An Alarming Number Of Construction Company Owners Are

Being Ripped-Off And Driven Into Bankruptcy!

That sounds harsh but it is true! Whenever we see a contractor is heading toward a problem, issue or disaster we immediately raise an alarm. We are judicious about doing it so when we say there is a potential problem our clients know we are serious.

Contractors by nature are tough, resilient and have a tremendous amount of "Grit And Determination To Succeed" which means they are not easily disturbed or prone to react in a hasty or rash manner at the first sign of trouble. This is just one of the many qualities I sincerely admire about these wonderful men and women.

Most of our contractor clients will listen carefully and thoughtfully when we offer advice and words of wisdom because they know, like and trust us and are aware that everyone on here at Fast Easy Accounting have many years of "Real World Construction Experience", not simply academic egg-heads. I say that with all due respect to egg heads since I am an egg-head with several degrees and certifications in Accounting, Construction Accounting and Project Management.

We have callouses on our hands and a tremendous amount of "Grit and Determination" to succeed that comes with having owned and operated construction companies and some of us have served an apprenticeship in one of the construction trades. For example I am a licensed Journeyman Plumber (PL01) in Washington State, and have owned and operated successful residential remodel companies, new construction residential and commercial plumbing companies as well as service, repair and drain cleaning plumbing companies.

In other words, when it comes to owning, operating and making a substantial amount of money with construction and contractor service companies we know what we are talking about.

Bookkeeper Embezzlement Can Destroy Your Construction Company And Your Personal Finances

Unfortunately, until a contractor has gotten to know us they tend to think of us as just another contractors bookkeeping service. Which means some contractors think we are crazy to suggest that any trusted employee, especially an in-house bookkeeper would steal money from their company and so they ignore us until it was too late.

A Google search for Bookkeeper Embezzlement Construction Company will return over 100,000 results. This is, always has been and will continue to be a major headache and in some cases the direct cause for construction company owners to file business and personal bankruptcy.

For Example the case of a 54 year old woman, a family friend stole more than $852,000 from 2007 through 2013 before being caught. For the full article http://www.equipmentworld.com/bookkeeper-charged-with-embezzling-852k-from-pa-construction-company/

Construction Bookkeeper Embezzlers come in every race, creed, color, gender, age. There is no definitive profile, not absolute way to know which contractor bookkeeper is an embezzler until they have been caught and convicted and even then if you do not perform extensive background checks you may never know it until it is too late.

Just becuase you catch a bookkeeper embezzling funds don't think for one minute they will always be punished and made to pay you back. You must understand, for the most part, in the eyes of the public, employees are poor innocent victims of brutal greedy business owners.

It is further emphasized and reinforced by the media, television and movies most of the villans and bad people are business men and weomen. Just understand this Randalism "We live in a world of what is, not what should be"

In one particular case a bookkeeper for an automotive company who was suspected of embezzling tens of thousands of dollars, but only admitted to stealing $10,000.

She was put on two years probation without any jail time and was ordered to pay $50 a month in restitution; however, she claimed due to medical issues and financial hardship she was unable to pay anything.

A Google Search - Of Construction Bookkeeper Embezzlement will generate thousands of hits and most of it could have been avoided if the construction owner had known about and followed a few simple guidelines.

#01 - Don't Hire A Bad Bookkeeper Click Here For More...

#02 - Understand The Employee Theft 10-10-80 Rule - Discovered over many years of experience and first hand observation by auditors, accountants, fraud examiners, anyone involved in detecting employee theft.

Ten Percent - Of all employees including bookkeepers will steal in a variety of ways from office supplies, petty cash, graft, kickbacks and payoffs from your suppliers, vendors and sub-contractors and even hundreds of thousands or even millions of dollars. They will do it regardless of how many security systems are in place because they lack integrity and have an "taker's" entitlement paradigm that states: "It Is Better To Take Than To Make". They cannot be stopped, only caught! And only then if you have systems in place and if you can convince the criminal justice system to take action, good luck with that!

Ten Percent - Of all employees including bookkeepers will never steal because they have integrity and a "Producer's" paradigm that states: "It Is Better To Make Than To Take". In the end these are the people who will add so much value to your company you cannot help but reward them with more money, benefits and recognition. Because if you do not they will be recruited by your competitors. This is another example of Leveling, click here to learn more.

Eighty Percent - Of all employees including bookkeepers will steal if they feel certain they can get away with it and if circumstances allow for it due to weak integrity and a sense of "Redistributing The Wealth, But Not The Work Or The Responsibility"

#03 - Your Bookkeeper - Asks for signature authority on your checking / savings / payroll accounts

#04 - Your Bookkeeper - Has a lifestyle that seems above what they are earning

#05 - Your Bookkeeper - Takes Records Home to work on or they want to work in the office when no one is around (Fraudulent activities are easier when nobody is around).

#06 - Your Bookkeeper - Refuses to take a vacation.

#07 - Your Bookkeeper - Gets defensive when you or your CPA asks questions.

#08 - Your Bookkeeper - Has access to your credit/debit cards.

#09 - Your Bookkeeper - Receives mail-order packages at work.

#10 - Your Bookkeeper - Has QuickBooks in a complete mess and you cannot understand any of it.

#11 - You Bookkeeper - Tries to explain away delinquency tax notices.

#12 - Your Bookkeeper - Insists on picking up the daily mail.

#13 - Your Bookkeeper - Is the primary contact for your company's banks, auditors, creditors, etc.

#14 - Your Bookkeeper - Misplaces payroll receipts, deposit records, supplier letters and estimates.

#15 - Your Bookkeeper - Makes the bank deposits and they seem to be too small.

#16 - Your Bookkeeper - Show signs of a drinking, drug, or gambling problem or family financial problems.

#17 - Your Bookkeeper - Suggested they could save money by getting rid of the outside accounting firm.

#18 - Your Bookkeeper - Gets angry when you ask for a QuickBooks report

#19 - Your Bookkeeper - Tries to blame the previous Bookkeeper or outside accounting firm for messy QuickBooks

#20 - Your Bookkeeper - Does not get along well with other employees and staff members.

#21 - Paying bills with Cashiers Checks - When you look it up on the internet it will only show as a withdrawal

Action Steps Construction Company Owners Can Take To Help Avoid Bookkeeper Embezzlement

Outsource To A Professional Contractors Bookkeeping Service - That has a Contractors Bookkeeping Services System in place:

-

Make Certain The Do Not - Collect your money, make bank deposits or pay any bills or taxes.

-

Make Certain The Do - Only the Bookkeeping including Payroll Processing, Quarterly Tax Reports, Invoicing, Pay Applications, and bank reconciliations and provide you with online access to your QuickBooks For Contractors and a separate 24/7 web based financial reporting tool so you can generate Job Costing and Financial reports anytime you want too.

-

Make Certain They Have - Qualified construction accountants and construction bookkeepers on staff

-

Make Certain They Are - U.S. Based. There are many services that can be outsourced off shore and in foreign countries; contractor bookkeeping services is not one of them. It may be cheap in the short run; however, in many cases construction company owners have cost themselves a lot of money in the long-run and in most cases many times what it would have cost to have us handle their contractors bookkeeping services.

-

Make Certain They Have - A professional office, not somebody's home where there are little or no controls on who has access to your contracting company records; including your competitors. You would be surprised if you knew how many contractor's wives and girlfriends take on other contractors bookkeeping and the information about bids, estimates profit and loss finds its way into your competitor's hands.

This Is One More Example of how Fast Easy Accounting is helping construction company owners just like you put more money in the bank to operate and grow your construction company. Construction accounting is not rocket science; it is a lot harder than that and a lot more valuable to people like you and me so stop missing out! Call Sharie 206-361-3950 or sharie@fasteasyaccounting.com and schedule your no charge one-hour consultation

We Remove Contractor's Unique Paperwork Frustrations

For Construction Company Owners who do not need the full power of QuickBooks for contractors and want 24/7 online access we offer Xero Accounting Online and we have custom setup for construction companies. Click Here For More.

This Is One More Example of how Fast Easy Accounting is helping construction company owners all across the USA including Alaska and Hawaii put more money in the bank to operate and grow your construction company. Construction accounting is not rocket science; it is a lot harder than that and a lot more valuable to people like you so stop missing out! Call Sharie 206-361-3950 or sharie@fasteasyaccounting.com and schedule your no charge one-hour consultation.

Profitable Contractors and Construction Company owners have known about the value of outsourced bookkeeping services and contractor coaching services like ours for a long time and now you know about it too!

We Scan Your Receipts And Invoices link the appropriate transactions to QuickBooks or Xero Accounting Online depending on the construction accounting service you are using and provide ongoing Cloud Based Contractors Bookkeeping Services by accountants who understand construction.

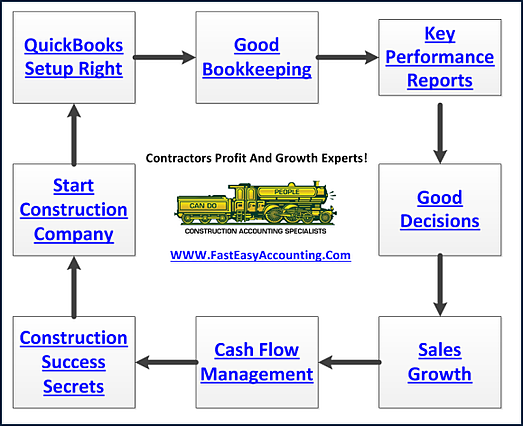

Our Contractor Bookkeeping Services System Is A System

Thinking About Outsourcing Your Contractors Bookkeeping Services To Save Time And Money?

Click On The Button Below To Download A Free Guide

Business Process Management (BPM) For Contractors

Need Help Now?

Call Sharie 206-361-3950

sharie@fasteasyaccounting.com

Xero Outsourced Construction Accounting Services

QuickBooks Outsourced Construction Bookkeeping Services

We Are Xero Accounting Experts Specializing In Construction Bookkeeping Services

About The Author:

Randal DeHart, PMP, QPA is the co-founder of Business Consulting And Accounting in Lynnwood Washington. He is the leading expert in outsourced construction bookkeeping and accounting services for small construction companies across the USA. He is experienced as a Contractor, Project Management Professional, Construction Accountant, Intuit ProAdvisor, QuickBooks For Contractors Expert and Xero Accounting Specialist. This combination of experience and skill sets provides a unique perspective which allows him to see the world through the eyes of a contractor, Project Manager, Accountant and construction accountant. This quadruple understanding is what sets him apart from other Intuit ProAdvisors and Xero accountants to the benefit of all of the construction contractors he serves across the USA. Visit http://www.fasteasyaccounting.com/randal-dehart/ to learn more.

Randal DeHart, PMP, QPA is the co-founder of Business Consulting And Accounting in Lynnwood Washington. He is the leading expert in outsourced construction bookkeeping and accounting services for small construction companies across the USA. He is experienced as a Contractor, Project Management Professional, Construction Accountant, Intuit ProAdvisor, QuickBooks For Contractors Expert and Xero Accounting Specialist. This combination of experience and skill sets provides a unique perspective which allows him to see the world through the eyes of a contractor, Project Manager, Accountant and construction accountant. This quadruple understanding is what sets him apart from other Intuit ProAdvisors and Xero accountants to the benefit of all of the construction contractors he serves across the USA. Visit http://www.fasteasyaccounting.com/randal-dehart/ to learn more.

Our Co-Founder Randal DeHart - Is a Certified PMP (Project Management Professional) with several years of construction project management experience. His expertise is construction accounting systems engineering and process development. His exhaustive study of several leading experts including the work of Dr. W. Edward Deming, Michael Gerber, Walter A. Shewhart, James Lewis and dozens of others was the foundation upon which our Construction Bookkeeping System is based and continues to evolve and improve. Check out our Contractor Success Map Podcast on iTunes and Follow Randal on Google+