QuickBooks Training Live Instructor Led Webinar For Contractors Private Training By Appointment

Contractors and other small business owners having nothing to do with construction have told us how frustrated they are about the amount of time, money and effort they are losing from bad bookkeeping and bad bookkeepers.

Because of your feedback we have decided to restart our QuickBooks Training Programs Desktop Versions. Our QuickBooks Training Programs are open to everyone not just contractors. We also offer these QuickBooks Training Programs in classroom setting at our headquarters in Lynnwood Washington.

Your Instructor

Randal DeHart, PMP, QPA is the co-founder of Business Consulting And Accounting in Lynnwood Washington. He is the leading expert in Outsourced Construction Bookkeeping and Construction Accounting Services for small construction companies across the USA. Certified as a Project Management Professional (PMP) and an Intuit QuickBooks ProAdvisor. He is a QuickBooks expert having used QuickBooks from its first release in DOS version in the early 1990's through the most current version.

His construction experience includes new construction, commercial tenant improvement, residential remodel, service and repair, Commercial Journeyman Plumber (PL01) and owner operator of several construction companies, Project Management Professional and construction accountant.

His background provides a unique perspective which allows him to see the world through the eyes of a contractor, project manager and accountant and most important a construction accountant. This quadruple understanding sets him apart from other Intuit QuickBooks ProAdvisors and accountants in the arena.

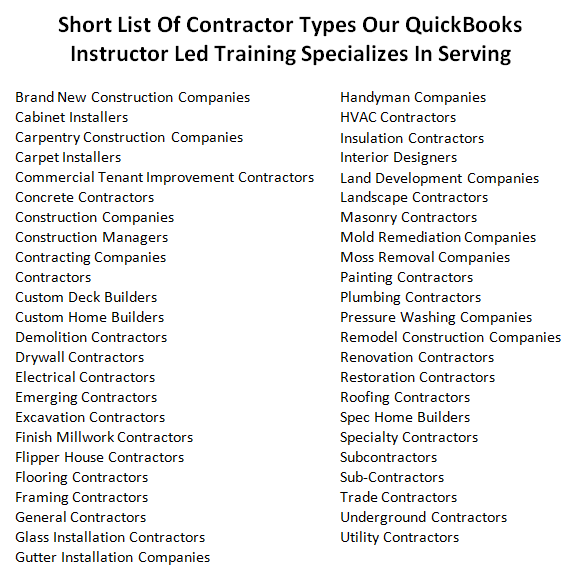

QuickBooks Training For Contractors Webinar

If you do not see your business listed please contact Sharie 206-361-3950 or sharie@fasteasyaccounting.com

QuickBooks Training Program For Contractors Details

QuickBooks Training Program For General Business Webinars - Will be offered using an online meeting service.

One To Ten People Can Attend - For the same low price. We encourage you to have everyone who will have anything to do with QuickBooks at the training session.

You Will Need High Speed Internet Access - If you have dial-up internet access, we strongly recommend that you get access to high-speed internet for your class.

You Will Need A Computer With - Speakers or headphone jack in order to hear the instructor via your computer. You'll be able to ask questions via chat or out loud if your computer is equipped with a microphone.

A Quiet Location Without Interruptions - To avoid distractions, we recommend you find a location where you won't be interrupted and can focus on the material.

Bring A List of Your QuickBooks Questions - This is your golden opportunity to have a QuickBooks expert to answer all of your QuickBooks questions including QuickBooks For Contractors or construction accounting. Make a list and bring it to class. Your instructor will do their best to answer all your questions.

QuickBooks Training For Contractors - Designed for those with a basic understanding of QuickBooks including at least six months hands on experience; however, it is not required.

If You Would Like A Basic Understanding Of QuickBooks - You may want to enroll in one of our QuickBooks Training General Business Programs. We offer them in webinar and classroom format Click Here for details. If you would more information please feel free to contact Sharie 206-361-3950 or sharie@fasteasyaccounting.com

QuickBooks Versions And Years Supported:

-

QuickBooks Pro 2008 To Present Year

-

QuickBooks Premier 2008 To Present Year

-

QuickBooks Premier For Contractors 2008 To Present Year

-

QuickBooks Enterprise 2008 To Present Year

-

QuickBooks Enterprise For Contractors 2008 To Present Year

You Decide What - You want your private construction accounting instructor to train you on. Some contractors have found it helpful to have an outline like the one shown below to use as a menu to pick and choose. You are welcome to change direction and alter the course of your training as you see fit.

Most Popular QuickBooks Training Modules:

Module 01 - Introduction To QuickBooks Training For Construction

-

Perform a simple QuickBooks Setup for a small construction company

-

Introduction to simple data entry required for a construction company

-

Introduction to printing and emailing Job Costing Reports

-

Introduction to Items and Accounts for a construction company

-

Introduction to Direct Construction Costs and how they are used in construction

-

Introduction to Indirect Construction Costs and how they are used in construction

-

Simple Invoicing for time and material and fixed bid

-

Setup the Five Key Performance Indicator Reports in QuickBooks

Module 02 - Basic QuickBooks Training For Trade Contractors

-

Module 01 Basic Bookkeeping For Construction is recommended before taking this course

-

Introduction to QuickBooks Progress Billing and tracking

-

Introduction to Change Orders and how to manage them properly

-

Introduction to Job Deposit Tracking including setup of Accounts, Items and Icon Bar

-

Troubleshooting Estimates Vs. Actual Reports for construction progress billing

Module 03 - Basic QuickBooks Training For Sub-Contractors

-

Module 01 Basic Bookkeeping For Construction is recommended before taking this course

-

Introduction to QuickBooks Progress Billing and tracking

-

Introduction to Change Orders and how to manage them properly

-

Introduction to Job Deposit Tracking including setup of Accounts, Items and Icon Bar

-

Introduction to Estimates Vs. Actual Reports for construction progress billing

Module 04 - Basic QuickBooks Training For Service And Repair Contractors

-

Module 01 Basic Bookkeeping For Construction is recommended before taking this course

-

Introduction to Complex Invoicing issues that result from service call work orders

-

Introduction to Sales Tax Reporting issues that cause invoices to be out of balance

-

Introduction to recording payments when customer uses credit cards, cash and checks

Module 05 - Basic QuickBooks Training For Residential Remodel Contractors

-

Module 01 Basic Bookkeeping For Construction is recommended before taking this course

-

Introduction to Work-In-Process setup and tracking - Cost of Goods Sold Based

-

Introduction to tracking down payments and multiple job deposits

-

Introduction to Complex Invoicing for "Not-To-Exceed", "Fixed Bid" and "Cost Plus"

-

Introduction to Change Order Management

-

Introduction to Job Costing Reporting

-

Introduction to Payment Applications for complex projects with draw schedules

Module 06 - Basic QuickBooks Training For Spec Home Builders

-

Module 01 Basic Bookkeeping For Construction is recommended before taking this course

-

Introduction to Work-In-Process setup and tracking - Asset based

-

Introduction to Job Costing Reporting

-

Introduction to Invoicing finished home sale and convert to Cost of Goods Sold

-

Introduction to Payment Applications for complex projects with draw schedules

Module 07 - Basic QuickBooks Training For Custom Home Builders

-

Module 01 Basic Bookkeeping For Construction is recommended before taking this course

-

Introduction to Work-In-Process setup and tracking - Cost of Goods Sold Based

-

Introduction to tracking systems for down payments and multiple job deposits

-

Introduction to Complex Invoicing for "Not-To-Exceed", "Fixed Bid" and "Cost Plus"

-

Introduction to Change Orders and Change Order Management

-

Introduction to Job Costing Reporting

-

Introduction to Payment Applications for complex projects with draw schedules

Module 08 - Basic QuickBooks Training For Commercial Tenant Improvement Contractors

-

Module 01 Basic Bookkeeping For Construction is recommended before taking this course

-

Introduction to Work-In-Process setup and tracking - Cost of Goods Sold Based

-

Introduction to tracking systems for down payments and multiple job deposits

-

Introduction to setting up Schedule of Values Item Based

-

Introduction to setting up Schedule of Values Account Based

-

Introduction to Complex Invoicing for "Not-To-Exceed", "Fixed Bid" and "Cost Plus"

-

Introduction to Change Orders and Change Order Management

-

Introduction to Job Costing Reporting

-

Introduction to Payment Applications for complex projects with draw schedules

Module 09 - Basic QuickBooks Training For Land Developers

-

Module 01 Basic Bookkeeping For Construction is recommended before taking this course

-

Introduction to Work-In-Process setup and tracking - Asset based

-

Introduction to Inventory tracking system for raw land

-

Introduction to Converting raw land inventory to individual lots

-

Introduction to Setting up Schedule of Values Item Based

-

Introduction to Setting up Schedule of Values Account Based

-

Introduction to Complex Invoicing for "Not-To-Exceed", "Fixed Bid" and "Cost Plus"

-

Introduction to Change Order Management

-

Introduction to Job Costing Reporting

-

Introduction to Invoicing finished land / lot sale and convert to Cost of Goods Sold

-

Introduction to Payment Applications for complex projects with draw schedules

Module 10 - Basic QuickBooks Training For Excavation And Heavy Equipment Contractors

-

Module 01 Basic Bookkeeping For Construction is recommended before taking this course

-

Introduction to Work-In-Process setup and tracking - Cost of Goods Sold based

-

Introduction to Inventory Tracking System for Heavy Equipment

-

Introduction to Allocating Heavy Equipment costs to jobs

-

Introduction to Setting up Schedule of Values Item Based

-

Introduction to Setting up Schedule of Values Account Based

-

Introduction to Complex Invoicing for "Not-To-Exceed", "Fixed Bid" and "Cost Plus"

-

Introduction to Change Order Management

-

Introduction to Job Costing Reporting

-

Introduction to Payment Applications for complex projects with draw schedules

Summary

Disclaimer Regarding Accounting: Mastering accounting is a skill that requires a minimum of 10,000 hours of intense training and practice and many volumes of instruction manuals and workbooks. The difference between regular accounting and construction accounting is similar to the difference between climbing a set of stairs in your home and climbing Mount Everest. Learn more...

Our Intent - Is to provide a brief overview of bookkeeping services. It is not to provide you with all of the skills to become a fully qualified construction accountant able to serve all of the contractors types listed above but to provide you with enough training in order to perform adequately in a construction company office and handle most of their QuickBooks for contractor needs.

Ongoing Support - We offer fee based ongoing support for QuickBooks and QuickBooks for contractors regardless of whether or not you have taken any of our QuickBooks Training Program For General Business or our QuickBooks Training Program For Construction Contractors.

For More Information Please Contact Sharie 206-361-3950 or sharie@fasteasyaccounting.com

Click Here For QuickBooks Pro And QuickBooks For Contractors Training Classroom

Need Help Now?

Call Sharie 206-361-3950

sharie@fasteasyaccounting.com