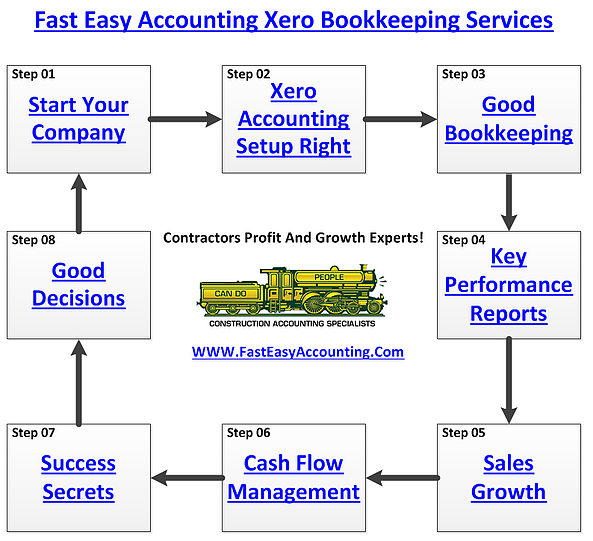

Did You Have Trouble Setting Up Xero Accounting Online?

You are not alone, it is an accounting program built to satisfy the needs of accountants with an attempt to make it easy for non-accountants.

There are hundreds of mistakes that can be made which can lead to an unbelievable number of problems later on when you try to use Xero Accounting Online and generate useful reports.

It makes sense to contract out the tasks you are not familiar with like Xero Accounting Online Setup or QuickBooks Setup because it is a lot harder than they salespeople and the marketing hype would have you believe.

Xero Accounting Online Setup is not as complicated as QuickBooks setup projects. For QuickBooks Setup we have built a custom set of step-by-step checklists to make certain we do a proper job of QuickBooks Setup for Construction. The checklists are over twenty pages long and growing every year as QuickBooks adds new features.

Considering we have been doing construction accounting since 1991 that should give you some insights as to how difficult it is to setup any accounting program.

If you are starting a construction company you could qualify to have us set up your company in Xero and give you 30 days of Xero software for FREE so you can find out if Xero is right for you!

The Initial Xero Accounting Setup Includes:

-

Set up your organization in Xero

-

Prepare an application for Tax-ID number, if needed.

-

Set up your Chart of Accounts

-

Connect your bank and PayPal feeds

-

Give you a tour of the system and how it works

-

Provide ongoing virtual CFO support (We are more than bookkeeping services provider!)

-

Contact Sharie 206-361-3950 or sharie@fasteasyaccounting.com

If you have an existing construction company and you want your existing accounting converted to Xero accounting by people who understand construction you have come to the right place. The investment required to transfer your existing transactions to Xero accounting will depend of the amount of information and the extent of customization you want.

We Can Convert The Following To Xero Accounting:

-

Shoe Box Full Of Paperwork, Receipts And Bank Statements

-

Handwritten Paperwork

-

QuickBooks Enterprise

-

Quicken (All Versions)

-

QuickBooks For Mac

-

QuickBooks Premier

-

QuickBooks Online

-

Microsoft Money

-

QuickBooks Pro

-

FreshBooks

-

Peachtree

-

MYOB

-

Wave

-

Sage

-

Excel

If you do not see yours listed here it is likely we can work with it as well. Please contact Sharie 206-361-3950 or sharie@fasteasyaccounting.com to find out.

The Short List Of Essentials In Our Custom Xero For Construction Setup

Not every construction company will need the custom Xero Accounting Online setup options shown below. If you have less than three employees including yourself chances are the basic Xero setup will work just fine for you.

-

User Permissions

-

Company Information Window

-

Chart of Accounts Direct Construction Costs

-

Chart of Accounts Indirect Construction Costs

-

Chart of Accounts Retention For Your Subcontractors

-

Chart of Accounts Job Deposits From Your Customers

-

Chart of Accounts Indirect Construction Costs

-

Chart of Accounts Prepaid Expenses

-

Chart of Accounts Job Deposits

-

Chart of Accounts Fixed Assets

-

Chart of Accounts Depreciation

-

Chart of Accounts Intercompany Transfers

-

Chart of Accounts Payroll

-

Chart of Accounts Payroll Taxes

-

Chart of Accounts Payroll Tax Liabilities

-

Chart of Accounts Customer Discounts

-

Chart of Accounts Bad Debts

-

Chart of Accounts Customer Checks Returned From Bank

-

Chart of Accounts Employee Loans And Repayments

-

Chart of Accounts Jobsite Costs

-

Chart of Accounts Warranty Work

-

Chart of Accounts Sales Tax Errors

-

Chart of Accounts Mobilization

-

Chart of Accounts De-Mobilization

-

Chart of Accounts Leases

-

Chart of Accounts Purchases

-

Chart of Accounts Marketing

-

Chart of Accounts Advertising

-

Chart of Accounts Owner Loans And Repayments

-

Chart of Accounts Special Accounts For Sole Proprietors

-

Chart of Accounts Special Accounts For LLC Corporations

-

Chart of Accounts Special Accounts For Sub-S Corporations

-

Chart of Accounts Special Accounts For Partnerships

-

Chart of Accounts Special Accounts For LLP Limited Partnerships

-

Chart of Accounts Special Accounts Flipper Houses

-

Chart of Accounts Credit Cards

-

Chart of Accounts Lines Of Credit

-

Chart of Accounts Short Term Loans

-

Chart of Accounts Long Term Loans

-

Chart of Accounts General And Administrative

-

Chart of Accounts Occupancy Costs

-

Chart of Accounts Triple Net Leasing Costs

-

Chart of Accounts Technology

-

Chart of Accounts Professional Fees

-

Chart of Accounts Taxes

-

Chart of Accounts Licenses

-

Chart of Accounts Insurance Builders Risk.

-

Chart of Accounts Insurance Vehicles

-

Chart of Accounts Insurance Liability

-

Chart of Accounts Insurance Health And Dental

-

Chart of Accounts Financing Costs

-

Chart of Accounts Interest Earned

-

Chart of Accounts Gain And Loss On Fixed Assets

-

Chart of Accounts Estimates

-

Chart of Accounts Sales Orders

-

Chart of Accounts Purchase Orders

-

Retention Tracking For Your Customers

-

Retention Tracking For Your Trade / Subcontractors

-

Payroll For Your Employees

-

Payroll Sick Days

-

Payroll Vacation Days

-

Payroll Loans Setup And Tracking

-

Payroll Loan Repayment Setup And Tracking

-

Payroll Reimbursement Setup And Tracking

-

Payroll Garnishment Setup And Tracking

-

Payroll Child Support Setup And Tracking

-

Customer List

-

Vendor List

-

Proper Setup Of All Expenses And Costs In Chart of Accounts

-

Retention Hold By Your Customers

-

Retention Hold For Subcontractors

-

Job Deposits From Customers

-

Employee Loans - Admin

-

Employee Loans - Sales

-

Employee Loans - Operations

-

Employee Reimbursements - Field

-

Employee Reimbursements - Admin

-

Employee Reimbursements - Operations

-

Employee Reimbursements - Sales

-

Employee Reimbursements - Officers

-

Payroll Preperation - Field

-

Payroll Preperation - Admin

-

Payroll Preperation - Sales

-

Payroll Preperation - Operations

-

Payroll Preperation - Officers

-

Payroll Tax Reporting – 941

-

Payroll Tax Reporting - 940

-

Payroll Tax Reporting - 940

-

Payroll Tax Reporting - W-2

-

Payroll Tax Reporting - W-3

-

Insurance Audit Reporting

-

Insurance Audit Support (Business Consulting And Accounting Office)

-

Bank Reconciliations

-

Credit Card Reconciliations

-

Washington State Cities Business And Occupation Tax Reporting - Monthly

-

Washington State Cities Business And Occupation Tax Reporting - Quarterly

-

Washington State Cities Business And Occupation Tax Reporting - Annually

-

Washington State Business And Occupation Tax Reporting - Monthly

-

Washington State Business And Occupation Tax Reporting - Quarterly

-

Washington State Business And Occupation Tax Reporting - Annually

-

Washington State Sales Tax Reporting - Monthly

-

Washington State Sales Tax Reporting - Quarterly

-

Washington State Sales Tax Reporting - Annually

-

Petty Cash Register

-

Fixed Asset Tracking

-

Monthly Depreciation Transactions

-

Intercompany Transfers

-

Security Deposits Tracking

-

Loan To Shareholders / LLC Members / Partners

-

Cost of Goods Sold - Direct Costs

-

Cost of Goods Sold - Indirect Costs

-

Tool Lease Tracking

-

Vehicle Lease Tracking

-

Equipment Lease Tracking

-

Occupancy Expense - Office

-

Occupancy Expense - Shop

-

Marketing Cost Tracking By Chart of Accounts

-

Vehicle Costs – Admin / Sales / Operations / Officer

-

Other Income Tracking

-

Other Expense Tracking

-

Upload Documents To Inbox

-

Read, Print And E-Mail Documents

-

24/7 Access To Web Based Online Financial Reports

-

Paperless Server Vault Options

-

Custom Management Reports

We offer the most comprehensive contractors bookkeeping services system in the world. Your Letter of Engagement includes some or all of the options listed below. If there are options, you would be interested in knowing more about please contact Sharie at 206-361-3950 or email sharie@fasteasyaccounting.com and she will be happy to review them with you.

Our process for Xero Accounting Online setup of a new client is a whole lot longer than what I am showing here and for some of you this was TMI (Too Much Information).

Profitable Construction - Companies have known about the value of outsourced bookkeeping services for a long time and now you know about it too!

We Scan Your Receipts And Invoices link them to Xero transactions where it is appropriate and give you back a CPA-ready packet for your tax return and we provide ongoing Cloud Based Contractors Bookkeeping Services by accountants who understand construction.

Need Help Now?

Call Sharie 206-361-3950

sharie@fasteasyaccounting.com

Xero Outsourced Construction Accounting Services

QuickBooks Outsourced Construction Bookkeeping Services

We Are Xero Accounting Experts Specializing In Construction Bookkeeping Services

About The Author:

Randal DeHart, PMP, QPA is the co-founder of Business Consulting And Accounting in Lynnwood Washington. He is the leading expert in outsourced construction bookkeeping and accounting services for small construction companies across the USA. He is experienced as a Contractor, Project Management Professional, Construction Accountant, Intuit ProAdvisor, QuickBooks For Contractors Expert and Xero Accounting Specialist. This combination of experience and skill sets provides a unique perspective which allows him to see the world through the eyes of a contractor, Project Manager, Accountant and construction accountant. This quadruple understanding is what sets him apart from other Intuit ProAdvisors and Xero accountants to the benefit of all of the construction contractors he serves across the USA. Visit http://www.fasteasyaccounting.com/randal-dehart/ to learn more.

Randal DeHart, PMP, QPA is the co-founder of Business Consulting And Accounting in Lynnwood Washington. He is the leading expert in outsourced construction bookkeeping and accounting services for small construction companies across the USA. He is experienced as a Contractor, Project Management Professional, Construction Accountant, Intuit ProAdvisor, QuickBooks For Contractors Expert and Xero Accounting Specialist. This combination of experience and skill sets provides a unique perspective which allows him to see the world through the eyes of a contractor, Project Manager, Accountant and construction accountant. This quadruple understanding is what sets him apart from other Intuit ProAdvisors and Xero accountants to the benefit of all of the construction contractors he serves across the USA. Visit http://www.fasteasyaccounting.com/randal-dehart/ to learn more.

Our Co-Founder Randal DeHart - Is a Certified PMP (Project Management Professional) with several years of construction project management experience. His expertise is construction accounting systems engineering and process development. His exhaustive study of several leading experts including the work of Dr. W. Edward Deming, Michael Gerber, Walter A. Shewhart, James Lewis and dozens of others was the foundation upon which our Construction Bookkeeping System is based and continues to evolve and improve. Follow Randal on Google+