Lately a number of contractors have contacted us about the messed up financial reports and job costing reports coming out of their QuickBooks contractor files.

It appears regular bookkeepers who are in over their head with construction accounting are trying to figure out how to input new QuickBooks transactions by copying previous transactions.

This is not an issue with regular accounting because there is only one or two cost of goods sold accounts (COGS), no direct COGS, no indirect COGS, no Work-In-Progress (WIP), no retention, no job costing allocation to consider and only one customer "cash sale" in addition to a number of other variables involved in construction accounting. To learn more visit construction accounting vs. regular accounting.

For example a material receipt arrives at the regular bookkeeper's desk from a lumber supplier and they open QuickBooks contractor file, look up the supplier to determine how the previous lumber purchase was coded and proceed to code the new transaction the same way.

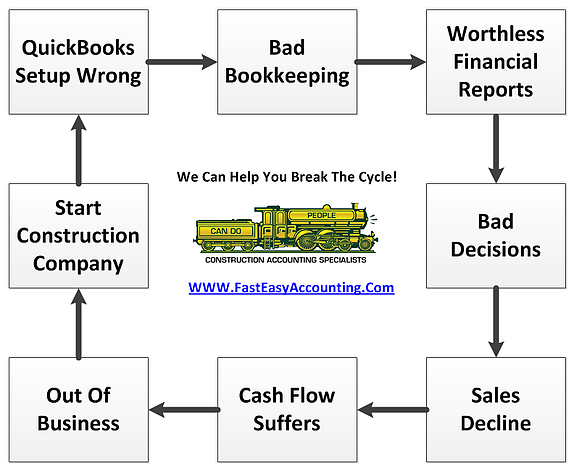

The problem is each transaction is unique and could go into any one of a dozen accounts or item codes depending upon whether it is a direct cost, indirect cost, WIP, retention, warranty, overhead, administrative, other cost or simply an expense. The cumulative effect of these bookkeeping errors in one month can do enough damage to the financial and job cost reports to eventually bankrupt a contractor.

For example if the bookkeeper generates job costing reports that are off by 10% it could cause the contractor to make radically different decisions based upon what he or she believes about the job costing reports.

If the contractor believes the company is undercharging they may raise bid prices, lose jobs, eventually run out of cash and file bankruptcy.

If the contractor believes the company is overcharging they may lower bid prices, lose money on all jobs, eventually run out of cash and file bankruptcy.

A lot of bookkeepers have lost their jobs and are freelancing as Jack-of-All-Trades and Master-of-None bookkeepers doing whatever work they can find and I understand that, everyone needs to eat. I would prefer they stay away from contractors and stick to regular bookkeeping like retail stores.

The net result is more contractors are going out of business due to bad financial and job costing reports just when construction demand is about to grow.

It is heartbreaking to see so much suffering due to incompetent bookkeepers and especially the ones that have good intentions destroying the construction companies of the men and women who depend on them to take care of themselves and their families.

I can certainly understand the desire to save money! In an effort to help contractors avoid some of the dangers of hiring in house bookkeepers we put together a FREE guide you can download that you may find useful.

QuickBooks Expert Specializing In Construction Bookkeeping Services

About The Author:

Randal DeHart, PMP, QPA is the co-founder of Business Consulting And Accounting in Lynnwood Washington. He is the leading expert in outsourced construction bookkeeping and accounting services for small construction companies across the USA. He is experienced as a Contractor, Project Management Professional and Construction Accountant and Intuit ProAdvisor. This combination of experience and skillsets provides a unique perspective which allows him to see the world through the eyes of a contractor, Project Manager, Accountant and construction accountant. This quadruple understanding is what sets him apart from other Intuit ProAdvisors and accountants to the benefit of all of the construction contractors he serves across the USA. Visit http://www.fasteasyaccounting.com/randal-dehart/ to learn more.

Randal DeHart, PMP, QPA is the co-founder of Business Consulting And Accounting in Lynnwood Washington. He is the leading expert in outsourced construction bookkeeping and accounting services for small construction companies across the USA. He is experienced as a Contractor, Project Management Professional and Construction Accountant and Intuit ProAdvisor. This combination of experience and skillsets provides a unique perspective which allows him to see the world through the eyes of a contractor, Project Manager, Accountant and construction accountant. This quadruple understanding is what sets him apart from other Intuit ProAdvisors and accountants to the benefit of all of the construction contractors he serves across the USA. Visit http://www.fasteasyaccounting.com/randal-dehart/ to learn more.