Seasoned Builders Knows Exactly What They Need

Builder Accounting begins with a proper QuickBooks setup For Spec Home Builders. and QuickBooks Setup for Custom Home Builders Seasoned Builders understand that their needs are different and more specific than the general and specialty contractors that they hire to complete the project.

When Everyone Is On The Same Page Paperwork flows like a Waltz in an old time movie, moving between the participants as needed.

Seasoned Builders Have Processes They Like

I like Builders, General and Specialty Contractors that are “Seasoned” They are a pleasure to work for and with by everyone involved. They have a clear understand on the flow of paperwork and are willing to Give Directions to who work for them and Receive Directions from Advisors who are working with them.

Over a course of time they have developed a group of processes that work. This includes a custom estimate sheet on Excel that they use to bid each job. Understand to get good, usable information out of any accounting system that they need to be an active participant and code the paperwork. Accountants do not have a crystal ball and or a magic wand…It Is True – Garbage In = Garbage Out.

The Seasoned Builder has processes in place for Bidding, tracking Certificate of Insurance , W9’s and making sure that a Specialty Contractor is paid only once for the work that is performed.

Seasoned Builders want to have an External Accountant that can follow their internal paperwork (estimate), understand the job codes and make the accounting system easy for the Tax Accountant.

New Builder Learning Curve

New Builder just starting out can mirror one the “Dog and Pickup Truck” who was employed by a General or Specialty Contractor and hates paperwork because he doesn’t understand the need for paperwork. Friends tell them – you don’t need to write “all that stuff down” - You’re The Boss Now!

Now Or Later: Are you willing to learn the “Right Way” to deal with your accounting needs?

Casual Builders Have Preconceived Ideas

It’s almost Tax Time for those who filed an extension. Some of you New Contractors may not realize that you need to file an Annual Tax Return for your company…….I shouldn’t have to” Because” and “Let Me Explain My Situation” If you are a new S-Corp or filing as a S-Corp for tax purposes be sure to file:

Yes – I still need to file 2013 Taxes and My Paperwork is a combination of Receipts, Notes on a Brown Paper Bag, a Couple of Excel Sheets. So……How Much Is My Taxes – The Builder, General or Specialty Contractor asks their Brand New Bookkeeper…..You have had the documents since last week…It only takes 10 Minutes or so to put in the Excel Sheet into QuickBooks. You don’t really need the receipts

Confused: This Brand New Frustrated Bookkeeper / Spouse / Partner Calls Me And Asks For Help

Bookkeeping Is Treated All The Same

This contractor will hire “Someone To Do The Bookkeeping” – Because “Anybody Can Do It – No Special Skills Are Needed” We Can Help! We welcome talking with your “Brand New Unskilled Bookkeeper”

We can Setup Your QuickBooks File, Enter Your Current and Past Accounting Documents and create the Unique Reports for you and have a Clean Set of Books for your Tax Accountant to file the taxes.

Continue Outsourced Accounting And Bookkeeping

We have processes for your Newly Hired Bookkeeper to do Admin Work in your office. There are Many Tasks that need to be completed without throwing a Newly Hired Bookkeeper into the “Deep End of The Pool” (Includes Spouses / Partners) Think of them as an “Apprentice”. They need guidance and training.

Partners Who Supervise From A Long Way Off

Partnerships work great when there is a fair division of labor. Smart Partners will let focus on business and let an outside firm such as Fast Easy Accounting do the accounting. (Our clients still pay all of their own bills) This allows for fairness.

Communication Breakdown

Sometimes in a “New Partnership” both of the partners will decide one of the partner’s spouse can do the bookkeeping. Over a course of time – it will “grate of the nerves” as the partnership becomes lopsided. Another Issue is when One Partner is a “Casual Partner” or “Silent Partner” and decides the accounting is not really necessary….This becomes a problem as tax liability is shared between partners.

It Happens:

A General or Specialty Contactor miss expenses therefore pay Higher Taxes

Builders do not properly use WIP and therefore pay Higher Taxes.

Tax Accountant:

Your Tax Accountant can only work with the data that you give them.

They work very hard to keep on top of the latest changes to the IRS Tax Code

The IRS Tax Code is similar to the OSHA Book – Thick and has Tiny Print.

Congress met today – Did they decide something at impacts you or your business?

It’s your Tax Accounts Job to know or be able to find out.

Not Ready – How Do You Know

I chat with everyone and hope to have a clear understanding on the following:

Where You Are Now?

What You Are Currently Doing?

Where You Are Trying To Go?

What Is The Accounting Gap?

How Can We Get You Current?

Our niche is Construction Accounting from the Builder (Spec. or Custom), General or Specialty Contractor all the way to the Maintenance Contractors providing on-going Service and Repair.

We have many processes that are simple and easy to implement when The Client Is Ready.

The Type of Contractors Who Call Me That We Can Help

Seasoned – Know What They Want

New – Unsure Sure What They Need

Casual – Want To Improve On What They Are Doing

Hobby – Just Making A Little Extra Money

Seasoned, New or Casual Builder, General and Specialty Contractors Wanted

Fast Easy Accounting translates Builder Documents Into Usable Reports for better profits.

Fast Easy Accounting translates Builder Reports for Tax Accountant to save on annual taxes.

Fast Easy Accounting is a Seasoned Construction Accountant who understands WIP and when and where to use it. Create Pay Applications as requested. It is Easy When You Know What To Do and We Do!

The Cost

Goal is to determine a Flat Rate number for services whenever possible that works for both sides.

How Can I Do That: We review all of the Answers to the Questions Listed Above.

For Existing Business - Ask for a copy of your QuickBooks File.

Review, Review, and Review some more to be sure I completely understand your business.

Object is to take a little more time upfront for a good long term relationship.

Looking Forward To Chatting, Reviewing Details About Your Business, Inviting You To Become A Client!

We Remove Contractor's Unique Paperwork Frustrations

Need A Mentor? - Someone who has been were you want to go and can guide you. We would like to be that person for you. Fill out the form on the right or call Sharie 206-361-3950 or email sharie@fasteasyaccounting.com and schedule your no charge one-hour consultation

For Construction Company Owners who do not need the full power of QuickBooks for contractors and want 24/7 online access we offer Xero Accounting Online and we have custom setup for construction companies. Click Here For More.

This Is One More Example of how Fast Easy Accounting is helping construction company owners all across the USA, Alaska and Hawaiii just like you put more money in the bank to operate and grow your construction company. Construction accounting is not rocket science; it is a lot harder than that and a lot more valuable to people like you and me so stop missing out! Call Sharie 206-361-3950 or sharie@fasteasyaccounting.com and schedule your no charge one-hour consultation

Profitable Contractors and Construction Company owners have known about the value of outsourced bookkeeping services and contractor coaching services like ours for a long time and now you know about it too!

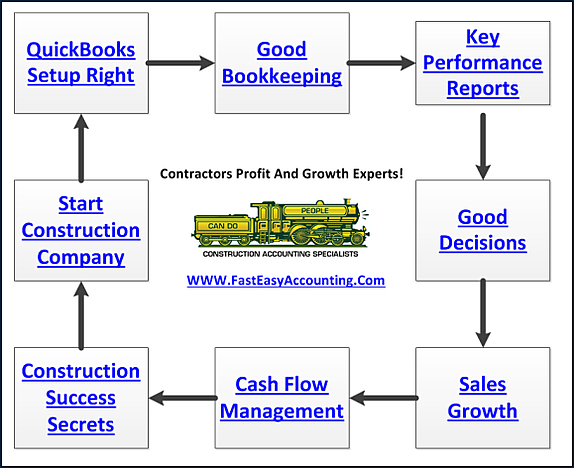

Our Contractor Bookkeeping Services System Is A System

Thinking About Outsourcing Your Contractors Bookkeeping Services?

Click On The Button Below To Download A Free Guide

Business Process Management (BPM) For Contractors

Fill Out The Form And Get The Help You Need!

Need Help Now?

Call Sharie 206-361-3950

sharie@fasteasyaccounting.com

Xero Outsourced Construction Accounting Services

QuickBooks Outsourced Construction Bookkeeping Services

We Are QuickBooks Experts Specializing In Construction Bookkeeping Services

About The Author:

Sharie DeHart, QPA is the co-founder of Business Consulting And Accounting in Lynnwood Washington. She is the leading expert in managing outsourced construction bookkeeping and accounting services companies and cash management accounting for small construction companies across the USA. She encourages Contractors and Construction Company Owners to stay current on their tax obligations and offers insights on how to manage the remaining cash flow to operate and grow their construction company sales and profits so they can put more money in the bank. http://www.fasteasyaccounting.com/sharie-dehart/ Check out our Contractor Success Map Podcast on iTunes