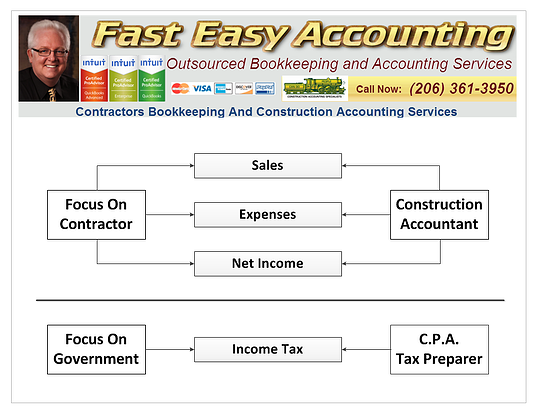

Both Groups Are Important And Each One Fills A Need

Project Management Construction Accounting Professionals (PMP) work above the line focused on generating positive outcomes and results for contractors:

-

Increase Sales

-

Reduces Expenses

-

Increase Net Income

Certified Public Accountants (CPA) work below the line focused on filling out annual income tax forms, making sure contractors pay their fair share of taxes, preparing certified financial statements and performing audits on your QuickBooks contractor file.

Three Times Construction Contractors Need A CPA In Their QuickBooks For Contractors File:

-

You apply for a large loan or line of credit over a million dollars

-

You need certified financial statements to get a performance bond

-

Your construction company is so large that you are required to have an annual audit

Most construction contractors with annual sales under $10,000,000 and less than 20 employees will never have those issues.

Construction accounting firms save contractor's a lot of time and money by filling out the monthly and quarter tax returns but a tax preparer or CPA should be the one filling out the annual income tax return. Allowing a construction accounting firm to prepare your annual tax return is foolish because there is nobody to review the work.

Annual tax preparers and CPA's work feverishly from January 1 to April 15 filling out annual tax returns for businesses, people's personal tax returns, non-profits, corporations, LLC's, Sub-S and a whole lot more. During the rest of the year they are not busy which leads some of them get an idea in their head to offer bookkeeping services to those same industries they prepare annual tax returns for and they hire a bunch of cheap bookkeepers to do the actual work.

Then the CPA decides to put together a one size fits all QuickBooks setup template to make filling out the annual tax return faster and easier and to make doing the day-to-day bookkeeping services easy for their cheap bookkeepers. Which means the butcher; baker, candle stick maker and the construction contractor have the same QuickBooks setup and data entry methods.

This is another example of "Every complex problem has a simple answer...and it is usually wrong!" A quick review of the differences between tax accounting and management accounting would clear up any confusion.

Unfortunately CPA's and annual tax preparers QuickBooks setups are useless for construction contractors because they do not include the extensive list of special accounts and items for job costing reports, Work-In-Process and dozens of other customizations construction contractors need. To learn more about what is required for construction contractor QuickBooks setup click here

The reverse holds true as well, never, ever let a construction accounting firm prepare your annual tax return. Get a CPA or a qualified tax preparer to do it for you. Just for the record we have used CPA's for our business and personal annual tax returns since the early 1970's and they are worth every penny!

Trust But Verify!

Another good reason to keep your construction accounting separate from your annual tax return is when you need to get financing. Most bankers and finance sources like to see separation of duties. They like to see two different firms involved because it reduces the chance of errors, collusion, cover-up and fraud. The may not say a word to you about; however, we hear about it a lot!

We insist our construction contractor clients use an outside CPA or tax preparer to review the QuickBooks contractors bookkeeping services that we have performed and prepare the annual income tax return. As a result we have developed good working relationships with a number of CPA firms and qualified annual tax preparers.

It is good to know our contractor clients trust us and know that we have their best interest in our minds and in our hearts; however, we are human and we make mistakes and we welcome input from CPA's and tax preparers. It is all about teamwork and people working together to make certain everything in your construction accounting system is working properly.

After your CPA or tax preparer is finished with your annual tax return they often have a list of adjusting journal entries for your QuickBooks contractor files which we put into our outsourced accounting clients QuickBooks for Contractors files at no charge.

QuickBooks Expert Specializing In Construction Bookkeeping Services

About The Author:

Randal DeHart, PMP, QPA is the co-founder of Business Consulting And Accounting in Lynnwood Washington. He is the leading expert in outsourced construction bookkeeping and accounting services for small construction companies across the USA. He is experienced as a Contractor, Project Management Professional and Construction Accountant and Intuit ProAdvisor. This combination of experience and skillsets provides a unique perspective which allows him to see the world through the eyes of a contractor, Project Manager, Accountant and construction accountant. This quadruple understanding is what sets him apart from other Intuit ProAdvisors and accountants to the benefit of all of the construction contractors he serves across the USA. http://www.fasteasyaccounting.com/randal-dehart/ to learn more.

Randal DeHart, PMP, QPA is the co-founder of Business Consulting And Accounting in Lynnwood Washington. He is the leading expert in outsourced construction bookkeeping and accounting services for small construction companies across the USA. He is experienced as a Contractor, Project Management Professional and Construction Accountant and Intuit ProAdvisor. This combination of experience and skillsets provides a unique perspective which allows him to see the world through the eyes of a contractor, Project Manager, Accountant and construction accountant. This quadruple understanding is what sets him apart from other Intuit ProAdvisors and accountants to the benefit of all of the construction contractors he serves across the USA. http://www.fasteasyaccounting.com/randal-dehart/ to learn more.