It is no secret that contractors are among the industries where many cash transactions take place and sometimes they get busy and forget to deposit the money in the bank, properly track it inside their contractors bookkeeping services system and pay the taxes on it.

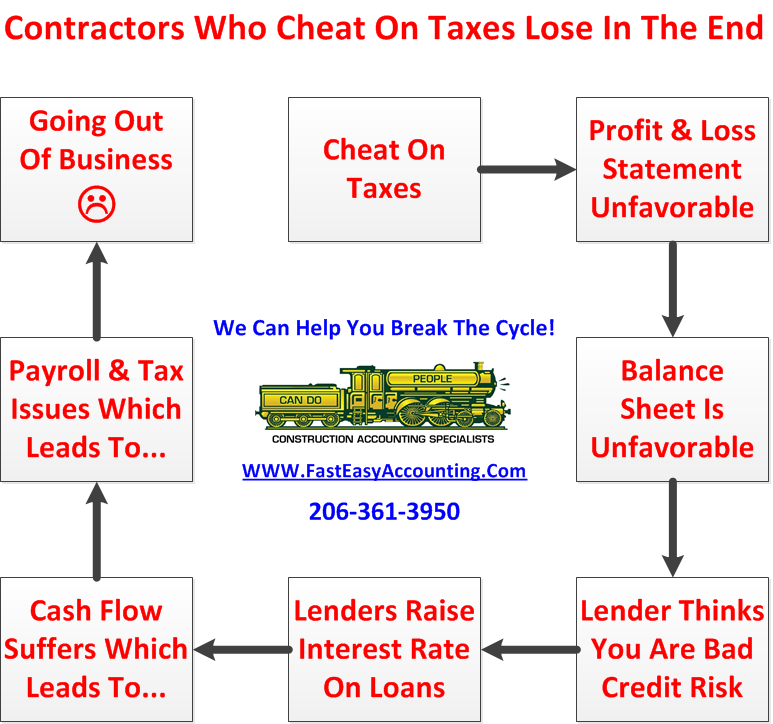

From several decades of experience and observations as construction accountants serving contractors all across the USA including Alaska and Hawaii we have proof that contractors who cheat on their taxes lose out on enjoying big cash flow and profits in the long run. Their financial statements give lenders and creditors the impression they do not know how to run a Construction Company, which in most cases is absolutely false!

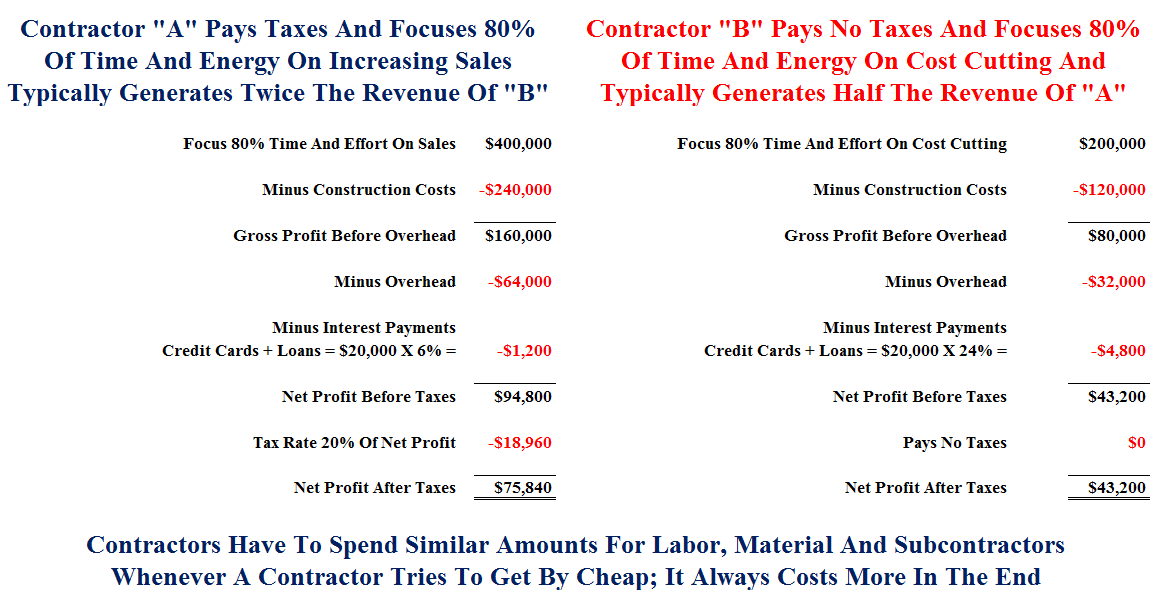

Let's Run The Numbers With Two Fictional Contractors

There are several more unintended consequences that are hard to measure the true impact to your net profit and overall wealth-buildingcapabilities I will submit just one of the dozens of examples I have for your consideration:

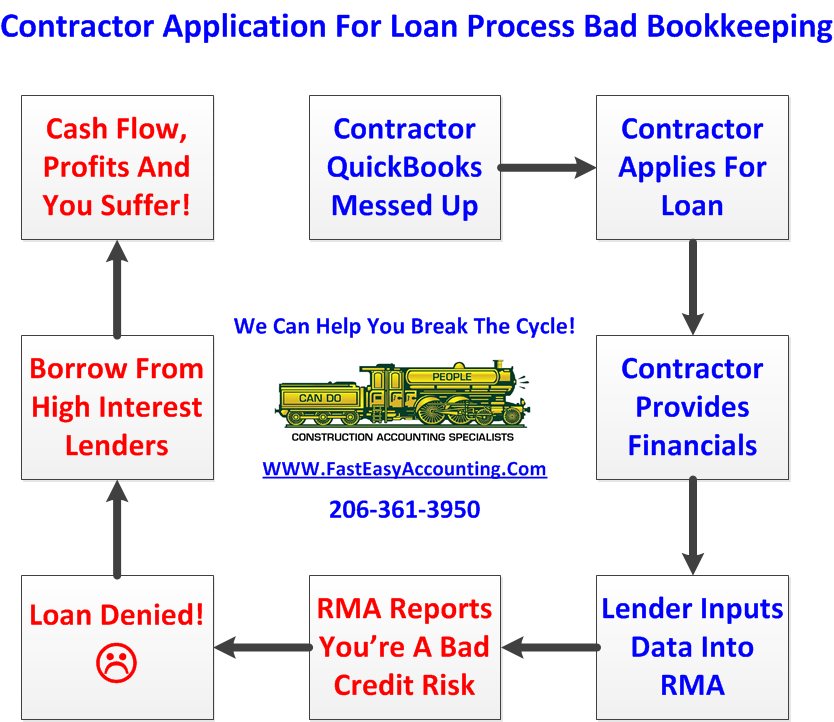

When an opportunity arises to bid large profitable projects in your area of expertise more often than not you will be asked to provide financial statements. In most cases, the prospect will have access to online databases like RMA

A Bit Of History Helps With Understanding How RMA Can Affect You Personally

The Robert Morris Club (RMA) was formed to help businesses and bankers exchange credit information. The RMA developed several tools among them was a system of Ratios that most lenders, creditors and all credit card companies use to separate the good companies from the bad in all industries.

The RMA and other reports show where your contracting company stands in relation to other contracting companies serving similar geographic and demographic markets. Each major category, Sales, Cost of Goods Sold, Overhead, Other Expenses and Other Income are rated on a scale of top 25%, middle 50% and bottom 25%.

Ideally all of the numbers on your Profit & Loss and Balance Sheet falls somewhere in the middle 50%. Whenever a contractor "forgets" to declare all of their income or "overstate their expenses" it will show up here like a red flag.

Finally a Z-Score is compiled which is a formula for predicting bankruptcy. Edward I. Altman published it in 1968. The formula may be used to predict the probability that a firm will go into bankruptcy within two years. Although not 100% accurate it is a useful tool, similar to a tape measure is not 100% accurate yet still useful.

You apply for a loan, line of credit, bond, credit card or something similar and the lender asks for a copy of your Construction Company Profit & Loss and Balance Sheet. The lender or bonding agent logs into their RMA account and fills out electronic forms, answers questions about your construction company and inputs specific numbers taken directly from your construction company Profit & Loss and Balance Sheet. Any construction accountant worth his or her salt knows exactly how to setup QuickBooks correctly for your application to be presented in the most favorable light.

If a contractor gives the banker, lender or bonding agent a set of financial reports that do not conform to the RMA requirements they may or may not try to extrapolate the numbers they need. In most cases, they will give you the "Thank you for applying" speech before giving you the "We will let you know as soon as we know anything" speech.

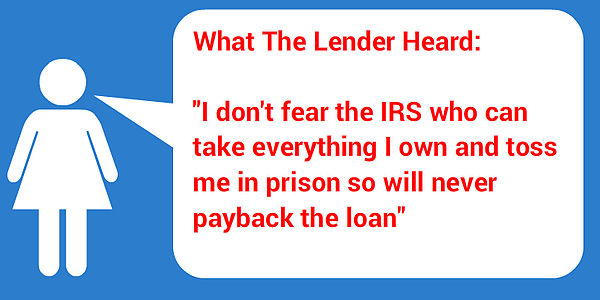

The rotten shame is most of the time the lender knows the contractor and believes you are a good and decent person who is a valuable client and they know you will pay the loan back, on time, with all of the interest. The problem is most decisions are made based on software and the loan officer cannot violate the lenders policies.

This is why sometimes a contractor with excellent credit cannot get a loan or line of credit and yet another contractor with only good credit can get financing at low interest rates, with low down payments and a long time to pay it back.

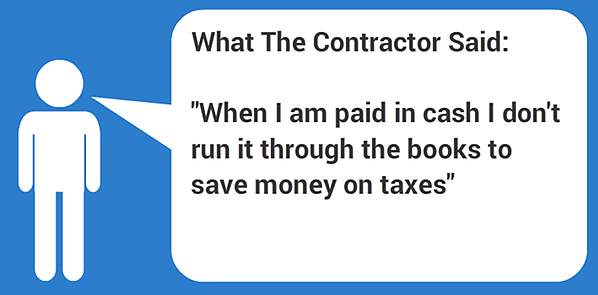

The Worst Thing A Contractor Can Say

The good news is the Universe is always in balance and it is never too late to make things right. We have worked with many contractors who have come to realize the only way to get rich and keep the money is to play the money game to win. In all cases we have found tax agencies very willing to work out a payment plan.

The reason is from the tax agency point of view it is better to a percentage of something over a course of time than to waste time, money and effort making an example of someone and get nothing in the end.

For those who feel the tax collectors are corrupt I suggest it is wise to "Give to Cesar What is Caesars..." which means pay your taxes and focus on making big money. Do not be concerned about the tax collectors because the Universe is always in balance and if the tax collectors have something to answer for it is better for you to stay out of that discussion, if you get my meaning.

We Remove Contractor's Unique Paperwork Frustrations

For Construction Company Owners who do not need the full power of QuickBooks for contractors and want 24/7 online access we offer Xero Accounting Online and we have custom setup for construction companies. Click Here For More.

This Is One More Example of how Fast Easy Accounting is helping construction company owners all across the USA including Alaska and Hawaii put more money in the bank to operate and grow your construction company. Construction accounting is not rocket science; it is a lot harder than that and a lot more valuable to people like you so stop missing out! Call Sharie 206-361-3950 or sharie@fasteasyaccounting.com and schedule your no charge one-hour consultation.

Profitable Contractors and Construction Company owners have known about the value of outsourced bookkeeping services and contractor coaching services like ours for a long time and now you know about it too!

We Scan Your Receipts And Invoices link the appropriate transactions to QuickBooks or Xero Accounting Online depending on the construction accounting service you are using and provide ongoing Cloud Based Contractors Bookkeeping Services by accountants who understand construction.

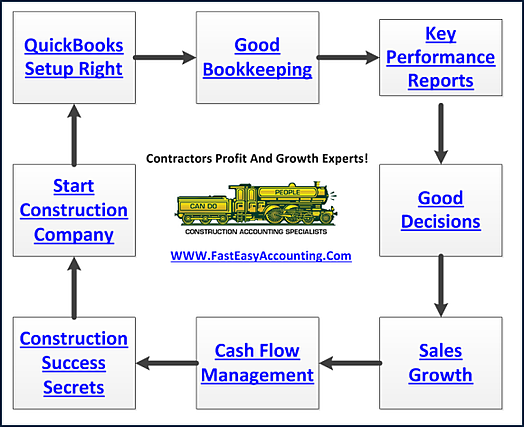

Our Contractor Bookkeeping Services System Is A System

Thinking About Outsourcing Your Contractors Bookkeeping Services To Save Time And Money?

Click On The Button Below To Download A Free Guide

Business Process Management (BPM) For Contractors

Need Help Now?

Call Sharie 206-361-3950

sharie@fasteasyaccounting.com

Xero Outsourced Construction Accounting Services

QuickBooks Outsourced Construction Bookkeeping Services

We Are Xero Accounting Experts Specializing In Construction Bookkeeping Services

About The Author:

Randal DeHart, PMP, QPA is the co-founder of Business Consulting And Accounting in Lynnwood Washington. He is the leading expert in outsourced construction bookkeeping and accounting services for small construction companies across the USA. He is experienced as a Contractor, Project Management Professional, Construction Accountant, Intuit ProAdvisor, QuickBooks For Contractors Expert and Xero Accounting Specialist. This combination of experience and skill sets provides a unique perspective which allows him to see the world through the eyes of a contractor, Project Manager, Accountant and construction accountant. This quadruple understanding is what sets him apart from other Intuit ProAdvisors and Xero accountants to the benefit of all of the construction contractors he serves across the USA. Visit http://www.fasteasyaccounting.com/randal-dehart/ to learn more.

Randal DeHart, PMP, QPA is the co-founder of Business Consulting And Accounting in Lynnwood Washington. He is the leading expert in outsourced construction bookkeeping and accounting services for small construction companies across the USA. He is experienced as a Contractor, Project Management Professional, Construction Accountant, Intuit ProAdvisor, QuickBooks For Contractors Expert and Xero Accounting Specialist. This combination of experience and skill sets provides a unique perspective which allows him to see the world through the eyes of a contractor, Project Manager, Accountant and construction accountant. This quadruple understanding is what sets him apart from other Intuit ProAdvisors and Xero accountants to the benefit of all of the construction contractors he serves across the USA. Visit http://www.fasteasyaccounting.com/randal-dehart/ to learn more.

Our Co-Founder Randal DeHart - Is a Certified PMP (Project Management Professional) with several years of construction project management experience. His expertise is construction accounting systems engineering and process development. His exhaustive study of several leading experts including the work of Dr. W. Edward Deming, Michael Gerber, Walter A. Shewhart, James Lewis and dozens of others was the foundation upon which our Construction Bookkeeping System is based and continues to evolve and improve. Check out our Contractor Success Map Podcast on iTunes and Follow Randal on Google+