There Is A Disturbing Pattern Among Contractors And You Need To Be Aware Of It!

Are you getting resumes and applications from bookkeepers who worked for a construction company that went bankrupt and now they are so desperate for a job so they offer to work for minimum wage or less! What they are not saying in some cases is "And everything I can embezzle, steal and sell online."

Are you getting resumes and applications from bookkeepers who worked for a construction company that went bankrupt and now they are so desperate for a job so they offer to work for minimum wage or less! What they are not saying in some cases is "And everything I can embezzle, steal and sell online."

There could be a pattern and it is may be a so obvious that you could be missing it.

No construction company goes bankrupt that had useful accurate Financial Statements and Job Costing Reports that they understood and paid attention to because they would have seen bankruptcy coming well enough ahead of time to avoid it.

If your bookkeeper is an employee and they have no equity interest in your company they do not have the same concern about your construction company's cash flow and bottom line profit that you do because when it fails they can blame you for "Not knowing how to run a business" and go wreak havoc elsewhere.

The Relationship Between Contractor And Bookkeeper

Is Like Ham And Eggs For Breakfast Where The Pig

Is Committed And The Hen Is Only Involved!

The Contractor Depends On The Bookkeeper To Know What To Do

If The Bookkeeper Has Limited Construction Accounting

And Job Costing Skills Bankruptcy Is A Matter Of Time!

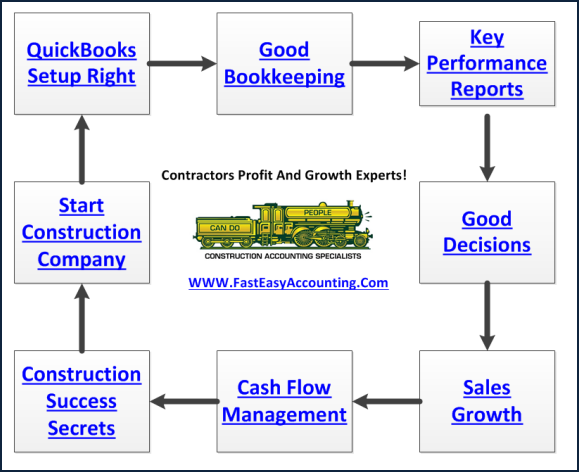

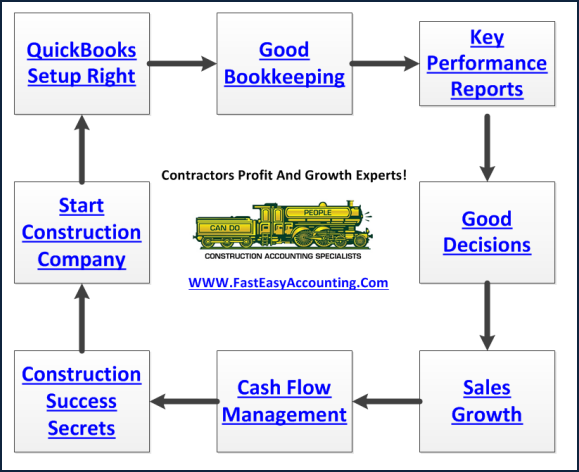

In today's fast paced construction environment you need accurate up to date Profit & Loss, Balance Sheet and Job Costing Reports to produce accurate bids, invoices and progress billings for your customers and clients.

In some extreme cases we have encountered bookkeepers working in construction companies who learned the basics of accounting twenty or thirty years ago and never updated their bookkeeping skills let alone enroll in any continuing education courses to learn construction accounting which is so much different than regular accounting.

It is obvious because they are using QuickBooks For Contractors and still attempting to use General Journal Entries for almost every transaction. If you want to know if that is happening on your QuickBooks file watch the video below and follow along on your QuickBooks file or you can contact Sharie for a FREE QuickBooks file review.

This is a recipe for disaster since General Journal Entries will NOT APPEAR ON JOB COSTING REPORTS! The typical answer the bad bookkeeper gives is "QuickBooks is at fault!" The truth is most of them do not have twenty years bookkeeping services experience they have six months bookkeeping services experience forty times over. This means they cannot find their way out of a paper bag with a sign printed on it!

It may seem that I have a dim view of most internal bookkeepers and that is because of the pain, havoc, destruction, divorce, bankruptcy, despair and in some extreme cases suicide they have caused company owners and their families.

It may seem that I have a dim view of most internal bookkeepers and that is because of the pain, havoc, destruction, divorce, bankruptcy, despair and in some extreme cases suicide they have caused company owners and their families.

Every failed contractor learns the value of proper bookkeeping at the auction where there business is being sold off to their competition.

Having interviewed, worked with hundreds of bookkeepers and listened while the ranted and raved about the boss I have found the most common complaint is they actually believe they are doing the bulk of the work and should be getting the bulk of the cash flow and profits even if it means the contractor has to sell their home and move their family into the street.

The less the contractor and the bookkeeper understand about the differences between construction accounting and regular accounting the worse the relationships is and the bigger the strain.

This is because the contractor needs more than just financial reports like Profit & Loss and Balance Sheet Reports they need Job reports like Job Costing and Job Profitability Reports and estimates vs. actuals including Overhead Allocation to know exactly where money is being made and lost and those reports require someone with Construction Accounting Skills.

Without A Construction Bookkeeping Services System Chaos Rules!

One of the most misunderstood concepts is that financial reports and Job reports are not connected. The totals shown on a Profit & Loss By Job report will not match the totals on a standard Profit & Loss Report unless the Overhead Allocation has been assigned to each job.

Profitable Construction - Companies have known about the value of outsourced bookkeeping services for a long time and now you know about it too!

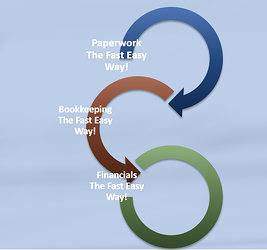

We Scan Your Receipts And Invoices link them to QuickBooks transactions where it is appropriate and give you back a CPA-ready packet for your tax return and we provide ongoing Cloud Based Contractors Bookkeeping Services by accountants who understand construction.

We Are QuickBooks Experts Specializing In Construction Bookkeeping Services

About The Author:

Randal DeHart, PMP, QPA is the co-founder of Business Consulting And Accounting in Lynnwood Washington. He is the leading expert in outsourced construction bookkeeping and accounting services for small construction companies across the USA. He is experienced as a Contractor, Project Management Professional, Construction Accountant, Intuit ProAdvisor and QuickBooks For Contractors Expert. This combination of experience and skill sets provides a unique perspective which allows him to see the world through the eyes of a contractor, Project Manager, Accountant and construction accountant. This quadruple understanding is what sets him apart from other Intuit ProAdvisors and accountants to the benefit of all of the construction contractors he serves across the USA. Visit http://www.fasteasyaccounting.com/randal-dehart/ to learn more.

Randal DeHart, PMP, QPA is the co-founder of Business Consulting And Accounting in Lynnwood Washington. He is the leading expert in outsourced construction bookkeeping and accounting services for small construction companies across the USA. He is experienced as a Contractor, Project Management Professional, Construction Accountant, Intuit ProAdvisor and QuickBooks For Contractors Expert. This combination of experience and skill sets provides a unique perspective which allows him to see the world through the eyes of a contractor, Project Manager, Accountant and construction accountant. This quadruple understanding is what sets him apart from other Intuit ProAdvisors and accountants to the benefit of all of the construction contractors he serves across the USA. Visit http://www.fasteasyaccounting.com/randal-dehart/ to learn more.

Our Co-Founder Randal DeHart - Is a Certified PMP (Project Management Professional) with several years of construction project management experience. His expertise is construction accounting systems engineering and process development. His exhaustive study of several leading experts including the work of Dr. W. Edward Deming, Michael Gerber, Walter A. Shewhart, James Lewis and dozens of others was the foundation upon which our Construction Bookkeeping System is based and continues to evolve and improve.