As a contractor, you are highly skilled, intelligent and adaptable. That is a given because you operate in a multi-faceted changing environment doing the impossible with limited time, money and resources on every project and soon as one is finished another one is waiting for you.

You press a few keys on your keyboard thinking you are going to get the results you want, accurate bank balances, a report showing who owes you money and who you owe money too, a Profit and Loss Report and Balance Sheet Report you can understand and if all goes well perhaps even some Job Costing Reports. Instead, what you get is a hot steaming pile of fertilizer that cannot even be used in the garden.

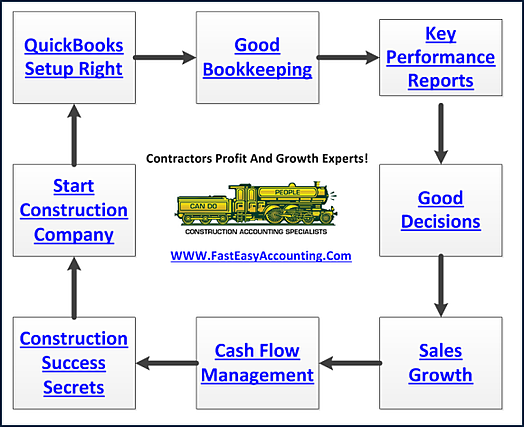

Many contractors like you feel like hiring a Professional Contractor Bookkeeping Service is a waste of money when you should be able to do it yourself. That is often what leads good contractors like you into The Vicious Construction Company Failure Cycle.

Does The Graphic Below Look Familiar?

The DIY approach is one of the traps every contractor who is struggling financially falls into because as contractors we don't believe in asking for help until we are in deep trouble. We find it hard to trust experts because they cost to much and not understand how construction works.

In the end, hiring QuickBooks Experts in Construction Accounting like Fast Easy Accounting can prove to be not only beneficial but a safer option. After all, what makes a homeowner or businessperson call an expert contractor like you instead of DIY their own construction project? You have the skills, expertise and experience about how construction projects are done. You know how to bid jobs, collect money, coordinate labor, material, subcontractors and other things needed to get work done and in the end you will have saved your customers and clients time, money and frustration.

So, "what is the harm if I do provide my own contractors bookkeeping services?" you may ask. Doing it yourself is appears to be a cheaper and surer option right? However, in the case of contractors bookkeeping accounts you may incur financially crippling fines, penalties and interest if you miscalculate payroll, quarterly tax returns, and don't invoice your customers and clients for all of the work you do including Change Orders. Here are seven reasons that underline why you may want to hire a Professional Contractor Bookkeeping Service and leave the accounting department to the construction accountants:

Figure Out QuickBooks vs. QuickBooks Expert:

A good construction accounting services firm will be able to make instant light out of the chaos in your QuickBooks. Besides, with proper Job Costing, Payroll, Tax, Job Deposit, W.I.P. and Cost of Goods Sold management accounts you will not only be able to see if work is progressing according to your targets but also where things are going sideways in time to fix it.

Payday vs. Employee Revolt

Payroll calculations are tedious, time consuming and thanks to a variety of local, state and federal regulations, they are rather complex to compute. You have to consider everything from time cards, workers compensation, unemployment, Federal withholding, social security, employee loans, child support, wage garnishments, certified payroll reports, sick pay, vacation pay, holiday pay – not to mention, filing the entire group of local and state and Federal payroll tax returns. In this area alone a Professional Contractor Bookkeeping Service is worth having because of the you will save time, aggravation and hopefully avoid fines, late fees, interest and penalties.

Doing The Books For Contractors, Subcontractors, Trade Contractors, Handyman And Other Related Contractors

Regular bookkeeping is relatively easy; however, contractor bookkeeping is completely different. Regular bookkeeping is like taking a casual walk on the beach on a sunny afternoon with clear skies vs. construction accounting, which is more like slogging through a hot steamy jungle, during a heavy rainstorm, at dusk with hidden quicksand traps, steep mountain passes, raging rivers, razor sharp rocks, deep dark holes in the pathways and giant insects buzzing around you and biting you everywhere from head to toe.

Doing The Books For Spec Home Builders And Commercial Tenant Improvement Contractors

Doing construction accounting for speculative builders or commercial tenant improvement contractors who need WIP reports, Schedule of Values, Payment Applications, multiple job deposits, bank draws and earned value reporting and a whole lot more is when things get real bad! For more about construction accounting vs. regular accounting click here.

Cloud Based Vs. Desktop

If your QuickBooks is on someone's desktop or notebook and you don't have it setup as a "server" then it is likely only one person can be in it at a time. A Professional Contractor Bookkeeping Service keeps your QuickBooks Desktop In The Cloud where multiple users can access your QuickBooks Desktop™ through a PC, Mac or Apple at the same time from different offices, cities, states or countries, anywhere you have internet access.

Filing Tax Returns

Filing Tax Returns takes time and can be a misadventure for those who aren’t aware of the local, state and federal regulations. If you find yourself in audit situation, it is in your best interest to have an accountant doing the math rather than playing the rookie apprentice.

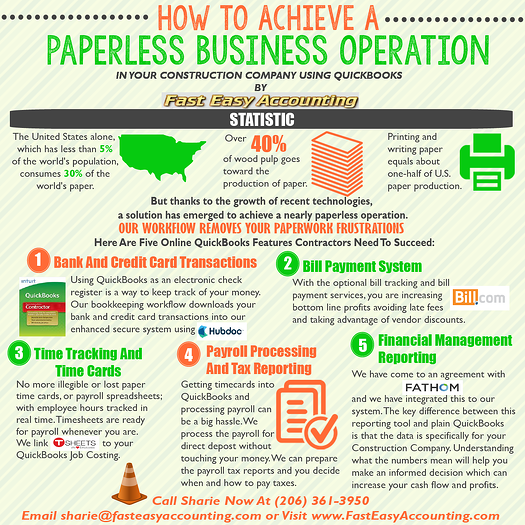

We Remove Contractor's Unique Paperwork Frustrations

For Construction Company Owners who do not need the full power of QuickBooks for contractors and want 24/7 online access we offer Xero Accounting Online and we have custom setup for construction companies. Click Here For More.

This Is One More Example of how Fast Easy Accounting is helping construction company owners all across the USA including Alaska and Hawaii put more money in the bank to operate and grow your construction company. Construction accounting is not rocket science; it is a lot harder than that and a lot more valuable to people like you so stop missing out! Call Sharie 206-361-3950 or sharie@fasteasyaccounting.com and schedule your no charge one-hour consultation.

Profitable Contractors and Construction Company owners have known about the value of outsourced bookkeeping services and contractor coaching services like ours for a long time and now you know about it too!

We Scan Your Receipts And Invoices link the appropriate transactions to QuickBooks or Xero Accounting Online depending on the construction accounting service you are using and provide ongoing Cloud Based Contractors Bookkeeping Services by accountants who understand construction.

Our Contractor Bookkeeping Services System Is A System

Thinking About Outsourcing Your Contractors Bookkeeping Services To Save Time And Money?

Click On The Button Below To Download A Free Guide

Business Process Management (BPM) For Contractors

Need Help Now?

Call Sharie 206-361-3950

sharie@fasteasyaccounting.com

Xero Outsourced Construction Accounting Services

QuickBooks Outsourced Construction Bookkeeping Services

We Are Xero Accounting Experts Specializing In Construction Bookkeeping Services

About The Author:

Randal DeHart, PMP, QPA is the co-founder of Business Consulting And Accounting in Lynnwood Washington. He is the leading expert in outsourced construction bookkeeping and accounting services for small construction companies across the USA. He is experienced as a Contractor, Project Management Professional, Construction Accountant, Intuit ProAdvisor, QuickBooks For Contractors Expert and Xero Accounting Specialist. This combination of experience and skill sets provides a unique perspective which allows him to see the world through the eyes of a contractor, Project Manager, Accountant and construction accountant. This quadruple understanding is what sets him apart from other Intuit ProAdvisors and Xero accountants to the benefit of all of the construction contractors he serves across the USA. Visit http://www.fasteasyaccounting.com/randal-dehart/ to learn more.

Randal DeHart, PMP, QPA is the co-founder of Business Consulting And Accounting in Lynnwood Washington. He is the leading expert in outsourced construction bookkeeping and accounting services for small construction companies across the USA. He is experienced as a Contractor, Project Management Professional, Construction Accountant, Intuit ProAdvisor, QuickBooks For Contractors Expert and Xero Accounting Specialist. This combination of experience and skill sets provides a unique perspective which allows him to see the world through the eyes of a contractor, Project Manager, Accountant and construction accountant. This quadruple understanding is what sets him apart from other Intuit ProAdvisors and Xero accountants to the benefit of all of the construction contractors he serves across the USA. Visit http://www.fasteasyaccounting.com/randal-dehart/ to learn more.

Our Co-Founder Randal DeHart - Is a Certified PMP (Project Management Professional) with several years of construction project management experience. His expertise is construction accounting systems engineering and process development. His exhaustive study of several leading experts including the work of Dr. W. Edward Deming, Michael Gerber, Walter A. Shewhart, James Lewis and dozens of others was the foundation upon which our Construction Bookkeeping System is based and continues to evolve and improve. Check out our Contractor Success Map Podcast on iTunes and Follow Randal on Google+