Contractors Should Use Reseller Permits When Buying Items For Resale

The Rule Is - “Have a Resale Certificate or Pay the Tax” It’s all about paying sales tax. Who is the customer?

Construction Companies - In Washington State contractors selling material (as part of your service) is a taxable event.

When is sales tax paid? - Without any other documentation that the material is purchased for resale; then the person purchasing the material is the end user. Sales tax charged and paid at point of sale.

But I’m a contractor - Yes and the State of Washington Department of Revenue has a document called a “Resale Certificate” In the last couple of years the State of Washington has begun issuing a nicely printed Resale Certificate with all of the necessary information on it. This can be copied and mailed / emailed to your major suppliers and sub-contractors.

Years Ago – The Resale Certificate was a blank form that was filled out by the contractor as needed with an ending date selected by the contractor. Needless to say some certificates were a challenge to read.

Some Permits - May be automatically issued or renewed. The new one is filled out and renewed and the end of the year.

Renewals - There is NO Additional Cost for resale certificate.

Check Your Mail - A percentage of resale certificates are auto renewed others will require a form to be filled out with projected sales (retail / wholesale / government / etc.)

It’s A “Pop Quiz” - And one of the reports used to project future revenue. If your QuickBooks is clean, tidy, and up to date it is easy to find the information to fill out the report.

You Can Pay Sales Tax - On every purchase as you go if you have unlimited cash flow?

Without A Copy - Of the current resale certificate suppliers and sub-contractors must charge sales tax.

Not All Businesses Qualify - For a resale certificate. One example is builders (depending on type of construction) must always pay sales tax “as they go”

Not all material is tax exempt - Consumables are not and there is an expanding list of items that the state considers “consumables” and will charge sales tax at the time of the sale. Major suppliers are accustomed to managing and work with the state to make sure the list of consumables is up to date.

If A Supplier Has - Your resale certificate on file and charges you tax count on them being 99.9999999999% accurate. No one wants to handle any more sales tax then they have to.

Equipment rental - Is always considered as a consumable and when billed it will include sales tax. If you list equipment rental on an Invoice you give to your customer you need to include sales tax on the item. Most contractors and construction clients agree it is double taxation.

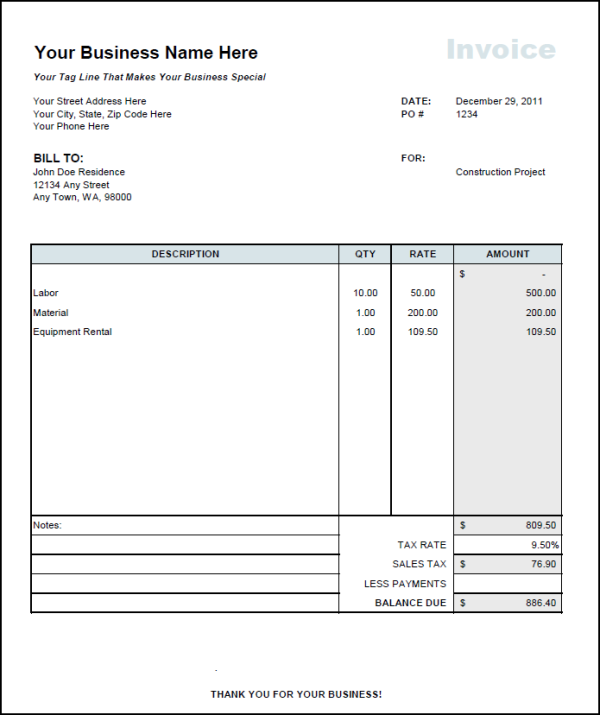

For Example:

-

You rent a tool for $100.00 and the rental company charges you $109.50; $100.00 Rental Fee + $9.50 sales tax.

-

You send your customer an invoice as shown below and add tax on top of tax or you can deduct the $9.50 tax the rental company charged off your bottom line profit.

-

You should not show the rental fee as $100.00 and "non-taxable" on your Invoice. The fines, penalties and interest Washington State Department of Revenue could charge at an audit will far outweigh the minor savings.

Do you have a resale certificate? Do you need one? Who is your client?

-

Are you a General Contractor requesting services from other contractors?

-

Are you a General Contractor working for another contractor?

-

The answer impacts WHO pays the sales tax.

What type of client is it?

-

Wholesale

-

Retail

-

Service

Where Does Your Client Live - Washington State is destination based. Each city receives a portion of the local taxes charged and you must track each sale location individually.

Just Starting Out – The Washington State Department of Revenue may classify you as an annual filer.

Every Year I Ask - The Washington State Department of Revenue on behalf of a client if can they change their filing status. It is the option of the Washington State Department of Revenue to require every contractor to file monthly. Based on guidelines – some contractors are switched from monthly to quarterly or quarterly to annually.

Oops, I haven’t Paid Anything! Call Sharie 206-361-3950 and Let’s Chat! Or email her at sharie@fasteasyaccounting.com

There Are A Few Exceptions - Where someone does not have to pay sales tax. Depending on the services provided the sales may also be exempt from Business & Occupation Tax. Let’s figure it out together, what you have done, haven’t done and should have done yesterday and how to make it be better going forward in 2013.

All The Departments Work Together - Washington State Department of Revenue / Washington State Department of Labor & Industries / Washington State Employment Security work together. Washington State needs additional tax revenue so they are on the lookout everywhere for anyone who working as an unlicensed contractor. It is easy to find and tax revenue - Between the licenses, actual taxes and penalties.

Each Tax Agency - May be open to a payment plan to catch up on the back taxes owed for businesses who want to stay in business and we may be able to help you. Government forms can be complicated and intimidating – when you ignore them the letters come more often followed up by telephone calls. You need your phone free for your customers to call you!

You Have Handled - Your paperwork enough let us help you! enter the world of Easy Accounting.

Emergency Accounting - If you have emergency accounting, bookkeeping or quarterly tax issues call Sharie at 206-361-3950.

QuickBooks Setup, QuickBooks Clean Up, QuickBooks Tune-Up, Emergency Accounting, Bookkeeping Services Including Sales Tax Reports

QuickBooks Expert Specializing In Construction Bookkeeping Services

About The Author:

Sharie DeHart, QPA is the co-founder of Business Consulting And Accounting in Lynnwood Washington. She is the leading expert in managing outsourced construction bookkeeping and accounting services companies and cash management accounting for small construction companies across the USA. She encourages Contractors and Construction Company Owners to stay current on their tax obligations and offers insights on how to manage the remaining cash flow to operate and grow their construction company sales and profits so they can put more money in the bank. http://www.fasteasyaccounting.com/sharie-dehart/