Construction Company Opportunity Costs

Opportunity costs are something contractors earning over $200,000 a year in take home pay understand and use on a daily basis and since the majority of our readers earn less than $75,000 I felt it would be something useful to share.

What is an opportunity cost? Simply put it is the decision-making process of production. If construction workers can remodel one large home a year or remodel six smaller homes a year then the opportunity cost of producing one large remodel is the six smaller remodels forgone (assuming the production possibilities is a linear equation).

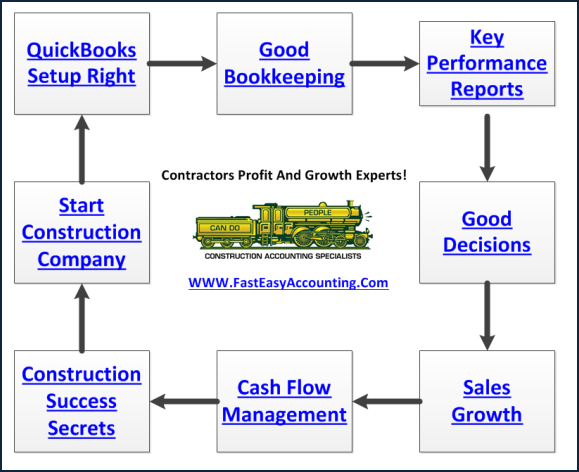

Opportunity cost is defined as the value of the best alternative that you give up to do something else. For instance, if you could earn $200,000 a year working on your construction company but you decide to spend 15% of your time be your own part-time contractors bookkeeping services having spent weeks in QuickBooks setup and now being a data entry clerk working in your QuickBooks for Contractors file to save money, your opportunity cost of being a bookkeeper, (not a contractors bookkeeper because the difference is at least 10,000 hours of combined training and practice), is $30,000 or roughly twice the cost to outsource your contractors bookkeeping services to us. For more in depth information download the Opportunity Costs Reference Guide.

When opportunity cost is used in decision making, it is important to consider all costs and benefits. For example, if a contractor could earn $100,000 a year working on his company developing construction company strategy and monitoring reports from the job costing reporting services or $50,000 a year doing the physical work on the jobsite every day his opportunity cost of being in the field with his nail bags on is $50,000.

Looking at only opportunity cost, it appears that the contractor should stay out of the field and keep focused on strategy, but this decision cannot be made without considering the non-monetary benefits of spending a few days every now and again in swinging a hammer or doing whatever it is your work company your construction company performs.

Whenever you decide to pursue one area of construction you are probably giving up the opportunity to do something else (e.g. If you start a premier residential remodeling company you may not have the infrastructure, tools, equipment, labor to build low cost spec homes in a production environment.

All contractors make rational decisions by weighing the sacrifices involved. Some do it their head, some on paper and others use a variety of tools including Job Costing Reports and Marginal Revenue Vs. Marginal Cost analysis.

When Marginal Revenue Is Greater Than Marginal Cost (MR>MC) The Investment Has Merit

Example #01: When you can invest $1.00 and get back $2.00 in one year MR>MC

Example #02: When you can buy goods or services cheaper than you can make them MR>MC

MR>MC is the primary reason general contractors hire specialty contractors. It is not usually cost effective to hire a plumber, buy a van and stock it with all the tools and equipment unless the contractor can generate enough profitable work to keep him or her busy all day, every day. Click here for more

Whenever you are working on a mundane task ask yourself two important questions:

-

Is there somebody else who can do this task better, faster and cheaper than I can?

-

Am I saving a nickel (doing a mundane task) and spending a $5.00 bill (me doing something more productive)

QuickBooks Expert Specializing In Construction Bookkeeping Services

About The Author:

Randal DeHart, PMP, QPA is the co-founder of Business Consulting And Accounting in Lynnwood Washington. He is the leading expert in outsourced construction bookkeeping and accounting services for small construction companies across the USA. He is experienced as a Contractor, Project Management Professional, Construction Accountant, Intuit ProAdvisor and QuickBooks For Contractors Expert. This combination of experience and skillsets provides a unique perspective which allows him to see the world through the eyes of a contractor, Project Manager, Accountant and construction accountant. This quadruple understanding is what sets him apart from other Intuit ProAdvisors and accountants to the benefit of all of the construction contractors he serves across the USA. Visit http://www.fasteasyaccounting.com/randal-dehart/ to learn more.

Randal DeHart, PMP, QPA is the co-founder of Business Consulting And Accounting in Lynnwood Washington. He is the leading expert in outsourced construction bookkeeping and accounting services for small construction companies across the USA. He is experienced as a Contractor, Project Management Professional, Construction Accountant, Intuit ProAdvisor and QuickBooks For Contractors Expert. This combination of experience and skillsets provides a unique perspective which allows him to see the world through the eyes of a contractor, Project Manager, Accountant and construction accountant. This quadruple understanding is what sets him apart from other Intuit ProAdvisors and accountants to the benefit of all of the construction contractors he serves across the USA. Visit http://www.fasteasyaccounting.com/randal-dehart/ to learn more.