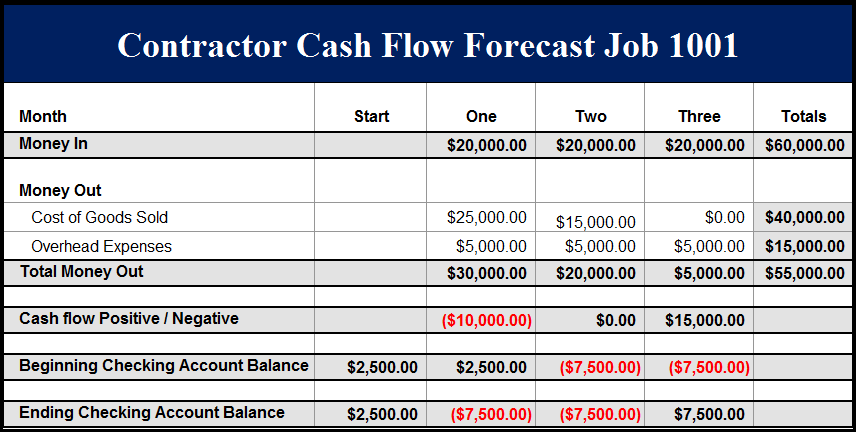

Construction Cash Flow Example

[Starting Cash + Cash In - Cash Out] = Cash Flow

"If You Know The Answers The Questions Will Not Bother You" - Randalism

Let's Get Some Answers - Contractors and sub-contractors know there is more to profits than what is shown above and most of you rely on your "gut feel" to know when project has made a profit or not.

Most contractors add a 5%-25% profit margin to their estimated costs to arrive at a final bid price which means a minor increase in any of the big four Labor, Material, Other Costs and Subcontractors can have a huge negative impact on your QuickBooks For Contractors Job Profitability Reports.

For anyone reading this who is not familiar with how cash flow works for a mid-size construction job, consider the following general example.

Example Job 1001

-

Bid Price = $60,000

-

Three Monthly Payments $20,000 Each

-

Job Costs Are Heaviest In Month One And Get Lighter Month Two And Three

Month 1: Materials, labor and G&A expenses are paid by the contractor but only part of the contract amount (draws) has been collected to offset the expenses. At the end of month 1, the project shows a cash flow drain of $7,500.00

Month 2: Labor, materials, G&A (overhead) are expensed by the contractor for Month 2, but no payments (draws) are still behind the job costs for Month 2. At the end of Month 2 the project still shows no cash flow at all.

Month 3: The project is finished but the material, labor, and G&A for the balance of the project is paid in full. At the end of Month 3, the project starts to show a cash flow increase.

There Are More details regarding opportunity costs including why two contractors can do the same job and have the same expenses yet one contractor will earn more profit than the other one due to differences in Construction Company Business Process Management Strategy.

The Short Video Below Shows A Sample Of It

With Bonus Material On Job Profitability

Without proper tracking and matching of income and expenses, most construction companies never know if they made a profit until the job is over.

Because of the special nature of construction accounting, most accountants have little understanding of how construction accounting works. Construction accountants are trained to provide accurate information for contractors while C.P.A.'s and tax preparers are trained to make certain contractors pay their fair share of income taxes. Learn more...

The bottom line is working with us you get the best contractor bookkeeping services company on your side which means you will improve your chances of success substantially. We are not Jack-Of-All-Trades, Master-Of-None accountants or bookkeepers who take anyone who contacts us. We are construction accounting specialists, with one purpose and only one purpose; serve construction contractors who are in business and those who are preparing to get into business. Who We Help...

Profitable Construction - Companies have known about the value of outsourced bookkeeping services for a long time and now you know about it too!

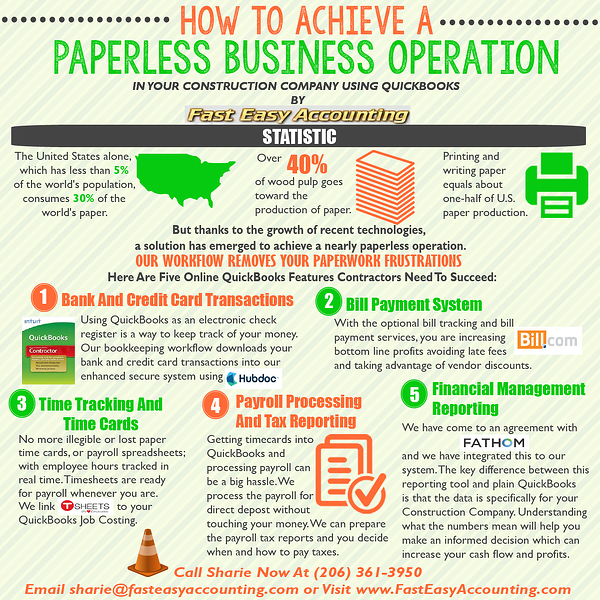

We Scan Your Receipts And Invoices link them to your QuickBooks or Xero transactions where it is appropriate and give you back a CPA-ready packet for your tax return and we provide ongoing Cloud Based Contractors Bookkeeping Services by accountants who understand construction.

Thinking About Outsourcing Your Contractors Bookkeeping Services To Save Time And Money?

Click On The Button Below To Download A Free Guide

Business Process Management (BPM) For Contractors

Need Help Now?

Call Sharie 206-361-3950

sharie@fasteasyaccounting.com

Xero Outsourced Construction Accounting Services

QuickBooks Outsourced Construction Bookkeeping Services

We Are Xero Accounting Experts Specializing In Construction Bookkeeping Services

About The Author:

Randal DeHart, PMP, QPA is the co-founder of Business Consulting And Accounting in Lynnwood Washington. He is the leading expert in outsourced construction bookkeeping and accounting services for small construction companies across the USA. He is experienced as a Contractor, Project Management Professional, Construction Accountant, Intuit ProAdvisor, QuickBooks For Contractors Expert and Xero Accounting Specialist. This combination of experience and skill sets provides a unique perspective which allows him to see the world through the eyes of a contractor, Project Manager, Accountant and construction accountant. This quadruple understanding is what sets him apart from other Intuit ProAdvisors and Xero accountants to the benefit of all of the construction contractors he serves across the USA. Visit http://www.fasteasyaccounting.com/randal-dehart/ to learn more.

Randal DeHart, PMP, QPA is the co-founder of Business Consulting And Accounting in Lynnwood Washington. He is the leading expert in outsourced construction bookkeeping and accounting services for small construction companies across the USA. He is experienced as a Contractor, Project Management Professional, Construction Accountant, Intuit ProAdvisor, QuickBooks For Contractors Expert and Xero Accounting Specialist. This combination of experience and skill sets provides a unique perspective which allows him to see the world through the eyes of a contractor, Project Manager, Accountant and construction accountant. This quadruple understanding is what sets him apart from other Intuit ProAdvisors and Xero accountants to the benefit of all of the construction contractors he serves across the USA. Visit http://www.fasteasyaccounting.com/randal-dehart/ to learn more.

Our Co-Founder Randal DeHart - Is a Certified PMP (Project Management Professional) with several years of construction project management experience. His expertise is construction accounting systems engineering and process development. His exhaustive study of several leading experts including the work of Dr. W. Edward Deming, Michael Gerber, Walter A. Shewhart, James Lewis and dozens of others was the foundation upon which our Construction Bookkeeping System is based and continues to evolve and improve. Follow Randal on Google+