If You Own A Construction Company - Then you know Bookkeeping is one of those mundane, nasty, dirty, aggravating, grubby little chores somebody is going to get stuck with along with its rotten scoundrel cousin the Monthly / Quarterly Tax Returns.

If You Have Employees - Whoa! Look out! Now you have to process payroll. In some cases you may decide it is better to provide cash advances to your employees if it helps them stay focused on the job and not on personal issues. Finally, there are all the quarterly payroll tax returns to be prepared and filed.

Some Contractors - Decide their time is better-spent meeting prospective clients, putting together bids, managing jobsites and anything other than providing their own contractor bookkeeping services. So, they find someone else to do it and that is the subject of this article.

Just Like There Are - Skilled construction workers and clowns trying to pass themselves off as skilled workers there are Professional Bookkeepers and clowns who are really only Bad Bookkeepers.

You Know How To - Tell if someone knows what they are doing in construction because you have been doing it a while.

You May Not Know - If you have a professional bookkeeper or a bad bookkeeper unless you have at least 10,000 hours of training in accounting and another 10,000 hours training in construction accounting so here are the top ten things to watch out for:

Red Flag #1 Professionals Have A Real Office - Professionals in any field, doctors, lawyers, consultants and contractors bookkeeping services that cannot afford to maintain an office, even a small one room office, outside their home is in my opinion dangerous, dangerous, dangerous!

The Ones Who Say - "I keep my overhead low" may as well be saying "Your records are available to any of my family, friends and neighbors to rummage through them because I am not the least bit concerned about your exposure to Identity theft or you competition getting a peek at what your construction company is all about."

Red Flag #2 Professionals Do Not Work Alone - Because it is too easy to get sloppy and lazy when there is nobody else looking over his or her work. After a while, they develop a severe case of the stupids! Just like a hermit living in the mountains in a cabin, they go stir crazy.

Red Flag #3 Professionals Accept Credit Cards - Wanna Bees don't and in a lot of cases it is because of bad credit score, business location, business setup, criminal record, (Perhaps involving embezzlement) and a whole lot of other reasons including the fact that it cost money to take credit and debit cards.

The Ones Who Say - "It costs money to accept credit cards" ask them if they use credit cards ask yourself, "What are they really saying?"

Fast Easy Accounting - Accepts all major credit and debit cards including Visa, MasterCard, Novus, Discover, American Express, Check Cards, Cash, Checks and Wire Transfer. And it does not cost you anything extra!

Red Flag #4 Bad Bookkeeper - For a short list of Bad Bookkeeper Traits Click Here

Red Flag #5 Time Billing Only - Professional Bookkeeping Services charge a flat monthly fee for services. Only someone who does not know what they are doing still charges by the hour.

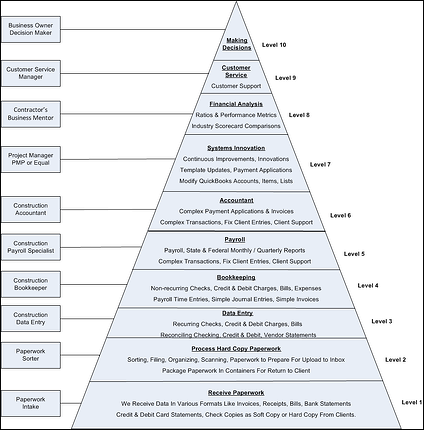

We Are Construction Accountants For Goodness Sake - Any bookkeeping or accounting firm that does not know how to calculate complex algorithms to allow for fluctuations in the workload and generate a monthly fee that is fair needs to go back to school and re-take courses on Decision Modeling, Statistical Analysis and Business Process Management.

All Professional Contractor Bookkeeping Services - Have formulas for calculating fee structures. It is not rocket science:

-

How many employees do you have? From that we know how much time and effort will be required to process payroll and do the tax reports

-

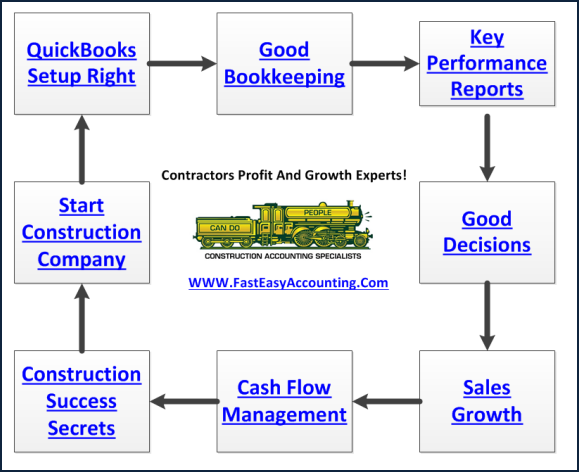

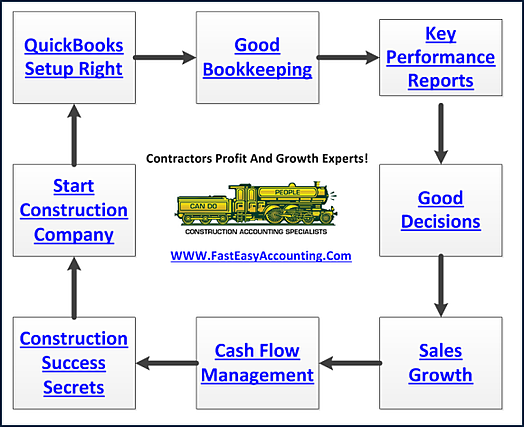

What type of construction do you do? New house builder, residential or commercial remodel, service work, residential, commercial? From the number of employees and the type of work you do we know how much time and effort will be required to do all the bookkeeping, bank and vendor reconciliations and the rest because we have a System. Click Here To Learn About Our System

Red Flag #6 All Businesses Welcome - Gone is the day of the person sitting at the desk with green eyeshades handling the books for all kinds of companies and industries. The complexities and speed of change in all industries means you need a firm that really understands your industry. If it is construction and you are based anywhere in the USA including Alaska and Hawaii we are your best choice.

You Are Facing Fierce Competition - And it is getting worse. You need someone who specializes in your industry. If you are in the construction industry, we can help. If you are in the restaurant industry or anything other than construction, sorry, we are not your best choice.

Red Flag #7 Your QuickBooks Is Hidden - Today more than ever you need to have access to your QuickBooks. Any bookkeeping service that cannot or will not allow you 24/7 access to your QuickBooks Desktop Version in a cloud based environment is doing you a disservice. If you do not want or need it that is O.K. too! But if you ever decide you want access to it that should be easy for them to provide.

Red Flag #8 Annual Tax Return And Bookkeeping - Bad, Bad, Bad....I have written several articles on this subject and you can Click Here For The Best One

Red Flag #9 Unwilling To Collaborate - When your bookkeeper gets a bit uncomfortable about other people being involved and overseeing your financial records you have a BIG PROBLEM.

We Advocate Trust-But-Verify - There are five people you need on your Board of Advisors and you are paying for their services anyway so you may as well take full advantage of them. They are there to help you.

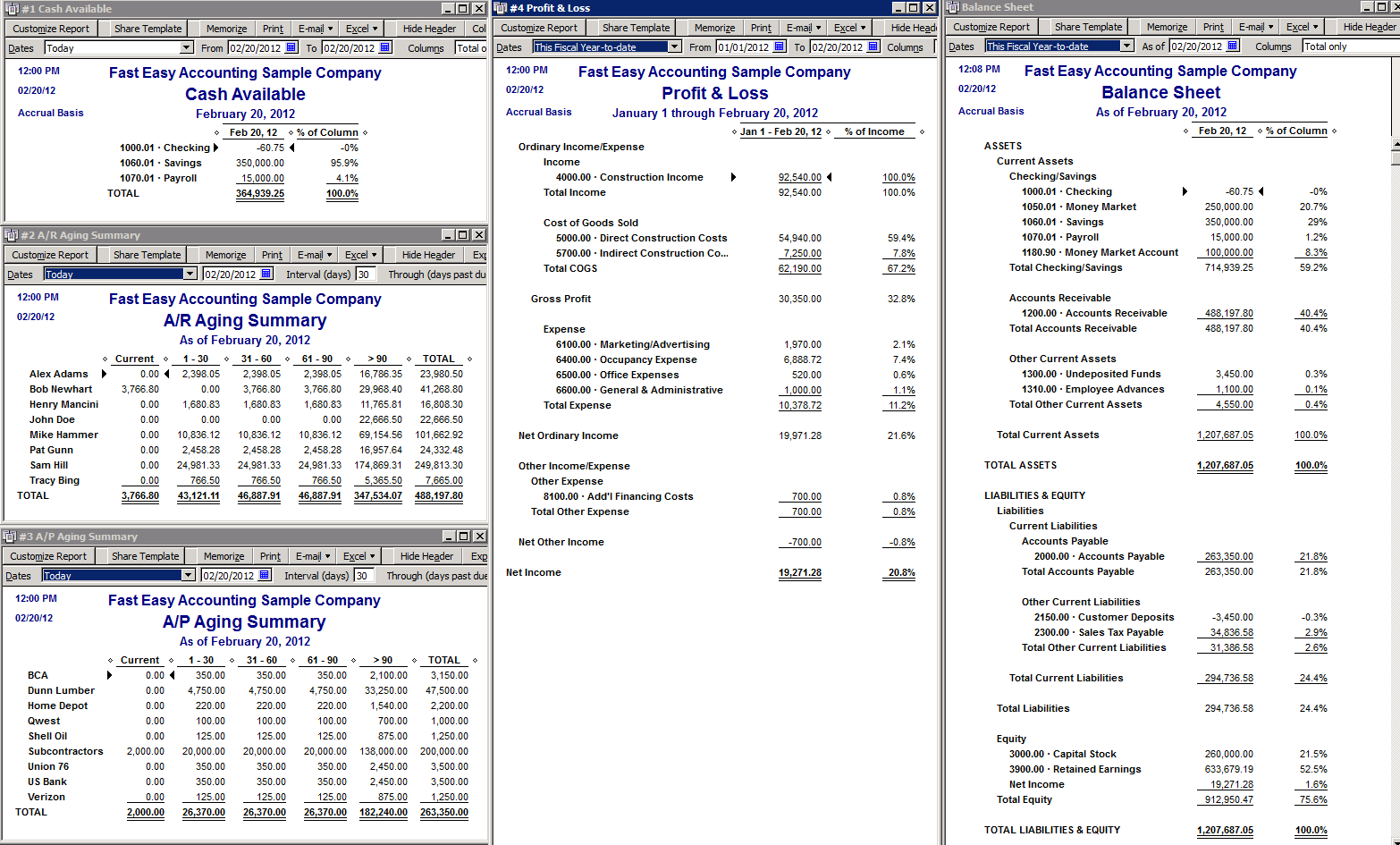

Red Flag #10 They Do Not Understand KPI - KPI is short for Key Performance Indicators also known as the Five Key Reports every contractor needs.

Here Are The Key Performance Indicators:

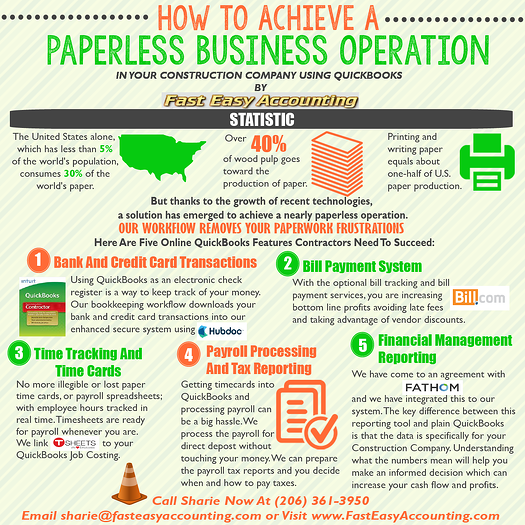

We Remove Contractor's Unique Paperwork Frustrations

For Construction Company Owners who do not need the full power of QuickBooks for contractors and want 24/7 online access we offer Xero Accounting Online and we have custom setup for construction companies. Click Here For More.

This Is One More Example of how Fast Easy Accounting is helping construction company owners all across the USA including Alaska and Hawaii put more money in the bank to operate and grow your construction company. Construction accounting is not rocket science; it is a lot harder than that and a lot more valuable to people like you so stop missing out! Call Sharie 206-361-3950 or sharie@fasteasyaccounting.com and schedule your no charge one-hour consultation.

Profitable Contractors and Construction Company owners have known about the value of outsourced bookkeeping services and contractor coaching services like ours for a long time and now you know about it too!

We Scan Your Receipts And Invoices link the appropriate transactions to QuickBooks or Xero Accounting Online depending on the construction accounting service you are using and provide ongoing Cloud Based Contractors Bookkeeping Services by accountants who understand construction.

Our Contractor Bookkeeping Services System Is A System

Thinking About Outsourcing Your Contractors Bookkeeping Services To Save Time And Money?

Click On The Button Below To Download A Free Guide

Business Process Management (BPM) For Contractors

Need Help Now?

Call Sharie 206-361-3950

sharie@fasteasyaccounting.com

Xero Outsourced Construction Accounting Services

QuickBooks Outsourced Construction Bookkeeping Services

We Are Xero Accounting Experts Specializing In Construction Bookkeeping Services

About The Author:

Randal DeHart, PMP, QPA is the co-founder of Business Consulting And Accounting in Lynnwood Washington. He is the leading expert in outsourced construction bookkeeping and accounting services for small construction companies across the USA. He is experienced as a Contractor, Project Management Professional, Construction Accountant, Intuit ProAdvisor, QuickBooks For Contractors Expert and Xero Accounting Specialist. This combination of experience and skill sets provides a unique perspective which allows him to see the world through the eyes of a contractor, Project Manager, Accountant and construction accountant. This quadruple understanding is what sets him apart from other Intuit ProAdvisors and Xero accountants to the benefit of all of the construction contractors he serves across the USA. Visit http://www.fasteasyaccounting.com/randal-dehart/ to learn more.

Randal DeHart, PMP, QPA is the co-founder of Business Consulting And Accounting in Lynnwood Washington. He is the leading expert in outsourced construction bookkeeping and accounting services for small construction companies across the USA. He is experienced as a Contractor, Project Management Professional, Construction Accountant, Intuit ProAdvisor, QuickBooks For Contractors Expert and Xero Accounting Specialist. This combination of experience and skill sets provides a unique perspective which allows him to see the world through the eyes of a contractor, Project Manager, Accountant and construction accountant. This quadruple understanding is what sets him apart from other Intuit ProAdvisors and Xero accountants to the benefit of all of the construction contractors he serves across the USA. Visit http://www.fasteasyaccounting.com/randal-dehart/ to learn more.

Our Co-Founder Randal DeHart - Is a Certified PMP (Project Management Professional) with several years of construction project management experience. His expertise is construction accounting systems engineering and process development. His exhaustive study of several leading experts including the work of Dr. W. Edward Deming, Michael Gerber, Walter A. Shewhart, James Lewis and dozens of others was the foundation upon which our Construction Bookkeeping System is based and continues to evolve and improve. Check out our Contractor Success Map Podcast on iTunes and Follow Randal on Google+