBooks is a disaster and in some cases they simply download it onto a flash drive and take it with them to hold for ransom, their final paycheck or payment. The poor unfortunate souls who do think they are backing up their QuickBooks files rarely get the chance to test the system until the try to restore a bad, corrupted, lost or stolen QuickBooks file and that is when they find out the hard way there a several data files that go into making QuickBooks work. It is not like backing up an Excel file or Word document. Most commercial backup services like DropBox.com and Box.com make it clear in their license agreements that QuickBooks file backups are not guaranteed to work. I will not even go into the number of contractors who thought the QuickBooks backup system inside QuickBooks works, google "why doesn't my QuickBooks backup work" and see for yourself. The only sure way we have found is to have our own web server inside an Intuit Commercial Hosting Environment.

The Final Statement From The Contractor's Wife Is Priceless

"I will never have to meet you again (Sharie), you will never come to my house

Because with technology we can make everything work."

We Remove Contractor's Unique Paperwork Frustrations

For Construction Company Owners who do not need the full power of QuickBooks for contractors and want 24/7 online access we offer Xero Accounting Online and we have custom setup for construction companies. Click Here For More.

This Is One More Example of how Fast Easy Accounting is helping construction company owners all across the USA including Alaska and Hawaii put more money in the bank to operate and grow your construction company. Construction accounting is not rocket science; it is a lot harder than that and a lot more valuable to people like you so stop missing out! Call Sharie 206-361-3950 or sharie@fasteasyaccounting.com and schedule your no charge one-hour consultation.

Profitable Contractors and Construction Company owners have known about the value of outsourced bookkeeping services and contractor coaching services like ours for a long time and now you know about it too!

Thank You For Reading This Far And I Hope You Understand we really do care about you and all contractors regardless of whether or not you ever hire our services.

We Scan Your Receipts And Invoices link the appropriate transactions to QuickBooks or Xero Accounting Online depending on the construction accounting service you are using and provide ongoing Cloud Based Contractors Bookkeeping Services by accountants who understand construction.

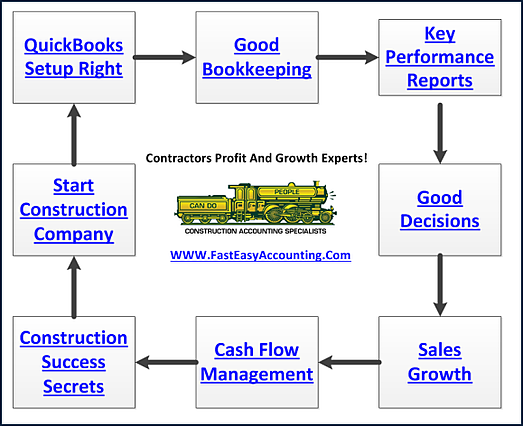

Our Contractor Bookkeeping Services System Is A System

Thinking About Outsourcing Your Contractors Bookkeeping Services To Save Time And Money?

Click On The Button Below To Download A Free Guide

Business Process Management (BPM) For Contractors

Need Help Now?

Call Sharie 206-361-3950

sharie@fasteasyaccounting.com

Xero Outsourced Construction Accounting Services

QuickBooks Outsourced Construction Bookkeeping Services

We Are Xero Accounting Experts Specializing In Construction Bookkeeping Services

About The Author:

Randal DeHart, PMP, QPA is the co-founder of Business Consulting And Accounting in Lynnwood Washington. He is the leading expert in outsourced construction bookkeeping and accounting services for small construction companies across the USA. He is experienced as a Contractor, Project Management Professional, Construction Accountant, Intuit ProAdvisor, QuickBooks For Contractors Expert and Xero Accounting Specialist. This combination of experience and skill sets provides a unique perspective which allows him to see the world through the eyes of a contractor, Project Manager, Accountant and construction accountant. This quadruple understanding is what sets him apart from other Intuit ProAdvisors and Xero accountants to the benefit of all of the construction contractors he serves across the USA. Visit http://www.fasteasyaccounting.com/randal-dehart/ to learn more.

Randal DeHart, PMP, QPA is the co-founder of Business Consulting And Accounting in Lynnwood Washington. He is the leading expert in outsourced construction bookkeeping and accounting services for small construction companies across the USA. He is experienced as a Contractor, Project Management Professional, Construction Accountant, Intuit ProAdvisor, QuickBooks For Contractors Expert and Xero Accounting Specialist. This combination of experience and skill sets provides a unique perspective which allows him to see the world through the eyes of a contractor, Project Manager, Accountant and construction accountant. This quadruple understanding is what sets him apart from other Intuit ProAdvisors and Xero accountants to the benefit of all of the construction contractors he serves across the USA. Visit http://www.fasteasyaccounting.com/randal-dehart/ to learn more.

Our Co-Founder Randal DeHart - Is a Certified PMP (Project Management Professional) with several years of construction project management experience. His expertise is construction accounting systems engineering and process development. His exhaustive study of several leading experts including the work of Dr. W. Edward Deming, Michael Gerber, Walter A. Shewhart, James Lewis and dozens of others was the foundation upon which our Construction Bookkeeping System is based and continues to evolve and improve. Check out our Contractor Success Map Podcast on iTunes and Follow Randal on Google+